metamorworks/iStock via Getty Images

CACI International Inc (NYSE:CACI) is a private defense, security, and intelligence contractor. For over half a century, the company has provided its services to the United States government, contributing to every major global and domestic operation, conflict, and event since the Cold War. The U.S. government spends more on its defense than every major country in the world combined, which provides a stable foundation for the company to thrive and expand. CACI’s growth strategy primarily relies on opportunistic capital deployment and mergers and acquisitions (M&A). Adapting to current megatrends – specifically the growing prevalence of informational, psychological, and cyber warfare — the company is investing heavily in modernizing U.S. digital infrastructure. As an investment, so long as it continues on its current path, CACI is well-positioned to deliver robust returns in the medium and long term.

Industry Analysis

CACI operates in the multibillion-dollar defense and intelligence industry. According to a report published by Visiongain, the global homeland security market is projected to grow at a CAGR of 5.89% by 2032. There are two major trends affecting the industry. First, the world is becoming increasingly multipolar, spurring political tensions between the U.S. and competing superpower nations like China and Russia. In a hostile global landscape, the U.S. government is accelerating market growth by spending heavily on replacing and modernizing aging equipment. Second, non-kinetic operations are increasingly important to national security. To this end, to meet the rapidly shifting needs of its clients, CACI is expanding its software and technological capacities through strategic M&As with technical companies specializing in artificial intelligence (AI), machine learning (ML), and Agile development. Internet of Things (IOT) integration is needed to ensure success on the battlefield, especially when it comes to unmanned aerial vehicles. This technology depends on robust, end-to-end security in combination with ML and AI to detect and predict malware, insider threats, and exploitable vulnerabilities. CACI has positioned itself to capitalize on well-funded DoD (Department of Defense) plans to deploy hypersonic missile technology, 5G communication, and quantum computing in the interest of national security.

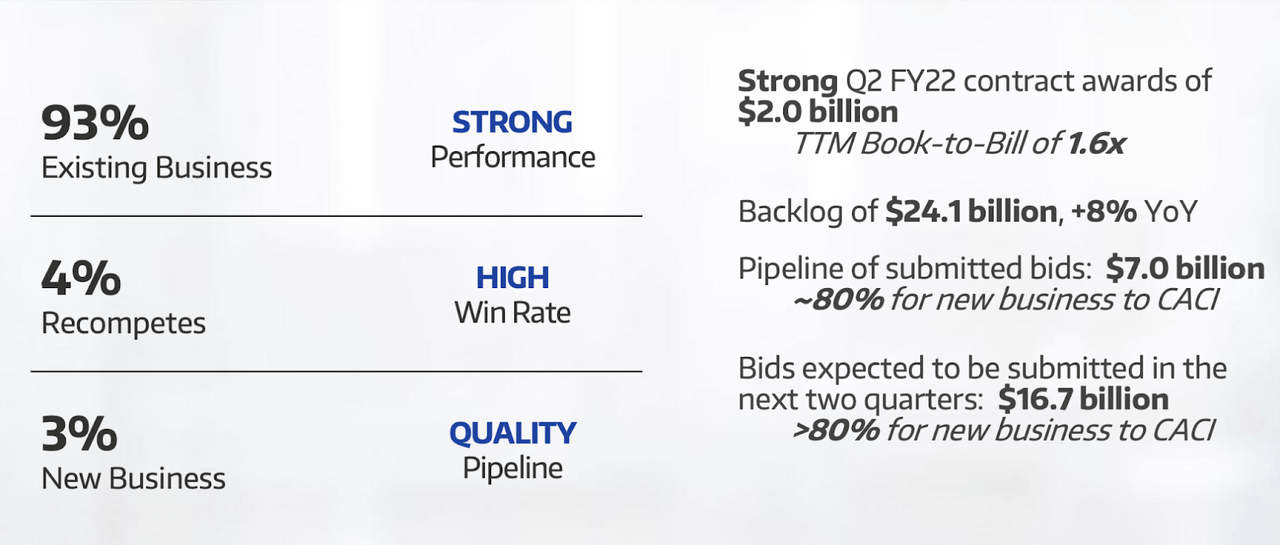

investor.caci.com

COVID-19 Impact

The COVID-19 pandemic had a two-fold effect on the defense sector. While there was an overall downturn in the global economy, the pandemic triggered a boom in digital markets, creating new risks and opportunities for CACI to leverage. In Fiscal Year 2020 (FY20), the U.S. continued to allocate a higher budget for defense, spending upward of USD 778 billion, a 4.4% increase year-on-year (YOY). The increase in spending during the pandemic was primarily driven by the unprecedented digital and electronic attacks risks. The positive impact of the pandemic on the defense industry was reflected in CACI’s financial performance, the fruits of which are still being reaped.

Competitive Landscape

The company’s primary competitors include Booz Allen Hamilton (BAH), Titan Mining Corporation (OTCPK:TNMCF), and Leidos (LDOS). CACI has strategically embedded itself in the industry in such a way as to secure its market share in the face of intense competition. The company regularly collaborates with its competitors, conducting joint operations and sharing intelligence and personnel in the process. For example, as part of the war on terror, CACI worked with Titan Mining Corporation to safeguard U.S. assets, gather intelligence, and organize counter-offensive operations. Given this collaborative nature of the defense industry, there are a few points to remember. CACI has a strong enough reputation and a history of large contracts that easily allow it to compete with Booz Allen Hamilton and Titan as equals. On top of this, collaboration between companies allows contracts to also produce revenues for each other and not be entirely exclusive. This mitigates the risk of being outcompeted for a finite number of government contracts, as it provides an assurance of revenue even in the face of stiff competition.

Risks and Mitigants

CACI faces two major risks that could harm its financial and reputational standing. Many of the company’s activities involve collaboration with the federal executive branch and intelligence agencies, both of which require high-security clearance. This exposes the company to the risk of attracting attention from hostile actors. CACI utilizes best-in-class counter-security measures to prevent hacking and infiltration. For sensitive tasks that concern national security (natsec), the company only hires vetted U.S. citizens with high aptitude scores. In the past, however, CACI has taken reputational blows by breaching standard operating procedures — the consequences of which are still being felt by the company to this day. Following its involvement in the Abu Ghraib prison scandal during the Iraq War, CACI was scrutinized for flaunting security protocols by illegally integrating Israeli interrogators into the U.S. military chain of command. The policy breach and subsequent lack of supervision led to gross human rights violations that triggered a strong internal and international reaction, spawning severe threats to natsec while undermining U.S. soft power in an unprecedented way. Following the incident, CACI was hit with several lawsuits and muckraking attempts.

In general, due to the nature of its business, the company is in the cross-hairs of journalists, political activists, and human rights lawyers. Reputational, legal, and security incidents make CACI vulnerable to the risk of repelling ethical investors, who are inherently averse to buying shares in the company. Similarly, Environment, Social, and Governance (“ESG”) analysts are inclined to score the company poorly. To mitigate these risks, CACI has made extensive efforts to improve its investability by adopting a policy of stringent alignment with the United Nations and other multilateral regulations. The company has also made strides to transform the natsec industry through diversity, equity, and inclusion, and corporate social responsibility initiatives, which have the effect of bolstering long-term solubility and cultivating positive public relations.

Products Overview

CACI has a diversified portfolio of products that include robotic automation technology, network modeling, skytracking, and electronic warfare systems. Most notably, the company has implemented surveillance grids that protect and monitor vital U.S. assets and infrastructure such as the White House and Capitol. In line with the Pentagon’s defense strategy and launching of the U.S. Space Force under the Trump administration, CACI expanded into the well-funded Low Earth Orbit market, which has become a crucial part of natsec infrastructure. In particular, the company provides the U.S. government with extraterrestrial communications technology, utilizing a series of high-end lasers, mirrors, and satellites to securely connect relevant institutions with space fleets, satellites, and orbital assets. Intending to consolidate expertise in the LEO field, CACI has aggressively exercised a series of M&As, making the company the largest provider of space defense and intelligence in the U.S. In Fiscal Year 2021 (FY21), CACI bought out Ascent Vision Technologies to leverage, amplify, and capitalize on its unique intelligence, surveillance, and reconnaissance technology in the context of space.

Financial Analysis and Valuation

In FY21, CACI achieved stable growth, comfortably outperforming previous years and the S&P 500. The company earned over $6 billion in revenue, a 5.7% increase year-on-year (YOY). While revenue growth was modest, profits were up 42.4% YOY, amounting to nearly half a billion. This stellar expansion of margins reflects the company’s strategy of streamlining operations and driving shareholder value.

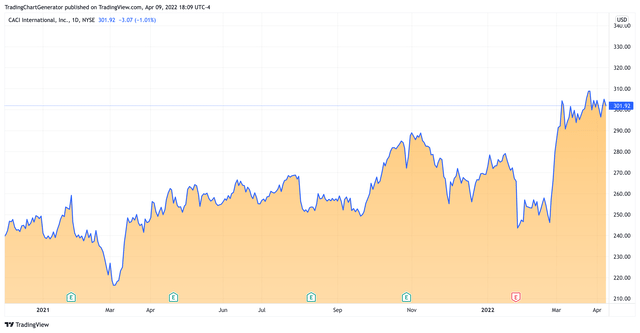

Illustrating its strategy to appease and attract shareholders, CACI repurchased about $500 million worth of shares, which, in addition to margin expansions, led to massive earnings per share improvements in FY21. CACI achieved a diluted EPS of 18.30 – up 45% compared to FY20. The company’s performance has swayed market sentiment, leading to historic highs in the stock market.

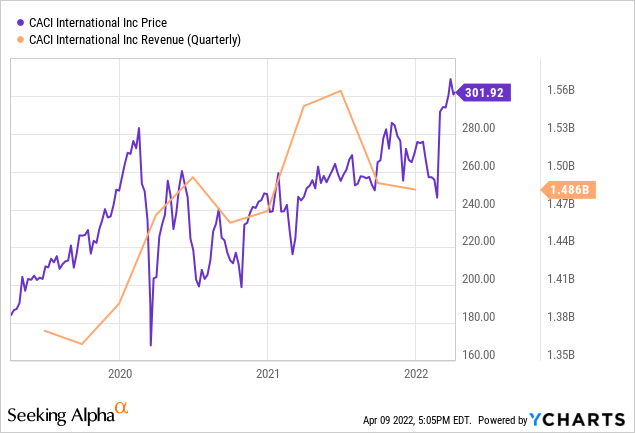

ycharts.com

In the second financial quarter of FY22 (Q2-22), the company secured contracts worth $2 billion, 70% of which represent new business. Nearly $600 million of the contracts comprise of unannounced, classified projects related to software-defined technology such as electromagnetic spectrums and quantum computing. The boom in business enabled CACI to acquire two companies: SA Photonics and ID Technologies. SA Photonics provides technologies for free-space optical communications (“laser comms”). The acquisition officially makes CACI the leading U.S.-based photonics provider and positions the company for further expansion into the LEO market. The second acquisition was of IDT, which will complement CACI’s existing modernization capabilities, especially regarding secure network remote access. The Q2-22 M&As are expected to contribute around $120 million in revenue, with IDT contributing $95 million and SA Photonics bringing in $ 25 million.

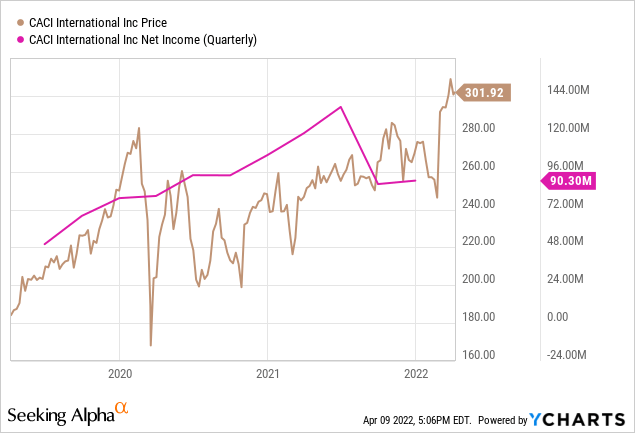

ycharts.com

Putting it all together, in FY22, CACI is expected to earn a net income of $435 million out of a revenue of $6.35 billion – a 6% increase YOY. Short of any extreme headwinds, the company is well on its way to achieving these guidance targets, which will yield an adjusted diluted EPS of somewhere between $18.14 and $18.57.

This raises the question of the current valuation with respect to a fair price in the future. CACI’s price has been in an overall uptrend for the last three years (counting out the drastic decline and ensuing V-shaped recovery in 2020 due to the pandemic). Going forward, given the consistent and concurrent uptrend of both revenue and net incomes, I expect CACI to continue its growth to where its GAAP TTM P/E ratio, 16.72, would approach the sector median of 20.49. This would represent a price increase of 22% holding current earnings stable – with the likely earnings growth over the next few quarters, a reasonable target could be as high as a 30-35% growth over the current share price.

Future Outlook and Final Thoughts

CACI is backed by top institutional investors such as Vanguard and BlackRock, which reflects strong market confidence in the company’s future. CACI’s executive management has consistently displayed competence in the face of an uncertain and ever-changing market. The company’s focus on ESG will ensure that returns are alpha and sustainable in the long term, making CACI a suitable investment for inter-generational funds and retail portfolios alike. The company’s recent expansion into cyber security and space defense provides ample growth opportunities, especially as the nature of warfare changes and adapts to the multipolar and potentially volatile global order. CACI has over half a century’s worth of experience in its field and has a proven track record of stable and profitable growth. All indicators, which include fundamentals, reputation, industry-backing, and megatrends, suggest that the company will deliver stellar returns for the foreseeable future. Investors looking for a solid long-term investment to anchor their portfolios should look no further than CACI International Inc.

Be the first to comment