Photon-Photos/iStock via Getty Images

The Q4 Earnings Season for the Gold Miners Index (GDX) has finally ended, and the most recent company to report its results is Centamin plc (OTCPK:CELTF). Unfortunately, the company had a much weaker year in FY2021, producing just ~415,400 ounces of gold at costs nearly 20% above FY2020 levels. The good news is that much of this looks priced into the stock, and production levels will climb going forward. At current levels, I still don’t see enough margin of safety given Centamin’s single-asset producer status, but I would view pullbacks below US$1.10 as buying opportunities.

Sukari Gold Pour (Company Presentation)

Centamin Egypt released its Q4 and FY2021 results last month, reporting quarterly production of ~107,500 ounces, a 4% improvement sequentially. Unfortunately, despite the satisfactory finish to the year, production was still down more than 8% due to higher waste stripping in 2021 and lower production related to a minor geotechnical issue, exacerbated by a lack of mining flexibility. Given the fewer ounces produced linked to lower open-pit grades, plus the impact of inflationary pressures, all-in sustaining costs soared [AISC] above the industry average. Let’s take a closer look below:

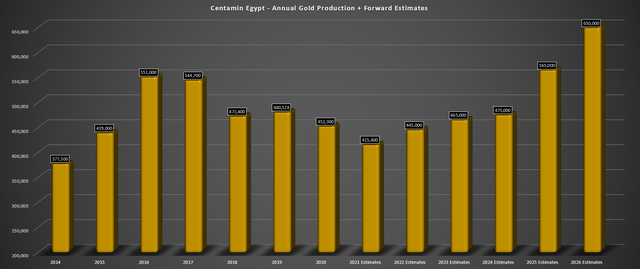

Centamin – Annual Gold Production & Forward Estimates (Company Filings/Guidance, Author’s Chart)

As the above chart shows, Centamin had a difficult year in FY2021, reporting its lowest production in nearly a decade. This was evidenced by the production of ~415,400 ounces of gold, the lowest production year for Sukari since 2014 (~377,300 ounces). As noted above, this was related to similar throughput but at much lower feed grades, with the focus of 2021 being on waste stripping to improve operational flexibility. Given the 13% decline in gold sales year-over-year, which was not offset by the gold price due to gold spending most of the year consolidating, revenue fell by 12% vs. FY2020 levels.

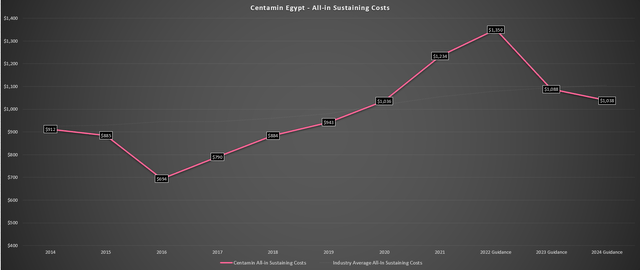

Centamin – Annual All-in Sustaining Costs (Company Filings, Author’s Chart)

Meanwhile, we’ve also seen a negative trend from a cost standpoint, with Centamin’s all-in sustaining costs soaring to $1,234/oz in FY2021, up 19% year-over-year, and marking the 5th consecutive year of higher costs at this asset. These costs were more than 10% above the industry average ($1,100/oz), and costs are set to worsen before they get better. This is based on the FY2022 guidance mid-point, which calls for 445,000 ounces of gold production at all-in sustaining costs of $1,350/oz.

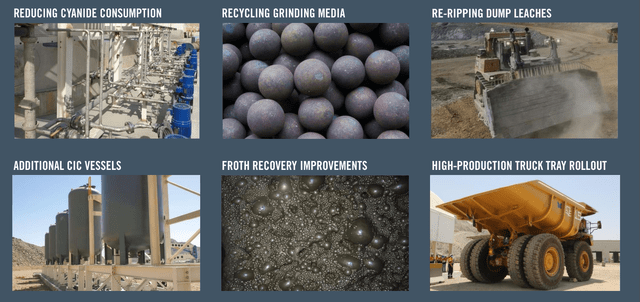

Centamin Cost Saving Initiatives (Company Presentation)

The good news is that Centamin has been successfully delivering on cost-saving initiatives, reporting $27 million in cost savings delivered last year alone. The company expects to see further cost improvements by adding high-production truck trays, plant upgrades, and a new solar farm which are currently ongoing. In February, the company also switched to an owner-fleet vs. contract fleet for its underground operations.

While these benefits will be “hidden” by inflationary pressures in FY2022 which have driven fuel and consumables costs higher, costs should begin to trend down in 2023. So, while Centamin will be a high-cost producer in FY2022 based on having operating costs 15% above the industry average estimates (~$1,170/oz), we will see Centamin regain its low-cost producer status in FY2024, with cost guidance set at $1,040/oz at the mid-point. Therefore, I don’t see any reason to get overly hung up on the high costs in FY2022, given that there is a path towards lower costs going forward.

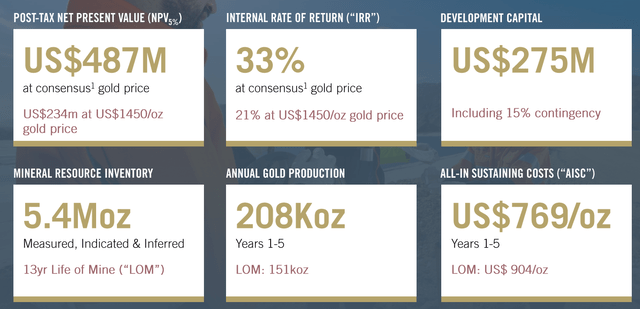

Doropo Project – PEA Economics (Company Presentation)

Finally, with a year of aggressive waste stripping complete, production is also increasing steadily, with a path towards gold production of 475,000 ounces per annum in FY2024. While this still represents a 16% decline from peak production in FY2016, there is the possibility that Centamin could report record production in FY2025/FY2026. This is because it’s finally begun to advance its Doropo Project, which has modest capex ($295 million estimate adjusting for inflation), and can produce over 200,000 ounces per year (years 1 to 5) at industry-leading costs. A Pre-Feasibility Study on the project is due by Q4 2022.

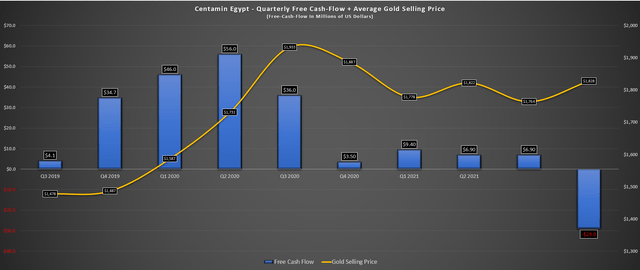

Financial Results

Looking at Centamin’s financial results, annual revenue fell 12% year-over-year to $733 million, which was certainly a negative development compared to the industry average and it was despite a higher average realized gold price ($1,797/oz vs. $1,766/oz). This was related to lower gold sales year-over-year due to lower open-pit grades at Sukari. The much lower revenue combined with a 74% increase in capital expenditures year-over-year also took a significant bite out of free cash flow generation, as shown below. In fact, FY2021 group free cash flow came in at negative $6.0 million, down from positive ~$142 million in FY2020.

Centamin Group Free Cash Flow & Average Gold Selling Price (Company Filings, Author’s Chart)

The good news for Centamin is that while capex will remain elevated in FY2022 at ~$225 million, and while the company did not generate any free cash flow last year, its strong balance sheet has allowed it to weather this period. This is based on Centamin’s net cash position of ~$260 million. The other piece of good news is that the gold price has been trending higher since Q4 2021, meaning that while Centamin’s costs will rise, much of this could be offset by the higher gold price.

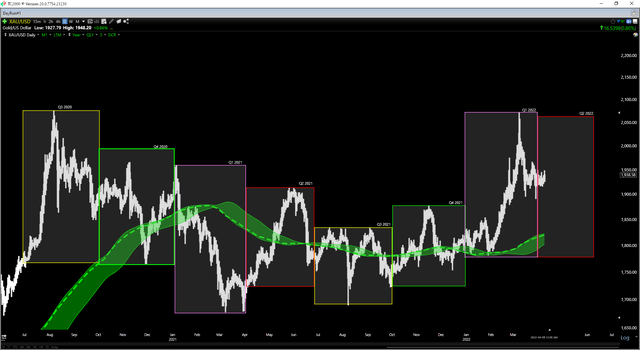

Gold Futures Price (TC2000.com)

Assuming an average realized gold price of $1,895/oz and AISC of $1,350/oz, Centamin would see only a slight dip in AISC margins vs. FY2021 levels despite its higher costs this year. This is based on FY2022 AISC margins of $545/oz under these assumptions vs. an FY2021 AISC margin of $563/oz. If we look ahead to FY2023 and assume a static gold price ($1,895/oz) and the expected cost decline to ~$1,100/oz, we should see a shift to meaningful margin expansion. Hence, I remain optimistic long-term on Centamin, but I would like to see Doropo green-lighted to better diversify the company post-2025.

Valuation

Based on ~1.16 billion shares outstanding and a share price of US$1.24, Centamin currently trades at a market cap of ~$1,438 million. After subtracting out ~$260 million in net cash, the company’s enterprise value comes in at ~$1.18 billion, a very reasonable valuation for a ~450,000-ounce producer. However, Centamin does have its risks, which partially explains its discounted valuation. These are the fact that it does not operate in a Tier-1 ranked jurisdiction, and it is a single-asset producer.

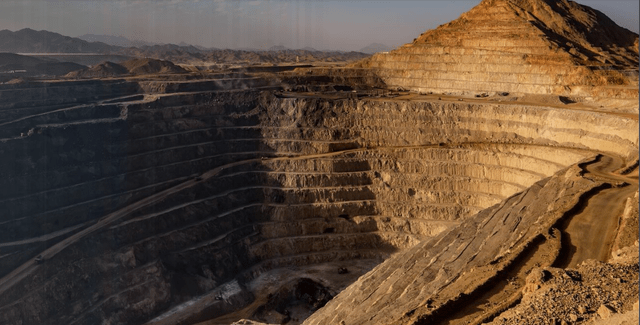

Sukari Operations (Company Presentation)

In the case of single-asset producers, risks are magnified if there is a major issue at an operation, and investors certainly saw how much pain this can inflict, evidenced by Centamin’s stock diving more than 60% from its all-time highs. This was related to the movement in a localized area of waste material at its sole asset: Sukari. The good news is that Centamin might be able to shed its single-asset producer status by H2 2025 if it green-lights its Doropo Project in West Africa. I would expect this to impact the share price positively, and we should get a better idea of project economics in Q3 2022.

However, for the time being, Centamin is a single-asset producer, which certainly makes it much riskier than its peers. The other negative is that it appears that Centamin’s dividend may decline from year to US$0.05 – US$0.06 vs. US$0.09 in FY2021. This is still an attractive dividend yield, but at the same time as Centamin’s dividend yield is shrinking, peers are increasing their dividends. Hence, the gap is closing between Centamin’s extremely high yield and its peers, which was why many investors likely stuck with the stock.

In summary, while Centamin has an attractive valuation, investors must be aware of the risks of owning a single-asset producer, which means that position sizing is critical. With Centamin currently trading at just over 14x trailing earnings and closer to 11x forward earnings, I still don’t see enough margin of safety, even if the stock is very reasonably valued. So, at current levels, I continue to remain on the sidelines. However, if we were to see the stock dip below US$1.10, I would view this as a buying opportunity.

Sukari Open Pit (Company Presentation)

It wasn’t easy to make any case for owning Centamin last year, which is why I exited my position in Q1 and switched to Endeavour Mining (OTCQX:EDVMF). This is because Centamin had a very high year ahead and uncertainty related to its mine plan. However, the outlook is much brighter with the company advancing Doropo, enjoying exploration success underground, and now lapping much easier year-over-year comps. Finally, the stock could be a takeover target if weakness persists. Given this improved outlook and more compelling valuation, the stock is worth keeping an eye on if we see further weakness.

Be the first to comment