Videowok_art/iStock via Getty Images

A few weeks ago, I wrote a contrarian bullish article on the Templeton Dragon Fund (NYSE:TDF) closed-end fund (“CEF”), arguing the market was too negative on China and that it was setting up for a sharp rally.

After a 25%+ rally, market sentiment has turned decisively bullish on China, as the Chinese government continues to ease COVID restrictions. I believe the “easy money” has been made, and it is now prudent to take some profits. To be clear, this is a tactical call to take profits and not a call to go short, as I believe a lot of long-term upside remains in Chinese equities.

A Buy Rating On Something That’s Uninvestable?

Earlier in the year, Wall Street analysts were fighting with each other to see who could be the most bearish on Chinese investments, with JPMorgan Chase & Co. (JPM) taking the crown with its “uninvestable” rating in May. Although the rating was quickly retracted by the investment bank, it did highlight how negative sentiment had gotten towards Chinese investments.

Fast-forward a few months, and after a 25%+ rally in Chinese assets, we suddenly have multiple investment banks like BofA and Morgan Stanley changing their tune and rating Chinese stocks a buy. Even JPMorgan is set to launch an actively managed Chinese ETF to capture a piece of the pie.

Wall Street’s rollercoaster stance towards China is a classic case of “investment banks chasing price momentum.” In the words of the great chart technician and columnist Helene Meisler:

Figure 1 – Nothing like price to change sentiment (Twitter)

China COVID Battle Entering A New Stage

The main reason behind the massive rally in Chinese assets has been a shift in the government’s stance towards controlling COVID infections. In my prior article, I wrote:

At the heart of the issue is whether China can continue its draconian zero-covid policies indefinitely. I believe the answer is no, as the policies are beginning to lead to civil unrest among the populace. It is a matter of when and how, not if, China will loosen its covid restrictions.

In recent weeks, we have seen even more civil unrest, including unprecedented protests (unprecedented in the sense that the protests were broadly uncensored within China) by university students towards the Draconian COVID restrictions.

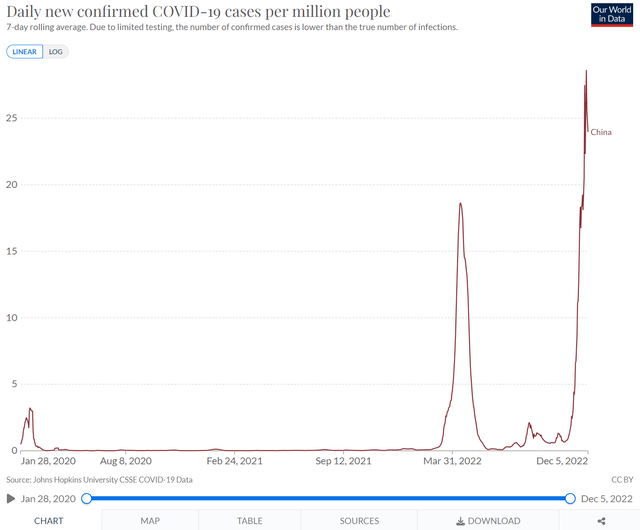

In response, the Chinese government has relaxed COVID restrictions across the country, despite surging COVID infections (Figure 2). The Chinese COVID czar, Sun Chunlan, also recently commented that the virus is becoming “less pathogenic” and China’s response is entering a “new stage.”

Figure 2 – Chinese COVID cases (Our World In Data)

This all culminated on December 7th with the Chinese government releasing new guidelines and measures that are focused on mitigating the effects of the virus instead of containment. The two most important changes are the removal of mass testing and travel restrictions, as well as allowing home quarantine for mild and asymptomatic cases.

But The Reopening Road Will Be Bumpy

However, looking forward, the path to fully reopening the Chinese economy will be bumpy. The main impediment is China’s elderly, many of which have not received a full complement of booster vaccines. According to a recent Economist article, only 40% of China’s over-80 population have received three covid vaccine shots, which would protect them against serious illness and death.

Furthermore, China’s homegrown vaccines have been shown to be less effective than Western mRNA-based vaccines in preventing COVID infections.

According to the Economist article, if COVID spreads unencumbered (i.e., China rips off the band-aid), around 680,000 people would die and the peak demand for intensive care beds would reach 410,000, about 7 times China’s current capacity.

Just as it was unrealistic for analysts to expect zero-COVID policies to last forever back in October, it is equally unrealistic for analysts to now expect China to reopen overnight.

As we head into January, investors need to be mindful of the timing of the Chinese New Year holiday (January 22, 2023), when traditionally many Chinese workers return to the countryside to celebrate with their families. Chinese New Year is also one of the busiest travel holidays of the year in China. Pre-pandemic, Chinese citizens collectively made more than 3 billion trips during the CNY celebrations. Investors should expect some sort of soft restriction to be put in place to mitigate the spread of COVID during the holidays.

I think a more comprehensive re-opening will occur after the CNY holidays and into Q2/2023, when the weather improves. Hopefully, by then, China will have boosted most of its elderly population with another vaccine shot.

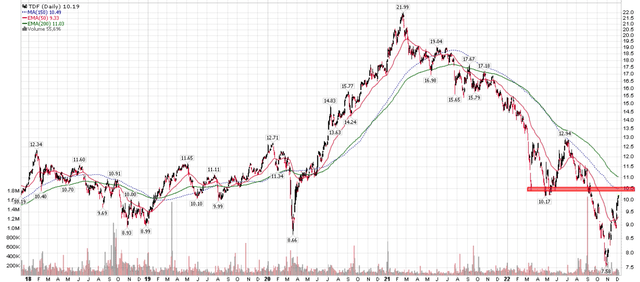

Technicals Approaching Resistance

Unfortunately, just as Wall Street is turning bullish, I think the “easy money” has been made in the China reopening trade, as many indices and ETFs are approaching long-term resistance levels. Specifically, on the TDF fund, I believe we are approaching technical resistance around $10.50, which corresponds to prior lows as well as the declining 150D moving average (Figure 3).

Figure 3 – TDF approaching resistance (Author created with price chart from stockcharts.com)

Therefore, I think it is prudent for investors to consider booking some profits.

Risk To My Call

As Chinese assets have been deeply discounted in the past year, it is certainly possible that they continue to squeeze higher on price momentum alone as short-sellers are forced to cover, and underweight investors are forced to add exposure. Therefore, my call is to trim my long position on the Templeton Dragon Fund, not go short.

Longer-term, I think there remains a lot of upside in Chinese equities. Again from my prior article:

When China does eventually loosen its covid policies, I believe it will dovetail with stimulus measures to revive its flagging economy and housing sector. With government debt to GDP of only 71%, among the lowest of the major economies, China has a lot of scope to provide stimulus to boost its economy

Importantly, China may be a counter-cyclical investment in 2023, as the rest of the world enters a recession while the Chinese government stimulates its domestic economy out of one.

Conclusion

I believe the “easy money” in the China reopening trade has been made, with many ETFs and indices rallying 25%+ in the last few weeks. Just as “zero-covid forever” was unrealistic, a sudden reopening is also unrealistic. China’s reopening path will be bumpy. I think it’s prudent to take some profits after a 25% rally in the TDF fund. To be clear, this is a call to trim the long position in the Templeton Dragon Fund, and not go short.

Be the first to comment