Sundry Photography/iStock Editorial via Getty Images

Analog Devices (NASDAQ:ADI) recently had its 2022 investor day, and there are some valuable pieces of information that we would like to share. The company highlighted its strategy to deliver more complete solutions, one of the reasons management feels confident they can deliver 7%-10% revenue growth over the next five years.

This high revenue growth target is likely to further improve profitability. There was also discussion about potentially obtaining $1 billion+ of revenue synergies with Maxim, starting in fiscal 2024.

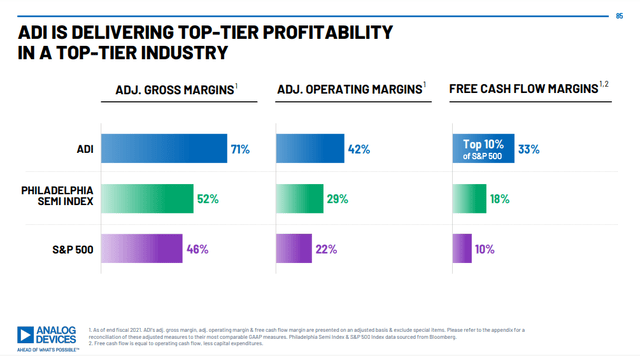

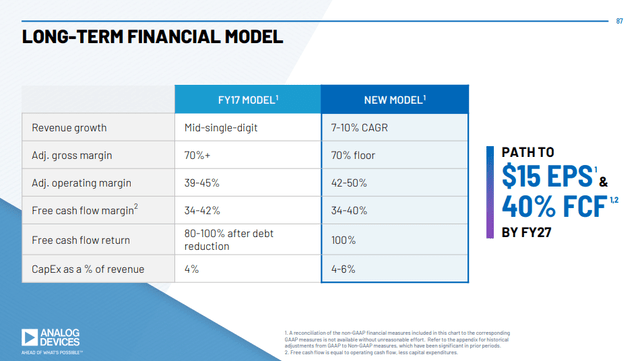

Some of the more interesting targets include establishing an adjusted gross margin floor of 70% and adjusted operating margins to be between 42%-50%. The free cash flow target was modestly reduced to 34-40% from 34-42%, the main reason being that ADI is seeking to increase capital expenditures to expand its production capacity.

A lot of examples were also provided showing how the business is set to benefit from secular tailwinds in the industrial, automotive, health-care, IoT, and communications end markets.

Revenue

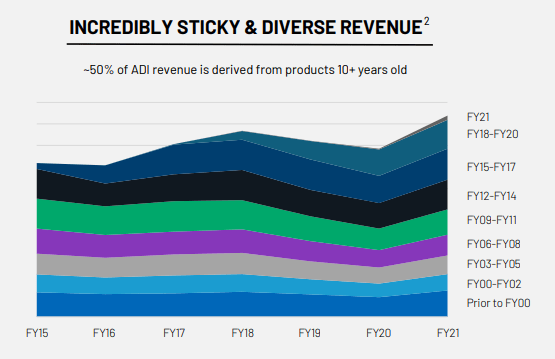

One of our favorite things about ADI is how sticky and diverse its revenue is, and the excellent profitability it has. Design wins are also very long-lasting, as can be seen in the cohort analysis below. Impressively ~50% of ADI’s revenue is derived from products that are more than ten years old. A significant portion is still derived from products launched before the turn of the millennium!

ADI Investor Day Presentation

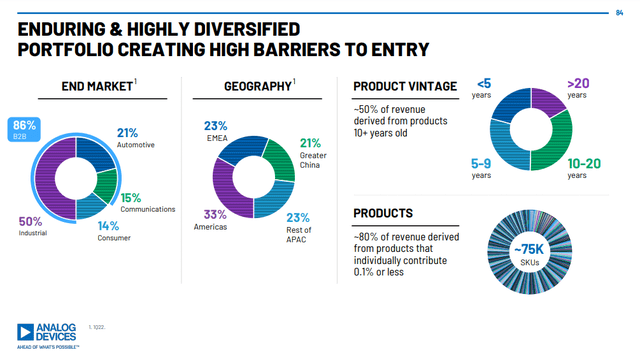

The enormous diversification also reduces risks, with approximately 75,000 SKUs and ~80% of revenue derived from products that individually contribute 0.1% or less. Additionally as seen below there is good diversification, both in terms of end-market as well as geography.

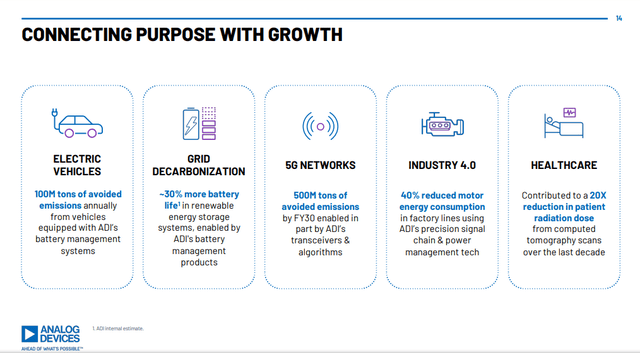

ADI is guiding for revenue growth to accelerate to 7-10% as it focuses more on solutions instead of products, as well as the company benefiting from several secular growth drivers. These include industry 4.0, the digitization of health care, vehicle electrification, renewable energy, data center growth, and IoT.

ESG

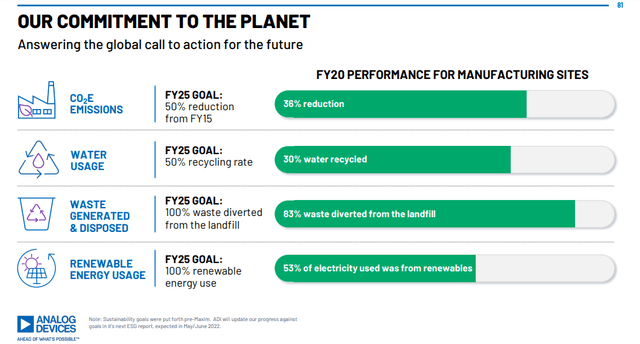

ADI is a company that take ESG commitments seriously and has a series of targets to reduce it impact on the planet.

ADI also has a positive ESG element in that many of its products are part of solutions to improve sustainability in the world. A good example is the extensive use of ADI’s products in electric vehicles. Another area where its products are doing plenty good is in healthcare and grid decarbonization.

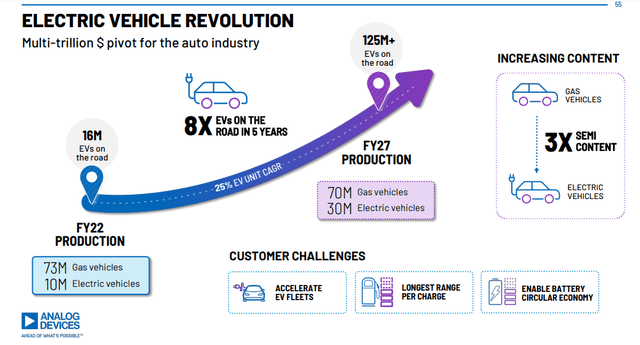

Speaking of electric vehicles, ADI has the #1 position in battery management systems (BMS). The electrification of transportation is a trend that will greatly benefit ADI, given that electric vehicles have on average 3 times more semiconductor content per car compared to regular gas vehicles.

Capital Expenditures

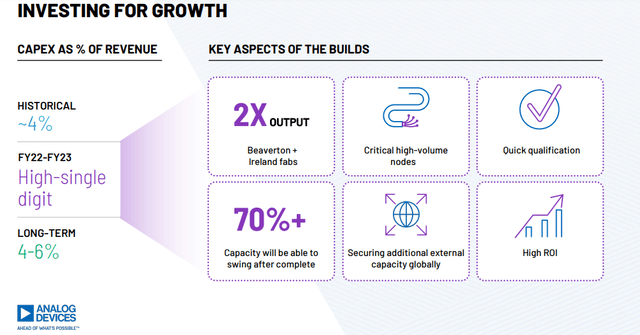

In order to be able to take advantage of these growth opportunities ADI will have to invest significant amounts into capital expenditures. Its historical capex spend had been ~4%, but given the accelerating growth the company now believes it will need to spend more like 4-6% of sales in capex to open new factories or expand existing ones. For fiscal years 2022 and 2023 capex spend is expected to be even higher, at high single digits.

Financials

Analog Devices has enviable profitability, and as they like to boast, they are a top-tier player in a top-tier industry. Its gross margins at ~71% approach those of the software industry, its operating margin is almost 2x that of the average S&P500 company, and its FCF margin almost 3x that of the average company in the S&P 500.

ADI took advantage of the investor day to update its financial model. The main differences with respect to the old one are that it sees higher operating margins, that it plans to return 100% of its free cash flow to shareholders given that there is no further need to reduce debt, and that capital expenditures as a percentage of sales will be higher. The company is also guiding to $15 in EPS by fiscal year 2027.

The company also updated on the maxim synergies progress. With respect to cost synergies it already accomplished $275 million in savings and it expects to add another $125 in fiscal year 2023. With respect to revenue synergies, it believes it can generate more than $1 billion the next few years from co-designs and cross-selling opportunities.

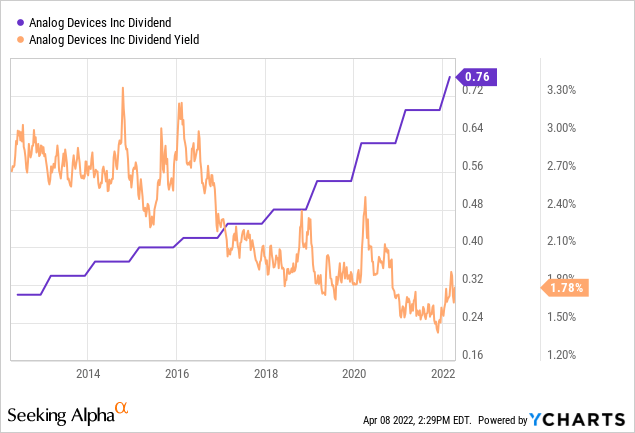

Looking at the capital allocation strategy, ADI is guiding to a dividend with a 40-60% free cash flow payout, and increasing by 10% through the cycle. The rest of the free cash flow will be allocated to share repurchases, with $2.5 billion to be executed by the end of FY22, and another $5 billion by the end of FY24. This should result in a significant reduction in shares outstanding. The company also believes that it has no need to further reduce debt, given that it is currently operating with very little leverage.

The dividend increases from ADI have been impressive as can be seen below. Unfortunately the current yield is relatively low, but yield on cost can quickly improve as ADI continues with the dividend increases.

Conclusion

Analog Devices shared a lot of interesting data points during their most recent investor day presentation. We selected what we thought was the most relevant highlights from the event, hopefully this gives a good idea of where the company sees itself going the next few years. We believe shares are a little undervalued, and that the company will continue to see several tailwinds that should benefit the business the next few years.

Be the first to comment