Vladyslav Varshavskiy/iStock via Getty Images

Introduction

It’s time to talk about coal again. Despite recession fears, the bull case continues to unfold. The International Energy Agency just came out saying it expects record coal demand. Not just in 2022, but also on a prolonged basis. This is helping Arch Resources (NYSE:ARCH). Formerly known as Arch Coal (I really like that name better), the company is exposed to both thermal and metallurgical coal markets, which are both seeing strong secular demand growth thanks to the energy crisis, subdued oil and gas production growth, as well as high steel needs tied to the energy transition.

In this article, we’ll discuss all of that and why ARCH is in a good spot to pay a high dividend on top of aggressive buybacks.

So, bear with me!

Coal Demand Isn’t Fading

I am not against clean energy – at all. I am a huge fan of nuclear energy and hydrogen as a tool to reduce pollution in critical areas like city centers.

However, what we’re currently witnessing isn’t a smooth transition away from coal. The past few years were characterized by politicians and corporations badmouthing fossil fuels while spending billions on renewable energy sources.

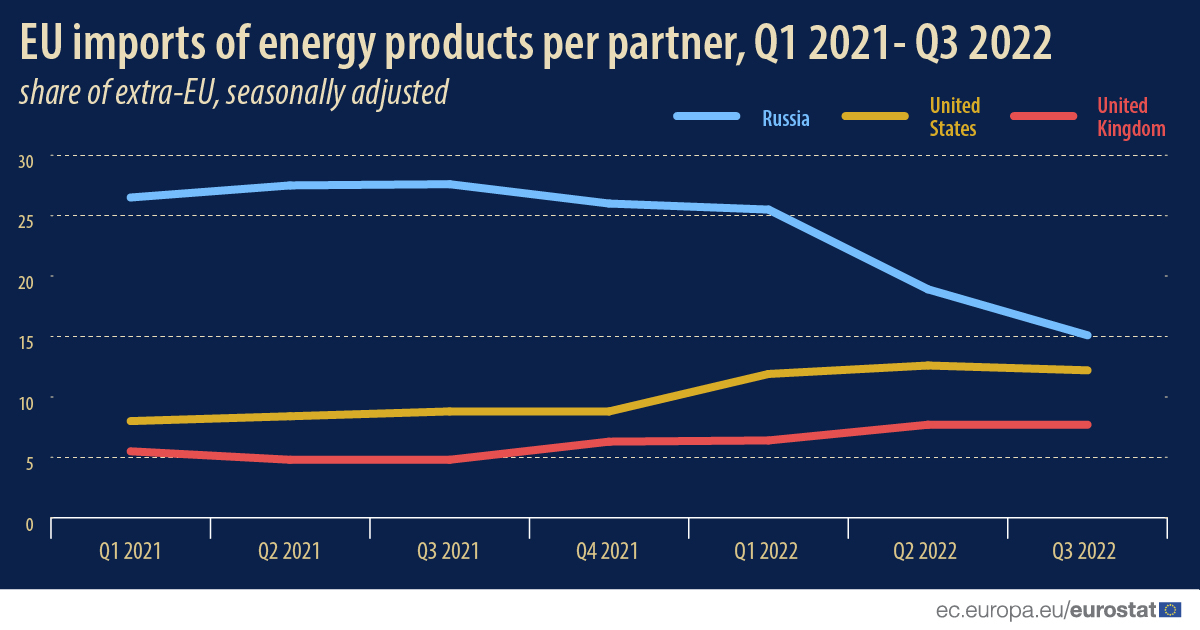

Now, as imports from Russian gas are down in Europe, renewable energy isn’t able to secure the needed energy supply.

Eurostat

Coal, albeit dirty, is reliable and (historically speaking) quite affordable. It’s the source of energy that allowed western nations to become prosperous in the 19th century.

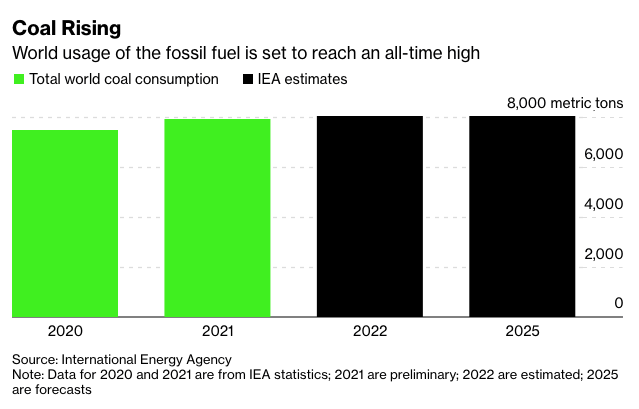

Hence, despite all efforts, coal is back. And it’s here to stay. According to the International Energy Agency (as reported by Bloomberg), coal usage is likely to increase by 1.2% in 2022, surpassing 8 billion tons in a single year for the first time ever.

Moreover, the IEA does not see lower levels until at least 2025.

Bloomberg

According to the IEA:

The international coal market remained tight in 2022, with coal demand for power generation set to hit a new record. Coal prices rose to unprecedented levels in March and then again in June, pushed higher by the strains caused by the global energy crisis, especially the spikes in natural gas prices, as well as adverse weather conditions in Australia, a key international supplier. Europe, which has been heavily impacted by Russia’s sharp reductions of natural gas flows, is on course to increase its coal consumption for the second year in a row. However, by 2025, European coal demand is expected to decline below 2020 levels.

Moreover, while developed nations are expected to further cut demand in the years ahead, emerging nations are likely to more than offset these declines, leading to higher global coal demand.

Coal demand is forecast to fall in advanced economies in the coming years as renewables increasingly displace it for electricity generation. However, emerging and developing economies in Asia are set to increase coal use to help power their economic growth, even as they add more renewables. Developments in China, the world’s largest coal consumer, will have the biggest impact on global coal demand in the coming years, but India will also be significant.

The full 137-page report can be accessed here in case you’re interested. The chart showing the breakdown of future coal demand can be found on page 12. I cannot show you a screenshot due to copyright reasons.

So, what does this mean for ARCH?

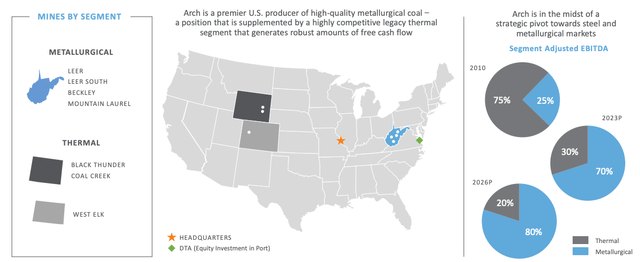

Headquartered in St. Louis, Missouri, Arch Resources combines the best of two worlds. With a market cap of $2.6 billion, the company is exposed to both thermal and metallurgical coal markets.

Essentially, thermal coal is used for energy and heating. Metallurgical, also called coking coal or met coal is used to produce coke, the primary source of carbon used in the steelmaking process.

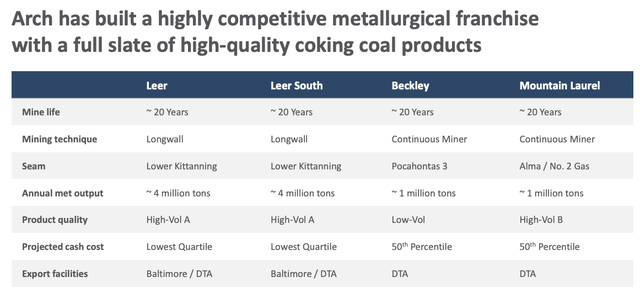

Arch coal has mining operations in West Virginia, where it operates the Leer, Leer South, Beckley, and Mountain Laurel mines. All of these mines are underground mines.

The company also operates in Wyoming and Colorado where it operates three mines. Two of them are surface mines. These mines are serviced by the Union Pacific (UNP) railroad, which is one of my largest holdings.

What’s interesting is that coking coal demand is also expected to remain strong in the years ahead. This is expected despite muted demand from the world’s steel hub China. This is what the IEA said in the same report I mentioned earlier in this article:

From 2022 to 2025, met coal consumption is forecast to be stable At 1 078 Mt by 2025, demand for metallurgical coal is forecast to be well below the pre-pandemic level, as China’s steel production is expected to remain muted. In total, lower use in the European Union, Japan, Korea, Russia, and China is offset by a strong demand increase in India and the rest of the world, mainly Southeast Asia.

In 2026, coking coal is expected to account for 80% of ARCH’s adjusted EBITDA. That’s up from 70% in 2023E, and just 25% in 2010.

Arch Resources is also export-focused. According to the company:

– Arch has strong, longstanding relationships with many of the world’s largest steelmakers.

– Arch has rail and terminal agreements – as well as a 35-percent-interest in the DTA facility in Newport News, Virginia – to facilitate export moves.

– Arch also has rail and terminal agreements in place to facilitate the movement of a small but at times highly profitable percentage of its thermal output into international markets.

In 2023, ARCH is expected to supply roughly a third of global High-Vol A coking coal, which is extremely high-value.

However, it’s not just coking coal. Thermal coal is also a highly profitable endeavor for the company. Since 4Q16, the company has generated $1.2 billion in thermal coal EBITDA. CapEx on these operations was just $123 million. The company’s adjusted EBITDA is 10x higher than CapEx. The company expects this number to rise further thanks to its licked-in book of advantageously priced thermal business.

The company has committed more than 120 million tons of Powder River Basin volumes for delivery from 2023 through 2026. 90% of 2023 volumes have been priced. All of these contracts are priced well-above historic levels.

Moreover, the company has sold nearly all projected 2023 and 2024 domestic sales volumes for the West Elk mine, at prices that provide a very solid and profitable baseload of business – according to ARCH.

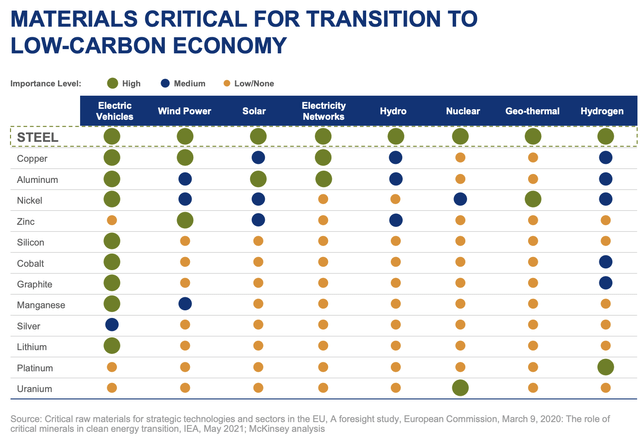

With that said, one major thing needs to be said. When people talk about coal, they often refer to heating coal (thermal coal). That secular bull case is clear as we discussed in the first part of this article. However, coking coal also has a secular bull case. Believe it or not, it’s driven by the energy transition.

As I wrote in an article earlier this year, the transition to net zero will require a lot of steel. For example, between 66% and 80% of the weight of a wind turbine comes from steel.

Steel is the key component of every single renewable energy technology.

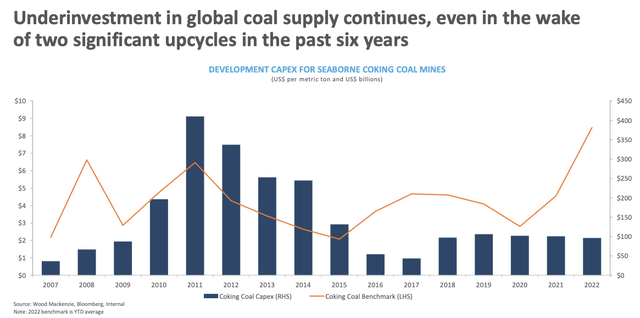

Just like oil and gas, higher demand is not resulting in higher industry CapEx. Environmental standards and whatnot keep companies from pouring billions into high-risk developments of new mines. Hence, seaborne coking coal CapEx has not improved since 2018. Meanwhile, prices have more than doubled.

Arch Resources expects price volatility to continue, but with an upward bias, as mining costs increase over time due to ongoing under-investment coupled with reserve degradation and depletion.

So, what does this mean for shareholders?

(Almost) nobody expected this when coal stocks got annihilated prior to the current upswing, but coal stocks are now a source of sky-high buybacks and dividends.

In the case of ARCH, we’re dealing with a company with plenty of long-term coal deals, strong pricing power, and a healthy balance sheet. The company has just $178 million of total debt as of September 30, 2022. The company is now net cash positive after paying down nearly its entire term loan and 84% of its convertible debt securities.

Hence, when subtracting cash from gross debt, we get a $323 million negative net debt value (that’s positive net cash). This includes taking care of a thermal mine reclamation fund for the Powder River Basin asset retirement obligations.

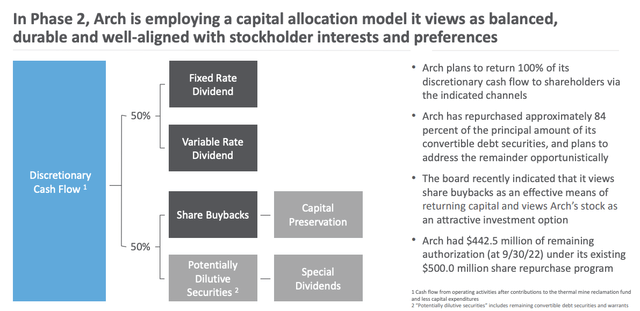

Thanks to these developments, ARCH is now in Phase 2 of its capital return program. The first program repurchased 40% of shares outstanding prior to March 2020. That was before the coal bull market took off.

As ARCH has no plans to expand its operations (there’s no need for that), it will return 100% of its discretionary cash flow to shareholders. That’s cash flow after CapEx. Half of that will go to the dividend (base + fixed). The other half will go towards buybacks.

According to the company:

Discretionary cash flow for the third quarter was $413 million and under our capital return formula, our board has declared a dividend of 50% of that amount, or $10.75 per share. The dividend will be paid on December 15, to stockholders of record on November 30.

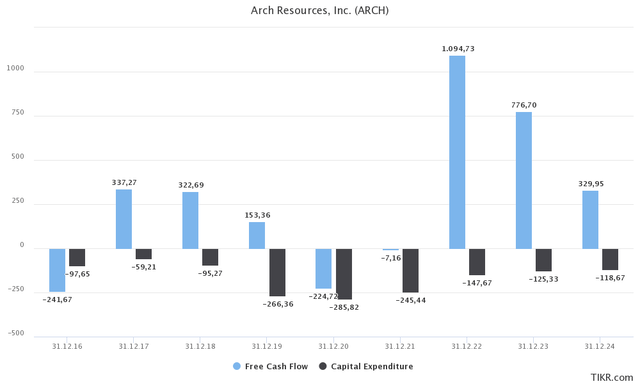

That’s an annualized dividend yield of 30%. However, don’t expect that to last. In 2023, free cash flow is expected to fall to slightly less than $800 million. Half of that is $400 million, which is 15% of the current market cap (implied yield). That’s still a lot, and it shows how passive income people can make while waiting for capital gains.

On a side note, note that CapEx is not expected to grow.

However, I do not recommend ARCH as a dividend vehicle. The dividend is a bonus. Coal is way too risky and volatile to be part of a conservative dividend (growth) portfolio. To me, the dividend is a great bonus (especially for investors who bought at low prices) and a sign that the company remains undervalued.

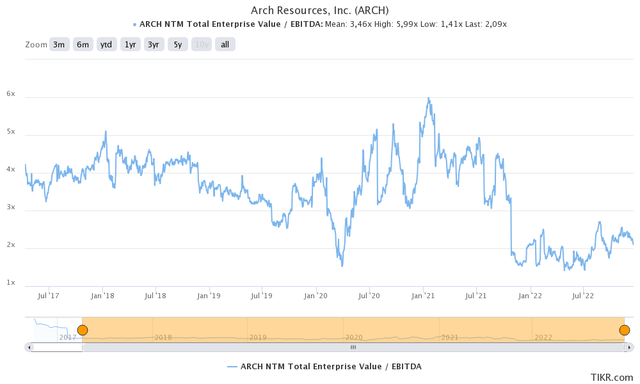

Speaking of undervalued, ARCH is trading at 2.3x 2023E EBITDA of $960 million. That’s based on its $2.6 billion market cap and $323 million in current net cash.

I would make the case that anything below 3x forward EBITDA is attractive.

The current target price average is $190. The most recent upgrade is from Jefferies on June 7 (PT $225).

That would imply roughly a 60% upside from the current $140 share price. I agree with that assessment.

Takeaway

In this article, we did two things. First, we discussed the outlook of coal demand and rivers of what looks to be a long-term demand uptrend.

Second, we looked into a stock poised to benefit from high global thermal and coking coal demand, subdued investments in mining capacities, and secular net-zero steel demand.

Moreover, Arch Resources is in a great spot to generate high free cash flow on a prolonged basis thanks to low CapEx, a stellar balance sheet, and no major other liabilities.

I believe that ARCH should be trading close to $230.

However, I urge investors to be careful. Coal is highly cyclical and very volatile. Treat the dividend as a bonus and maintain a small position if you decide that coal is right for you.

(Dis)agree? Let me know in the comments!

Be the first to comment