gorodenkoff/iStock via Getty Images

Life isn’t about waiting for the storm to pass…It’s about learning to dance in the rain.”― Vivian Greene

Today, we take our first look at a small clinical-stage developmental concern. The company recently addressed funding needs, during which a beneficial owner added to their stake significantly. With upcoming potential catalysts in 2023, the company merited further investigation. An analysis follows below.

Seeking Alpha

Company Overview:

Rain Therapeutics Inc. (NASDAQ:RAIN) is a Newark, California based clinical-stage biotechnology concern focused on the development of tumor-agnostic therapies that target cancers with particular genetic profiles. The company is advancing one in-licensed program (milademetan) through the clinic, which is currently undergoing evaluation in two trials with a third slated for 1Q23. Rain was formed in 2017 and went public in April 2021, raising net proceeds of $121.5 million at $17 per share. The stock trades at just seven bucks a share, translating to a market cap of approximately $260 million.

As a means of preventing unwanted shareholder influence, the company is capitalized by two classes of stock: voting and non-voting. The 26.05 million shares of the former are publicly traded, while the 10.34 million shares of the non-voting stock have no public market but are convertible into voting shares subject to beneficial ownership limitations.

Pipeline:

The company’s only clinical asset is RAIN-32 (milademetan), an oral inhibitor of the MDM2-p53 complex that reactivates p53. MDM2-p53 has long been a target of Big Pharma after its structure was identified in 1996. Wildtype [WT] p53 is a labile (i.e., susceptible to alteration) protein that responds to cellular injury to protect against cancer by induction of cellular apoptosis or senescence. It is known as the guardian of the genome. However, its tumor suppressor activity can be deactivated when bound by the MDM2 oncoprotein. As such, dysregulation of MDM2 – either through over-expression or the loss of its normal p14ARF regulator – can induce oncogenesis. Amgen (AMGN), Merck (MRK), Novartis (NVS), Roche (OTCQX:RHHBY), and Sanofi (SNY) all attempted to develop a therapy that would interrupt the MDM2-p53 interaction but failed due to a poor adverse event profiles that included depleted platelet counts.

Then, Daiichi Sankyo (OTCPK:DSKYF) reworked milademetan’s (then DS-3032’s) dosing schedule and was able to provide meaningful antitumor activity in a MDM2-amplified subtype of liposarcoma (LPS – cancer of the fat cells) and other solid tumors with a reduced adverse event profile in a Phase 1 study. Specifically, milademetan (on its current Phase 3 dosing schedule) demonstrated median progression-free survival (mPFS) of 7.4 months in well-differentiated/de-differentiated (WD/DD) LPS patients who exhibited amplified MDM2-p53. This outcome was significant as the two approved therapies for LPS (Johnson & Johnson’s (JNJ) Yondelis (trabectedin) and Eisai’s Halaven (eribulin mesylate)) only demonstrated mPFS of 2.0 to 2.2 months. Based on this study, Rain in-licensed milademetan from Daiichi in September 2020.

It is being investigated in two clinical trials. The MANTRA study is a 175-patient Phase 3 trial that is evaluating milademetan in the treatment of DD LPS +WD. Patients, who have unresectable or metastatic DD LPS +WD and have progressed after one or more systemic therapies – including at least one anthracycline-based treatment – are being randomized 1:1 to either receive 260mg of milademetan (once daily for three consecutive days followed by 11 days off) or current LPS therapy trabectedin (as indicated) with primary endpoint the difference in PFS between the two treatments. Originally planned as a 160-patient trail, Rain completed enrollment five months ahead of schedule with an additional 15 patients in August 2022. Top-line data is anticipated in 1Q23, after 105 events have transpired.

If ultimately approved, approximately 65% of LPS diagnoses include WD/DD, and nearly 100% of those cases involve an amplified MDM2-p53 interaction – making the total domestic addressable market ~1,400 patients (~2,300 worldwide). There are no approved drugs specifically targeting MDM2, although Kartos (Phase 3 myelofibrosis), Ascentage (OTCPK:ASPHF) (Phase 2 solid tumors), Boehringer Ingelheim (Phase 1 LPS), Aileron (ALRN) (Phase 1 solid tumors), and Kymera (KYMR) (IND enabling) all have MDM2 programs.

Milademetan is also being evaluated in a 65-patient Phase 2 trial (MANTRA-2) for a basket of relapsed/refractory and/or metastatic solid cancers that have progressed after standard of care treatment. The patient population is MDM2-amplified with a gene copy number > 8 – which represents the number of copies of a particular gene per genome in an organism – and exhibit WT p53. The primary endpoint for each indication is objective response rate. The study is still enrolling (n=17), although the company provided an interim data readout on November 4, 2022 with two unconfirmed partial responses and two near-partial responses (from ten evaluable patients) with tumor regressions of 34%, 30%, 29%, and 27% across four different cancers (pancreatic, non-small cell lung cancer, biliary, and breast, respectively). As for its safety profile, three Grade 3+ adverse events for thrombocytopenia (low blood platelet count) occurred in a 15-patient population that had received at least one dose of milademetan – in line with findings from the Daiichi’s Phase 1 study.

Additionally, Rain expects to commence a Phase 1/2 trial (MANTRA-4) that will assess milademetan in combination with Roche’s PD-L1 inhibitor Tecentriq (atezolizumab) in patients with cyclin-dependent kinase inhibitor 2A (CDKN2A) loss, p53 WT advanced solid tumors in 1Q23. CDKN2A codes for MDM2 regulator p14ARF. This upcoming study reallocated resources away from a planned Phase 2 study (MANTRA-3) in Merkel cell carcinoma patients, which has been shelved indefinitely.

In addition to milademetan, Rain has a preclinical program focused on inducing synthetic lethality in tumor cells through RAD52 inhibition.

Daiichi Sankyo Agreement

To in-license its only clinical asset, Rain paid Daiichi Sankyo an upfront consideration of $5 million with the latter eligible to receive milestone payments totaling $223.5 million and high, single digit royalties on any approved product containing milademetan.

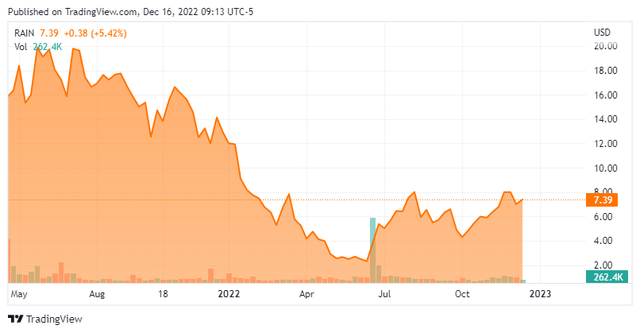

Share Price Performance

Except for the initiations of the two trials there had been a news vacuum from Rain before its MANTRA-2 interim data release on November 4, 2022. As such, with no positive market-moving events to push back against the general negativity in the biotech sector, thinly traded shares of RAIN cratered to the low-$2 area in May-June 2022. Its stock caught a bid in late-June 2022 when a coverage initiation by Jones Capital brought to light the fact that it was trading at more than a 50% discount to balance sheet cash.

Balance Sheet & Analyst Commentary:

Rain used the promising MANTRA-2 interim data as a liquidity event, raising net proceeds of $54.0 million at $5.83 a share and bringing the company’s cash and investments to ~$144 million against no debt, providing it a cash runway into mid-2025.

The Street is almost unanimously upbeat on milademetan, featuring five buy and two outperform ratings. Price targets proffered range from $12 to $29 a share.

Biotechnology Value Fund, which is a beneficial owner represented on the board of directors by Gorjan Hrustanovic, is also bullish on Rain, based on its purchase of 1.7 million shares on the recent secondary offering, moving its ownership interest to 14%, which includes 1.7 million shares of non-voting stock. A director also added almost a $1 million to his stake in the company in transactions on November 21st and 22nd.

Verdict:

To suggest that the early returns from MANTRA-2 have de-risked MANTRA may be a stretch, but it certainly does not hurt the latter’s prospects. The company was able to leverage that data into a $54 million capital raise without impacting share price ($5.90 at the close of November 4th). As such, Rain currently trades at a premium to cash. The investment thesis boils down to the success or failure of MANTRA and the bet here – using Daiichi’s Phase 1 data as a guide – is that the results will enable the company to file an NDA for milademetan in LPS. For those with a high risk-tolerance, the risk/reward profile suggests following the insider and making a small and measured investment.

Do not be angry with the rain; it simply does not know how to fall upwards.”― Vladimir Nabokov

Be the first to comment