jetcityimage/iStock Editorial via Getty Images

If everybody indexed, the only word you could use is chaos, catastrophe… the markets would fail.

– John Bogle, May 2017

Try to buy assets at a discount rather than earnings. Earnings can change dramatically in a short time. Usually, assets change slowly. One has to know much more about a company if one buys earnings.

– Walter Schloss

Introduction

Energy equities have outperformed significantly year-to-date in 2022, with the Energy Select Sector SPDR Fund (XLE) up 45.3% in 2022. This compares very favorably to a 7.5% YTD decline in the SPDR S&P 500 ETF (SPY), a 14.8% decline in the Invesco QQQ Trust (QQQ), a 18.2% decline in the iShares 20+Year Treasury ETF (TLT), and a 37.6% decline in the ARK Innovation ETF (ARKK).

XLE SPY QQQ TLT ARKK (Author, StockCharts)

Growth stocks, led by the momentum growth favorites that dominate ARKK, have been severely impaired, held back by their poor starting valuations, something I wrote about in detail on August 10th, 2021, with the article titled, “ARKK Implosion Is On The Horizon.” Since that article was published, ARKK shares are down 51.2%, vs. a 1% decline in the S&P 500 Index (SP500), as illustrated in the image below.

Author’s August 10th, 2021 Article Snapshot (Author, Seeking Alpha)

Obviously, growth stocks are struggling, as rising interest rates the yield curve, but particularly at the longer end of the yield curve, reduce the appeal of the longest duration assets.

On the opposite side of the ledger, high free cash flow yielding companies are being rewarded, and many of these free cash flow standouts reside in the commodity equity sector. Taken together, a historical capital rotation is underway. This is something I have chronicled on a regular basis, documenting the flow of money from the “Have’s” to the “Have Not’s.” These public articles below reference this historical capital rotation.

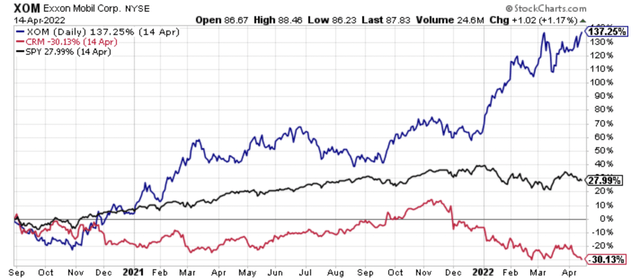

Adding to the narrative, with this public article, I outlined how removing Exxon Mobil (XOM) from the Dow Jones Industrial Average (DIA) and replacing the venerable, longest listed Dow Jones component with Salesforce.com (CRM) in August of 2020 would turn out to be a high water marker for the current state of the financial markets. The share price performance of Exxon and Salesforce.com shares since that removal date says everything that you need to know about the financial markets since August 2020.

XOM Versus CRM Performance Since XOM Was Replaced By CRM In The DJIA (Author, StockCharts)

Looking at the chart above, Exxon Mobil shares have strongly outperformed Salesforce.com shares since Exxon was removed from the DJIA and Salesforce.com shares were added. Let’s not forget that the active decision makers at S&P Global (SPGI) removed Exxon and added Salesforce.com because they thought that Salesforce.com was more representative of the future of the market. This happened even though the economic impact of Exxon Mobil was far greater at the time of the switch, and that gap has increased today as Exxon’s revenues, net income, and free cash flows have surged with higher energy prices.

With the benefit of hindsight, almost all market participants were crowded on one side of the boat, overweighting technology shares, and underweighting the left behind value stocks, particularly the downtrodden commodity equities.

The best example of this seismic shift in the investment landscape has been in the performance of natural gas equities, which have trounced their vaunted FAANG peers in performance terms, across a range of time frames dating to January 1st, 2020, as I will illustrate below in the body of this article, which is an updated fourth edition to my February 3rd, 2021 article, “Off To The RACES: Natural Gas Equities Lapping FAANG Stocks, the May 26th, 2021 follow-up, and then the September 10th, 2021 third edition.

As we approach the month of May, which is racing season in Indianapolis, the favored natural gas equities, which I have coined with the term RACES, which is the first letter of each of the equities profiled more in-depth below, are the best performing, most obscure corner of the market, that most investors have ignored, until recently. With the current slingshot higher in prices, many investors are now acknowledging, appreciating, and buying into natural gas equities and related equities as investment candidates, recognizing that their free cash flow estimates are surging on the back of higher natural gas, and natural gas liquids prices.

Off To The RACES Stocks Are Way Ahead Of FAANG Since The Start Of 2020 And The Gap Is Widening

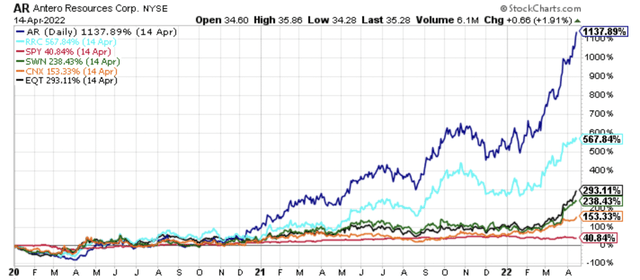

The following performance chart shows the total return of Range Resources (RRC), Antero Resources (AR), CNX Resources (CNX), EQT Corp. (EQT), Southwestern Energy (SWN), and the SPDR S&P 500 ETF (SPY) since January 1st, 2020 through Thursday, April 14th, 2022.

AR RRC EQT SWN CXN SPY Performance Since January 1st, 2020 through April 14th, 2022. (Author, StockCharts)

Antero Resources shares lead the pack, higher by 1137.9% since the start of 2020. For perspective, in the last article in this series published on September 10th, 2021, AR shares were higher by 462.2% from January 1st, 2020 through Thursday, September 9th, 2021. Range Resources is next in line, with a total return of 567.9%, followed by EQT Corp., whose shares have gained 293.1%. Southwestern Energy shares have gained a cumulative 238.4%, and CNX Resources shares have gained 153.3% since the start of January 2020.

Notably, all of these natural gas equities have significantly outperformed the SPDR S&P 500 Index ETF, which has gained 40.8% over this time frame, actually down from the 43.0% in the last update in this series, again published on September 10th, 2021.

Collectively, the “Off To The RACES” stocks have an average return of 478.1% since January 1st of 2020. This is up significantly from the 190.4% average return from the last update, and the 152.6% average return since January 1st of 2020 published in the May 26th, 2021 article.

Looking back to the first article in the series, the average return of 478.1% is up significantly from the average return of 80.4% from January 1st, 2020 through February 2nd, 2021. This might surprise many investors who have cast aside energy equities to the dustbin of history, yet these cast aside energy equities are significantly outperforming.

What are the returns of the FAANG stocks over this time frame?

GOOGL FB SPY AMZN AAPL NFLX January 1st 2020 Through April 14th, 2022. (Author, StockCharts)

Like a rotating cast of characters, Apple (AAPL) shares have now jumped into the lead amongst the FAANG quintet, posting a 128.8% gain from January 1st, 2020 through Thursday, April 14th, 2022. The gain for Apple is moderately above the 112.7% gain in Apple shares posted during the September 10th, 2021 update in this series. The problem, however, is that the rest of the FAANG stocks have struggled mightily over this time frame.

Alphabet (GOOGL), (GOOG), shares are now up 89.2% from January 1st, 2020, which is a decline from the 114.3% gain in the last update. Amazon (AMZN) shares now sport a 64.2% gain since January 1st, 2020, down from an 88.6% gain in the last update. Netflix (NFLX) shares have cratered, only posting a 5.4% gain since January 1st, 2020, down from 84.7% gain in the September 10th, 2021 update. Similarly, Facebook (FB) shares have cratered too, only up 2.4% from January 1st, 2020 through April 14th, 2022, which was down from the 84.2% gain in the last update.

The updated returns for the FAANG stocks collectively, are an average return of 58%, which is a major decline from the average return of 96.9% in the September 10th, 2021 update in this series. With this decline, the advantage of the FAANG quintet over the SPDR S&P 500 ETF has shrunk significantly, with SPY up 40.8% from January 1st of 2020.

Providing perspective, the average 58% gain for FAANG stocks not only below the average 96.9% gain in FAANG stocks from the September 10th, 2021 update, it’s also below the 68.5% return posted by the FAANG stocks from the May 26th, 2021 update, which covered January 1st, 2020 through September 9th, 2021 May 25th, 2021. That return was itself up moderately from the first article in this series, with FAANG shares higher by 62.2% on average since January 1st, 2020 through February 2nd, 2021. So, FAANG stocks have effectively declined as a group from their February 2nd, 2021 levels, which is remarkable when you think about the narrative in the markets today. On this note, as I like to say, narrative follows price.

Bottom line, the “Off To The RACES” stocks have delivered an 478.1% average gain since the start of 2020, up from the 190.4% return on average from the last update, significantly ahead of the FAANG average stock return of 58% since January 1st, of 2020. This FAANG 58% average gain is down from the 96.9% average gain from the September 10th, 2021 update. The return gap is widening with each updated article in this series, which is not a surprise given the starting valuation positions of each group of equities circa January 1st, 2020.

Energy Prices Are Surging Led By Natural Gas Prices

Adding to the bullish narrative and relative price performance strength is the fact that natural gas liquids prices and dry natural gas prices are both surging, led by an explosion higher in dry gas prices year-to-date in 2022.

Dry natural gas prices, which can be monitored with the United States Natural Gas Fund (UNG), and the United States 12-Month Natural Gas Fund (UNL), have recently broken through the $7 level (for perspective, they had broken the $5 level in the last update in this series).

Dry Natural Gas Prices (Author, StockCharts)

The breakout in dry gas prices has seen both UNG and UNL make new multi-year highs.

UNG Daily (Author, StockCharts)

UNL Daily (Author, StockCharts)

For perspective, in the September 10th, 2021 update in this series, UNG was priced at $17.49, and today it is at $25.60. Meanwhile, UNL was priced at $13.13 in the September 10th, 2021 update (these are September 9th prices), and it is at $23.21 as of the market’s close on Thursday, April 14th, 2022.

Given the favorable supply/demand fundamentals, the restrained growth capital spending (partially due to pipeline takeaway capacity restraints), ESG headwinds, and the continued avoidance by investors, as investors are still conditioned to plow funds in the broader market barometers and buy the dip in technology stocks, which keeps valuations low and compounding prospects robust, we could be in the early innings of a secular bull market in energy equities.

A Long Time In Development and The Start Of A Longer-Term Opportunity

Researching, chronicling, and tracking the opportunity in one of the most out-of-favor corners of the market has been a time-consuming initiative over the last couple of years, though it has proved worthwhile in terms of relative and absolute opportunity.

The following partial list of public articles chronicles my thought process on the targeted natural gas equities, including Antero Midstream (AM), and the broader developing opportunity in commodity equities over the past year.

- “Southwestern Energy: A Misunderstood Natural Gas Producer” – Published December 13th, 2019

- “Range Resources Continues Capex Cuts, Validates Appalachia Advantage” – Published January 8th, 2020

- “Antero Resources Is A Generational Buy: Dispelling The Myth Of Antero As High-Cost Producer” – Published February 19th, 2020

- “Antero Midstream Shares Are Significantly Undervalued Too” – Published February, 20th, 2020

- “The Long Oil, Short Natural Gas Trade Is Officially Dead” – Published March 9th, 2020

- “The United States Natural Gas Fund Was Up On A Historic Down Day For Energy” – Published March 10th, 2020

- “EQT Corp. Surges As The Bearish Natural Gas Thesis Is Dead” – Published March 17th, 2020

- “EQT Leading The Forthcoming Move Higher In Natural Gas Prices” – Published July 24th, 2020

- “Antero Resources Is A Generational Buy: Working Through The Near-Term Debt Maturities” – Published July 19th, 2020

- “Antero Midstream Has Outperformed All Other Midstream Firms Year-To-Date” – Published July 29th, 2020

- “Antero Resources Is A Generational Buy: Mapping Out The Free Cash Flow” – Published October 28th, 2020

- “Antero Resources Leading The Way In A Historic Energy Equity Rally” – Published December 11th, 2020

- “Not All Energy Stocks Are Created Equal” – Published December 24th, 2020

- “Antero Resources: Buy The Forgivable Dip” – Published August 2nd, 2021

- “EQT Corp.: Buy The Forgivable Dip At A 20% Free Cash Flow Yield” – Published August 4th, 2021

- “U.S. Steel: A Breakout Stock For 2022” – Published January 26th, 2022

- “Peabody Energy: A Breakout Stock For 2022” – Published January 28th, 2022

If you read through the articles above that chronicle this journey, there was pessimism and skepticism in the commentary sections, especially in the beginning.

This skepticism and pessimism was evident publicly, and privately, where many struggled to embrace such a poor performing group of stocks. In my contrarian mindset, the continued pessimism and skepticism, which still exists today to an extent, think Cathie Wood of ARK Innovation ETF fame calling for a commodity crash in the second half of 2021, and subsequently doubling and tripling down on this call, confirms that we’re still in the early innings of this opportunity in natural gas equities, commodities, and commodity equities.

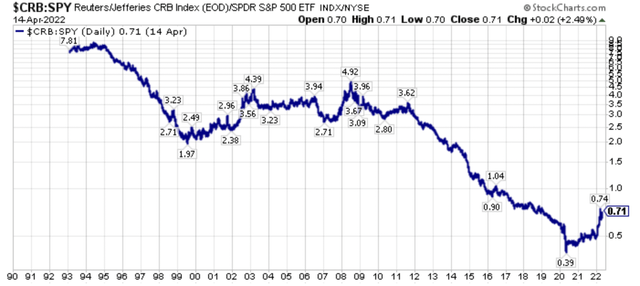

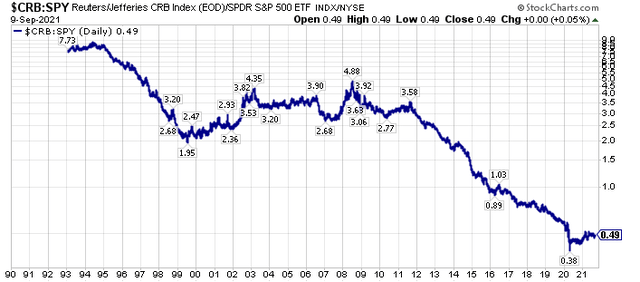

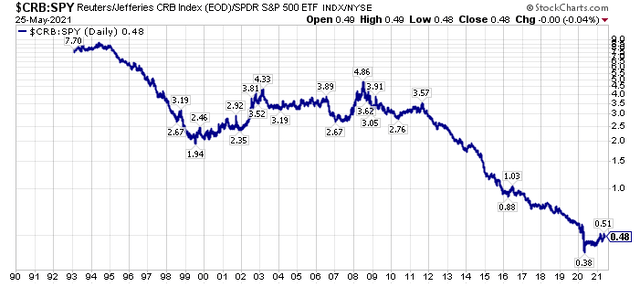

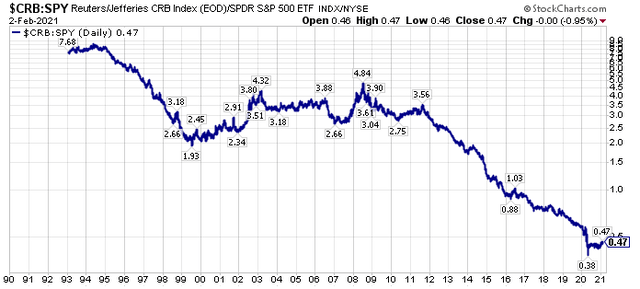

On that note, if you look at the relative performance chart of a broad based index of commodities vs. the SPDR S&P 500 ETF, the size and scale of the relative opportunity quickly become apparent.

$CRB Versus SPY as of April 14th, 2022 (Author, StockCharts)

For reference, here was the same chart posted on September 10th, 2021 in the last update in this series.

$CRB Versus SPY As Of September 9th 2021 (Author, StockCharts)

For further reference, here was the same chart I published in the May 26th, 2021 update. Look closely, as even with the relative outperformance of commodities, there has been only moderate movement in this reversion to the mean ratio. This should tell the market generalist that we are still in the midst of a reversion-to-the-mean higher.

$CRB Versus SPY As Of May 25th, 2021 (Author, StockCharts)

Going all the way back, to the first article in this series, here was the same chart from my aforementioned February 3rd, 2021 article. The point is this ratio basically stood still for the first three updates in this article series, and it has moved upwards moderately since the last update, with significant commodity and commodity equity outperformance.

$CRB Versus SPY As Of February 2nd, 2021 (Author, StockCharts)

From a bigger picture perspective, commodities and commodity equities have certainly had an explosive move from their 2020 depths. However, in the bigger picture, that may have been the final relative washout, and the reversion-to-the-mean trade has the potential for a lot more room to run.

Closing Thoughts: Something Is Changing Under The Surface Of The Markets As More Investors Recognize The Commodity Bull Market

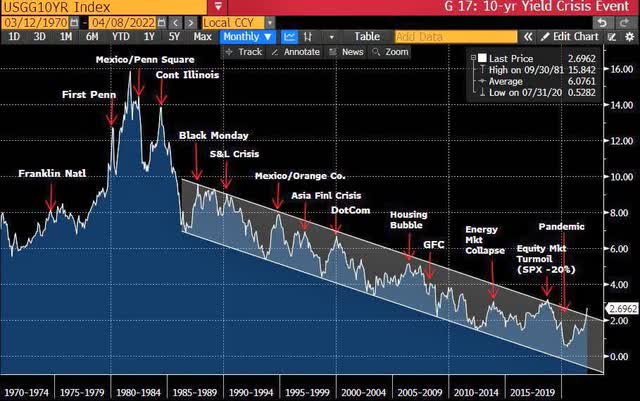

Different from the prior updates in this series, there is definitely an awareness building as to the outperformance of commodities, and commodity equities gather steam. This historical capital rotation is like a storm building its strength, and this storm could be further fed by a markedly different interest rate environment than many investors have lived through for the last roughly 4 decades.

Change In Interest Rate Backdrop (Bloomberg, AzizSapphire)

The untold story with the rise in energy equities, and more specifically natural gas equities, is that this is a supply side story. Going further, the capital cycle is playing out in real time in natural gas prices, natural gas liquids prices, and natural gas equities, with natural gas equities significantly outperforming their FAANG peers in 2020, in 2021, and year-to-date in 2022.

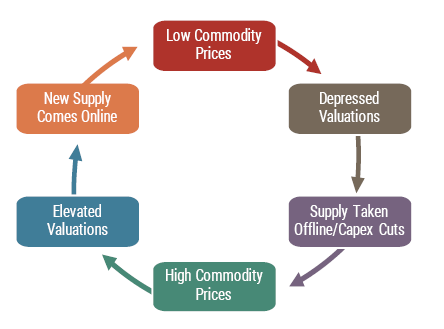

Capital Cycle (GMO)

This outperformance of the most out-of-favor energy equities, a sector I have been known to previously call the red-headed stepchild of the already out-of-favor energy sector, at least before the recent price run-up, has really accelerated in 2022.

With the broader equity market still exposed to the potential of a strong drawdown, or perhaps seven years of running in place, because of historically poor starting valuations, there’s a need for investors to consider alternative asset classes. Importantly, a further drawdown in the broader markets, which could be fueled by rising long-term interest rates rising because of supply side commodity inflationary pressures combined with building wage pressures, could accelerate fund flows into commodity equities.

Why?

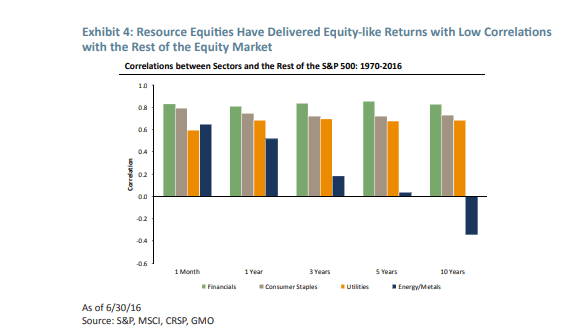

Simply put, investors will be looking for non-correlated sectors and non-correlated stocks, especially if the drawdown in both stocks and bonds continues. Notably, this dual decline in stocks and bonds is impairing the traditionally popular 60/40 portfolio as well as the previous very in-favor risk parity strategies. On this note, commodity stocks, specifically the once loathed, and still generally unloved energy equity sector, certainly fits the bill as a portfolio diversifier, and enhancer, which we have seen play out in spades in 2022.

Resource Equities Offer Diversified Returns (S&P, MSCI, CRSP, GMO)

Wrapping up, quietly at first, and now more rapidly as the capital rotation has broadened in scope, we have seen a passing of the baton of market leadership. Will there be ebbs and flows to this process? Unequivocally yes, meaning expect relative pullbacks as investors reposition, and investors of all stripes try to reorientate around the inflection point that is occurring real time.

At this juncture, most investors are simply just becoming aware of this leadership transition that has been taking place since the broader equity markets bottomed in March of 2020, though relative and absolute price action this year in 2022 has certainly opened more eyes. Recognizing this changing backdrop after years of study, including being too early, I have been pounding the table on the extremely out-of-favor commodity equities for several years now, and I still think we’re in the early innings of what will be a longer-term secular bull market, albeit with significant volatility. Personally, I think we will supersede the capital rotation that took place from growth-to-value during 2000-2007, which also coincided with the last secular commodity bull market which ran from 2000-2008.

Investors skittish of commodity equities should research cast aside financials as they also will benefit from rising inflationary expectations and rising long-term interest rates. Understanding the bigger picture, then having an understanding of the bottoms-up fundamentals has been the key to outperformance, and this is a path that has not been easy with those participating confirming this reality. However, the road less taken is sometimes the better one, and I firmly believe that today, as traditional stocks, bonds, and real estate continue to offer very poor starting valuations and very poor projected future real returns from today’s price levels. More specifically, the out-of-favor assets and asset classes, including commodities and commodity equities and out-of-favor specific securities, are where the historic opportunity has been, and that’s where it still stands, from my perspective.

Be the first to comment