Pedro Jose Garcia Flores/iStock via Getty Images

Life is a long preparation for something that never happens.”― W.B. Yeats

Today, we put Nuvve Holding Corp. (NASDAQ:NVVE) in the spotlight for the first time. Like so many EV-related concerns, the recent months have not been kind to its shareholders. In addition, the stock just saw the first of what might be many insider sales as lock ups expire. What’s ahead for this “Busted IPO?” We take a look under the hood via the analysis below.

Seeking Alpha

Company Overview:

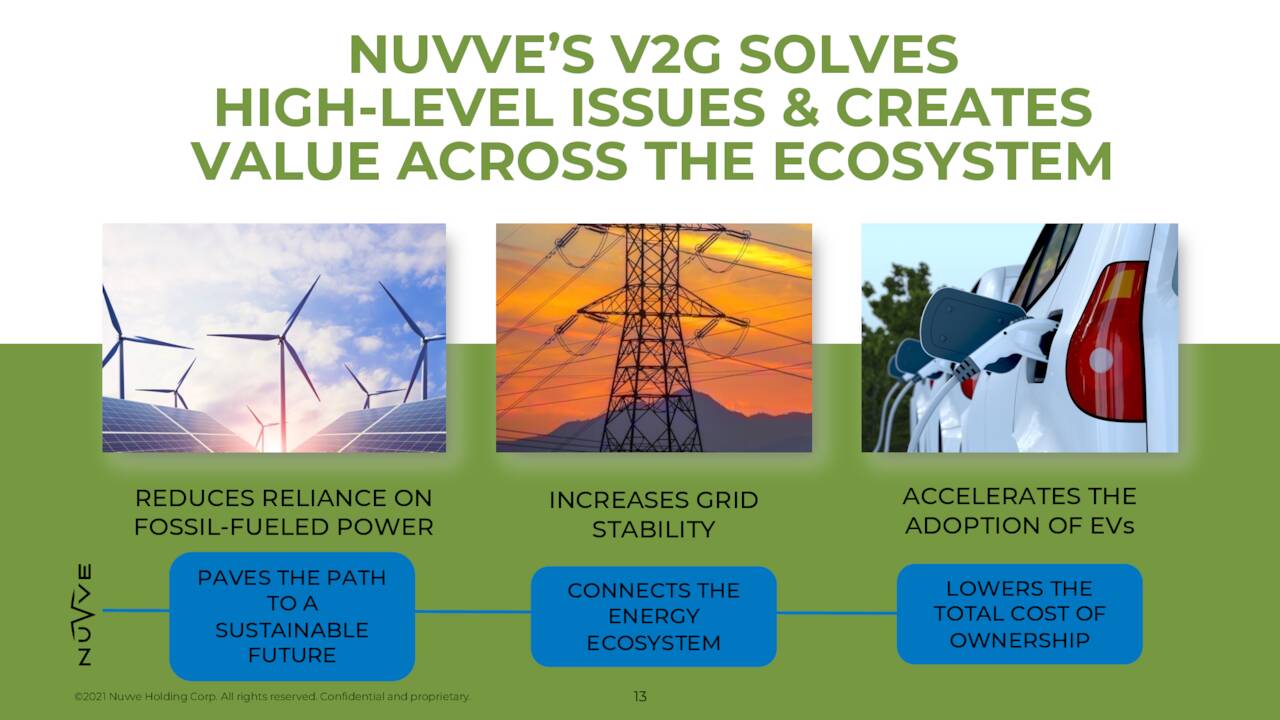

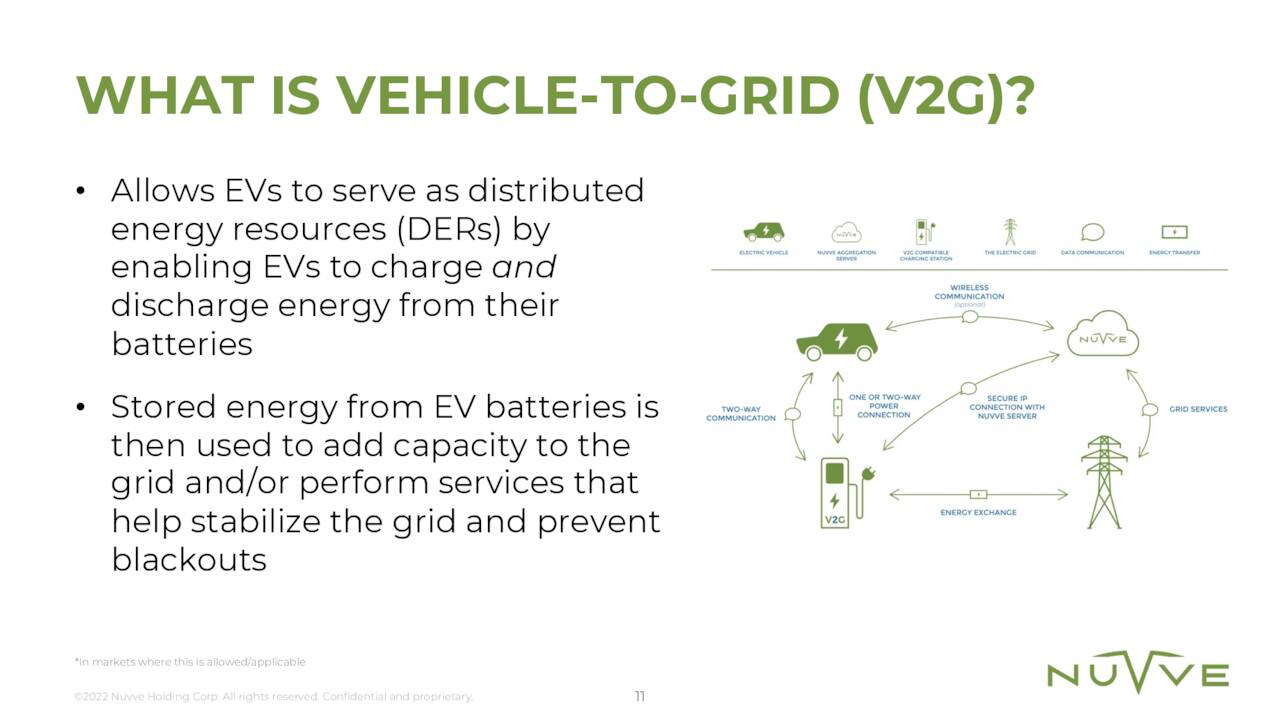

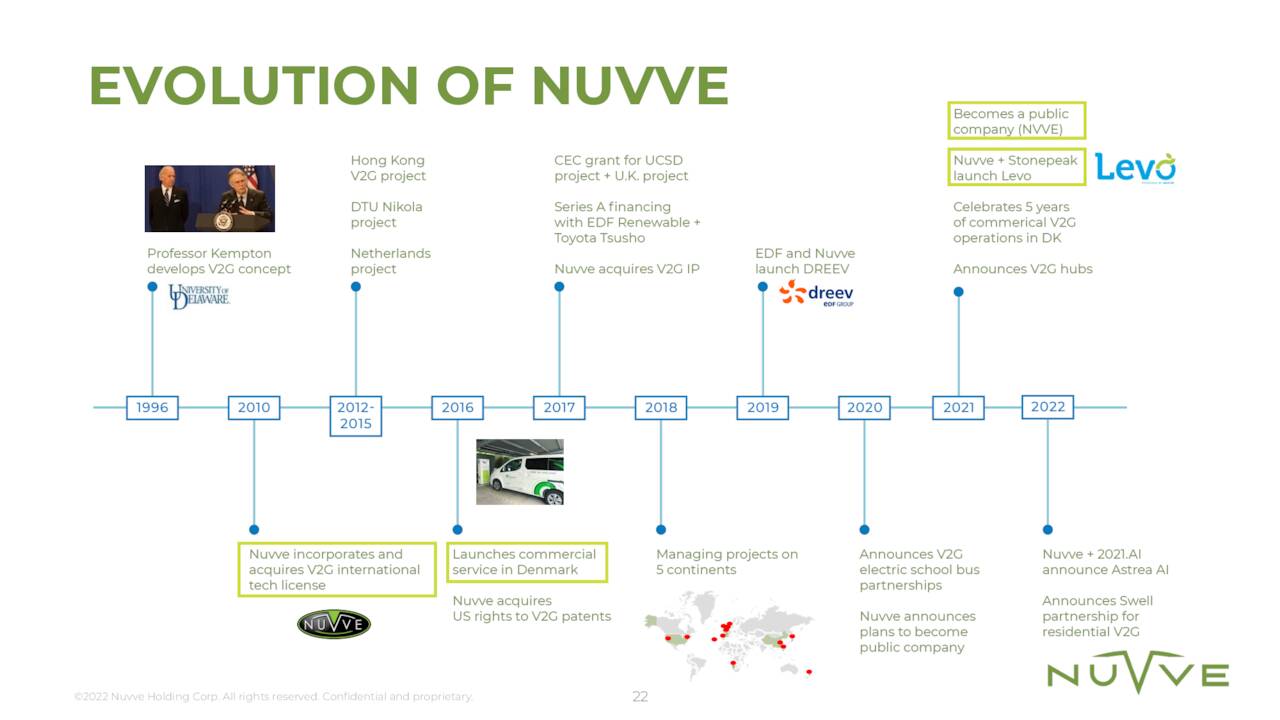

Nuvve Holding Corp. is headquartered in San Diego. The company’s Vehicle-to-Grid or V2G technology optimizes electric vehicle (EV) charging. This lowers the total cost of ownership for EVs.

March Company Presentation

The company’s technology allows electric vehicles to supply energy back to the power grid through bi-directional charging stations and produces an additional income stream for EV fleet owners. The company’s vision is that will support the accelerated introduction of renewable energy sources such as wind and solar as an alternative to fossil fuel power plants. The stock currently trades just under nine bucks a share and sports an approximate market capitalization of $160 million.

March Company Presentation

Fourth Quarter Results:

On March 31st, the company posted fourth quarter results. Nuvve had a GAAP net loss of 47 cents a share on revenues of just $1.25 million (which was 14% lower than 4Q2020). Both top and bottom line number missed the consensus.

March Company Presentation

Despite paltry revenues at the moment, management did highlight milestones that happened during the quarter (above). The company has announced several partnerships since it went public that may pay significant dividends in the coming years. The most important of which appears to be the company’s participation in Levo Mobility announced in August. The two funding partners, Evolve Transition Infrastructure LP and Stonepeak Partners LP, plan to deploy up to an aggregate $750 million capital commitment to Levo Mobility. According to the announcement, Levo Mobility will

For a fixed monthly payment with no upfront cost will provide the EVs, such as electric school buses, charging infrastructure powered by Nuvve’s V2G platform, EV and charging station maintenance, energy management, and technical advice.”

March Company Presentation

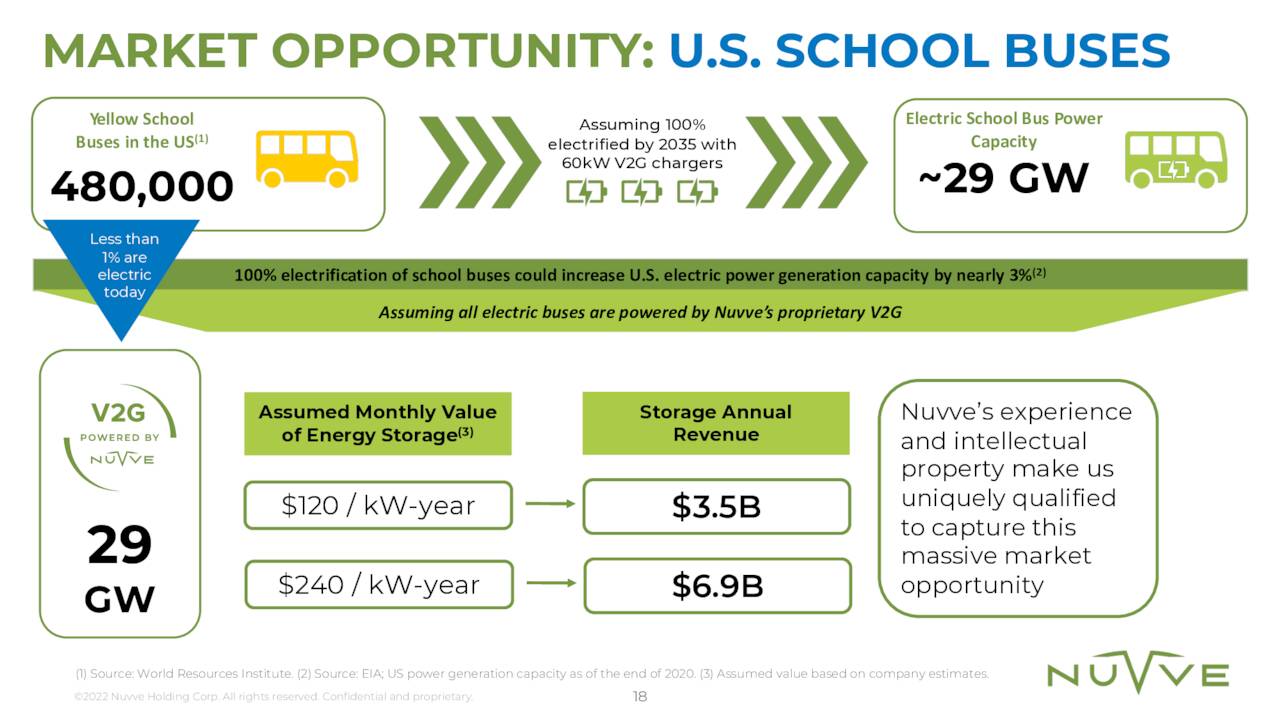

The initial effort of this new entity will focus on electrifying school buses. This partnership could enable 5,000 BYD medium and heavy duty battery electric vehicles to be leased at a fee through Levo to school bus operators over the next five years. Nuvve will own 51% of this joint venture. The company already has partnerships with OEMs Blue Bird and Lion Electric Group (LEV) that package Nuvve’s V2G services with the sale of the EV. We just posted an in-depth profile on Lion Electric.

Analyst Commentary and Balance Sheet:

Only two analyst firms have chimed in on the stock over the past year that I can find. On December 21st, Chardan Capital initiated the shares as a new Buy with a $24 price target. On April 1st, Craig-Hallum maintained its own Buy rating but lowered its price target from $25 to $16 a share. The company ended FY2021 with just over $30 million in cash and marketable securities on its balance sheet after posting a $6.1 million net loss for the fourth quarter.

The company’s CEO sold just over $650,000 of his stake in the company on April 8th. This made the first of numerous sales by insiders as lockups from the stock’s debut on the market expire. There have been no insider purchases of the shares since went public through a merger with blank check company Newborn Acquisition Corp. in the first quarter of 2021. Approximately one of out of every eight shares of the outstanding float in the stock is currently held short.

Verdict:

There’s a wide range of estimates for FY2022 from the three analyst firms that have provided projections. They have the company losing just over a buck a share this fiscal year on anywhere between roughly $15 million to $40 million in sales, compared to just over $4 million in sales in FY2021.

March Company Presentation

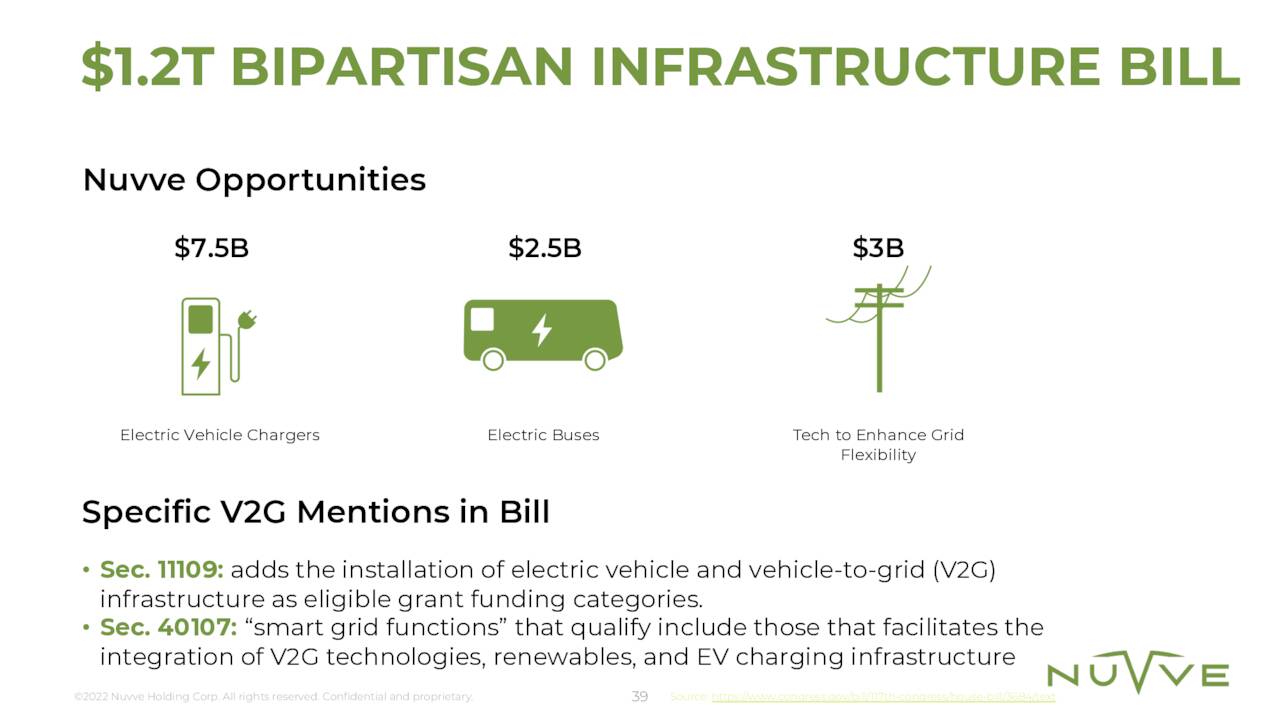

The company does have some opportunities in the year ahead and the $1.2 trillion infrastructure bill passed late in 2021 does have some “goodies” for the industry. Given the fast shrinking political clout and ratings of the current administration, it’s probably the last significant legislation the EV industry should count on until at least after the 2024 election.

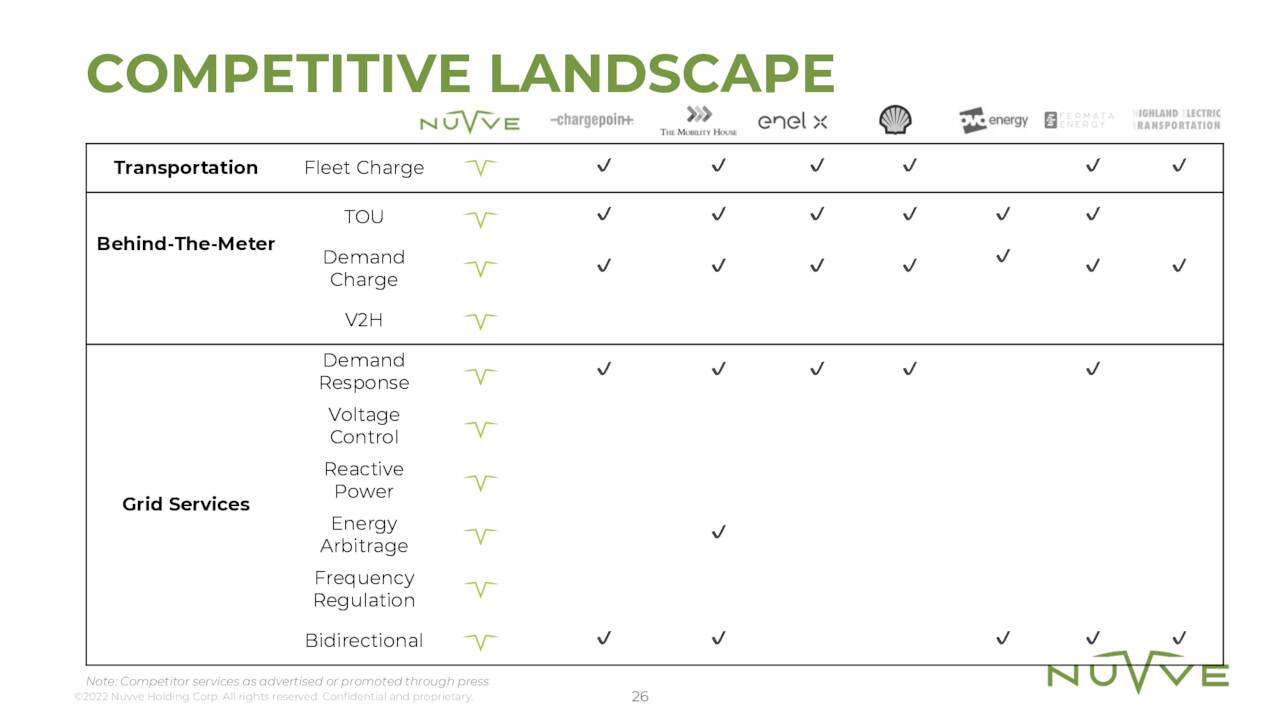

Competitive Landscape (March Company Presentation)

In addition, the problems with the global supply chain continues to be a headwind for this sector of the economy as does soaring lithium prices. The company also has a likely capital raise over the next year given its current burn rate.

March Company Presentation

That said, the company should produce its first significant revenues during this fiscal year after being founded over a decade ago. However, with profitability some ways off in the future and a capital raise likely on the near-term horizon, this is a story investors might want to keep an eye on but is one that doesn’t seem compelling enough at the present time to make a bet on in our view.

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment