JHVEPhoto/iStock Editorial via Getty Images

Shares of Olin (NYSE:OLN) have held in pretty well during a year that has been unforgiving to cyclical stocks. Its business is clearly deteriorating, and management will be put to the test whether they will be able to sustain as much free cash flow as they committed to during a recession. With the business entering a significant downturn, even if management’s guidance is vindicated, there are better stocks to own in this environment.

Just a few months ago, Olin’s results were very strong, but the commodity chemical cycle can turn extremely quickly. In the company’s second quarter, it earned $2.76 up from $2.17 last year. That is about $422 million in net income. With those strong results, it had generated $856 million of free cash flow in the first half, enabling $690 million in buybacks, including $426 million in Q2, or about 5% of all outstanding shares. Its share count is down nearly 10% over the past year to 153 million. Management also launched a new $2 billion authorization alongside Q2 results that would be funded out of free cash flow.

With strong free cash flow, Olin has also paid down $800 million in debt to $2.58 billion from $3.38 billion last year, and that stronger balance sheet should help the company better withstand downturns. Across its major units, results were strong in Q2, though there were signs of a weakening cycle.

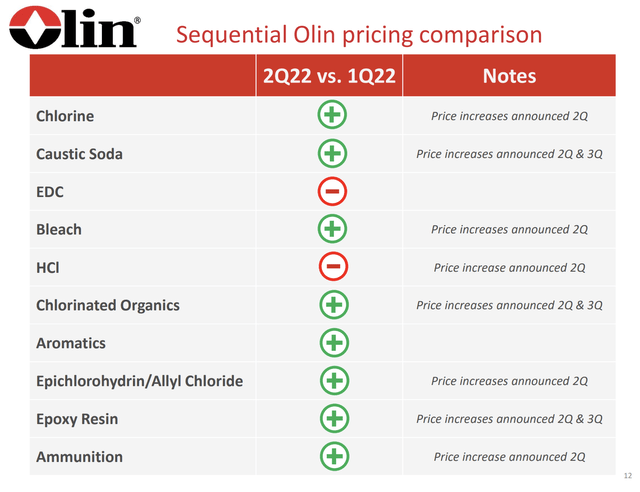

Chlor Alkali and Vinyl sales rose 45% even as volumes fell, driving EBITDA up 65% to $467 million. Pricing was an extraordinary tailwind, and it began to eat into demand, but still an excellent result. Epoxy sales fell 9% to $773, causing some loss of operating leverage primarily due to elevated European energy costs with EBITDA down 14% to $160 million. Winchester grew sales 9% to $440 million and EBITDA to $125 million, primarily due to price increases. Winchester, as an ammunitions provider, is the least economically-sensitive business unit whereas the others provide chemical inputs to and adhesives for PVC piping, and 70% of PVC is used in construction. As you can see, Olin was able to push price across nearly all of its products.

After Q2, management guided to $2.5-2.7 billion in EBITDA for the full year. In the first half, the company generated $1.44 billion, so management was guiding for a slowdown in H2. Indeed, after generating $727 million in EBITDA in Q2 management guided to about $615-620 million in Q3, down 15% sequentially.

In mid-September though, the company cut its Q3 EBITDA guidance to $530-550 million, about 13% below the previous guidance, indicating a sharp turn in the cycle. This followed an announcement in August of the permanent closure of a Texas facility as it continues to focus on shrinking its footprint and exiting low-margin operations to boost prices, even at the expense of volumes. It is hard to separate out the decision to close the plant from declining demand and the guidance cut.

Explaining the cut, management said there has been an “accelerated deterioration in both European and North American demand” in epoxy and vinyls. This has been made worse because Chinese demand is so bad that they are exporting more to Western markets, creating supply gluts in Europe and the US, hurting local producers. Ultimately, there will need to be supply rationalization, like Olin’s Texas closure. Worse. There is also excess ammunition inventory, which is weighing on Winchester. Olin concluded by warning that it is entering its “recessionary scenario.”

This is a significant statement because in a recession, management believes they can still generate $1.5-2 billion in EBITDA vs the $636 million generated in 2020. That would translate to about $1 billion in free cash flow. Management has closed excess capacity, shown more willingness to cut volume to meet price, and increased Winchester’s licensing revenue to create more durability throughout the economic cycle. Now, until we actually go through a recession, I suspect the market will express some skepticism that Olin has reduced its cyclicality that much. A $200 million sequential EBITDA decline just above its recessionary $400-$500 million run-rate when economic activity around the world still appears to be slowing puts Olin squarely in the “show me” category when the company reports Q3 earnings on October 27th. I am concerned about further guidance cuts.

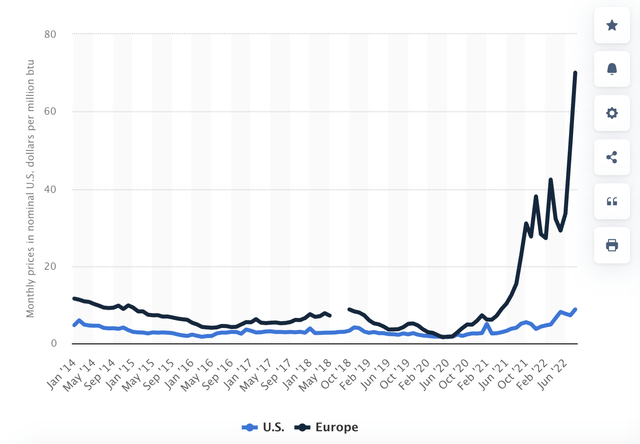

Olin is feeling the turn in the economy already because of its geographical and product mix. 17% of its business is in Europe, predominately its Epoxy unit. It’s exposure to the rest of the world is 21%. I would emphasize this disclosure: “A significant percentage of our Euro denominated sales are of products manufactured within Europe.” European natural gas prices are trading far higher than in the United States as the continent scrambles to buy LNG to offset lost Russian imports.

With natural gas an important input cost for chemicals manufacturing, these facilities face high costs and risk losing competitiveness to Chinese-exported epoxy. There is a worst-case scenario where European natural gas supplies get rationed this winter to ensure consumers have sufficient heat. I would expect profitability from this unit to substantially decline.

Statista

In addition to Olin’s adhesives and PVC products being exposed to the cyclical construction industry, China is at least 50% of the world’s consumption of epoxy, which is why their swinging from an importer to exporter as domestic demand disappoints has forced such large guidance cuts. The Chinese property market continues to be weak with no signs of improvement given the ongoing overhang of COVID-zero. As a consequence, volume and pricing are likely to weaken further. With headwinds from China and Europe, Q3 results are unlikely to be the trough in results.

While management had previously guided to $2.6 billion in EBITDA and $1.6 billion in free cash flow, the next twelve months will be far weaker. Given this quarter will be about $525 million, I would expect the next twelve months EBITDA to run closer to the $1.5 than the $2 billion side of its “recessionary range.” With the company likely to reduce cap-ex in a weakening environment, that points to $800 million in free cash flow.

Right now, the stock is trading 8.5x that free cash flow, so shares are not expensive. At even a 10% free cash flow yield, the stock could get to $60. There is no doubt the stock is cheap, so long as management is able to deliver on its promise to keep EBITDA above $1.5 billion in a recession. For the next few months, if you own OLN, you will be fighting sequentially declining results and skepticism around where results trough and if the recessionary guidance holds. While you may be proven right in the end, I suspect it will be a grueling journey with the stock remaining stubbornly cheap.

At this multiple, OLN is not an outright sell. However, I would encourage investors to look to the energy sectors. Companies like ConocoPhillips (COP), EOG (EOG), and Ovintiv (OVV) offer similar cash flow yields to OLN without the severe cyclical headwinds (indeed while a worsening European energy situation hurts OLN, it helps the energy companies). Rotating out of OLN and into the energy sector is a way to stay in a low-multiple stock while creating more near-term upside potential and would be my recommendation.

Be the first to comment