Thomas Barwick

Background

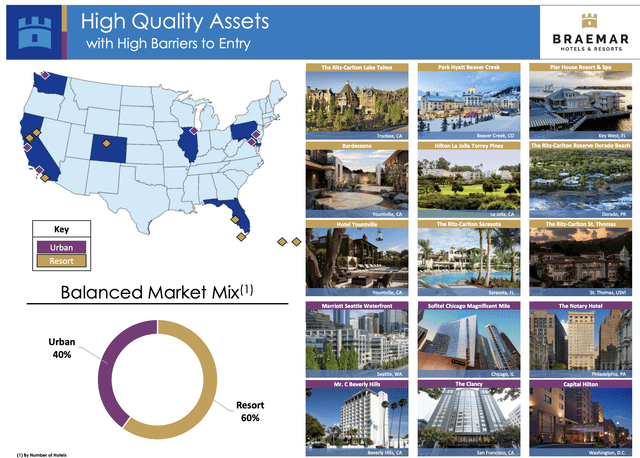

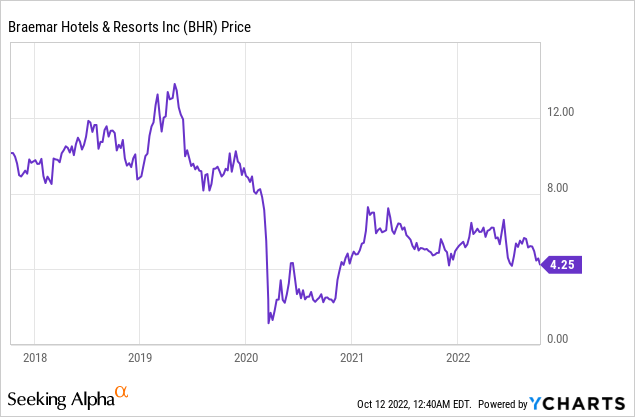

Braemar Hotels & Resorts (NYSE:BHR) is an externally managed hotel and lodging real estate investment trust that owns and operates hotels in the United States. BHR invests primarily in high revenue per available room (“RevPAR”) luxury hotels and resorts meaning RevPAR of at least twice the U.S. national average RevPAR for all hotels as determined by Smith Travel Research.

BHR owns 14 hotel properties predominantly located in U.S. urban and resort locations with favorable growth characteristics resulting from multiple demand generators. They own 12 hotel properties directly, and the remaining two hotel properties through an investment in a majority-owned consolidated joint venture entity.

BHR is advised by Ashford LLC, a subsidiary of Ashford Inc. (AINC), through an advisory agreement. Asset management functions include acquisition, renovation, financing and disposition of assets, operational accountability of managers, budget review, capital expenditures and property level strategies as compared to the day-to-day management of hotel properties, which is performed by hotel managers. BRH does not operate any of their hotel properties directly; instead, they employ hotel management companies to operate them for under management contracts. On November 6, 2019, Ashford Inc. completed its acquisition of Remington Lodging’s hotel management business.

Under hotel management agreements for BHR’s hotel properties they pay a monthly hotel management fee equal to the greater of approximately $15,000 per hotel (increased annually based on consumer price index adjustments) or 3% of gross revenues, or in some cases 3.0% to 5.0% of gross revenues, as well as annual incentive management fees, if applicable. These management agreements expire from December 2023 through December 2065, with renewal options.

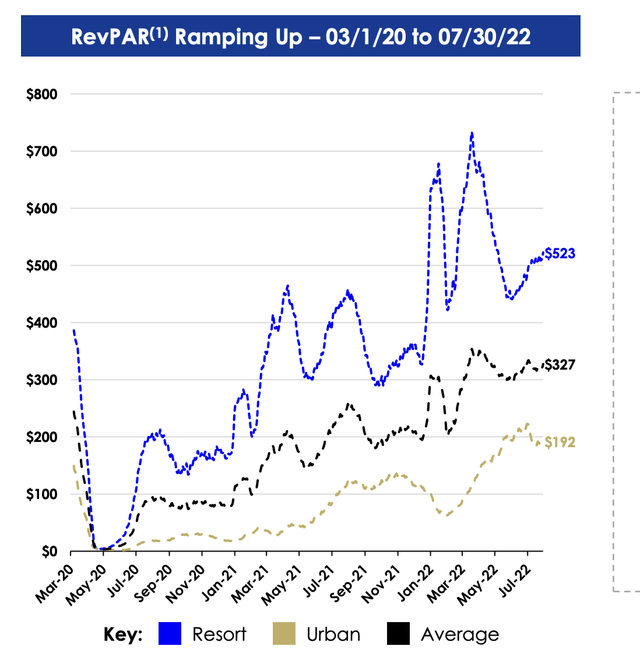

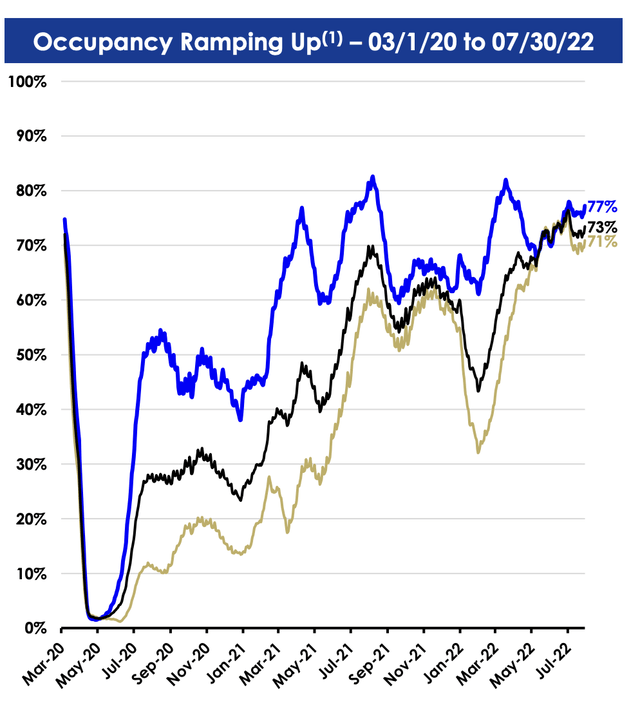

The majority of the hotels are classified as a “resort” hotel, and cater to vacation travellers and tend to be located near attractions. The properties of BHR are operated under most major brands which include Ritz-Carlton, Marriott (MAR) and Hilton (HLT). This does serve as a competitive advantage with there being only so much space surrounding an attraction. Resort properties usually fetch a higher RevPAR and have shown a much greater rebound since March 2020 than the urban counterparts demonstrating the resiliency of the segment.

August 2022 Investor Presentation (Braemar Hotels & Resorts)

August 2022 Investor Presentation (Braemar Hotels & Resorts)

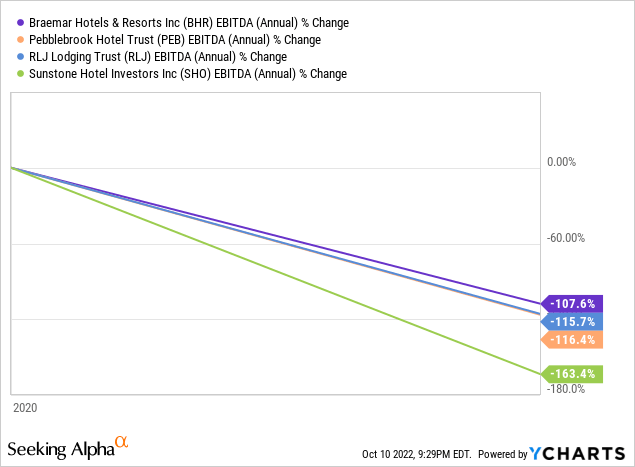

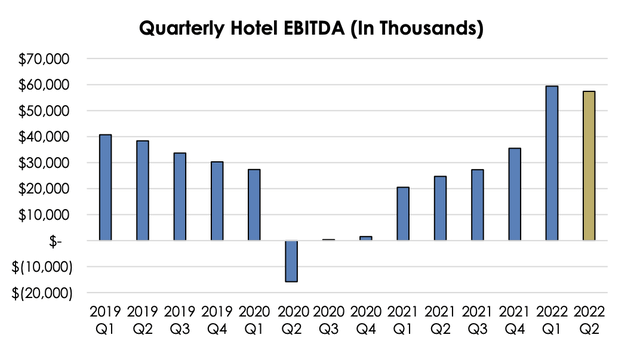

Like most hotel and lodging companies, BHR did not fare too well during COVID although its profitability did not decline as badly as most of its counterparts. As of July 2022 occupancy rates in both the resort and urban properties had recovered to pre-pandemic highs of 70%. The resort properties showed an 80% occupancy in January 2021, when there were the omicron lock-downs.

Braemar Hotels & Resorts (August 2022 Investor Presentation)

BHR does appear to be on track to exceed its pre-pandemic numbers at least for fiscal 2022 as TTM EBITDA as of June 2023 had exceeded 2019 annual EBITDA by 29% as a result of being able to demand higher prices and rising occupancy levels.

August 2022 Investor Presentation (Braemar Hotels & Resorts)

Risks

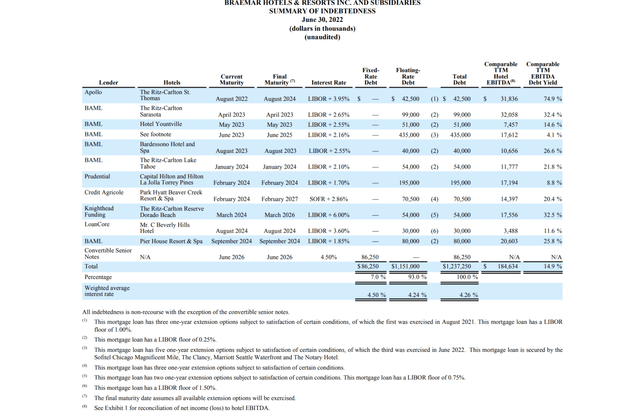

The biggest concern is the leverage the REIT employs as there is currently $1.2 Billion in mortgage debt outstanding on its properties which puts Net Debt/TTM EBITDA at 5x. This is not low as far as REITs go but is fairly conservative relative to other hotel REITs.

August 2022 Investor Presentation (Braemar Hotels & Resorts)

The larger concern is all debt is senior secured by the hotel properties and aside from the convertible senior notes which is only 7% of debt, 93% is variable rate. Variable rate debt is not what you want to see as an investor when a cyclical REIT is heading into a period of rising interest rates and possible recession.

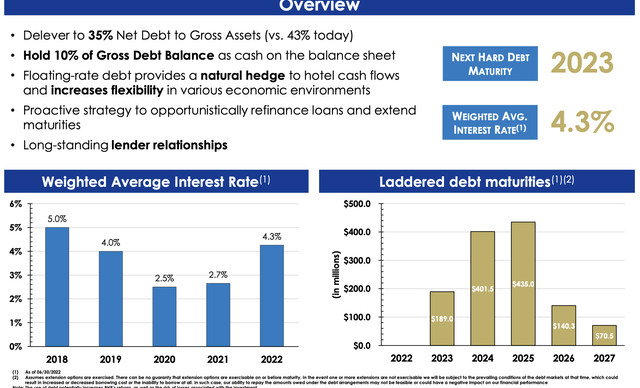

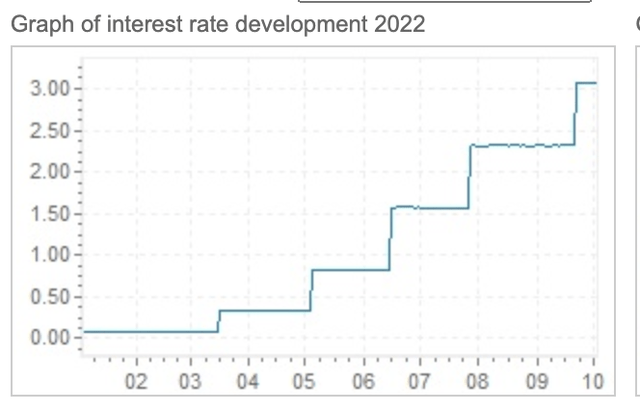

BHR showed a weighted average interest rate of 4.3% at June 30, 2022 and paid $18MM in interest expense on their debt. This while LIBOR rates had average less than 1% in the first half of 2022, and given that LIBOR is now at ~3.06% and with the FED signalling plans to lift rates by another 1.25 percentage points before the year is over, it would not be unreasonable to expect interest expense to double in the second half of the year for BHR.

Braemar Hotels & Resorts (August 2022 Investor Presentation)

Month/LIBOR (Global Rates)

The Fed is bracing to lift rates to 4.5-4.75% by next year and 14% of debt comes due before 2023 YE and 48% before 2024. Therefore, we could see interest expense more than double by 2023 YE from its current levels.

BHR has realized all-time highs in Average Daily Rates (ADR) throughout 2022 which is arguably the result of “pent up” demand to get out on vacations which is a luxury most were not able enjoy through the pandemic. With a recession looming, disposable income will likely drop and put the brakes on the high ADRs and RevPARs that have been realized in 2022.

Investment Thesis

I cannot even begin to forecast how much BHR’s financials will be impacted by increasing rates and a recession in the near term. I do however believe 2019 results provide a conservative run-rate to go off of. It is conservative because the ADR for that year was ~30% below what we are seeing today. Also, BHR had only 3,711 suites to finish that year while they finished Q2 2022 with 3,971, 260 less as they have since acquired the Dorado Beach Ritz-Carlton and the Mr C Beverly Hills Hotels.

| Revenue | $487,614 |

| EBITDA (25% Margin) | $121,904 |

| Interest Expense | ($50,000) |

| Sustaining CAPEX (Q2 of $9MM annualized) | ($36,000) |

| Preferred Dividend Payment | ($14,734) |

| Annual FFO | $21,170 |

| Diluted Shares Outstanding | 91,939 |

| FFO/share | $0.23/share |

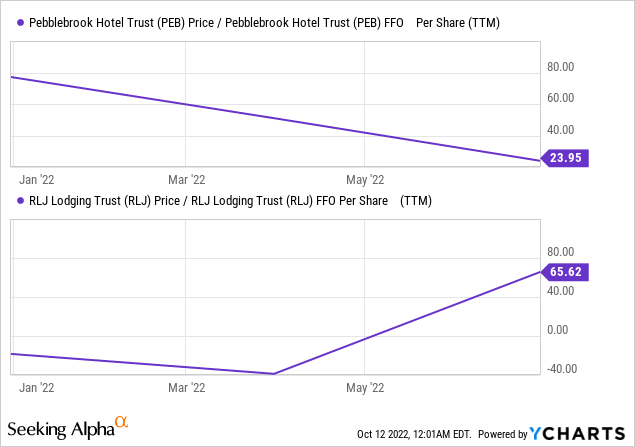

BHR will still have over $20MM to put towards debt repayment and with $318MM in cash and equivalents they should be able to meet the maturing debt through 2024 without having to cut the $0.01/share dividend. In this conservative scenario it would trade at 18x P/FFO, which would still put it at a discount relative to Pebblebrook Hotel Trust (PEB) and RLJ Lodging Trust (RLJ).

BHR has two publicly traded preferred shares for those who want an even better yield than what the common provides and increased safety through being higher in the capital structure and cumulative. The 8.25% Series D Cumulative Preferred Stock (NYSE:BHR.PD) ranks senior to all classes or series of the Company’s common stock and future junior securities. Series D cumulative preferred stock has no maturity date but is callable at $25/share after November 2023 and has a ~14.80% Yield to Call at its current price of $23.50/share. The current yield is 8.78%. If you add back $14.7MM in annual preferred share dividends the FFO coverage is more than 2.40x on common and preferred share dividends.

The other issue is the 5.50% Series B Cumulative Convertible Preferred Stock (NYSE:BHR.PB) which is not callable. At the current price of $14/share which is a 44% discount to par it has a juicy yield of 9.8%. It also has a somewhat favourable conversion option at a conversion rate of 1.3372. The share price of the common shares will have to exceed $10.50/share for the conversion to have any value but it could get there at the current run-rate as the price/share did surpass this amount in 2019. BRH has a forced conversion but the common share price would have to exceed $20.57/share for more than 45 consecutive days which seems highly unlikely in the current environment and BRH hasn’t traded at such highs since 2014. The likely reason for the large discount to par is the perceived risk is slightly higher than the Series D as a result of being subordinate in the capital structure and therefore the market believes it should have a higher yield to reflect. If we add back $4,232M in Series B share payments to FFO coverage on the preferred dividends and common dividends would be over ~4.0x.

The Series M and E are not publicly traded so are not discussed.

Conclusion

The likelihood of slowing economic activity combined with higher interest rates will likely slow down free cash flows in the near term, combined with large debt maturities over the three years starting in 2023, I do not see a significant dividend raise on the common shares in the near term.

The preferred shares, on the other hand, represent great income opportunities. The Series D have more safety with taking priority over the other Series and common shares and would be less likely to experience a dividend cut. The extra safety only comes at a cost of 102 basis point in yield. The Series B have greater long-term capital gain potential as a result of the conversion option and should trade at a smaller discount to par if the Series D shares get called.

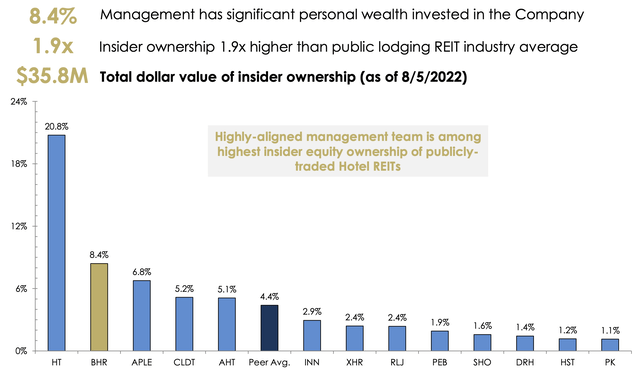

Management interests are aligned with shareholders as they own 8.4% of shares outstanding which is high for a hotel REIT which gives greater confidence that prudence will be exercised so as to increase returns to shareholders.

August 2022 Investor Presentation (Braemar Hotels & Resorts)

Be the first to comment