Hispanolistic/E+ via Getty Images

Kirkland’s Inc., (NASDAQ:KIRK) is a home décor and furniture company which currently operates in 360 stores in the U.S.. Kirkland’s have been posting some rough fundamentals, especially in terms of cash. The company has reported disappointing earnings for 1Q22, as sales, gross margin, and EBITDA have all been taking big hits. It is launching new marketing and delivery programs, which could generate success but do not give any edge to Kirkland’s over other competitors. Durable goods, including furniture, see huge drops in consumption and manufacturing during recessions, which could pose more issues if a recession does come in the future. Therefore, I will apply a Sell rating to KIRK stock.

Unstable Fundamentals Raise Issues

Kirkland’s income statement is very coarse with underperforming indicators all around. The balance sheet is more of the same, with cash being the highest of concerns. Fundamentals can indicate how a company is performing and which direction it is trending towards, which is not a good thing in this case for Kirkland.

Kirkland’s Struggles to Generate Revenues and Profits

Kirkland has very shaky fundamentals, and are especially going through trouble with the possibility of a recession nearing. The company’s total revenue has decreased from $634.12 million to $558.18 million from FY17 to FY22. It also has a current gross profit margin of 32.81% which is pretty adequate. However, the company has a very low net income margin, which is currently 2.31%. With revenue on the decline and a low net margin, Kirkland’s will need a strong balance sheet for times of uncertainty.

The Company Has Little Cash and May Need To Issue More Debt

The company’s cash has also taken an extreme hit, as it fell from $80.16 million to $25.0 million from FY17 to FY22. Kirkland’s generally blows through cash during the first half of the year as they are preparing to have strong sales of furniture and outdoor items throughout the year. The company usually relies on the holiday season and end of the year sales to bolster up the cash flow. However, the drop in cash is still substantial, and leaves the company with little protection and flexibility during times of uncertainty. The company currently has $35.0 million in debt, which can bring forth even more problems if the company continues to struggle to generate revenue. If a recession does come, the company will likely not have as much cash as they would like and may have to issue more debt to stay afloat.

First Quarter Earnings Show Difficulties Within the Company

Kirkland’s recently reported 1Q22 earnings which turned out to be fairly underwhelming. Net sales dropped to $103.3 million, which is down from $123.6 million from 1Q21. The drop includes a 23.6% decrease in e-commerce sales, which is an aspect of the company that is lacking and can see a ton of improvement. Inflation had a large impact on its gross margin, which decreased from 32.6% in 1Q21 to 27.4% this year. This equates to a $12 million drop in gross profit. EBITDA came in at a loss of -$6.6 million which is far from the company’s EBITDA of $7.3 million income in 1Q21. Kirkland’s poor quarterly performance may show it is going in the wrong direction.

Kirkland’s also decided to repurchase $6.3 million of shares at an average cost of $13.03 a share. Perhaps the company felt it needed to bring some value to its shareholders while it is having trouble generating value in most of the other aspects. CEO Woody Woodward believes the disappointing quarter for Kirkland’s can be attributed to the inflation, supply chain issues, and weakened margins:

We were impacted by the shift in consumer spending stemming from rising interest rates, inflationary pressures and geopolitical conflicts that adversely affected our customer traffic and sales. We also continued to deal with constraints across the supply chain, particularly heightened freight and transportation costs, which pressured our margins. While we are disappointed with our results, we are still executing upon our long-term transformation strategy and making progress in areas that are within our control.

With the company’s future looking potentially bleak, and with very little in cash available, Kirkland’s will possibly have to issue shares or issue debt in order to survive a possible upcoming recession. Also, the company has a negative EBITDA which means it will have a very difficult time paying off debt and could cause trouble for the company during uncertain times.

New Initiatives Will Help But Bring No Competitive Advantage to the Company

Kirkland’s is in the early stages of testing a new marketing campaign which is set to use data curation to attract both new and existing customers at the right times. The company is also planning a new in-home delivery system which has just launched with a full national rollout in June. This new program includes direct delivery into the customer’s room of choice where the product will be assembled and packaging will be removed.

The marketing campaign and delivery program could add value to Kirkland’s and will likely be somewhat a success, but it is not innovative. These initiatives have been done before and the in-home delivery idea is already offered by IKEA and other competitors. The company is seemingly late to the game, which means that these programs will not give any edge over its competitors. The furniture industry is very competitive, which is why Kirkland’s should be looking to be innovative and set itself apart from other competitors.

Durable Goods and Furniture Companies Throughout Recessions Struggle

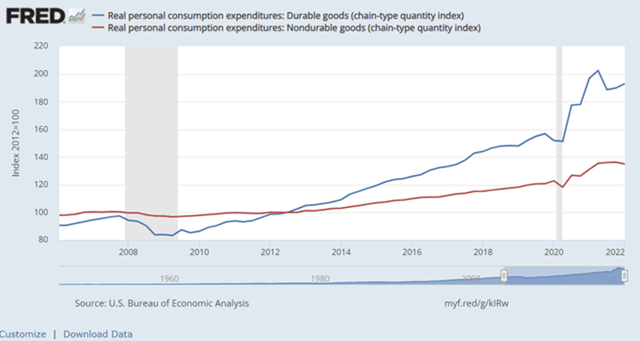

During the Great Recession, nondurable goods saw a decrease in consumption of about 3% while the consumption of durable goods such as furniture decreased by 12%. This is very troubling for Kirkland’s as if a recession does come, there will likely be a huge drop in furniture sales. The company was able to navigate and survive past recessions, but these market downturns create many hardships. Consumers prioritize nondurable goods much more than durable goods, and buying new furniture is the last of their concerns during a recession

Consumption of Nondurable vs. Durable Goods (FRED)

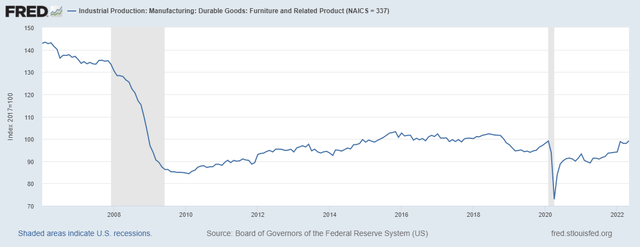

Not only did the consumption of durable goods drop much more than nondurable goods, but there was also much less of these goods manufactured during recessions. The manufacturing of furniture and related products dropped by over 35% during the Great Recession. Furniture companies are put in very difficult situations during recessions, as consumers are not prioritizing their goods. IKEA, Bed Bath & Beyond (BBBY), RH (RH), and Williams-Sonoma (WSM) have all had trouble during market downturns in the past. Most notably, IKEA had to cut 5,000 jobs worldwide during the Great Recession. With a possible recession looming, Kirkland’s could be at risk of some unfortunate developments.

Industrial Production: Manufacturing: Durable Goods: Furniture and Related Product (FRED)

Valuation

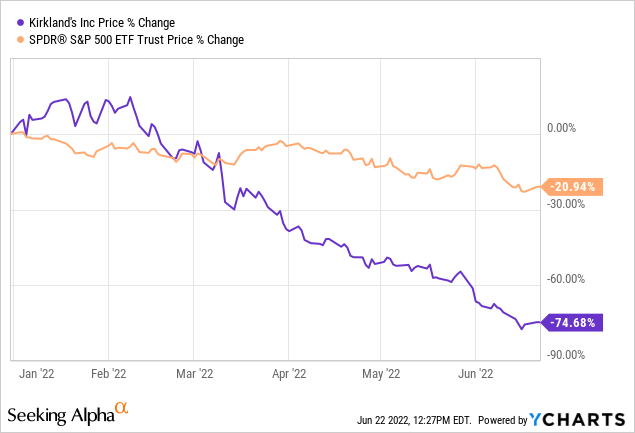

Kirkland’s share price is far underperforming the market which is not a good sign for the company’s future. With a possible recession in the cards, Kirkland’s future could be bleak.

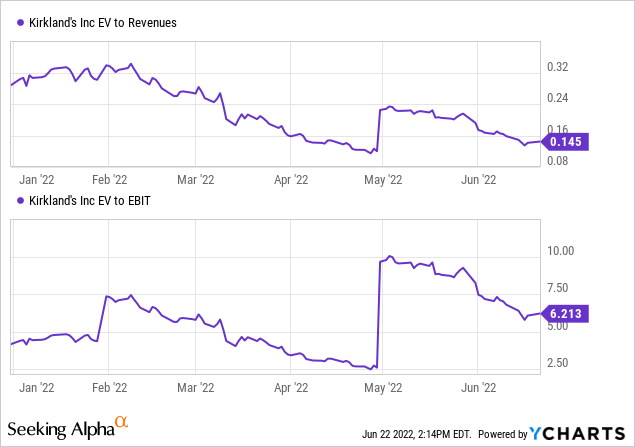

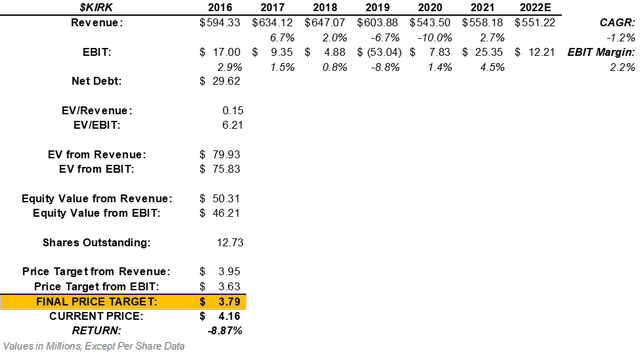

Over the last 6 years, Kirkland’s has seen a drop in its revenue from $594 million to roughly $558 million. This indicates a CAGR of -1.2% which can be extended into the company’s next fiscal year. This will project the company to generate $551.22 million in revenue in FY22. Additionally, Kirkland’s has seen an average EBIT margin of 2.2%. By multiplying this margin by the estimated revenue of $551.22 million, we can expect the company to generate $12.21 million in EBIT in the upcoming fiscal year. After multiplying these projections by its current EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s projected enterprise values for net debt, we can find Kirkland’s projected equity value from revenue and EBIT. After dividing the equity values by the current number of shares outstanding and averaging the price targets, a final price target of $3.79 can be calculated. This means KIRK stock could return a downside of about -8.87%.

Valuation of KIRK Stock (Created by Author)

The Takeaway For Investors

Kirkland’s seems to be losing stability in terms of fundamentals. The company has been able to stay in operation for almost 60 years, but it is set to go through some rough times with a possible recession nearing. If a recession comes, the company likely has insufficient cash, which would likely set it back. Kirkland’s has reported a fairly disappointing 1Q22 and will need to turn this around soon to recover and gear up for a possible recession. The company is beginning new marketing and delivery initiatives, which could help to generate revenue, but give no competitive advantage. Durable goods like furniture see large drops in consumption and manufacturing during recessions, which could further escalate the company’s problems. The stock also appears to be slightly overvalued and is likely heading into a rough future. Due to the company likely having a troubled future, I will apply a Sell rating to KIRK stock.

Be the first to comment