designer491

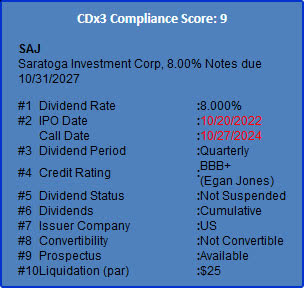

New offering summary:

CDX3Investor.com

State of the preferred stock market

Back in August, we had seen a resurgence of new preferred stock and Exchange Traded Debt (ETD) issuances, but then the door slammed to near-shut in September, and those conditions continued in October with just one single new offering alert here at CDx3 during the month, for an ETD issued by Business Development Company (BDC) Saratoga Investment Corp (NYSE:SAR).

Saratoga issued $40 million worth of 8% unsecured notes due 2027, which were rated BBB+ by Egan-Jones Ratings Company. The new notes trade on the New York Stock Exchange under symbol SAJ, where they currently change hands slightly below the $25 par value.

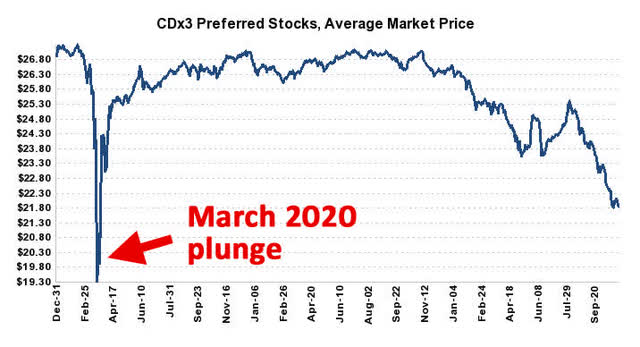

Illustrating the state of the market further, past offerings of high quality preferreds with CDx3 Compliance Score rankings of 10 out of 10 now trade at a 12.6% discount to par and offer a current yield of 6.56% at today’s average price of $21.84.

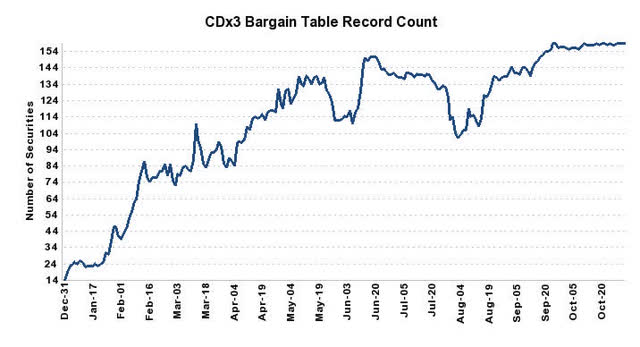

Our internal CDx3 “bargain table” count remains near all-time-high levels since we began tracking the metric in 2015, at a current 159. Here is a YTD chart of our bargain table count:

The average “CDx3-compliant” preferred stock (10 out of 10 CDx3 Compliance Score) saw its market price fall to levels not seen since the March 2020 Covid-driven plunge; below is a chart from 12/31/2019 through today:

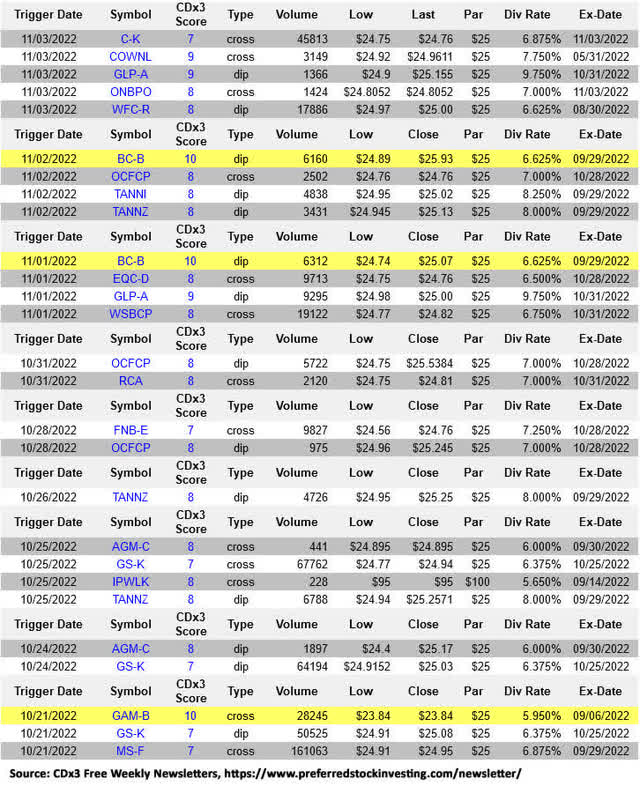

Past preferred stock IPOs below par

In addition to covering new preferred stock and ETD offerings, here at CDx3 Notification Service, we also track past offerings, with alerts when securities fall below their par values. Here are some of the recent dips/crosses below par we observed:

Note: Any yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table.”

Until Next Time…

Here at CDx3, our typical articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par. Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs and interesting preferred stock activity that we notice here at the CDx3 Notification Service. Thanks for reading!

Be the first to comment