Iuri Gagarin/iStock via Getty Images

Description

I believe Li-Cycle (NYSE:LICY) is worth $3.2 billion, representing ~220% upside from the date of writing. LICY is a leading company in the lithium-ion battery resource recovery and lithium-ion battery resource recovery market. They have a proprietary technology that enables them to track the battery recycling process from start to finish, which enables them to be involved in the entire process. Also, they have partnered with the government and most importantly, they have a strong customer base that likely guarantees them a steady flow of income.

Company overview

LICY is an industry leader in lithium-ion battery resource recovery, and they are leading the lithium-ion battery recycling market in North America.

Unique “Spoke & Hub” model

What LICY does is quite fascinating. Basically, under their “spoke and hub” process, end-of-life batteries and battery-related waste are taken to Spoke locations. In the Spoke locations, the materials are mechanically refined into different middle products, along with the black mass. Black mass is a dust-like substance that consists of quite a number of important metals, including lithium, cobalt, and nickel. All of the black mass that is from different Spoke locations is gathered together at a Hub location. At the Hub location, the black mass is then put through a hydrometallurgical process to generate end products, which at the end of the day can be sold back to the battery chain and used while producing new lithium-ion batteries.

LICY operates two kinds of Hubs. First, they have the ternary Hub that processes all kinds of black mass using their technology. The second type of Hub is the lithium iron phosphate [LFP Hub], which can use their technology to process any type of black mass in order to produce LFP cathode-relevant end-products. This black mass can come from LFP lithium-ion batteries, LFP lithium-ion battery materials, or even from third parties. These LFP lithium-ion batteries, from time immemorial, have been batteries that cannot be easily recycled in the market compared to other lithium-ion batteries. LICY’s plan is to change the status quo in the recycling industry and make these batteries prized resources.

It doesn’t take a genius to see that their recycling process plays a crucial role in the global shift toward renewable energy. They will reach this goal by offering an environmentally friendly alternative to energy-intensive pyrometallurgical processing methods and making sure there is a steady supply of recycled materials in the battery supply chain.

One of the best things that LICY has is that their production costs are low compared to the mining and processing costs obtained from suppliers that produce these same materials. This is so because it has the ability to produce a lot of materials from just one process, and the process yields little waste and no displaced earth or tailing when compared to traditional mining.

Proprietary technology sets it apart from competitors

The ability of LICY’s proprietary technology to adapt to new battery chemistries and inputs into the recycling process sets them apart from the competition. Cathode precursor input chemicals, cathode input chemicals, and raw materials that can be reused in batteries or the broader economy are all produced by their method. However, emerging technologies such as cathode-to-cathode recycling create products with a higher risk of obsolescence because of the constant improvement of cathode technology.

Cash flow from existing commercial supply contracts reduces liquidity risk

Major players in the EV and lithium-ion battery ecosystems, as well as leaders in consumer electronics, manufacturing scrap, and OEMs, are included in their commercial contracts. When added together, these factors account for more than 70 of LICY’s clientele, and according to their analysis of the available market, they control roughly 30% of the North American market (based on LICY’s S-1 filing).

Strong government relationship

As a result of their collaboration with New York State, they are now able to offer investors in the clean energy sector attractive financial incentives. The Eastman Kodak Business Park in Rochester, New York, is home to one of LICY’s Spoke facilities, and the city is also where the company intends to set up shop for the first of its ternary Hubs.

After years of building relationships with different Canadian government agencies, LICY was given grants and given access to a number of programs to help it grow.

Future off-take opportunities to further drive revenue growth

Construction is expected to be finally completed and production heightened at LICY’s Rochester Hub by the beginning of 2023. They have also entered into a marketing, logistics, and working capital contract with Traxys that covers 100% of the nickel sulfate, cobalt sulfate, lithium carbonate, manganese carbonate, and graphite concentrate end products from Rochester Hub. Their aim is to get customers to buy the copper sulfide, sodium sulfate, and gypsum that are produced by the Hub and the ones that are presently not covered by the Traxys contract.

Valuation

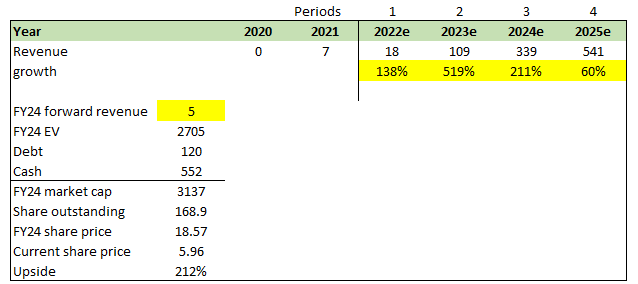

I believe LICY is worth USD3.2 billion in FY24 representing ~220% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s mid-term guidance (until FY25). To be frank, it is pretty hard to put a figure on growth. Even management’s guidance can only serve as a proxy, but it is the best we have.

- I believe LICY could trade at a higher multiple than it is today, given that in FY24 it will have a much higher revenue base and a better-established business model with a shorter timeframe to profitability. But that is an uncertainty that I do not wish to assume. Hence, I believe it would trade at least at the same level as today.

GS Investing estimates

Key risks

Dependent on sourcing lithium-ion batteries efficiently

If LICY is not able to search for and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap economically and efficiently, they will be edging towards failure. If they fail to meet the standards of what they would usually do, it will only affect them financially, and they might end up going out of business.

Future growth dependent on EV adoption rate

Their recycling services are partly fueled by the foreseen increase in demand for EVs. Hence, if the adoption rate of EVs reduces, there might be a reduction in the demand for LICY’s services. If the number of existing contracts reduces or they are unable to look for new supplier relationships, the business will be adversely affected.

Summary

I think LICY is undervalued at its current share price as of the date of this writing. There are a number of things that an investor will benefit from by investing in LICY. First, their aim is to source for and recycle lithium-ion batteries in an environmentally friendly way and, most importantly, at a low price. Also, they have a strong affiliation with the government that makes them different from other competitors. Furthermore, their revenue is expected to greatly increase in the coming years.

Be the first to comment