janiecbros

After a disappointing 2021, which included stopping work on a promising rare disease candidate, Vertex Pharmaceuticals (NASDAQ:VRTX) investors are enjoying a 24% YTD return and a stellar Q2 earnings report as the blue chip’s unique business model proves it can work.

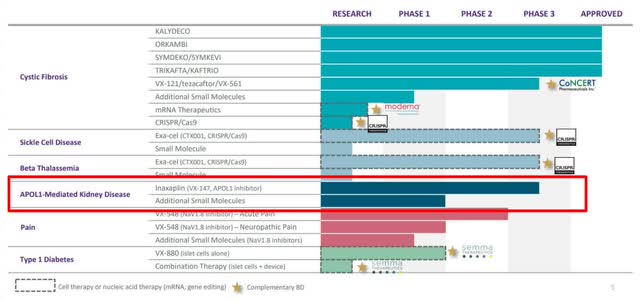

Pipeline

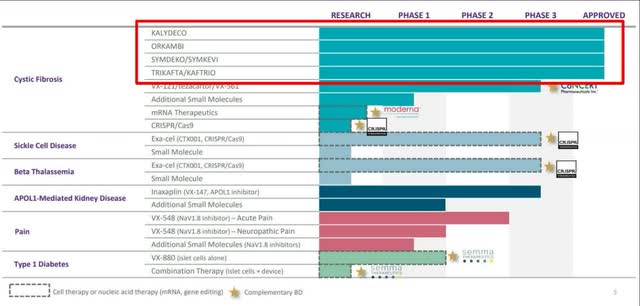

Quality over quantity is the best way to describe Vertex’s pipeline. Despite not having a deep portfolio of treatments, they dominate the markets they’re in.

Based on a $9.8B valuation of the cystic fibrosis (CF) market, Vertex has steadily controlled ~80% of it over the past few years through their 4 approved CTFR modulators.

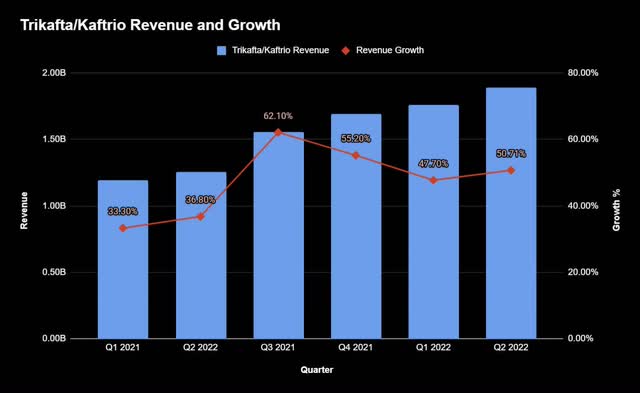

Trikafta, known as Kaftrio in Europe, is the newest of the bunch, spearheading the company’s growth profile. The triple combination therapy has put together four straight quarters of 50%+ growth and is the reason management has been able to enjoy 20%+ overall revenue growth in each of those quarters, including 23% in Q2.

Author, Vertex Earning Reports

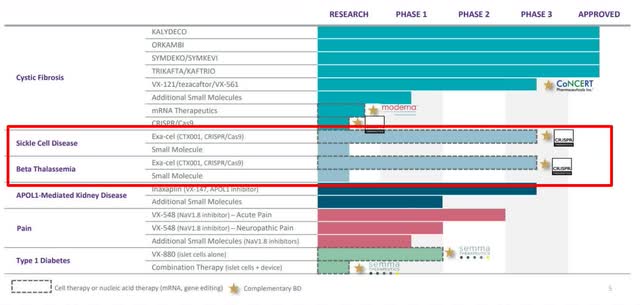

We see similar potential in Vertex’s future launches. Its sickle cell disease (SC) and beta thalassemia (TDT) drug, CTX001, in partnership with CRISPR Therapeutics (CRSP) is in phase 3 trials with regulatory filings coming in late 2022.

Results at each stage have been promising as June data showed 100% efficacy against severe SCD and 95% efficacy against TDT, providing hope that this collaboration could be a one-time cure.

This news solidifies Vertex’s $11B valuation on CTX001, especially because there are no competitors in the market. The company could potentially have two blockbuster drugs, both having unparalleled growth and a monopoly over the disease they treat, all in the next 2 years.

With a virtually guaranteed revenue stream, they can even fund other promising projects like their APOL1 kidney disease drug called VX-147.

In phase 2 trials, the treatment showed a 47.6% reduction in urine protein to creatine ratio, crushing analyst estimates of 30-40%. And a June 2026 estimated study completion date means Vertex could get a 3rd major drug coming as soon as late 2027. Keeping with the theme, this is because VX-147 is the first investigational therapy of its kind having zero future competitors.

Valuation Metrics

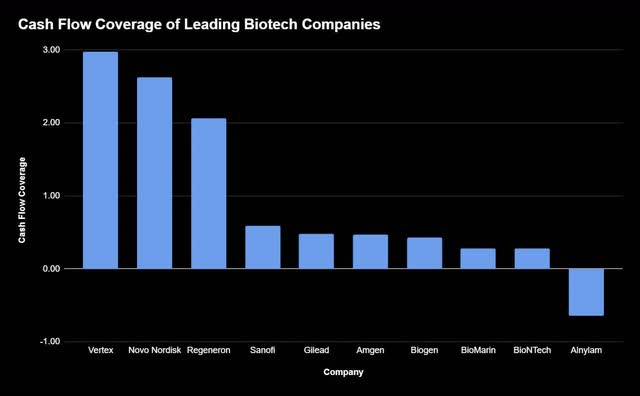

Cash flow coverage is a great way to measure the financial strength of biotech companies. Because FDA trial and approval process can take years, firms can get locked up in decade-long partnerships, accumulating debt on the balance sheet for products that haven’t even sold a dime. So operating cash flows running through the company should be able to cover debt at all times.

Author, Stock Analysis, MarketWatch

Vertex leads its peers in this category, reflecting long-term financial strength. Its debt-to-equity ratio of 0.08 is also among the industry’s best and showcases the maturity of not having to go into debt markets to finance treatments in the pipeline.

Beyond the strong balance sheet, Vertex is trading at an extremely undervalued share price. Despite having a PEG ratio just north of 2, which means the market expects double the projected earnings growth to sustain current prices, we believe future launches haven’t been factored in yet.

The potential to have a total of 3 multibillion-dollar drugs (CF, CTX001, VX-147) within the next 5-6 years not only justifies the stock’s current valuation but leads us to believe there is more room to go.

Risks

One obvious red flag is how concentrated the company is on CF products. Everything from R&D to returning shareholder value hinges upon the success of those approved treatments.

Although another major drug could come in about 2 years, that’s still 8 quarters without any revenue diversification. If growth declines or something worse happens, a costly trickle-down effect would be seen in every part of the business, hitting Vertex’s pipeline the hardest.

However, with revenue jumping over 20% in each of the past four quarters and Trikafta showing no signs of slowing down, everything should be fine until CTX001 hopefully gets approved.

Compounding concerns, like competition taking away market share, should also be mitigated as Vertex has grown its presence in the CF space every year, a trend that should continue as AbbVie (ABBV) discontinued its work on a Trikafta competitor earlier this year.

Another glaring issue is that the pipeline is not as deep as other biotechs. Looking at a Regeneron (REGN) or a Gilead (GLD), you see lists of treatments in phase 3 trials or being filed with the FDA, something that is visibly missing in Vertex’s portfolio.

But what the company lacks in quantity, it makes up in quality with 2 significant drugs on the way and over $8.2B in cash to acquire other firms, as it recently did with ViaCyte to bolster their Type 1 Diabetes (T1D) program, leaving us to believe that it will be just fine.

Conclusion

By placing its trust in established products and strong cash flows, Vertex has avoided being flushed out like other speculative peers. The predictable growth trajectory and way it dominates specific disease markets provide a level of certainty in the company and an immense amount of confidence in its stock.

Be the first to comment