hapabapa/iStock Editorial via Getty Images

Investment Thesis

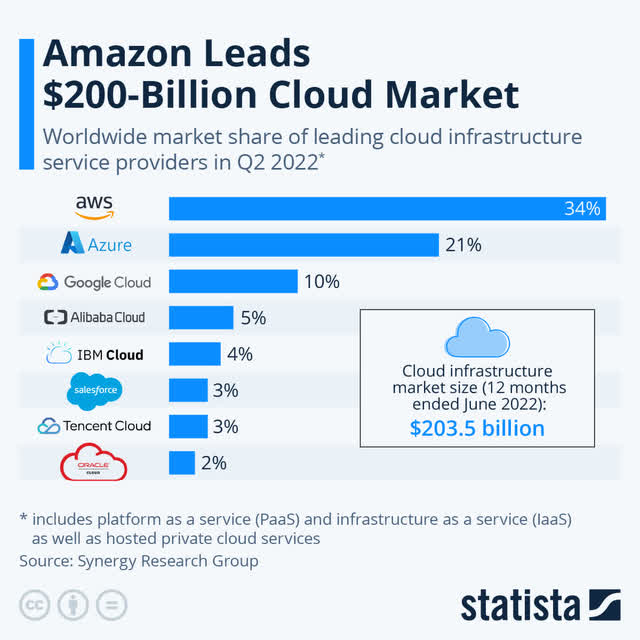

I previously wrote about Amazon (NASDAQ:AMZN) in an article entitled Amazon: AWS Is Brilliant, Everything Else Is Pretty Good, Too. I highlighted my belief that AWS should be the cornerstone of any investment thesis in Amazon, given that it’s the clear industry leader, boasts impressive margins, is the fastest growing segment of Amazon, and CEO Andy Jassy actually founded the AWS division back in 2006.

So, my investment thesis is this: AWS is a fast-growing, highly profitable business with powerful moats. This should propel Amazon to new heights, and I think AWS would be a great standalone business in its own right. The additional bonus with Amazon is everything else; this is a company with innovation running through its veins, and there’s no telling which of their next avenues could create the next AWS for the business. Amazon also has plenty of potential to expand on its retail margins, which will provide an additional boost to the bottom line in the future.

As many investors know, 2022 has been a difficult year for plenty of businesses – and especially difficult for ecommerce companies. Amazon is certainly not immune, and the retail side of the business has swung to huge losses, with AWS being the savior of Amazon’s net income.

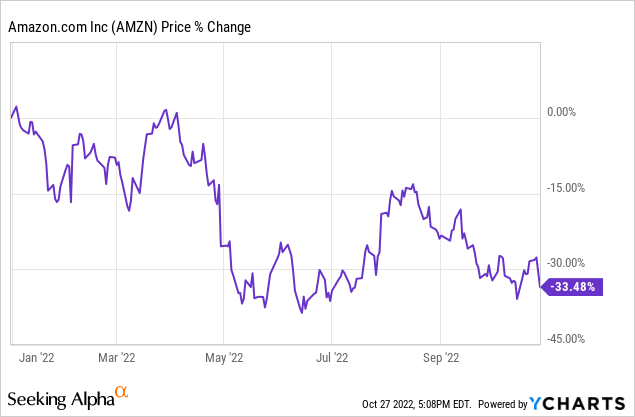

The tough 2022 for ecommerce companies is part of the reason why shares of Amazon have fallen more than 30% this year, combined with the looming threat of a recession as well as inflationary pressures along Amazon’s supply chain.

Investors (which, as of a few weeks ago, now includes me) were likely hoping that Q3 earnings would provide some good news that could give shares a boost.

So, how did Amazon get on? Let’s take a look.

Amazon Earnings Overview

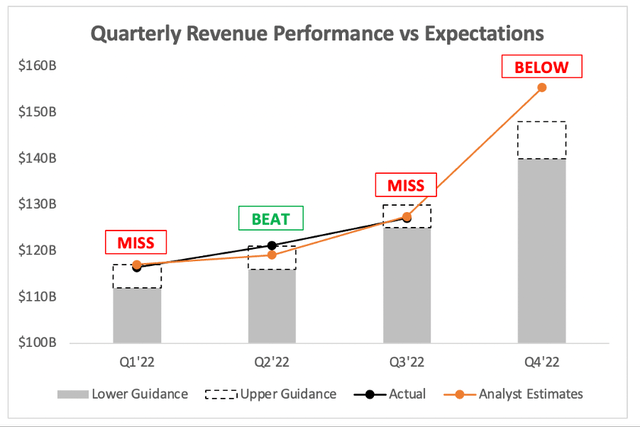

Starting from the top, Amazon’s Q3 revenue grew 15% YoY to $127.1B, coming in below analysts’ estimates of $127.5B. Whilst foreign exchange headwinds will have been taken into account in analysts’ estimates, perhaps they underestimated the $5.0B hit that Amazon took due to the strong US dollar; on a constant currency basis, revenue grew 19% YoY.

Unfortunately, the news didn’t get much better when it came to Amazon’s Q4 outlook, as management guided for revenue of $140-$148B, representing YoY growth of 2-8%; it does, however, reflect an unfavorable impact from foreign exchange rates of approximately 460 basis points. Unsurprisingly, this also came in way below analysts’ estimates of $155.4B.

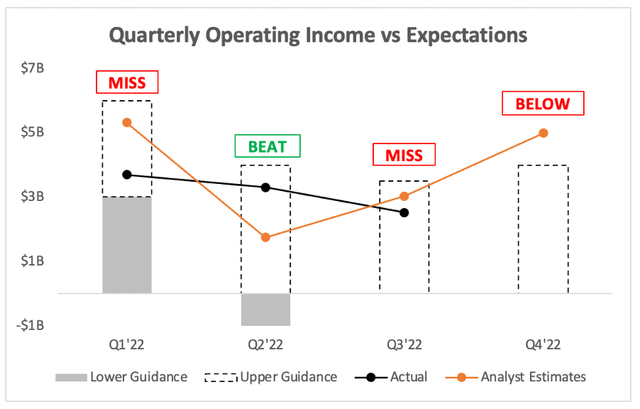

Moving down to operating income, the story doesn’t get much better. Amazon’s EBIT of $2.53B came in towards the high end of management’s guidance, but it was below analysts’ estimates of $3.04B.

The operating income guidance for Q4 also disappointed Wall Street, as management expects EBIT to be between $0.0-$4.0B, below analysts’ estimates of $5.0B.

All in all, a very disappointing quarter for Amazon when it comes to the headline numbers. I’m writing this before the earnings call, so will be particularly interested to see management’s explanation for the lower-than-expected performance; my number one guess is that it will all be due to foreign exchange headwinds, with some other macro factors thrown in for good measure.

As I outlined, my thesis is all about AWS – it has saved Amazon in previous quarters this year, so did it manage to do the same in Q3? Well, shares are down ~19% as I write this, so… you can be the judge.

AWS: Good, But Not Good Enough

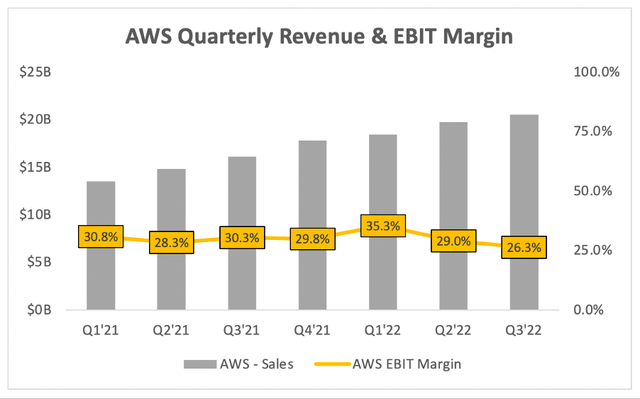

Sadly, for Amazon shareholders, AWS could not save the company from the host of headwinds that it currently faces. Revenue for AWS still grew an impressive 27% YoY, but the sequential growth rate slowed from 7% to 4%; this isn’t a huge issue (sequential growth was 3.7% in Q1’22), but it is something to note.

The other negative for AWS in this quarter was the EBIT margin hitting 26.3%, the lowest it has been for a long time. Amazon did not release much information about operating expenses in its press release, and I’m writing this prior to the earnings call taking place – but here’s my assumption.

I think that AWS has a higher portion of costs in the US compared to its revenue, meaning that a strong US dollar would negatively impact revenues more than it would impact costs – hence, lower margins.

Management also mentioned on the Q2 earnings call that AWS would be seeing additional investments that would impact Q3 EBIT:

Third quarter guidance assumes, we see approximately $1.5 billion in quarter-over-quarter sequential cost improvement in our fulfillment network operations, which we expect will be largely offset by investments in AWS and additional digital content for Prime members. For AWS, this quarter-over-quarter increases are primarily driven by higher infrastructure investments to support continued strong customer growth, including larger depreciation on a growing fixed asset base.

We also expect increased energy costs as we continue to see volatility in utility prices around the world and operating our AWS data centers.

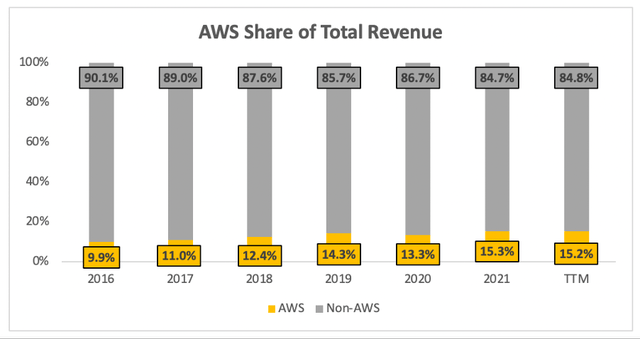

We can also see that AWS made up 15.2% of Amazon’s total revenue for the past 12 months; this is down slightly from 15.3% in 2021, but there is a level of seasonality involved in Amazon’s retail business.

Yet the overall trend is more revenue shifting to AWS, and that is critical; AWS has much, much higher EBIT margins than Amazon’s retail business, and so the more AWS we see in revenue, the more EBIT we see for Amazon.

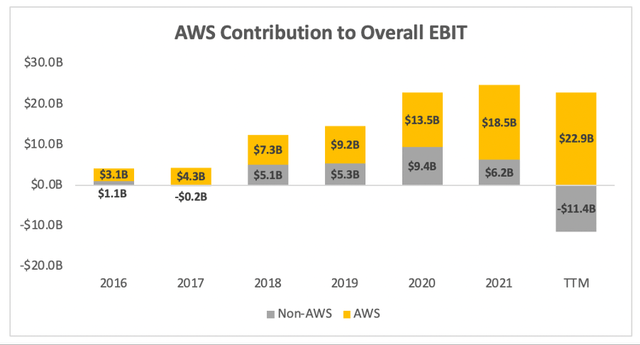

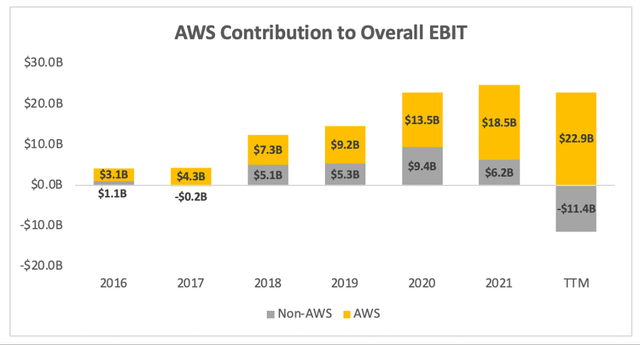

Just look at the below graph to see what a savior AWS has been for Amazon’s operating income over the past twelve months. The non-AWS side of the business has lost a jaw-dropping $11.4B due to a bunch of macroeconomic headwinds, including a strong US dollar, supply chain issues, higher energy costs, and a pullback in global ecommerce spending.

In fact, that is probably my favorite graph, because it shows just how powerful Amazon can become in terms of profitability once these macroeconomic headwinds have passed.

But, as the market’s reaction to today’s earnings will show, investors may be in for some pain until the macro sorts itself out.

AMZN Stock Valuation

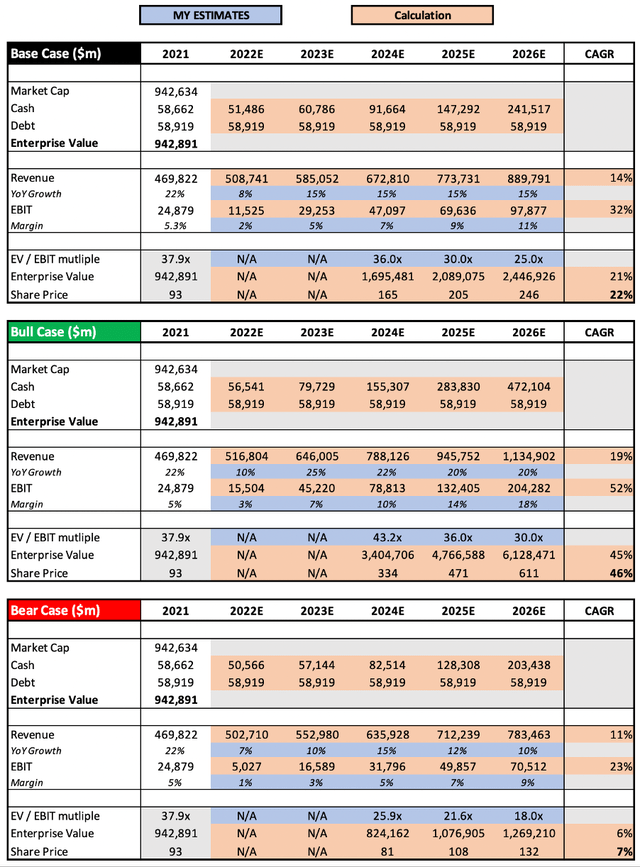

As with all high-growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have kept most assumptions similar to my previous article, with the exception of a reduction in 2022 expected revenue and EBIT due to the latest earnings. Put all that together, and I can see Amazon shares achieving a CAGR through to 2026 of 7%, 22%, and 46% in my respective bear, base, and bull case scenarios.

Bottom Line

Clearly, I underestimated just how much of an impact the current difficult macroeconomic environment would have on Amazon’s earnings; the currency impact to revenue growth, and all the other issues that are persisting to hurt EBIT.

I hope that management’s commentary on the earnings call will provide investors with more clarity behind the falling EBIT, particularly on the retail side; I may be investing in Amazon due to AWS, but it’s painful to see the non-AWS side of the business drag it down. Once I’ve read the conference call transcript, I’ll post any updates in the comments section.

This is a difficult quarter to take, but I do genuinely think Amazon is set up for success. It hasn’t seen the non-AWS side of its business make this much of a loss for a long time, which is why I believe it is driven substantially by broader macroeconomic factors. As my favorite graph shows, just imagine the impact on Amazon’s overall EBIT when it no longer has that $11.4B negative drag.

For this reason, I am reiterating my previous ‘Strong Buy’ rating for Amazon. It may be a painful 12 months ahead, but once the economy recovers, and it will recover, I think that the market will be stunned by Amazon’s ability to rapidly boost its profitability.

Be the first to comment