Justin Sullivan

ConocoPhillips (NYSE:COP) is one of the largest crude oil companies in the world, with a market capitalization of more than $150 billion and a dividend yield of more than 4%. The company’s impressive portfolio of assets is continuing to generate massive cash flow at more than $86/barrel Brent, however, despite that, we expect the company will struggle to generate strong returns.

ConocoPhillips’ 3Q 2022 Earnings

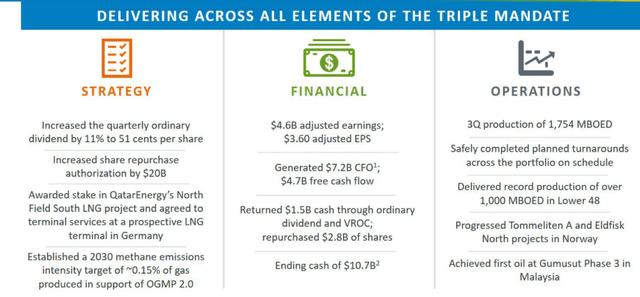

ConocoPhillips had strong 3Q 2022 earnings, highlighting its continued execution across its business.

ConocoPhillips 3Q 2022 Earnings (ConocoPhillips Investor Presentation)

The company, with a $150 billion market capitalization, had $18 billion in annualized earnings for the quarter, giving the company a high-single-digit P/E. That would indicate a strong quarter for the company, with its FCF coming in at similar numbers. The company has continued to pay its dividend of more than 4% and repurchase almost double that in shares.

The company’s production has remained strong, especially in the lower 48, and the company has continued to find new opportunities for growth.

However, there are also some key takeaways from the company’s results. The company’s marker prices for the quarter were Brent at over $100/barrel, with Henry Hub at more than $8/mmBtu, and WTI at almost $92/barrel. That’s almost $15/barrel above current prices, with Henry Hub at $2/mmBtu higher than current prices.

That means it’s less likely for the company’s substantial earnings to continue.

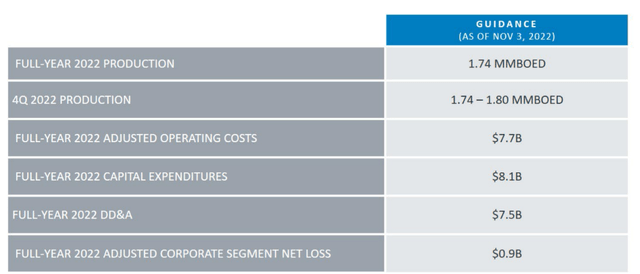

ConocoPhillips’ Guidance

The company’s guidance shows the ability to continue cash flow but makes it heavily subjective to prices.

ConocoPhillips Guidance (ConocoPhillips Investor Presentation)

The company expects 4Q 2022 production to average 1.77 million barrels/day, roughly 1% above the company’s 3Q 2022 earnings. The company’s capital expenditures for the year are expected to be more than $8 billion, or $2 billion a quarter, an amount that the company can comfortably afford in relation to its overall operating costs and cash flow.

We expect the company to maintain production, however, we also expect it to be heavily susceptible to price volatility. The company’s cash flow volatility of $100 million per $0.25/MCF change and $200 million per $1/BBL change. That highlights the volatility of the company’s cash flow, which has dropped $3 billion/$15 BBL.

ConocoPhillips’ Shareholder Returns

ConocoPhillips is focused on shareholder returns, however, the company is expensive.

The company’s annualized FCF is almost $20 billion, however, this is in a market where the company is realizing triple-digit oil prices. With a 20% price drop, that decreases substantially to become closer to $10 billion. For a company with a $150 billion market capitalization, that is a substantially worse FCF.

That will hurt the company’s ability to continue driving shareholder returns. We expect the company to maintain its current dividend of almost 5%, but taper back its share buyback program substantially, especially with capital spending. That’s an especially bad deal given that cash is being currently used to repurchase shares at higher prices.

As a result, we expect the company’s shareholder returns to underperform over the next several years.

Thesis Risk

The largest risk to the thesis is that oil prices have been especially volatile, and there’s plenty that could spike up prices. The price limit on Russian crude is expected to have an impact, and something such as China reopening could also have a substantial impact. These potential impacts are worth paying close attention to as it could result in more substantial cash flow for ConocoPhillips’ reliable crude.

Conclusion

ConocoPhillips is an impressive oil company that has continued to have substantial production, highlighting the strength of its assets. The geographic location of its assets and low-cost quality oil have allowed the company to continue to achieve strong pricing and generate incredibly high cash flow in the market.

However, the company does have the risk that its market capitalization has expanded substantially. That means the company now needs ~$15 billion in annual FCF to justify its valuation, something that requires high-double-digit oil prices, which we believe that the company will struggle to see for the long term. That makes it a poor investment.

Be the first to comment