Leestat

Note: Golar LNG (NASDAQ:GLNG) is a company focused on floating liquefied natural gas (FLNG) facilities. I suggest readers review an interview from March 2020 in which I offer a detailed analysis of the company, with an update in May 2021 and a new update in January 2022. I believe these articles will provide a good basis for the one that follows.

There has been a lot happening since my last article at the beginning of the year. I suppose the most important event from an external point of view is the fact that Golar’s stock price has performed extremely well in a rough market, rising 85% in contrast to the S&P’s 20% drop, according to the Seeking Alpha tracker.

As value investors know all too well, Mr. Market is a manic-depressive animal whose irrational mood sometimes offers the opportunity to buy very high-quality assets at very attractive prices. Investors have gone from hate to love in a short period of time, causing a huge swing in the stock price in a period when Golar has not added any new projects/assets to his portfolio. There is no doubt that the environment has improved after the Russian invasion, but I firmly believe that the biggest driver of such an amazing performance is that Golar has delivered, alleviating most of the concerns surrounding the company in recent years.

I would say that Mr. Karl Fredrik Staubo was key to achieving such a significant improvement. The market was somewhat dubious when he was named CEO in May 2021, as both the experienced CEO and CFO had just resigned from the company without giving much detail, suggesting that Golar’s business was deteriorating, and Karl seemed too young to take on such a large responsibility. Since then, however, Karl has proven at every conference that he is a shark who wakes up angry every morning looking to create shareholder value. There is no doubt that he has done an excellent job at the helm, despite the haphazard nature of the events that have unfolded.

Under Karl’s leadership, Golar has undertaken a massive transformation process to crystallize value, strengthen the balance sheet and simplify the corporate structure. This year alone, the company has spun off its LNG carrier fleet and raised $275 million, sold approximately one-third of its New Fortress shares (NFE) raising $250 million, sold Golar Tundra FSRU for $350 million and agreed to sell the steam turbine carrier Golar Arctic as a converted FSRU to Italy’s Snam for $288 million.

In addition, the company has increased utilization of Hilli FLNG to mid-2026 and has reached swap agreements for 75% of 2H 2022, all of 2023, and half of its 2024 TTF-linked exposure at a staggering price, locking in a total of $274M while maintaining upside Brent exposure. It is worth remembering that prior to that, Golar had already started the process of unlocking value by selling Hygo and GMLP to New Fortress for $5 billion EV.

All of these smart decisions have helped the company regain investor confidence, and are the main reason why Golar has soared from $11 per share when Karl came on board as CEO to the current >$25/share. The market ignored the company because it thought Golar’s business was too complex and the balance sheet was weak. However, these two nagging arguments have been softened. In fact, Golar has a strong balance sheet with a net cash position, and valuing the company has never been easier. The company has two assets, only one of which is generating profits (Hilli FLNG), while the other is under construction and will be deployed by the end of 2023 (Gimi FLNG). In addition, Golar has public stakes in NFE, CoolCo, and Avenir LNG.

Hilli FLNG

Hilli is the world’s best-performing FLNG. It is the only proven design that has excelled with 100% uptime, which has given Golar a unique reputation among its competitors. The asset has three sources of revenue:

- The base tolling tariff (T1 & T2), which has been generating around $66 million of EBITDA/year, occasionally increased due to overproduction.

- The Brent bonus tariff which contributes $2.7 million for every dollar of Brent crude oil price above $60 up to $102.

- The TTF gas tariff (T3) based on 0.2 Mpta, which has recently been extended until mid-2026. As I mentioned earlier, Golar has hedged most of the European gas exposure for the next few years, ensuring cash flow visibility at huge TTF gas prices – i.e., levels where energy is equivalent to a Brent oil price of $300/bbl.

Hilli’s FLNG is a cash cow, as Golar’s share of debt and interest service is $50 per year (based on current high LIBOR rates of 3%), implying that this asset alone will generate over $570 million of free cash flow to equity through 2024, which is over 21% of market capitalization in 2.5 years (40% if we exclude cash and marketable securities). It should be noted that Hilli is a tax-free asset and has almost no capex needs.

Although Hilli’s cash flow generation profile might surprise you, there is room for improvement, as Hilli is not yet fully utilized. But how much is this asset worth? You might be aware that Exmar recently sold its FLNG Tango to Eni for $572-$694 million. The final price depends on the barge’s performance in the first six months on site. Knowing that the FLNG Tango performed above expectations in its short period of operations with YPF in 2020 and that the asset has been well maintained in the lay-up period, I expect the final price to be close to the upper range, being the only FLNG deal and showing how valuable an FLNG is.

The Tango floating liquefaction plant, built in 2017, has an LNG storage capacity of 16,100m³ and a liquefaction capacity of up to 0.6 million tonnes per year, while Hilli Episeyo FLNG is 294m in length with a storage capacity of 125,000m3, and was designed to produce about 2.4 million tonnes per year of LNG. In addition, Hilli has much higher specifications as it can perform in a more complex environment.

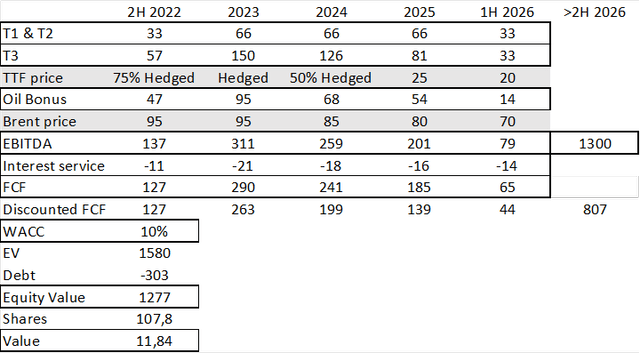

Therefore, knowing that Tango FLNG was sold for $660 million and has one-quarter of the liquefaction capacity of Hilli FLNG as well as much lower specifications, we should argue that Hilli is worth at least $2.6 bn. Being very conservative, I am valuing Hilli at a significant discount to the price we reach by comparing a fair and recent transaction. Using a 10% WACC, we reach a value of $1.27 billion or $11.8/share. You can see my estimates in the following image.

Hilli FLNG DCF model (Own elaboration based on my estimates)

Be aware that Hilli’s current contract with Perenco ends in mid-2026, but the asset has a long life left. I have argued in the past that Hilli will not leave Cameroon, but Golar has begun to explore other options in case Perenco does not make significant commitments. According to Cypriot and Greek media, Energean CEO Mathios Rigas proposed connecting Energean’s gas fields in offshore Israel to a Hilli floating liquefied natural gas unit that would be stationed off Vasilikos, Cyprus, by the end of 2026, just after the current contract expires.

That said, I remain confident that Perenco will increase production and extend the contract in late 2023 or early 2024 because if Hilli exits Cameroon, it will be extremely difficult for Perenco to monetize the remaining reserves. Therefore, once it happens, our valuation of Hilli will increase accordingly.

In addition, our utilization rate, and therefore the valuation of the asset, could prove to be very conservative. It should be noted that Gazprom Marketing & Trading is now Hilli’s off-taker. After the war, this entity has been under federal trusteeship and recapitalized with a contribution of about $10 billion from the German government. Following that liquidity injection, it was then renamed SEFE Securing European Energy and will soon be nationalized, so the buyer of Hilli liquified gas is now Germany, which is desperately seeking to increase its LNG supply. I understand that SEFE is in talks with Perenco about the possibility of adding at least 0.2 million tons and likely more, depending on production capacity. Based on the conservative assumptions well below the forward curve I provided above, an addition of 0.2 MPTA, which will only increase utilization to 66%, will generate an extra $350M from 2023 to mid-2026.

Gimi FLNG

Gimi’s conversion has continued steadily according to plan. Golar’s latest earning presentation shows that the asset is 86% complete. However, Keppel has not been immune to the current logistical and inflation issues and Golar had to contribute an extra $35 million (70% of $50 million) to secure the delivery date. The Gimi FLNG will set sail in H1 2023 and will begin its 20-year contract by the end of that year. Golar owns 70% of Gimi, which has a $4.3bn order backlog. This means that Gimi will start contributing $151 million of EBITDA each year starting by Q4 2023 for the next 20 years, so despite recent minor difficulties, Gimi’s economics look terrific. Be aware that according to current specifics, Gimi should be able to produce 10% more, so EBITDA could end up being higher than what I am modeling.

Gimi’s valuation is easier than Hilli’s as there are no moving parts such as TTF or Brent exposure. $151M EBITDA, 16-year straight debt amortization curve, which might be conservative on a 25+ year life and a 20-year contract value at a 5% interest rate. I understand that the company will refinance and increase the leverage of the asset once it is online, but it is something I am not modeling yet. I used a WACC of 8%. The lower discount rate than Hilli’s is because BP is an extraordinary counterparty, and our profit forecast is less uncertain, as revenues are fixed and hedged against inflation. Therefore, according to my model, the asset is worth about $1.5 billion, and after deducting Golar’s share debt and remaining capex, we reach an equity value of just under $0.8 billion or $7.2/share.

Golar Marketable Securities and Net Debt

After repayments on Golar’s credit facilities, corporate debt is only the $300M unsecured Norwegian bond, with Golar’s cash position being in excess of $700M after the latest sales. Note that I am considering Golar Arctic’s net proceeds. Remember that Golar will convert its trading steam turbine LNG carrier, Golar Arctic, to an FSRU and upon conversion, ownership of the asset will be transferred to Snam, which will pay €269.0M, but the conversion has a cost of $160M and is expected to take up to two years. All in all, Golar has a net corporate cash position (excluding Golar’s share of Hilli and Gimi debt) of $400M.

In addition, Golar holds marketable securities that could be liquidated in a short period of time for $845M. These are comprised of 12.4M shares of NFE, which at the current price of $50.7 implies $629M (or $806M taking the $65 consensus TP), and 12.5M shares of CoolCo company worth $169M, which is listed on the Euronext market. We expect a dual listing in the U.S. in the coming months, and Avenir LNG stake is worth $47M.

As Golar’s management has pointed out on numerous occasions during recent conferences, Golar is not a holding company; therefore, I expect Golar to divest all of those holdings to fund FLNG’s growth and that is the reason why I am not applying any holding discount. Due to the illiquidity of the CoolCo stake and the incredible prospects for LNG shipping, I personally expect Golar to distribute those shares as a special dividend to its shareholders once the company is listed on the U.S. market.

Lastly, Golar’s corporate costs are 21M per year, so after applying a multiple of 8x, we deduct $168M from our valuation. However, I am aware that core costs may decrease significantly after the CoolCo spin-off.

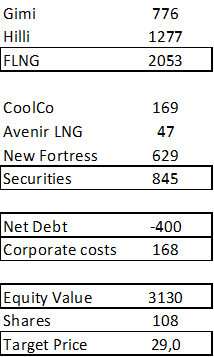

Golar Sum Of Parts Target Price (Own elaboration based on my estimates)

We reach a target price of $29 based on current assets, which implies an attractive upside from current prices. I am comfortable with this valuation as I consider myself very conservative. Conservatism is shown by playing with what-if scenarios. In the scenario where Golar does not grow further, we should expect FCF of $325M in 2024 after debt service (interest and debt amortization). Most of the FCF is fixed, so my estimates are accurate enough. Golar has stated that they will start paying dividends as soon as Gimi is online and if they have no capex growth needs, based on the stability of their income stream, I believe they will pay all free cash flow as a dividend, like Tor Olav Troim is famous for, because his ability to allocate capital where it creates the most value. If we take the current market cap of $2.7Bn and exclude listed securities and net cash (likely also distributed under that scenario), we reach a potential yearly dividend yield of >22% (12% to market cap). Given these figures, it is fair to say that my current valuation is conservative, even if we do not consider FLNG growth.

FLNG Growth

The upside based on current assets is attractive but would not by itself justify Golar as one of our top holdings. However, I would like to emphasize that the target price I showed you is not considering any growth and at this point, I think growth is more exciting than current assets. I firmly believe that Golar will be able to deliver three projects in the next 12-18 months, one of them starting this year.

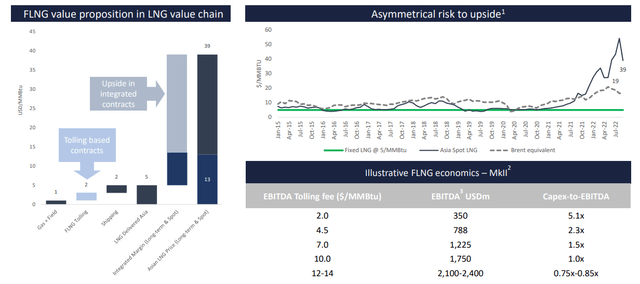

The environment for FLNG has never been more favorable. The lack of global supply became apparent after COVID-19, as demonstrated by high gas prices. Global supply was not able to catch up with strong demand, but the global gas market broke down following the Russian invasion. Unsurprisingly, Europe has cut ties with Russia and decided to move away from dependence on Russian gas. It should be known that the annual gas demand in Europe is about 500 bcm of which 400 bcm is imported and Russia used to supply (mostly by pipeline) 45% of it, up to 55/60% in the closest countries like Germany, while Norway supplies about 25% of European imports and LNG imports add another 25%. The remaining 5% is supplied by Algeria, Azerbaijan, Libya and Iran.

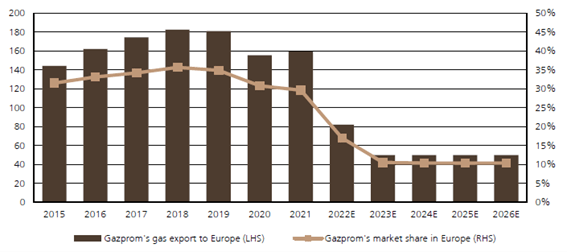

Gazprom’s gas exports to Europe (UBS research )

As can be seen, Russia already serves only 14% of total imports, creating a huge imbalance between demand and supply that is unlikely to be fixed soon as there is not enough LNG infrastructure to replace Russia in the short term. Nor is the European regasification infrastructure large enough, nor is the global liquefaction capacity. Initially, I expected Russia to restart Nord Stream pipeline flows, as I felt they had cut off pipeline flows using gas as a weapon to gain leverage in a tough negotiation, but I do not foresee volumes coming back after the recent Nord Stream pipeline explosion.

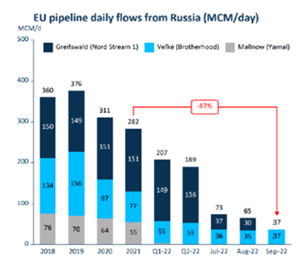

Russia’s daily exports to Europe (CoolCo presentation)

Note that daily Russian gas flows in H1 2022 were significantly lower than in 2019 but much higher than today. While I continue to expect Russian gas to flow to Europe via Ukraine at the current level, I see downside rather than upside risk.

Therefore, I expect gas prices in Europe to remain extremely high, as suggested by the forward curve. In fact, I expect gas prices on average for 2023 to be higher than in 2022 due to a greater challenge to refill storage next year with the loss of Russian flows.

You might see that the price of gas in Europe has plummeted due to the oversupply. That’s fair enough, as natural gas prices are driven by daily supply and demand, as it is a commodity that trades in the present, unlike equities, which discount the future. Current demand is not strong as unseasonable weather depresses it, while storage is full because Europe has rushed to buy all available LNG so as not to run out of gas during the winter. However, winter is coming and Europe’s consumption will be 2-4x higher than it is now, while pipeline supply will remain tight. Moreover, even though storage is full, European storage only covers two to three months of consumption.

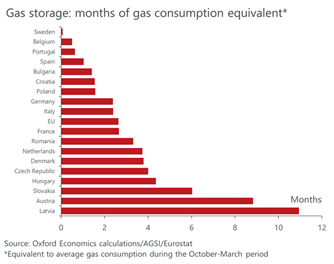

Months of gas storage per country (Oxford Economics)

Therefore, the European pain is not over yet, and the gas price will increase significantly in the coming weeks, as the current forward curve suggests (around €140MWh compared to the €15MWh it used to trade or €40/50MWh now). In addition, we should be grateful to China for remaining in a continuous lockdown. This is the first year in which LNG imports from China have not grown; on the contrary, we would be required to pay even higher prices to attract LNG cargoes to Europe.

As can be concluded, the only way for Europe to normalize its energy situation is to build LNG infrastructure and secure capacity. Moving away from Russia means that Europe will have to seek up to 150 bcm or 110 million tons of LNG. Europe has already taken the first big step by ordering enough regasification terminals to process LNG, but it remains to be seen how they will be able to secure LNG capacity over the next few years. I don’t think the U.S. will be able to supply such a large amount of LNG because it does not have sufficient LNG liquefaction capacity, but even if it could do so over the next decade, I would not expect Europe to make the same mistake a second time and rely on a single source.

As reported in the news, Europe is actively targeting Africa. This continent has unique advantages, such as proximity and proven African gas fields associated with a low cost of supply. It is evident that Africa is set to occupy a key place among European gas suppliers.

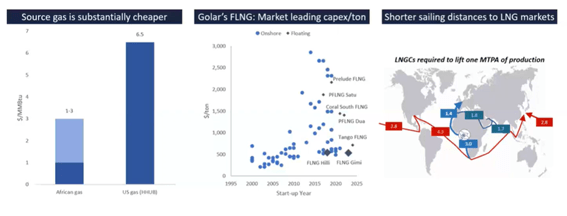

Africa’s competitive advantages (Golar presentation)

Also, as shown in the picture, Golar’s liquefaction technology is one of the lowest cost and carbon footprint solutions in the world, including onshore liquefaction facilities in the United States. It is known that Golar can supply gas to Europe or Asia at $5 MMBtu, which means it can easily make huge profits in almost every scenario. Golar is aware of this huge opportunity and is looking not to be a single service provider but to make it an integrated project. In fact, it is rumored that Golar and New Fortress could partner and revive Fortuna FLNG.

Golar’s integrated project economics (Golar presentation)

Fortuna FLNG is a project that Golar knows very well, as it was going to be FID in 2018 teaming up with Schlumberger (SLB) among others, but eventually, after a key manager left the company, Schlumberger rejected the project to focus on its core business and killed the project. As time has proven, Schlumberger made a big mistake, but I think the current economics are even better now than they were then.

The Fortuna FLNG integrated project required $2 billion to obtain the first gas, of which $1.2 billion would be financed with debt and would be used entirely for the start of commercial operations. We should factor inflation into these figures, but I believe this is a project that Golar should be able to afford.

As shown in the figure, the payback of the project under current conditions is about one year, which provides an astonishing IRR. Most importantly, however, it is environmentally friendly and has a low break-even cost. Europe will prioritize this “green” gas and even in a very challenging market, the Asian LNG market has never been consistently below $5 MMBtu, which means that even in the worst situation, this project will not burn cash. That said, I would like to stress that the world has changed after Europe realized the huge energy risk it was taking from Russia’s concentration of gas suppliers and even if the war is resolved and we move on, the price of gas will be structurally higher, as it is known that the cost of LNG imports, which requires liquefaction, shipping and regasification, is much higher than that of Russian pipeline gas.

The growth of Golar FLNG is a matter of time. In fact, the company has publicly stated that an FLNG project will be announced before the end of the year and I don’t expect Golar to go back on its word. There are many candidates, Kosmos (KOS) reported at the last earnings conference that they want to move forward with the Greater Tortue expansion. In fact, they said they expect to reach an FID in the coming months and expect first gas by the end of 2026. Based on my conversations with them, I would guess that the fact that they haven’t moved forward yet would be because they are considering increasing the size of the project from the estimated 2.5 Mpta to 3.5-5 Mpta.

As seen, there are many FLNG candidates for Golar and I am not sure what deal Golar will take, but I expect three FLNG projects in the next 18 months, with one being in the next few weeks. Why am I so confident? Golar has the most efficient and proven solution that can be delivered quickly. It is also the most environmentally friendly solution, which is the first step in participating in a large gas project these days.

At this point, one might ask, if the current global gas market imbalance has been so clear for a year now and has been intensified by the Russian invasion, why hasn’t Golar announced an FLNG project yet?

It is a fair question, but it shows the overall lack of knowledge of the sector among investors. The FID of an LNG project is very complex. It is a huge infrastructure project that requires the intervention of many players at the same time and tons of money. The FEED, EPC award, project financing, host government agreements, environmental firms, financing due diligence, offtake contracts – all have to go down and integrate with each other. Just one example: most of the financing will be done through ECAs, tied to a percentage of the procurement, which in turn is tied to the FEED and the EPC award. It quickly becomes clear how complex all this is. Moreover, it is a binary outcome. All parties could have been working for years and in the end, one of them leaves the table and all the work is lost.

An offshore gas project is a big infrastructure headache; however, when FID is done and Golar’s expertise is on the table, the returns are amazing, as we have seen on Hilli’s FLNG.

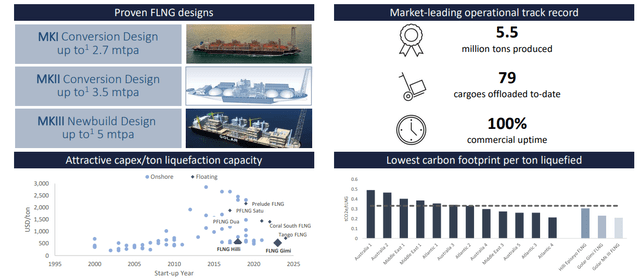

Golar’s FLNG designs (Golar presentation)

Golar is uniquely positioned for FLNG growth and has three different alternatives that cover all customer needs. The MKI and MK II designs are conversions that could be deployed in three years, while the largest new-build design (MK III) will require four years to be operational.

Based on the current balance sheet, I expect Golar to be able to move forward with 3 FLNG growth projects in parallel in the next 18 months that could increase my target price by $25/share (depending on final capex and generation specifications), reaching a total of over $50/share. Dividend capacity can be huge by the end of 2026 and could justify a higher valuation. Moreover, once time passes and Golar keeps delivering FLNG projects, the target price could eventually grow up to $100/share by 2030.

Conclusion

Earlier this year, I called Golar a strong buy and titled my analysis “2022 Is Set to Be the True Inflection Point.” The company has delivered on plan and the market has rewarded them closing most of the gap between price and value. However, the current market price is ignoring Golar’s ability to grow, which I understand as the company has not announced any FLNG projects since 2019.

Golar is well positioned for growth and should be able to pursue three FLNG projects in parallel, which should raise the target price above $50/share. In addition, I remain very confident in my core holding due to the low downside, as Golar’s cash flow generation is set to quadruple and should offer a huge dividend yield should growth fail to materialize.

Golar has a fiduciary duty to Europe to advance FLNG growth by helping Europe regain control of the energy chaos. The environment has never been better and the company is in advanced talks with many credible players which prompted them to be confident enough to guide for an FLNG FID before the end of the year.

Be the first to comment