gguy44/iStock via Getty Images

Introduction

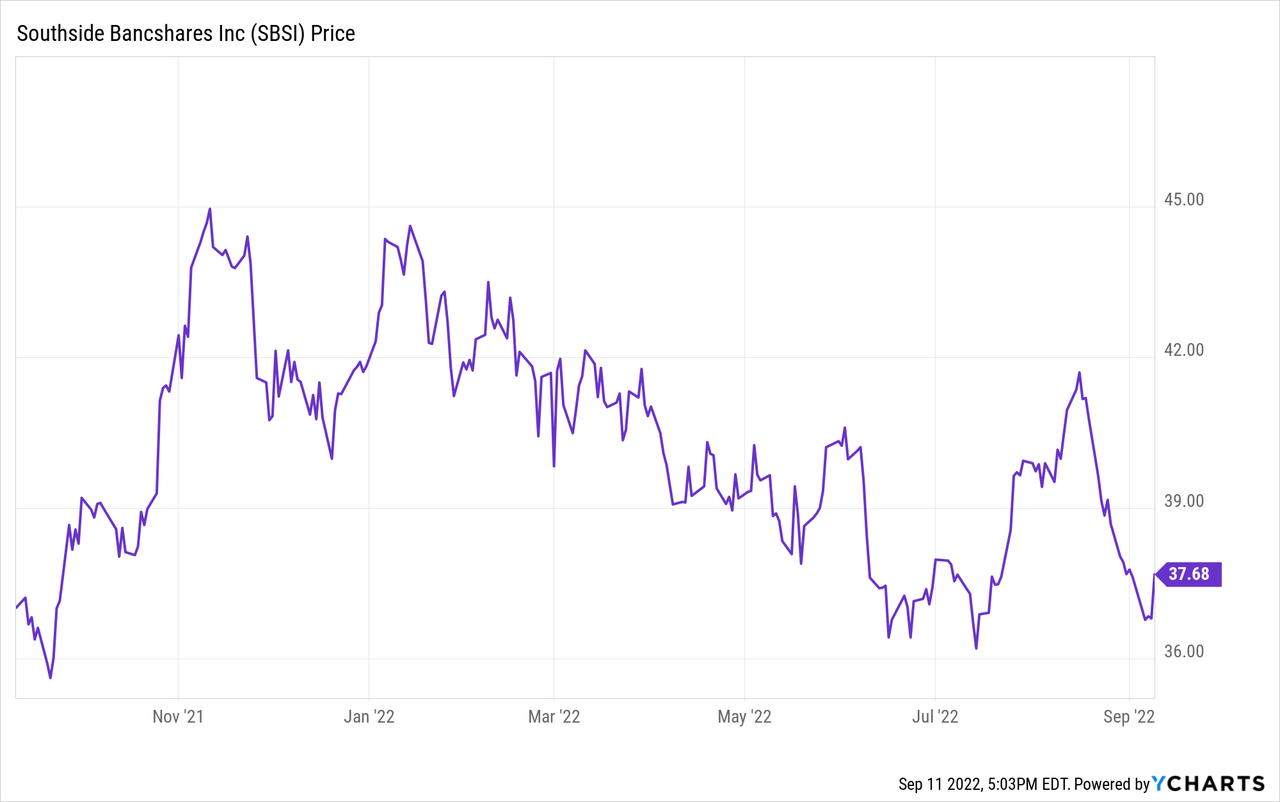

In January, I wasn’t too sure what to think about Southside Bancshares (NASDAQ:NASDAQ:SBSI). I could see the bank offered good quality when it came to the balance sheet and investments, but the rather sharp increase in the interest rates also weighed on the value of the securities for sale which need to be valued on a mark-to-market basis.

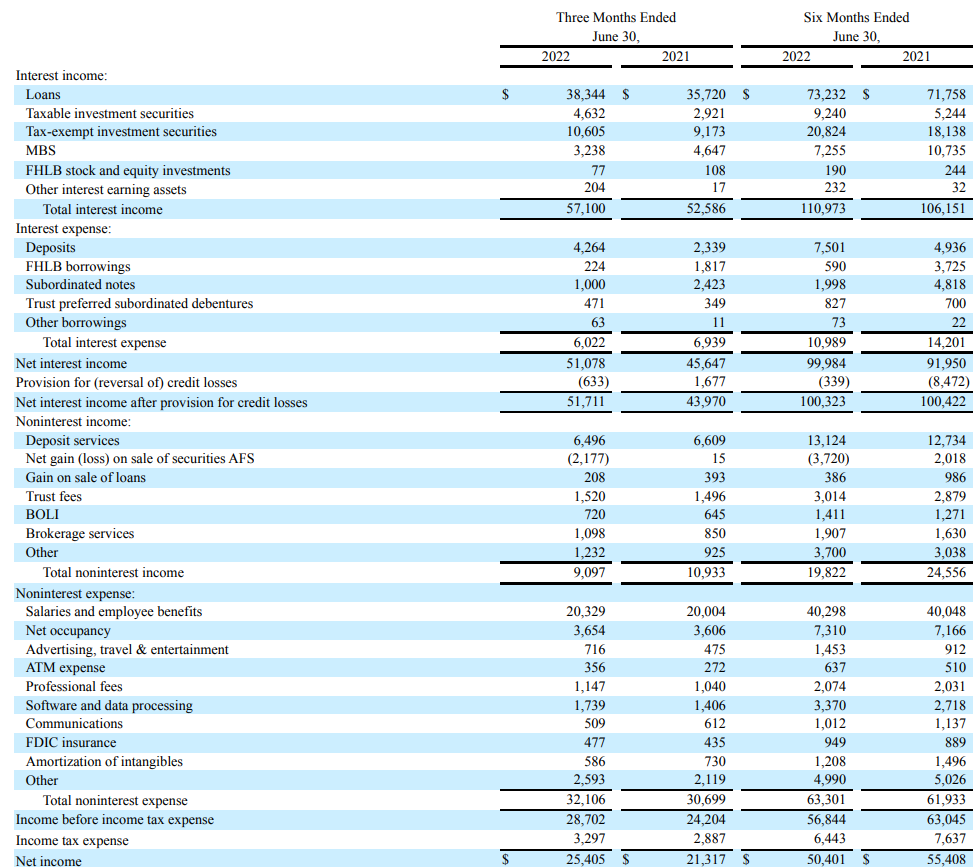

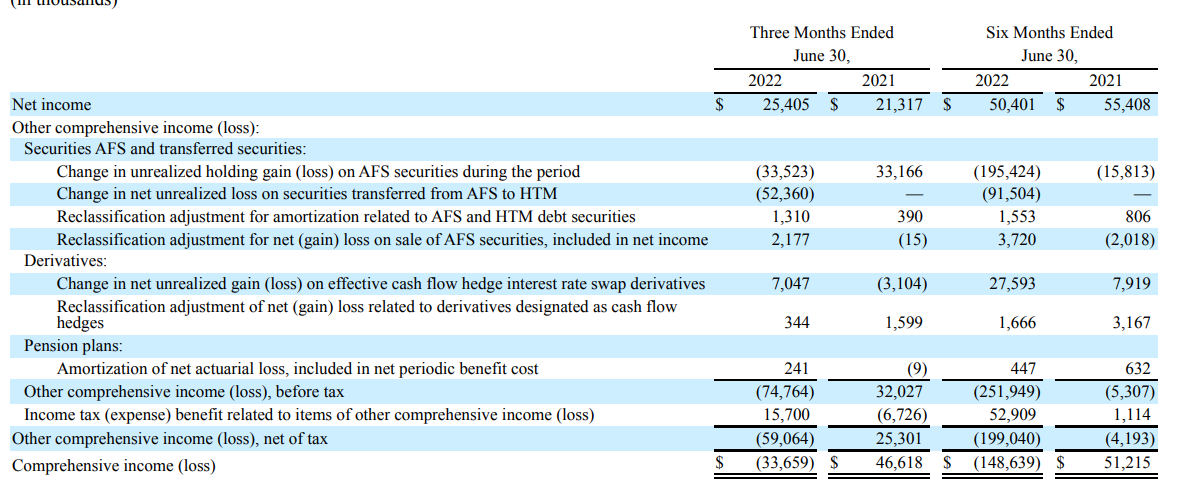

A strong net interest income helped the net income

During the second quarter of the year, the bank saw its net interest income expand as the total interest income increased from $54M to $57M compared to the first quarter of the year while the total interest expenses increased from $5M to $6M. The result is a net interest income increase from $49M to $51M. A decent result and as the bank was able to keep the additional loan loss provisions pretty. They were actually non-existent on a net basis as the bank reversed about $0.6M in previously recorded provisions. The net interest income after taking these loan loss provisions into consideration came in at $51.7M.

SBSI Investor Relations

The net non-interest expenses in the second quarter came in at approximately $23M, which includes a $2.2M loss on the securities available for sale that were actually sold (I will explain later that the securities AFS that haven’t been sold are weighing on the book value per share, but are not included in the income statement). The increased net non-interest expense wiped out the positive performance from the net interest income, and the bank reported a total pre-tax income of $28.7M. A sharp increase compared to the $24.2M in Q2 2021 due to the $23M difference in the loan loss provisions and the $5.5M improvement in the net interest income partially offset by the higher net non-interest expenses.

The net income was roughly $25.4M resulting in an EPS of $0.79. This brings the EPS in the first half of 2022 to $1.56. A decrease from the $1.69 recorded in the first half of last year but that result included a $8.5M provision reversal which added about $0.25 per share in pre-tax income.

As Southside is currently paying a quarterly dividend of $0.34, that dividend is very well covered as the payout ratio is less than 50% based on the earnings in the past few quarters.

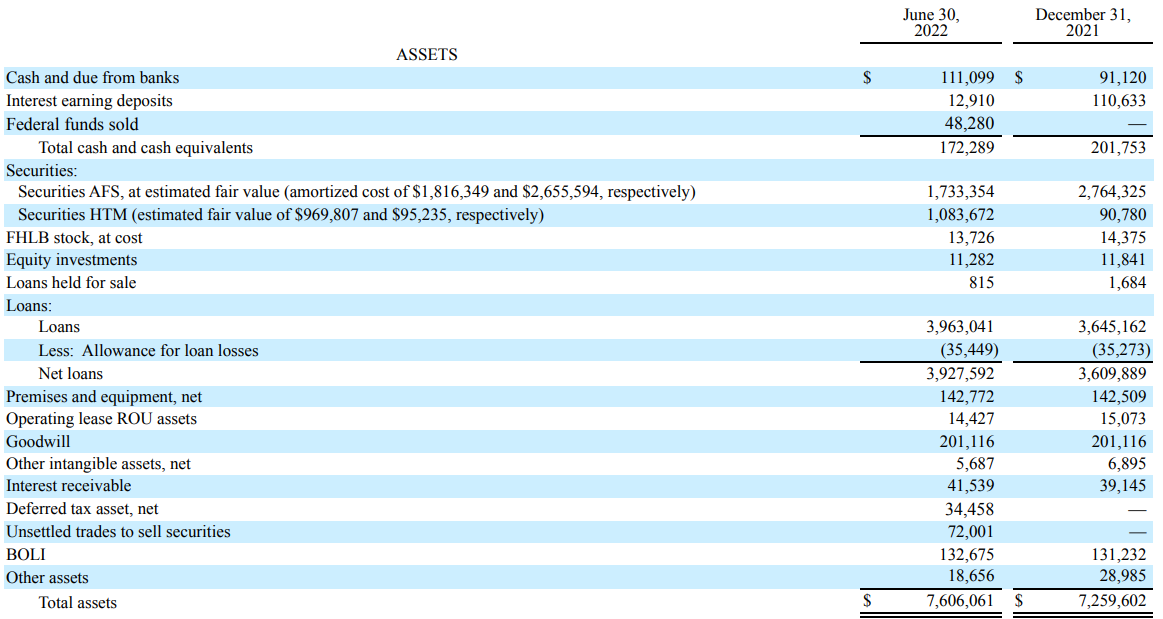

The loan book remains satisfying, but the book value has dropped

In my January article, I was actually quite charmed by the bank’s high exposure to cash and securities but unfortunately this didn’t work out as well as I had anticipated or hoped. While it for sure makes the balance sheet safer when about half of the assets are invested in liquid assets like cash and securities, the bank held almost $2.8B in securities available for sale as of the end of last year.

And as interest rates started to increase, the value of these securities decreased and exactly because they were booked as a security available for sale, Southside has to use market values for these securities.

SBSI Investor Relations

As you can see above, the bank’s management team has executed on a few very important changes. The total amount of securities AFS has decreased by almost 40% while the proceeds from these sales were used to build up the portfolio of securities held to maturity. Those don’t have to be marked down based on the market prices and this should result in a more stable book value.

It is important to see the bank is still sticking with its exposure to liquid assets. As of the end of 2021, the bank had about $3.06B in cash and securities, and as of the end of June, this decreased just slightly to $2.99B. This still means that almost 40% of the total amount of assets on the balance sheet has been invested in liquid securities and cash. And about 30% of the municipal securities in the available for sale portfolio are hedged now.

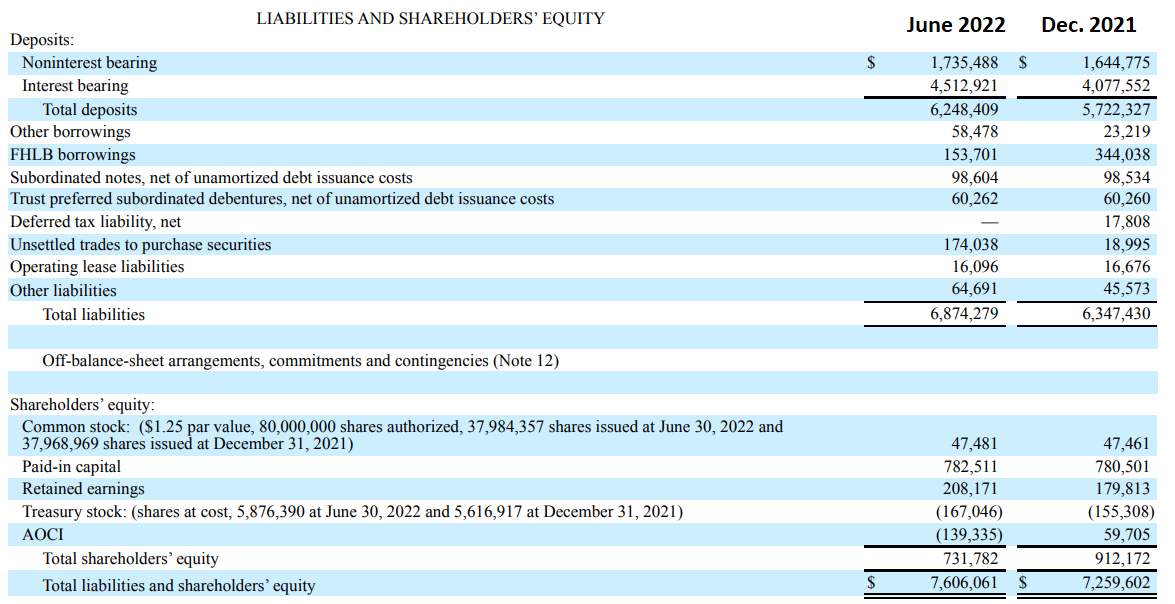

Looking at the liabilities side of the balance sheet, the sole reason why the total amount of shareholders equity fell by $180M are those securities available for sale.

SBSI Investor Relations

On a pre-tax basis, the bank actually had to take a haircut of almost $300M on the securities held for sale. That’s very unfortunate as it will take a few years before the bank can build up its book value to the level of two quarters ago.

SBSI Investor Relations

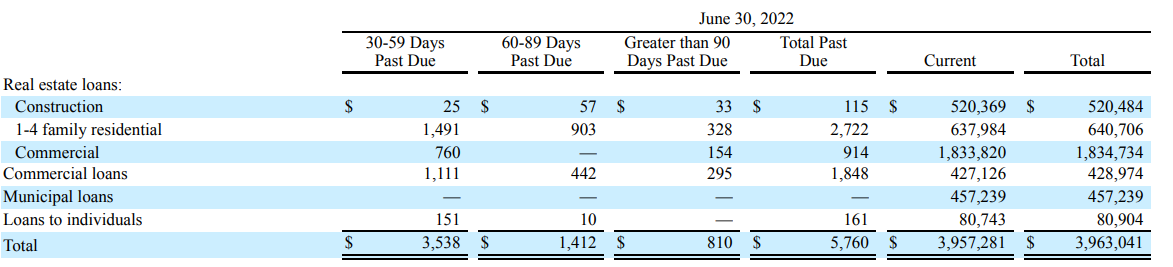

Fortunately, SBSI’s issues remain isolated to the interest rate issue hitting the value of the securities available for sale. Looking at the loan book of the bank, the total amount of non-accrual loans and loans past due remains very low. As of the end of June, only $3.1M of the loans were put on non-accrual status while just under $5.8M of the loans were past due, as you can see below.

SBSI Investor Relations

Considering the total allowance for loan losses is still in excess of $35M, the bank has a very healthy cushion even in the (unlikely) event not a single dollar could be recouped from these loans.

Investment thesis

As the bank has made the switch to add more securities held to maturity in the portfolio and as it invested in higher yielding mortgage-backed securities as well, we should see a substantial uptick in the interest income and net interest income in the third quarter.

While the bank appears to be reasonably priced from an earnings perspective at about 11 times earnings which isn’t too bad considering the local bank is running a safe balance sheet, the premium to the tangible book value has increased substantially.

As of the end of 2021, SBSI had a tangible equity value (defined as equity minus goodwill) of $711M or around $22/share but due to the value destruction in the securities portfolio, the equity value had dropped to just under $732M by the end of June. After deducting the $201M in goodwill, the tangible equity fell to just $531M which is just $16.5 per share. That means the bank is now trading at in excess of 2 times the tangible book value, and while this makes SBSI very attractive if you are speculating on sudden interest rate decreases, this valuation is just a bit too high for my liking.

A very well-run bank, but I’m just not interested at the current valuation.

Be the first to comment