JasonDoiy

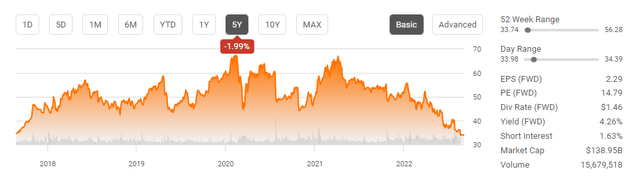

The declining value in shares of Intel Corporation (NASDAQ:INTC) has been dramatic over the past year. Shares have declined by -39.5% (-$22.23) from peak to trough and are currently resting at a newly formed bottom. INTC has declined -4.81% over the past week and is at 5-year lows as shares of INTC have declined -1.99%. This is INTC’s worst decline since the dot-com bubble, when shares fell by -$56.85 (-80.57%) from 7/31/00 – 9/16/02. During the Covid-crash, shares of INTC declined by -33.87% (-$22.85) from 2/11/20 – 3/13/20. With INTC taking out every previous low over the past 5-years, I need to reassess why I am invested in INTC, if I made a mistake and if it’s time to call it quits. I last wrote on INTC earlier this month.

Reflecting on my investment in shares of INTC and looking at the looming problems

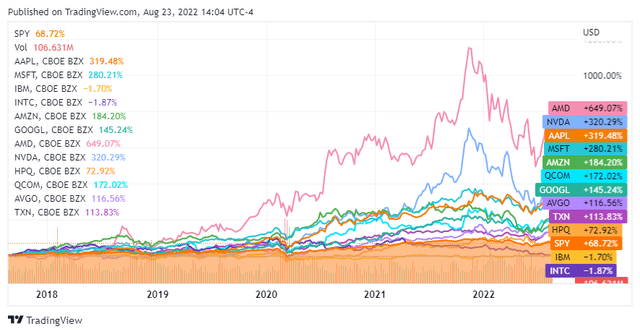

Sometimes investing in companies that look as if they have slipped into value territory doesn’t play out the way you believe it will. Over the past 5-years, just investing in an S&P 500 index fund such as the SPDR S&P 500 Trust would have generated a 68.72% return. There are many popular companies that have beat the market and returned triple digits over this period, including Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN). Looking at the chip sector, Advanced Micro Devices (AMD) delivered a 649.07% return, while Nvidia (NVDA) appreciated by 320.29% and Texas Instruments (TXN) appreciated by 113.83%. INTC is now looking like an unwelcoming technology company as its produced similar returns as International Business Machines (IBM). Anybody can look backward and say that they should have done something different. I am looking at the past data to reflect on what occurred and determine if my investment thesis is still intact, or if INTC is dead money that should just get allocated to SPY.

Even if shares of INTC didn’t fall this year, it still would have underperformed the market. Prior to Q2 earnings, INTC traded at $39.71, then after their huge miss, declined to $35.69 the very next day. Shares have traded sideways, and the little bit of momentum that was created going into 8/18 when shares traded at $36.20 has been lost as shares are struggling to stay above $34.

The first question is have I made a mistake? The obvious answer is yes, as INTC has been a horrible investment this year, and a bottom has yet to be established. I can’t answer if INTC is dead money because I can’t predict the future, but based on its previous performance, there is a substantial chance that allocating capital toward a low-cost index fund such as SPY could be a much better idea.

Anyone who is invested in INTC or is thinking about trying to catch the bottom should be well aware that it could get much worse, and there is a chance shares will drop below $30. INTC missed Q2 earnings by a whopping $0.41 as their Non-GAAP EPS came in at $0.29 while their revenue of $15.3 billion missed by -$2.63 billion, which was a YoY decline of -17.3%. INTC revised its full-year guidance to $65B to $68B vs. a consensus of $74.35B, and they are expecting Q3 to be ugly as their revenue is expected to be in the range of $15B to $16B vs. a consensus of $18.67B and EPS of $0.35 vs. consensus of $0.66.

Investors seem to have short-term memories, and while INTC has already guided down for Q3, if they miss their lowered estimates, it could send shares further into freefall. Last year, INTC generated $19.19 billion of revenue in Q3, and in 2020, INTC’s Q3 revenue came in at $18.33 billion. The street was looking for $18.67 billion of revenue in Q3 2022, and INTC just guided for $15 – $16 billion when they generated $19.83 billion in Q1 2020 and $19.73 in Q2 2020 at the height of the pandemic. If INTC misses earnings in Q3 and the revenue number comes in under $15 billion, I think there could be a knee-jerk reaction that sends shares to around $25. The headwinds INTC is facing are well-known. On the earnings call, management indicated that they expect the PC TAM to decline roughly 10% in the calendar year 2022. Their Q2 PC unit volume suggests that INTC is shipping below consumption as some of their largest customers are reducing inventory levels at a rate not seen in the last decade. We don’t know if INTC is being conservative in their lowered guidance, but I think everyone can agree that if they miss, or if INTC extends what they consider to be the financial bottom into Q4, shares could see another significant drop. Stocks can drop -80%, just look at Peloton (PTON), or Teladoc (TDOC), and while INTC is a much different story, shares did drop by over -80% in the dot-com bubble.

As current or potential investors, the questions become, has anything changed to make us want to exit INTC, is the capital allocated toward INTC better off in a different investment, and do we deliver INTC is still a viable long-term investment? Everyone needs to do their own research, and I can’t answer these questions for anyone other than myself. My view is that INTC is a 5-10 year investment and not a trade. As a long-term investment, my investment thesis hasn’t changed as I had gone into this knowing 2022 was going to be a disaster, I just didn’t catch the bottom. Maybe the capital I allocated can generate a larger return if I allocate the remaining capital into shares of AAPL or SPY; history would say that there is a higher probability in that option. I don’t think shares of INTC are going to make new all-time highs anytime soon. This doesn’t mean that getting back into the high $50s or low $60s isn’t a possibility in 2024 or 2025. I am not expecting INTC to be a better investment than AAPL, but I do think that its valuation is attractive and that I will average down. If shares go below $30 after the next earnings report and my investment thesis stays the same, I would probably average down again.

Why I am sticking with Intel even though the investment isn’t looking good at the moment

The main reason why I am sticking with INTC isn’t because of momentum or hype, it’s because of the financials, followed by their future projections. The company and a company’s stock are two separate things, and there are many cases where a misevaluation occurs in a company’s stock, as financials are not the only component of the valuation. At the end of the day, when you’re buying a share of stock, you’re buying an equity position in that company where your shares represent a portion of the overall revenue and profits of the business endeavors.

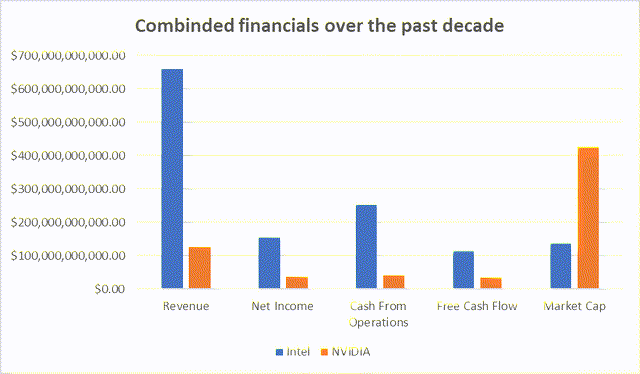

I will provide two real-world sets of financials and ask two questions: Which company would you rather invest in, and which company do you think has a larger valuation by market cap? The numbers will be from the previous decade, with 2022 represented by the TTM.

Over the last decade company A has generated $659.18 billion of revenue, $154.64 billion in net income, $254.63 cash from operations, and $114.78 in FCF. Company A has a market cap of $138.95 billion. Company B has generated $126.21 billion of revenue, $36.88 billion of net income, $40.49 billion of cash from operations, and $35.03 billion in FCF. Company B has a market cap of $426.53 billion.

Company A is INTC, and Company B is NVDA. Both are great companies, and while NVDA has generated explosive growth, increasing its annual revenue by 615.28% over the previous decade, its market cap is more than triple INTC’s, yet INTC has generated more in net income over the past decade than NVDA has done in revenue. When I look at these numbers, I don’t see INTC as a company that is fading into the night or a company that can’t turn the ship around. INTC is a cash cow that can make the proper investments to solidify its future, and it has.

Steven Fiorillo, Seeking Alpha

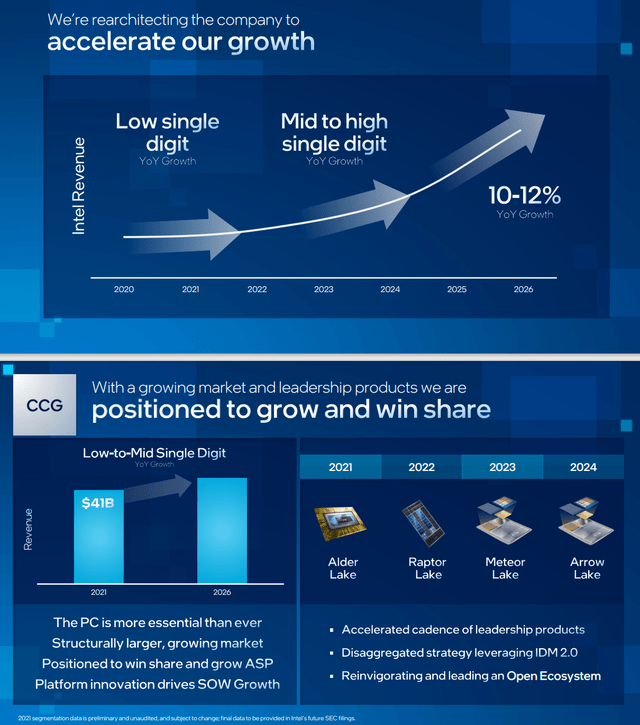

Over the next decade, INTC is making a tremendous capital investment to build several foundries, which will take considerable market share away from Taiwan Semiconductor Manufacturing (TSM). The new INTC foundry business will provide INTC the ability to make chips for other chip companies such as AMD, NVDA, and AAPL. INTC is making a capital investment of $20 billion to build 2 new plants in Arizona. INTC is spending roughly $95 billion over the next decade building 2 new foundries in Europe. INTC is also investing in related manufacturing and research efforts in France, Ireland, Italy, Poland, Belgium, and Spain as part of its EU spending allocation. Pat Gelsinger, INTC CEO believes the automobile TAM (Total Addressable Market) for semiconductors will rise from $50 billion today to $115 billion by 2030. He also expects automotive semiconductor demand to hit 11 percent of the total market by that year. INTC is also investing $20 billion in the construction of two new leading-edge chip factories in Ohio. Over the next decade, INTC will provide critical manufacturing infrastructure for the semiconductor industry and will become a focal point in the global supply chain. AMD and NVDA aren’t making these types of capital investments. On 8/23, INTC announced that Brookfield Infrastructure Partners (BIP) and INTC had signed a deal worth up to $30 billion to help pay for its factory expansion plans. This deal is projected to accelerate INTCs IDM 2.0 strategy and INTC will fund 51% of its previously announced expansion at its Ocotillo campus in Arizona, with BIP paying the remaining 49%. INTC will retain majority ownership and operating control of the factory.

The question I ask myself is should I take what management says at face value when INTC has generated $154.63 billion in net income over the past decade? My answer is yes, and since I am looking at INTC as a 5-10 year investment, the current lows its shares are experiencing could end up being temporary. When I look through the analyst day report, INTC is projecting mid-high single-digit growth in 2023 – 2025, then 10 -12% YoY growth from 2026 forward. INTC is far from a dead company, and nothing about its numbers indicates a desperate situation.

Conclusion

Shares of INTC continue to decline, even though the investment community has been well informed that INTC guided down for Q3. Investors need to decide if INTC is a long-term investment in their portfolio or not. Shares of INTC have declined so much that its dividend yield now exceeds 4%. INTC and AMD have a duopoly in the PC chip market, and this is unlikely to change. INTC is setting the stage for its future and will bring manufacturing plants online in Arizona, Ohio, and Europe over the next several years. This will create an additional revenue segment as they make chips for other companies, give them more control over their destiny within the chip fabrication process, and make INTC a focal point in the global supply chain. You either believe INTC can navigate through the storm, or you don’t. I am willing to average down on my investment, collect the dividends along the way, and wait for INTC’s story to unfold. INTC has generated $154.63 billion in profits over the past decade, and when I look at the numbers, I think INTC is undervalued compared to other chip manufacturers.

Be the first to comment