Justin Sullivan

Dear readers/followers,

It’s time for an update article on Hewlett Packard (NYSE:HPE) at this time. Since my last piece published on the business, HPE has held surprisingly steady in the face of ongoing pressure from the market. The company has, in fact, beat the market which is not something many investors seem to have expected from HPE.

HPE Article (Seeking Alpha)

While somewhat volatile, the company has continued to show operational stability in the face of market instability – and this is a massive advantage in the current volatile market.

Tech and software stocks overall are mostly down. We’re seeing a substantial capital outflow from these investments on a very broad basis as interest rates normalize (Don’t kid yourself that zero percent interest rates were ever going to be a long-term “normal”). So, with that in mind, it’s a good time to position yourself in excellent investments that make for some great upside, even if the market doesn’t go up much more.

So, let’s get going here.

Updating on Hewlett Packard

I’ve spoken about significant tailwinds to HPE as a business. Those tailwinds have continued and continue to this day. This includes the recent set of company results, which we will take a look at in this article and include into our forward calculations.

HPE is only a small part of Hewlett Packard. The company was formed as the larger HP company split up, and what came to be within HPE was servers, storage, networking, containerization, consulting & support, and software. The former Hewlett Packard changed its name to HP Inc and now trades under a different symbol (HPQ). HPQ would retain the personal computers, printing, and stock price history, sticking HPE with its own ticker and its own history.

But in this case, we’re looking at what I view as the more attractive portion of things – HPE – and specifically seven business segments of Compute, High-performance Compute & Mission Critical Systems (“HPC & MCS”), Storage, Advisory, and Professional Services (“A&PS”), Intelligent Edge, Financial Services (“FS”), and Corporate Investments. The company earns more than 10% of its total revenues from Compute Products, Storage Products, and Computer Services.

We’ve seen how the company has been able to showcase impressive operational stability and organic top-line growth during this year. These positive trends continue well into the latest set of results that we’re looking at here.

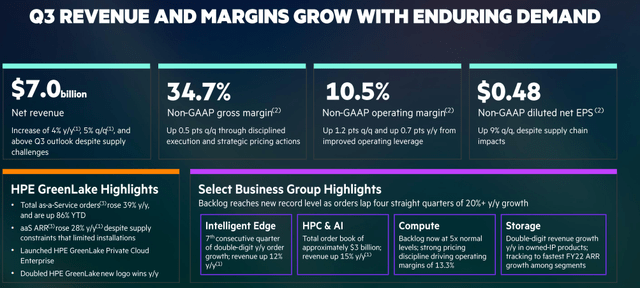

And 3Q22 showed even more growth, on top of 2Q22.

5% sequential revenue increase and above the company’s original forecast/outlook is impressive – but even more impressive is the fact that the company managed its GM’s to be flat, its operating profit to be up 8% YoY and 16% Q-o-Q, and both top and bottom line growth above and beyond what was expected here.

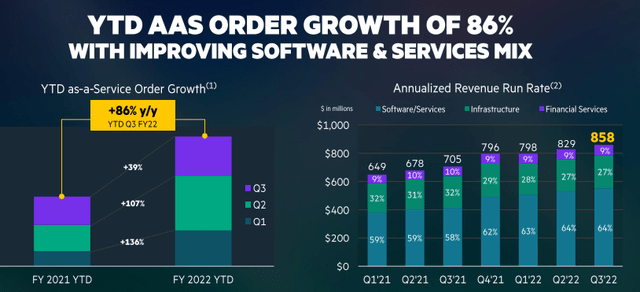

I’ve focused a bit on the service order growth and the trends here – and these positive trends actually continue here, leading to the company affirming the 2024E CAGR of 45% on the top end in the AAS segment.

The company is showcasing EPS growth in an environment where many companies are struggling not to showcase anything but bottom-line declines, from a combination of solid pricing actions and a more service-oriented mix, which is more conducive to a positive margin expansion. The company’s GM’s haven’t dropped below 30% at any time in the last 2-3 years, and their bottom-line operating margin have stayed stable at between 7-11%.

The company manages a superbly differentiated portfolio that’s designed to do one thing – capitalize on high-level and macro-level trends, in things like AI, Computing, Storage, Finservices, and Edge. This is going very well. The only segment that’s showing any sort of “lag” or slowdown is the financial services segment, and even that segment is showing operating margin expansion, and assets up 2% YoY with RoE up to nearly 19.5% which is above pre-pandemic sort of levels.

Key balance sheet metrics are showing continued strength, and far from being indebted, the company has a net cash position of $0.7B. That’s pretty impressive in today’s day and age.

Remember. There’s war in Europe and continued China shutdowns due to COVID-19 – and despite this, revenue and EPS are not only maintained – they’re growing.

Consider what may happen if this wasn’t the case (in terms of headwinds). At the same time, the company managed through very strategic pricing actions, to drive resilient margins, which have continued to remain almost flat despite massive input-related headwinds and global macro downturns.

The operational margins continue to emphasize the company’s focus on growth, and this gives us a significant overall upside.

The company’s diverse portfolio is, as I see it, fully capable of capitalizing on the current global megatrends in cloud data, connectivity, and global storage. Its net revenue hails from computing, AI, Storage, Fintech, and intelligent edge, and the company’s splits are close to a 33/33/33 split between NA/EMEA/APJ (more NA, less APJ).

It’s also a clear shift that organizations may no longer want IT as a tailored solution with products on-site, essentially “purchasing” the products and being left to manage it but would rather purchase IT as a service – again, as we’ve seen the growth in the company’s AAS-specific segments. The company has specifically moved to a portfolio structure that the market, for the time being, seems to want.

Another word on safety before moving on. HPE’s net cash position, in a single quarter, is improved by half a billion dollars. This should give you confidence in the company’s ability to generate impressive earnings over time.

I, therefore, characterize these latest earnings of 3Q22 as very good, and the latest stepping stone in the company’s positive overall trajectory. The market did not like the latest earnings all that much, or at least in conjunction with the earnings, because they’re lowering 2023E adjusted EPS – but the demand for the company’s services nonetheless stays strong. Also, the reason for lower earnings wasn’t because of anything internal – but due to continued FX headwinds.

So, anything seen in the latest quarterly or latest investor presentation that notes challenges, these challenges are to me in no way thesis or upside-breaking.

Let’s look at valuation.

Hewlett Packard Valuation

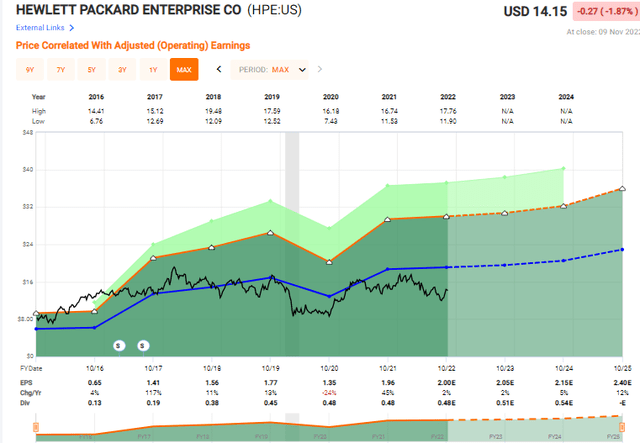

HPE continues to trade at much less than I consider the company to be worth – and even that the market, on average, has considered the company to be valued at. A 7.7x P/E – does that sound reasonable for a BBB rated company with a record of growing EPS at 14% CAGR over the past 6-7 years?

Not really, I would say. While there has been some EPS volatility during COVID-19, the overall picture that I see is still that the company is absolutely solid as a player here, and is very likely to continue to grow as expected.

Overall, the company has delivered superb results once again, expecting to continue to grow earnings during the coming fiscal year.

Take a look at the current trends respective to forecasts and pricing.

HPE Valuation (F.A.S.T graphs)

Now, that’s the sort of picture that can beg the question of what is wrong with a certain company. However, in this case, I don’t see any sort of underlying or undocumented risk that begs your attention or your notice – what risks there are controllable, or as with many companies, outside of their control – such as FX.

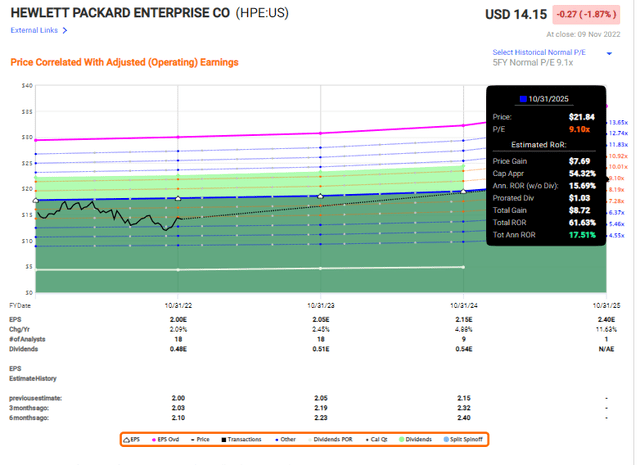

The fact remains, I would never forecast HPE above 9.5x P/E. The company hasn’t shown that it deserves it from the market at this time despite EPS growth, and forward growth is around 5.2% annually, which means we’re forecasting the following sort of trends here.

That, dear readers, is a 17.5% annual conservative upside to a P/E below 10x and even below 9.5x, which yields an extremely well-covered 3.39%, while being BBB rated. It’s not the best opportunity out there in terms of valuation and underlying company quality. But it’s still a superb opportunity in a relatively volatile market.

Even if the company sticks more or less to its current valuation range, that’s still a conservative upside very close to double digits – and these two arguments are part of the basis of why I continue to push money to work in HPE – and why I think you could consider doing the exact same thing.

The yield isn’t market-beating – but at 3.3%+, it doesn’t have to be. The combined potential capital appreciation upside together with that dividend produces enough returns to satisfy even conservative investors – because it’s double digits in a volatile world. What more could you want?

If we look at analyst averages, S&P Global gives the company a $13 low and $21 high. That means the current share price is very close to the lower-end target of the most conservative analyst here. 20 analysts give the company an average of $15.8, which gives us an analyst average upside of 11.2%. 12 of the 20 analysts following the company have it at a “BUY” or “outperform” rating at this time, which is a change-up of 2 from my previous article, even if the base PT has gone down a few dollars.

The company is a BBB-rated IT business with deep roots trading at a P/E of below 9X or an earnings yield of well over 6%. That’s excellent, no matter what way you slice it. Its limited history means that the company won’t go up to 15X or above here, but we can use the relatively well-established discount average to see where the company might go going forward.

HPE has managed a 6-year EPS growth of over 10% and is expected to continue growing at this, 5-8+% CAGR until 2024 – though this does include a 40% EPS bounce back in 2021, followed by 2 years of meager, single-digit growth.

I view any valuation lower than $17.5 for this business as being way too cheap – and I see no reason to give the company anything but a small bump down to account for some of the more direct FX impacts. This means I’m adjusting from $18.5/share to $18/share, which is only a very small change.

I’m still at a “BUY” for HPE, and together with Infineon (OTCQX:IFNNY) and maybe Qualcomm (QCOM), this represents one of the few opportunities in the space that I find even remotely interesting.

Thesis

My thesis for HPE is:

- After a decline, I believe HPE trades at a very attractive overall valuation. My new, improved valuation including the company’s recent outperformance and raised 2022E is now $18/share.

- I consider this company likely to continue to outperform.

- Despite its performance, it’s still below 9X average P/E, which makes it one of the more appealingly valued IT businesses out there at the moment. It’s also one of the very few IT businesses I’ve currently invested in and hold as a “BUY”.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation but hovers within a fair value or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Be the first to comment