junce

When we last covered Intel Corporation (NASDAQ:INTC), we remained rather skeptical that there was a bright future for the once-glorified chipmaker. In our view, the Intel dip buyers were going to get punished and it was too early to get long this company. Specifically, we said:

Yes, we get the idea of buying when things are down, but this is not a time for heroics. You are looking at likely zero profits for INTC and this is being coupled with the most massive capex cycle we have ever seen. Analysts are still hopelessly out of touch and that dividend looks completely unsustainable. At a minimum, consider buying this when the Federal Reserve is at least easing, rather than trying to collapse asset markets to reduce inflation. We think that point is far lower.

Source: “If AMD Is A Harbinger, Prepare For An Unprofitable Year.”

INTC reported Q3-2022, and everyone appeared to breathe a sigh of relief that it actually did beat estimates. But what we saw was quite scary and we go over why that dividend danger has increased.

Q3-2022

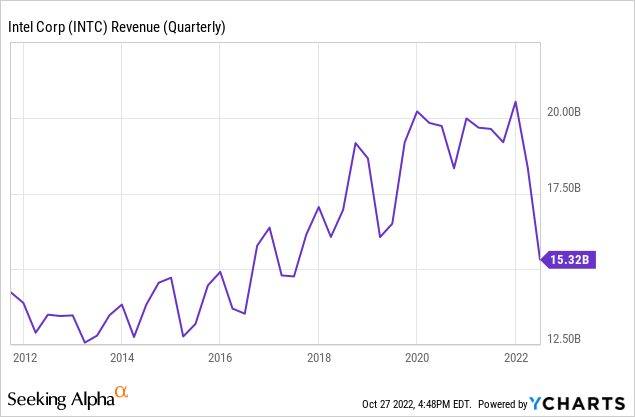

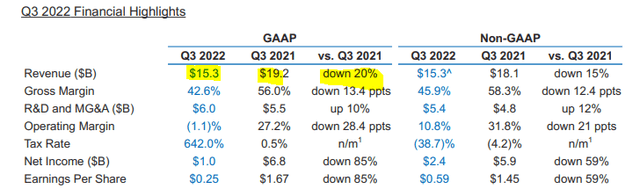

Apparently INTC did manage to telegraph just how bad things were going to get in Q3-2022. That led to a quarter with a 20% revenue decline, creating a cause for celebration.

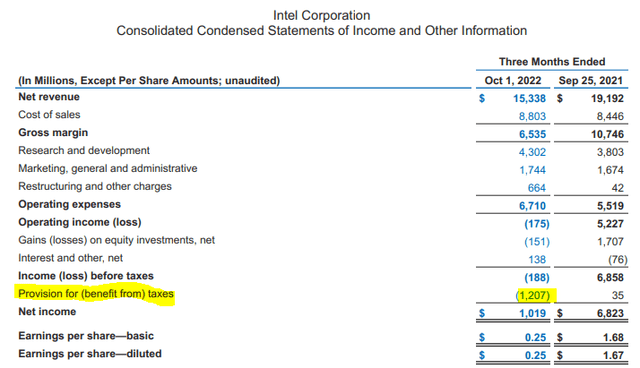

Gross margins were down 13.4% on a GAAP basis and 12.4% on a non-GAAP basis. R&D and MG&A actually went up by 10% and smashed operating margins to negative 1.1%. In a weird upside-down world, this actually created positive earnings per share of 25 cents, as provision for taxes was a large negative number.

Non-GAAP EPS was even higher, at 59 cents.

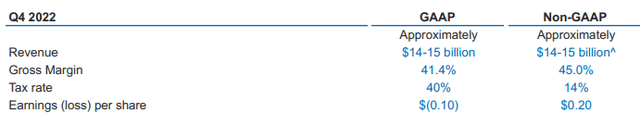

What we want to get across here is that this is not remotely the bottom. INTC lowered its revenue guidance for the year. Non-GAAP revenue is now expected at between $63 billion to $64 billion vs. consensus at $65.35 billion. $14.5 billion is expected for Q4-2022. INTC first hit that revenue number on a quarterly basis in 2011.

Non-GAAP EPS is already at $1.73 for the 9 months, so the whole year estimate of $1.92 has INTC making just 20 cents (rounded) in Q4-2022.

Our Outlook

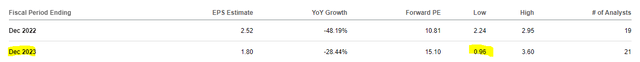

Analysts are still hoping for more than $65 billion next year for sales.

We don’t see the $14 billion quarterly run-rate holding up in a recession so we would go with a sub $56 billion number. On the earnings front, we believe all the analysts are wrong. Even the lowest number of 96 cents looks optimistic.

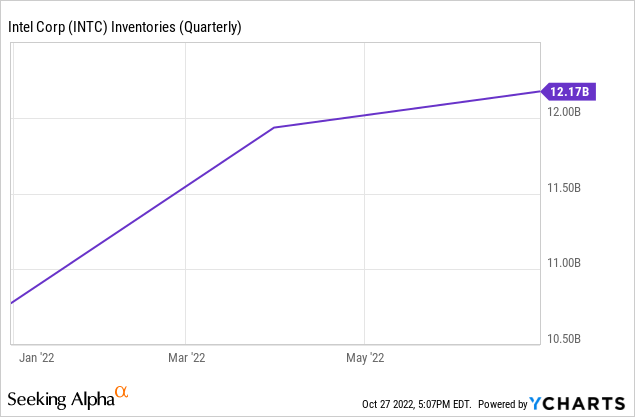

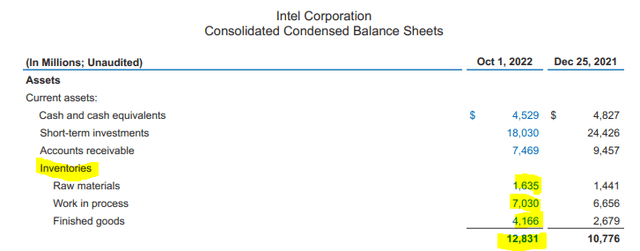

INTC is already guiding for GAAP losses next quarter and in all likelihood as its costs increase, we will see at least 2 out of the next 4 quarters have GAAP losses. The biggest factor that makes us extremely confident is what is happening to INTC’s inventory. We had raised the alarm on these numbers in the last quarter, as INTC’s $12.17 billion in inventories were completely incompatible with a $64 billion revenue run-rate.

In fact, historically, INTC has had about $7.5 billion worth of inventories at these revenue run-rates. Well, guess what happened to that inventory number?

We are now approaching $13.0 billion and are we cannot think of bigger lead balloon for gross margins than this accumulated inventory.

Verdict

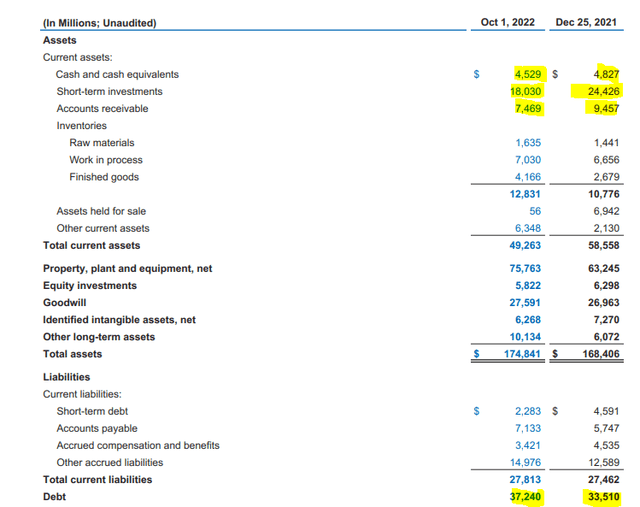

Let’s add it all up. In the last 9 months, INTC has started burning through its investments for its large capex program and its debt has steadily moved up.

To be sure, these are not at dangerous levels, but let’s take another year ahead and this gets more problematic. If you buy into the idea that they will have $0 of GAAP profits, then dividends plus capex should exceed depreciation by about $15-$17 billion. Some might argue that that can be spent just from the cash and investment portion. Possibly. But bear in mind that INTC also carries $27.8 billion of current liabilities. So far, rating agencies are happy to give the benefit of the doubt to INTC and value it on 2026 numbers. That 2026 success story is a long way away, and there are no guarantees that INTC will get there unscathed. The dividend consumes $6 billion annually and it likely has already come up in discussions.

Our take is that the dividend needs to be reduced to give INTC flexibility. This has to happen before the rating agencies have that hard talk, because by then, a lot more damage has been done. The market is celebrating the results (up 7% as we type this), but we see this as an oversold bounce that will fix itself. Mobileye Global Inc. (MBLY) has raised very little cash for the company and won’t change trajectory of things. Look lower for a buy point and be prepared to say farewell to that fat yield.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment