AscentXmedia/iStock via Getty Images

Though not for everybody, spending time in the outdoors can have a positive impact on one’s lifestyle. Naturally, there are a variety of products that have been developed over the years that help to improve the outdoor experience. And those products have been developed by numerous companies, some public and others private. Of the publicly traded players in this market, one that warrants some attention from investors is Clarus Corporation (NASDAQ:CLAR). In recent years, the company has exhibited significant revenue growth and its cash flows have generally improved over time. The downside to this is that the market demands a hefty premium in order to part with shares. But if management can succeed in growing the company at the rate they have forecasted, the stock might be fairly valued or slightly underpriced.

A diverse player in the outdoor space

Clarus operates these days as a ‘global leading designer, developer, manufacturer and distributor’ of outdoor equipment and lifestyle products aimed at both outdoor and consumer enthusiasts. The company has built its business model around identifying and acquiring, and then subsequently growing, what it dubs ‘super fan’ brands in the outdoor space. This has led to a diverse portfolio of product offerings. One example would be Black Diamond Equipment, which acts as a seller of climbing, skiing, and mountain sports equipment that’s based out of Salt Lake City. This falls under the firm’s Outdoor segment which, in 2021, generated 58.8% of the company’s sales and 32.1% of its positive segment operating profits.

The company also has a second segment called Precision Sport that includes two different businesses. One of these is Sierra, which produces bullets and ammunition for both sport and hunting enthusiasts. These products are used for precision target shooting, hunting, and defense purposes. And the brands underneath it include Sierra MatchKing, Sierra GameKing, Sierra BlitzKing, GameChanger, PrairieEnemy, Outdoor Master, and Sport Master. The other brand under the segment is called Barnes, and it focuses on producing all copper bullet technology products. These are technologically advanced lead-free bullets, as well as hunting, self-defense, and tactical ammunition. Brand names under this segment include, but are not limited to, Barnes TSX, X Bullet, Varmint Grenade, and VOR-TX. During the firm’s 2021 fiscal year, this segment accounted for 29.2% of overall revenue and for 67.9% of positive segment operating profits.

In addition to the aforementioned products, the company also operates another segment called Adventure. This is the newest segment the company has added to its portfolio and it includes two main businesses. The first of these is Rhino-Rack, which provides aftermarket automotive roof racks and accessories to its customers. Its accessories include luggage carriers, shade awnings, kayak carriers, bike carriers, and other related offerings. The other business under this segment is MAXTRAX, which produces what the company calls a vehicle recovery board. In the event that a vehicle gets stuck in the mud or in the sand, or in some other similar environmental situation, these boards can be used as a firm foundation for their tires to gain traction in order for the vehicle in question to become dislodged. In 2021, this segment accounted for 12% of sales but generated an operating loss of $2.2 million. Of course, neither of these operations within this segment had a full fiscal year with the company. For instance, Rhino-Rack was acquired in July of 2021, while in early December of last year the company purchased MAXTRAX.

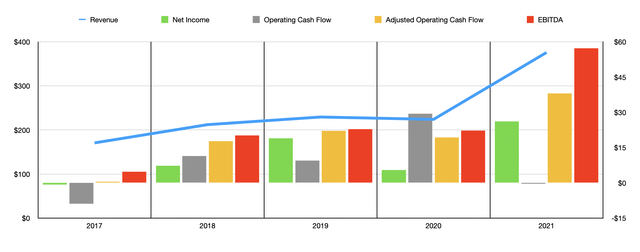

In recent years, acquisitions, combined with organic growth, have had a significant positive impact for shareholders. The company has grown its revenue in most years, increasing sales from $170.7 million in 2017 to $375.8 million last year. It is important to note that if all of its acquisitions had been completed at the start of each fiscal year, sales in 2021 would have been even higher at $441.6 million. Because of this, combined with continued organic growth, management does have high hopes for the business. Excluding other possible acquisitions, the firm expects sales for 2022 to come in at around $470 million.

Author – SEC EDGAR Data

When it comes to profitability, the picture has generally improved over time. In 2017, the company incurred a net loss of $0.7 million. This number improved in most years, eventually climbing to a profit of $26.1 million last year. But once again, had its acquisitions been completed at the beginning of each fiscal year, the net profit for the company in 2021 would have been even more impressive at $46.9 million. Of course, there are other profitability metrics for investors to consider. Operating cash flow, for instance, has been all over the map as the chart above illustrates. But if we adjust for changes in working capital, it would have risen in most years, climbing from just $0.5 million in 2017 to $38.1 million last year. Meanwhile, EBITDA for the business would have grown from $4.8 million to $57.2 million. Management has provided no pro forma financial estimates for these cash flow items. But if we assume that they would have increased by the same percent that profits would have, then adjusted operating cash flow would have been $68.5 million, while EBITDA would have been $102.8 million.

For the 2022 fiscal year, management has provided some guidance. At present, the company anticipates EBITDA coming in at about $78 million. Meanwhile, free cash flow should come in at between $50 million and $60 million. With capital expenditures forecasted at $9 million, the company should see operating cash flow, at the midpoint, of about $64 million in total. The company has not given any guidance when it comes to net profits. But if we assume a similar growth rate for income as what we should see for EBITDA, then investors should anticipate income for the year of about $35.6 million.

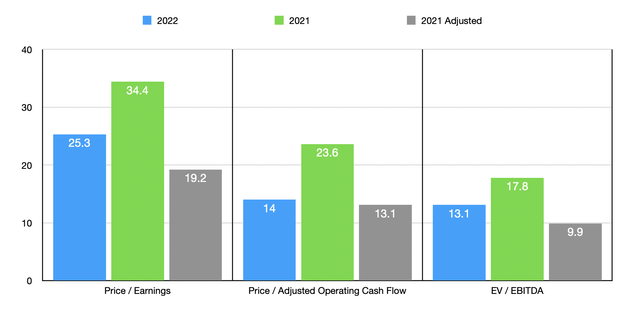

Author – SEC EDGAR Data

Taking all of these figures, we can effectively price the business. Using the firm’s 2021 results, we see that it is trading at a price-to-earnings multiple of 34.4. This drops to 19.2 if we rely on the company’s pro forma calculations for the year. The price to adjusted operating cash flow multiple would be 23.6, with that figure dropping to 13.1 on an adjusted basis. And the EV to EBITDA multiple would be 17.8, with a decline to 9.9 if, again, we rely on my pro forma estimate. Meanwhile, if we rely instead on the company’s 2022 forecasts, as well as my estimate for profits for that year, these multiples would be 25.3, 14, and 13.1, respectively.

To put in perspective how the company is valued today, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 3.3 to a high of 18.2. In all three valuation scenarios that I used for the price-to-earnings multiple of the company, it is the most expensive of the group. I then priced the companies based on the price to operating approach, resulting in a range of 3.5 to 123.8 for four of the five firms. The other one had a negative reading. Of the four, three were cheaper than our prospect in each of the three scenarios. And finally, I looked at the company through the lens of the EV to EBITDA approach, with a range of 1.8 to 11. Using both the 2021 results and 2022 forecast, our prospect was the most expensive of the group. And using the adjusted estimate for 2021, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Clarus Corporation | 19.2 | 13.1 | 9.9 |

| Johnson Outdoors (JOUT) | 11.3 | 123.8 | 5.7 |

| Smith & Wesson Brands (SWBI) | 3.3 | 3.5 | 1.8 |

| AMMO, Inc. (POWW) | 18.2 | N/A | 11.0 |

| MasterCraft Boat Holdings (MCFT) | 8.4 | 10.0 | 5.9 |

| Sturm Ruger & Co. (RGR) | 8.3 | 7.6 | 4.5 |

Takeaway

All things considered, Clarus strikes me as an interesting company that has succeeded in growing at a rapid pace. If management can continue to grow the company as they have, it could very well appreciate considerably. At present, shares are definitely pricey relative to similar firms. But based on the adjusted 2021 results and the forecasted 2022 results, I wouldn’t necessarily say they are overpriced. Given the growth the company has achieved, I would say that they are either fairly valued or slightly underpriced if we assume growth will continue.

Be the first to comment