Pe3check/iStock Editorial via Getty Images

I released an article on Kontoor Brands (NYSE:KTB) in December 2020 and the time has come to revisit the company and its past performance. Especially in times of the hype over cryptocurrencies, EVs, NFTs, metaverse, SaaS, cybersecurity, renewable energy, and other buzzwords which have accompanied investors since the pandemic broke out, the simplicity of the Kontoor Brands business model may be appealing as we enter an uncertain period with a war in the background. The company designs, produces, and distributes apparel and it’s best known for its brands Lee and Wrangler. That would summarize how the enterprise operates. Warren Buffett – one of the fathers of value investing once said:

So I want a simple business, easy to understand, great economics now, honest and able management, and then I can see about in a general way where they will be ten years from now. If I can’t see where they will be ten years from now, I don’t want to buy it. Basically, I don’t want to buy any stock where if they close the stock exchange tomorrow for five years, I won’t be happy owning it.

Kontoor Brands is obviously a simple, easy-to-understand business as described above. Since its spin-off, the management has navigated through a one-in-a-hundred-year event and the company has been delivering solid numbers so far. The company’s leadership has a clear vision which was reiterated in the last 10-K:

We continue to be focused on accelerating revenue generation, expanding margin and generating cash flow to fuel and sustain long-term performance and our competitive advantage around the world. The options in our capital allocation strategy are to (i) pay-down debt; (ii) provide for a superior dividend payout; (iii) effectively manage our share repurchase authorization and (iv) act on strategic investment opportunities that may arise.

This information and a business growth estimate should let investors make a reasonable prediction of where the company will be ten years from now. There are a few details that can be found in the company’s reports that can shed more light on the past performance relative to the goals once set which will make the assessment of the analyzed business even easier.

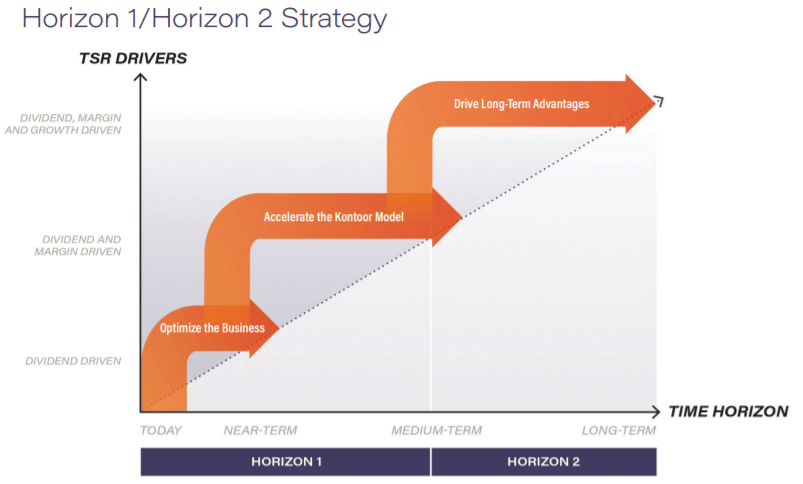

Last spring, the company hosted its first investor day which marked the transition into Horizon 2 growth phase. The strategy was laid out in the Annual Report for FY 2019 and encompassed near, medium, and long-term expectations.

Kontoor Brands’ Strategy (Kontoor Brands)

The progress that was supposed to be achieved in the Horizon 1 phase may be considered a success. Kontoor Brands put emphasis on a steadily growing dividend which was to attract investors. The current yield amounts to 3.73% and with the latest hike, it increases to 3.99%, which is very appealing when compared to the dividend yield offered by the S&P 500, which was at 1.29% as of December 31st, 2021. According to the plans contained within the Horizon 1 phase, the company’s other main goal was to improve margins, which will be given a closer look in the next paragraphs. Regarding business optimization, the company launched initiatives to improve operational performance, made numerous transitions within its business, exited certain stores, and focused on optimizing sales. Taking all that into consideration, it’s time to see how it translated into business financials.

Fundamentals

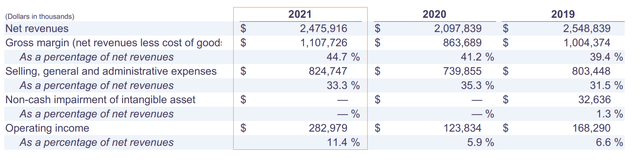

Kontoor Brands has recently released its financials for the FY 2021 and investors got an overview of the performance in the last three years since the company’s IPO. As already mentioned, the management focuses on margins, which considerably improved even compared to the pre-COVID year.

Financials for the last three years (Kontoor Brands)

Gross margins saw an increase of more than 500 basis points compared to 2019 and the profit margin exceeded the 10% mark for the first time since going public.

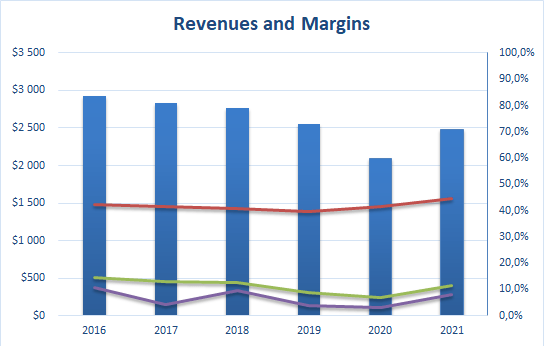

Revenues and Margins (Author’s Calculation)

There is still no clear revenue trend, especially when considering the years following the company’s IPO. Nevertheless, the margins are distinctly improving, which is in line with the management’s long-term goals.

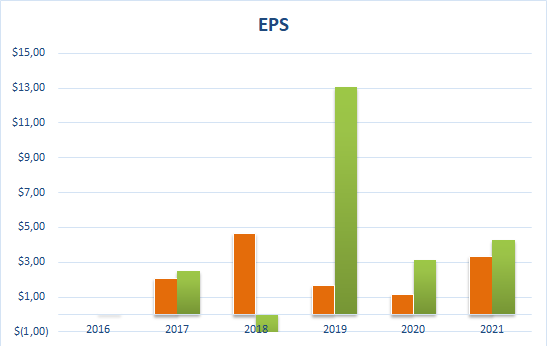

EPS (Author’s Calculation)

Due to the growing net income and stock buybacks, Kontoor Brands’ EPS and Free Cash Flow per share both show stellar growth. In the fiscal year 2021, the company purchased 1.4 million shares of its common stock for $75.5 million. In the fourth quarter alone, almost 1.2 million shares were bought back. On one hand, it’s a sign of financial strength. On the other hand, it would be probably better if the management waited for a better price. They arguably overpaid, since the average purchase price was $54.87.

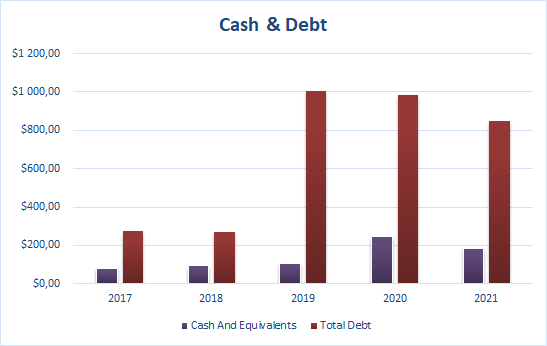

One of the arguments mentioned in the previous article against the business was its debt which at that time seemed to be getting out of control. Although the debt levels decreased, the cash position on the company’s balance sheet deteriorated as well. When compared to the last assessment from over a year ago, the Cash-to-Debt ratio sank from 0.26 to 0.22.

Cash and Debt (Author’s Calculation)

In 2021, Kontoor Brands reduced its debt by $123 million and finished the fiscal year with $606 million in net debt, significantly lower from $922 after the spin-off. The whole team is devoted to debt management, which should be a positive sign for shareholders. The company’s CFO Rustin Welton addressed it in one of the recent interviews when discussing debt management. He pointed out that teams’ efforts revolve around an efficient cash conversion cycle, by turning over inventory or collecting payments in the possibly quickest manner in order to release funds that can be utilized to pay down debt. “Cash has been, and always will be, frankly, a key focal point for us,” he added.

He also elaborated on the importance of cash and ways to improve cash generation which in result creates more shareholder value either through debt paydown, dividends, or mergers and acquisitions (M&A). Mr. Welton adds that the company focuses on a cash conversion cycle which involves special care of inventory, accounts receivable, and accounts payable as the biggest pieces of the working capital. Focus laid on these elements has shown excellent results.

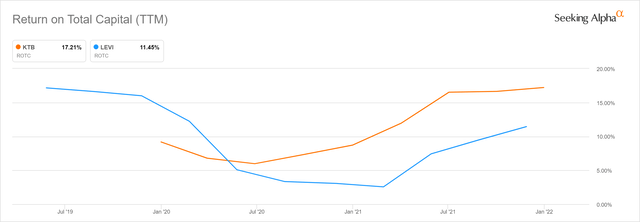

Return on Total Capital (Kontoor Brands vs. Levi’s) (Seeking Alpha)

Return on total capital experienced significant growth. Kontoor Brands was contrasted in the graph above with another leading denim manufacturer – Levi’s (LEVI) – and one can see a strong rebound from the pandemic low with a major acceleration when compared to the competitor. What high return on invested capital means in the long term was well summed up by the billionaire value investor, the Vice-Chairman of Berkshire Hathaway (BRK.A) – Charlie Munger in his speech “A Lesson on Elementary, Worldly Wisdom As It Relates to Investment Management & Business.”

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.

If Kontoor Brands keeps on focusing on cash, debt, and its cash conversion cycle, investors might expect to be richly rewarded.

Risks

Even though the business model is simple, financial results are promising and the brand is recognized around the globe, there are certain risks that can adversely affect the company. One of the important ones is a high reliance on cotton which is a commodity having the disadvantage of strong price fluctuations. Other commodities such as blends, synthetics, and wools are also used in the manufacturing process and carry similar risks. However, cotton accounts for roughly 20% of the cost of a pair of jeans, so it’s a significant portion that may get influenced. It’s worth noting that current cotton prices are the highest since the peak in 2011. With inflation at the highest levels in forty years, it’s a matter of time before the product prices will mirror the characteristics of the current rough environment. In such circumstances, pricing power is detrimental to business health. Warren Buffett once described it as the ability to increase prices without negative effects on the business.

If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.

However, assuming that rising cotton prices will affect all textile businesses as well as elevated inflation, there shouldn’t be any major customer outflow.

Another risk that might be disturbing for conservative investors and concerns the American market is the high dependability on wholesale customers, specifically Walmart (WMT). The company reports that

… sales to Walmart as a percentage of total revenues were approximately 34% in 2021, 38% in 2020 and 34% in 2019.

This is a huge piece of sales generated from one customer. No matter how well the partnership has been and for how long, it’s still over a third of revenues in the USA that might be quickly hit if the collaboration between the two parties worsens. It’s important to keep it in mind when investing in Kontoor Brands.

Valuation

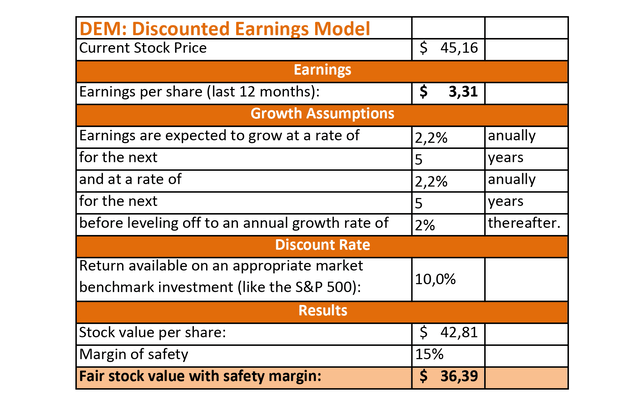

For the purpose of the valuation, earnings growth for the next 10 years was estimated at 2.2% and 2.0% afterward. The margin of safety used in the calculation amounts to 15%. The discount rate is 10% which corresponds with the average annual returns of the market over a long period of time.

Discounted Earnings Model (Author’s Calculation)

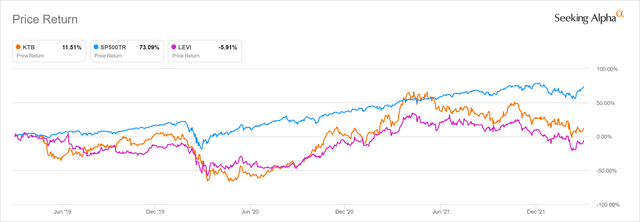

Having applied the values to the discounted earnings model, a fair value of the Kontoor Brands stock is $36.39, which is 19.4% below the current price of $45.16 as of writing the article. Since IPO, the stock appreciated by 11.51% without including dividends, which is not an outstanding performance, especially when considering the gains of the S&P 500 amounting to 73.09% for the same period of time. However, Kontoor Brands has performed better than Levi’s. As stated in the previous article, it’s crucial to enter at the right moment when investing in a business like Kontoor Brands which is characterized by slow growth and low volatility.

Price Return (KTB, LEVI, S&P 500) (Seeking Alpha)

Conclusion

Owning Kontoor Brands gives a shareholder cash flow in the form of quarterly dividends, relatively low price volatility, and stability from the business perspective. The company’s progress is predictable and doesn’t demand constant supervision from the investor. An entry point is very important due to the slow-growing nature of the business in order to achieve returns better than the broad market. Besides that, the business might be an interesting choice for those who get closer to their retirement and apart from dividends appreciate low volatility. The market prices Kontoor Brands above its intrinsic value; that’s why patience is advised.

Be the first to comment