gorodenkoff

To be truly radical is to make hope possible rather than despair convincing“― Raymond Williams

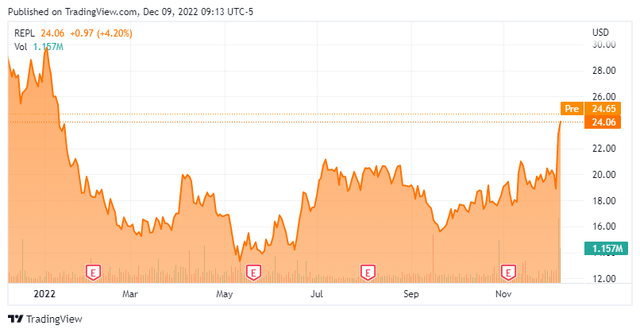

Replimune Group, Inc. (NASDAQ:REPL) was up nicely in trading yesterday on a new positive development. Given, we have not touched on this name since this article in October of last year; it seems a good time to revisit this intriguing developmental name. An analysis follows below.

Company Overview:

Replimune is a clinical stage developmental firm based just outside of Boston. The company is focused on using its proprietary Immunotherapy platform to design and develop product candidates that are intended to activate the immune system against cancer. The stock currently trades just above $24.00 a share and sports an approximate market capitalization of $1.2 billion.

Company Presentation

Replimune’s focus is to render all solid tumor types (hot and cold) susceptible to checkpoint inhibitors by introducing an engineered and armed strain of herpes simplex virus 1 (HSV-1) into the tumor. Replimune’s pipeline candidates are encoded with therapeutic genes designed to aid in the tumor destruction process. These “off-the-shelf” therapies are relatively inexpensive to manufacture and easy to deliver. Replimune has a 63,000 square foot state-of-the-art facility to produce these therapies.

The company has several candidates in its pipeline

RPI

This candidate is designed to induce both direct tumor-cell destruction and immune response and is currently undergoing evaluation as both a monotherapy and in combination with anti-PD-1 therapies. As can be seen in this pipeline chart, RPI is currently being evaluated in several ongoing studies. The most advance of which is called “CERPASS.” This is a randomized Phase 2 registration directed clinical trial. This study will compare the effects of cemiplimab alone versus a combination of cemiplimab and RP1. Researchers will study the effectiveness of these treatments against tumors and how long the effect lasts for. Cemiplimab is also known by the brand name Libtayo, which is a monoclonal antibody medication for the treatment of squamous cell skin cancer. Primary analysis of this study should be available sometime in the first half of 2023.

Replimune also has a trial called “IGNYTE” ongoing with RP1 in combination with Opdivo. This 125 patient registration intended study to evaluate this combination to treat anti-PD1 failed cutaneous melanoma and has seen a 36% overall response rate or ORR in a 75 patient cohort with a complete response or CR rate of 20%. This is consistent with prior data in 16 anti-PD1 failed melanoma patients in the phase 2 melanoma cohort. There was a particularly high ORR (50%) and CR rate (30%) in patients who progressed while on prior adjuvant anti-PD1 therapy. According to management this data to this point “Supports a potential sizeable commercial opportunity to address the complete range of anti-PD1 failed melanoma patients regardless of tumor burden, setting, stage, line of treatment, resistance profile, or prior treatments.” Approximately 7,200 Americans and 62,000 worldwide die annually from metastatic melanoma.

RP2

This compound is targeting less immunologically responsive tumor types and currently in mid-stage development as combination therapy with Opdivo for solid tumors.

RP3

This candidate additionally expresses a pair of immune costimulatory pathway activating ligands, CD40L and 4-1BBL, to further increase the potency of the immune responses to treat immunologically ‘cold’ tumors. It is in early stage development as a potential treatment for various incidences of sarcoma.

Recent Developments:

Earlier this week, the company announced a new collaboration deal with drug giant Roche (OTCQX:RHHBY) to study combination therapies for colorectal cancer [CRC] and hepatocellular carcinoma [HCC]. The studies will be designed to study Replimune’s therapeutic candidates RP2 and RP3 in combination with Roche’s FDA-approved cancer therapies atezolizumab and bevacizumab. Roche will run the studies and the companies will splits the costs of the trial efforts.

Analyst Commentary & Balance Sheet:

Since November, five analyst firms including JPMorgan and Jefferies have reiterated Buy/Overweight ratings on REPL. These include three this week. Price targets range from $34 to $49 a share.

Several insiders sold just over $2 million worth of shares collectively in the first half of this year. However, there has been no insider activity in the stock since mid-May. Just over five percent of the outstanding float is currently sold short.

The company ended the third quarter with just over $370 million worth of cash and marketable securities on its balance sheet. During the quarter, Replimune completed a $200 million non-dilutive debt financing with Hercules Capital, Inc. that extended the company’s cash runway into 2025. Replimune also took advantage of the runup in its stock this week to announce a secondary offering of pre-funded warrants to purchase 4.2 million shares of its common stock at a purchase price of $23.4999/pre-funded warrant. This should take all funding needs off the table for the foreseeable future.

Verdict:

Replimune has seen significant positive news flow this week. Funding needs look completely addressed, and picking up Roche as a development partner for RP2 and RP3 was a nice win. One of the hard parts of evaluating Replimune is there are no quarterly conference call transcripts to analyze. This makes putting exact timelines around developmental efforts somewhat difficult.

That said, Replimune Group, Inc. seems to be making significant progress moving its pipeline forward and is seeing positive analyst commentary. The company is developing treatments that could eventually be a cornerstone in immuno-oncology with three wholly owned compounds. That said, Replimune Group, Inc. management does not expect any significant revenue until at least 2025. I would not be chasing this big rally this week, but Replimune Group still merits a small holding within a well-diversified biotech portfolio given the potential and progress of its pipeline.

Think big thoughts but relish small pleasures.“― H. Jackson Brown Jr

Be the first to comment