Justin Sullivan

Thesis

Visa Inc. (NYSE:V) stock has staged a remarkable recovery from its October lows, as the market forced weak holders to capitulate astutely.

Accordingly, it gained more than 25% from its October bottom (pre-Q4 earnings) toward its December highs before sellers returned to stanch further upside. Relative to V’s 5Y and 10Y total return CAGR of 14% and 19.6%, we believe it’s reasonable for buyers to pause for now.

The market has correctly anticipated solid FQ4’22 earnings from the leading global payments technology company. Its cross-border volume has continued to underpin its recovery. In addition, the company has continued to broaden its growth drivers through Visa Direct, expanding its TAM with real-time payment across consumers, businesses, and governments.

Coupled with its highly profitable operating model, V’s competitive moat has demonstrated incredible resilience in 2022, outperforming the S&P 500 (SPX) (SP500) YTD.

We believe the company’s growth drivers remain intact, even though it trades at a significant premium against its peers’ median and SPX. However, the market appeared to have de-rated V’s valuation after its surge from the COVID lows.

Still, the market also appears ready to support V’s long-term uptrend, which has been tremendously resilient through this year’s bear market. As a result, we assess that long-term buyers remain confident of Visa’s execution, despite some expected moderation in its growth cadence moving ahead.

Given the sharp recovery of its cross-border business in 2022, we expect some normalization is warranted, as it outperformed its pre-pandemic volume. Also, with a potential recession over the horizon, it remains to be seen whether we could see a further impact on consumer discretionary spending. But, Visa’s omnichannel global network has been much more resilient and robust than its e-commerce-focused payment peers such as PayPal (PYPL).

With V’s price action suggesting near-term caution, we think a pullback looks likely, which should also improve the reward/risk for investors waiting to add more exposure.

Revising from Buy to Hold for now.

Visa: Cross-Border Growth Is Expected To Moderate

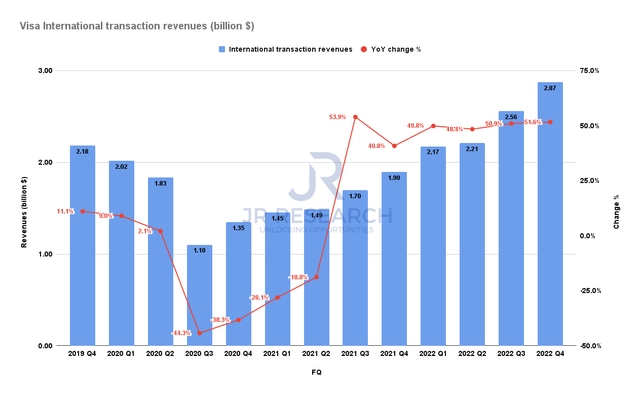

Visa International transaction revenues (Company filings)

As seen above, Visa’s international transaction revenue has recovered its pre-pandemic FQ4’19 levels in its recently concluded quarter. However, its recent performance also came off a much lower base in FQ4’21.

As such, we believe it’s reasonable to expect Visa’s cross-border-driven growth to slow down in FY23 as its growth normalizes.

Furthermore, the global recessionary headwinds could intensify, given the most recent IMF forecasts highlighting tepid global growth.

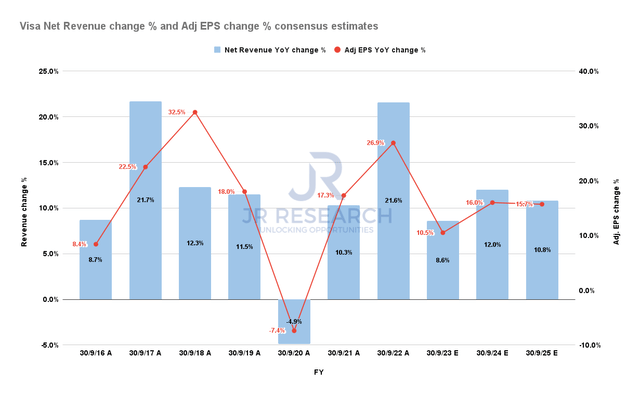

Visa Net revenues change % and Adj. EPS change % consensus estimates (S&P Cap IQ)

Therefore, we assess that the consensus estimates seem credible, as they modeled Visa’s net revenues growth to moderate in FY23, impacting its operating leverage gains.

It’s also consistent with the company’s more conservative outlook, as highlighted by CFO Vasant Prabhu in a recent conference:

We did set ourselves up to be prepared if there is a recession. And our revenue growth actually might accelerate if there’s no recession because we don’t have the Russia comparisons. So unless you’re in the camp that says the dollar is going to get even stronger as we go through the year, the comparisons to last year and the exchange rate drag become smaller. And so without us doing much, our revenue growth actually begins to look better. (Credit Suisse 26th Annual Technology Conference)

As such, we believe the company’s more cautious outlook has likely been contemplated in the Street’s modeling and also in its valuation. Therefore, the potential for upside earnings surprises is possible if the Fed turns out to be less hawkish than anticipated through 2023.

Is V Stock A Buy, Sell, Or Hold?

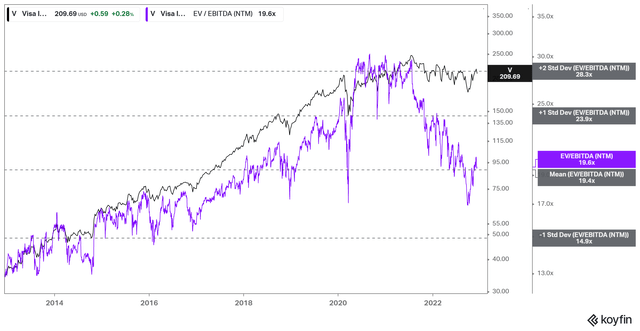

V NTM EBITDA multiples valuation trend (koyfin)

V’s NTM EBITDA multiples last traded close to its 10Y average. Also, the panic selling that sent V to its October bottom was rejected decisively as V’s valuation neared its pandemic lows then.

Hence, we believe the worst of V’s headwinds has likely been priced in unless the market anticipates a significant recession (which is not our base case).

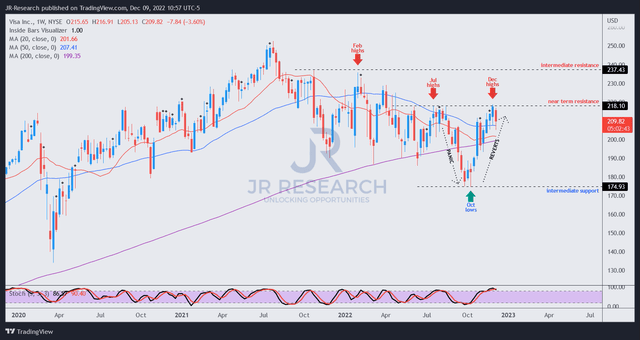

V price chart (weekly) (TradingView)

As such, we believe V’s long-term uptrend should remain robustly supported above its 200-week moving average (purple line).

However, with the sharp reversal from its October lows, we assess that V has reached overbought levels, coupled with price action facing selling pressure.

Hence, V’s near-term upside has likely been reflected, with a potential pullback to digest its recent surge constructive in improving the reward/risk for investors.

Revising from Buy to Hold for now, as we anticipate a pullback.

Be the first to comment