CHUNYIP WONG/E+ via Getty Images

Alico Inc. (NASDAQ:ALCO) is one of the largest citrus producers in the United States while also managing an extensive portfolio of land holdings in Florida. Playing a critical role in the orange juice supply chain, the attraction here is the strong consumer demand and higher market pricing driving positive financial trends for the company. Indeed, shares of ALCO have been a winner over the past year, climbing 25% which also reflects an appreciation of the company’s real estate assets. We are bullish on ALCO which we believe remains undervalued considering the exposure to climbing agricultural prices while offering an attractive 5.3% dividend yield.

ALCO Key Metrics

The first point to make is that orange juice futures prices have been strong currently at 156.50 “cents per pound” of frozen concentrate, up 43% over the past year. Beyond strong consumption demand at retail, lower production globally going from pandemic disruptions since 2020 along with weather-related harvest issues more recently has contributed to a higher price for citrus fruit.

While Alico technically only deals with fresh not-from-concentrate supplies of oranges, the commodity benchmarks are typically connected. The trend follows the global theme of food inflation that we expect to continue. The point here is to say that business has been good for Alico Citrus in a hot market segment.

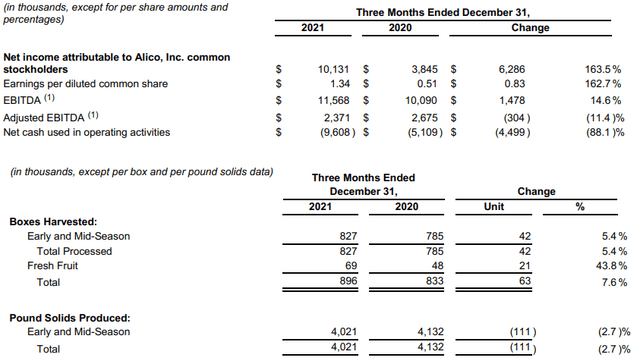

The company last reported its quarterly results for the period ending December 31st, back in early February. A 15% y/y climb in the reference price of “Valencia Oranges” balanced a 2.7% decline in solid pounds produced. The company was able to generate an EBITDA of $11.6 million, up 15% year over year. EPS in the period at $1.34 climbed from $0.51 in the period last year.

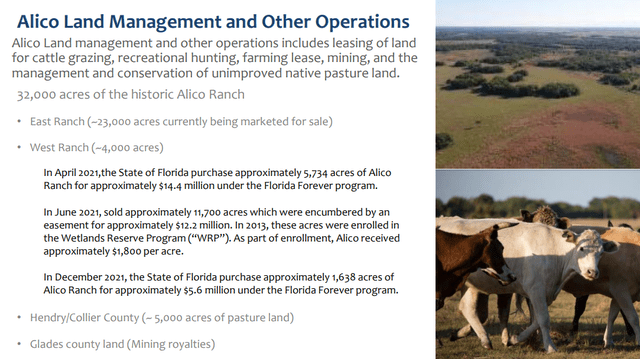

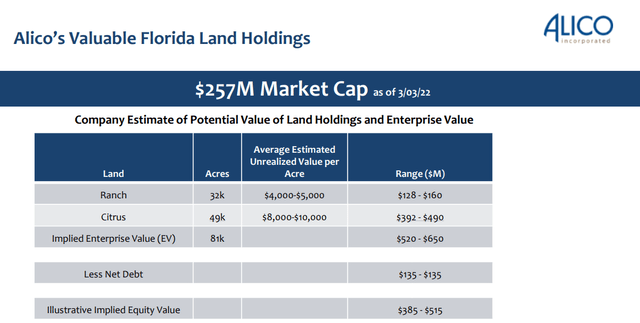

The other important dynamic here is that Alico has been actively managing its land portfolio with opportunistic sales. During the quarter, the company gained about $8.4 million from the sale of approximately 1,900 acres of the “Alico Ranch” property to several third parties. In total, Alico still owns over 81,000 acres including 32,000 acres undeveloped within “Alico Ranch”, along with its active citrus growing operation. The company also looks for new strategic purchases of orange groves to expand capacity.

For the year ahead, one of the near-term challenges is a poor 2022 harvest season forecast based on some late winter below freezing weather that limited yields. The result is an expectation for an 11% decrease in annual orange box production by volume against what was a stronger 2021. This compares to a USDA forecast for the total citrus crop from the State of Florida to decline by 22% for the 2021/22 harvest season. There is a thought that this should be balanced by higher market pricing. Efforts to plant new orange trees in recent years which take about 4 years to reach maturity support an expectation of higher output down the line.

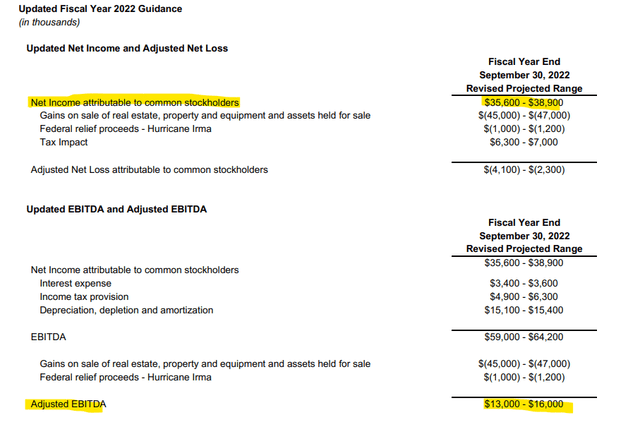

In terms of guidance, Alico expects to reach a net income between $35.6 million and $38.9 million, which represents an increase of 7% at the midpoint compared to fiscal 2021. Making adjustments for expected real estate and property sale gains, the company is guiding for fiscal 2022 adjusted EBITDA between $13.0 and $16.0 million.

Is ALCO a Good Dividend Stock?

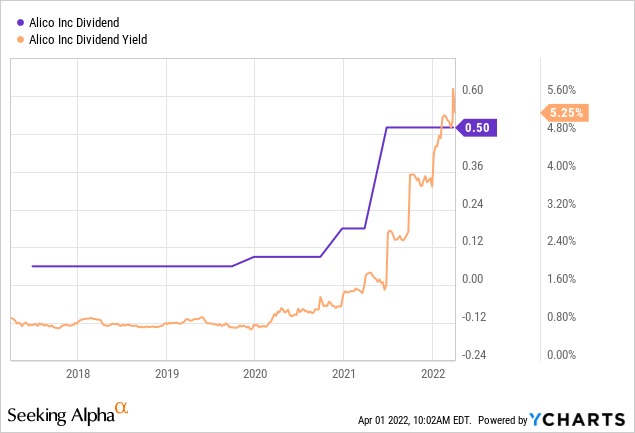

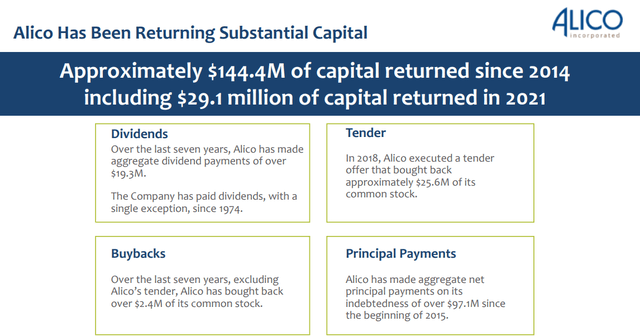

Alico’s unique business model has provided some flexibility to manage a generous capital distribution policy. In 2021 the company hiked its quarterly dividend rate by 178% to $0.50 per share from a prior amount of $0.18. The current annualized payout yields 5.3% and represents a distribution of $15.0 million, or approximately 40% of its 2022 net income guidance.

We believe the dividend is well supported by underlying cash flows and the solid balance sheet position. On this point, the company ended the last quarter with $42.7 million in working capital again $134 million in long-term debt. A debt to equity ratio of 0.53x highlights an overall solid financial position as a strong point in the company’s investment profile.

ALCO Stock Price Forecast

Shares of ALCO have gained momentum and are approaching the highest level for the stock going back to levels from 2019. The company benefits from the strong orange juice market pricing and the broader positive sentiment toward food names and agriculture. We believe the next move is higher.

There is a sense that the company is simply undervalued relative to its land assets. Compared to the stock’s current market cap of $270 million, management highlights the potential value of its ranch and citrus properties holdings at between $385 million and $515 million as an implied equity value. This estimate considers the 81k total acres with a range of estimated values on the open market. In other words, shares of ALCO are priced at a discount to NAV between 30% and 50%. Recognizing the current strength in real estate prices recently, there’s a case to be made that these estimates are conservative.

Is ALCO a Buy, Sell, or Hold?

Putting it all together, ALCO works as an alternative investment within the public equity market. There is a defensive component being the exposure to orange juice as a consumer staple while the land portfolio benefits from inflationary trends. It’s the type of stock we believe can work in different market conditions.

We rate ALCO as a buy with a price target for the year ahead at $45.00 which is based on a view that the dividend yield has room to narrow towards 4.5%. Our price target also implies a 23.5x multiple on the current consensus 2022 EPS.

In terms of risks, the company will remain exposed to broader macro conditions. Sharply lower orange juice prices or a deteriorating outlook of the U.S. growth environment would likely force a reassessment of the earnings outlook. The harvest level and production volumes are key monitoring points.

Be the first to comment