Couple Celebrates The Fact That They Did Hear About Mortgage REITs Till Today

IURII KRASILNIKOV/iStock via Getty Images

When we last covered AGNC Investment Corporation (NASDAQ:AGNC), we looked at the relative changes in the common equity thickness over time. We felt that this change was an important barometer of the relative safety of the preferred shares. With Q3-2022 results out, we got to see exactly how AGNC protected that equity thickness.

Q3-2022

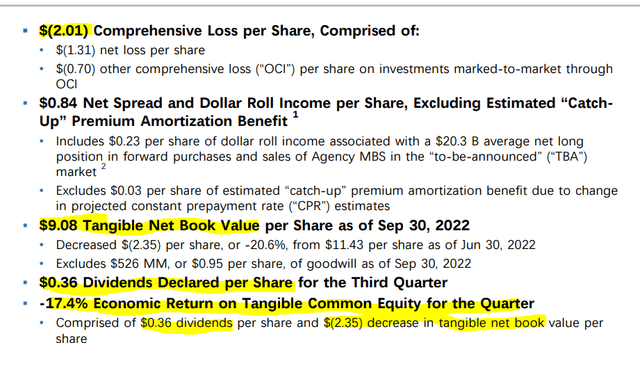

In many ways, Q3-2022 was one of the worst quarters we have seen for AGNC. That is saying a lot with COVID-19 still fresh in people’s memories. The REIT is straightforward about is results and did not pull any punches. There was no talk about “you guys are still getting your income”. Instead, it was to the point about a $2.01 comprehensive loss per share.

AGNC Q3 Presentation

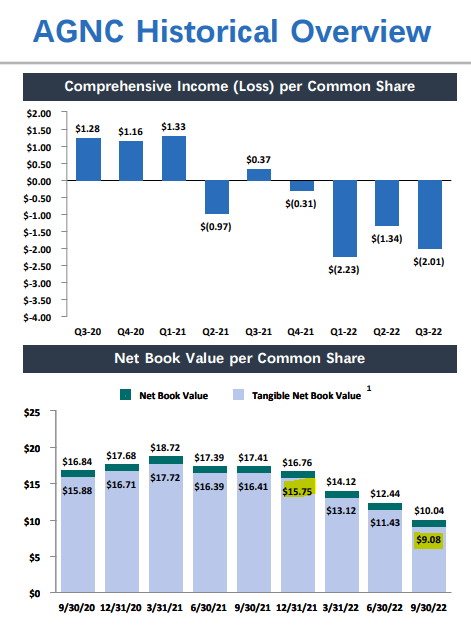

AGNC also said that economic return on tangible common equity was negative 17.4% or close to negative 70% annualized. The last three quarters have also seen massive book value erosion and tangible book value per share is down from $15.75 to $9.08.

AGNC Q3 Presentation

This is of course the most important metric in the case of mortgage REITs. If they had $0 tangible equity they would be able to produce $0 of income for investors. Price, tangible book value and dividends are linked at the hip as you can see from the chart showing trailing 12-month dividends.

One quick note here is that Y-Charts has not been updated for Q3-2022 values. When that happens, the orange line will once again be amongst its brethren.

Outlook

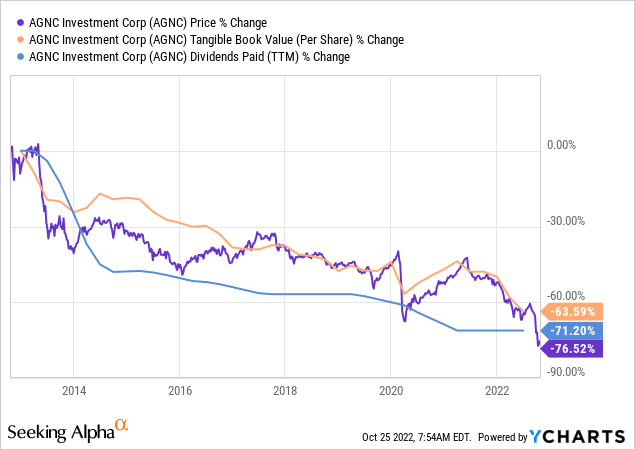

One problem with investing in mortgage REITs, is that their massive leverage forces selling and margin calls when things turn south. So, we were surprised to see that AGNC actually maintained its total assets held during this quarter.

AGNC Q3 Presentation

Of course, that came with the pesky side effect that its leverage ratios which were trending down, actually spiked back up to highs. 8.7X is exceptionally dangerous when bond yields moving around with such pace, but perhaps it works in their favor if things reverse.

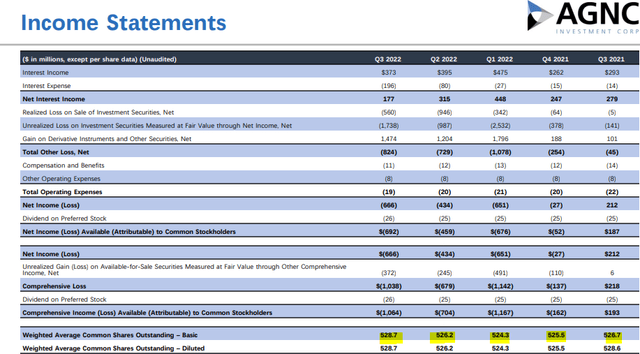

The interesting aspect of that 8.7X number is that it is measured at quarter end and AGNC was certainly very active in the quarter from an issuance standpoint.

AGNC Q3 Presentation

The preferred offering was the AGNC Investment Corp. 7.75% DP PFD G (NASDAQ:AGNCL). The common equity size and price were quite a surprise. AGNC’s average share count has not budged much in the last few quarters.

AGNC Q3 Presentation

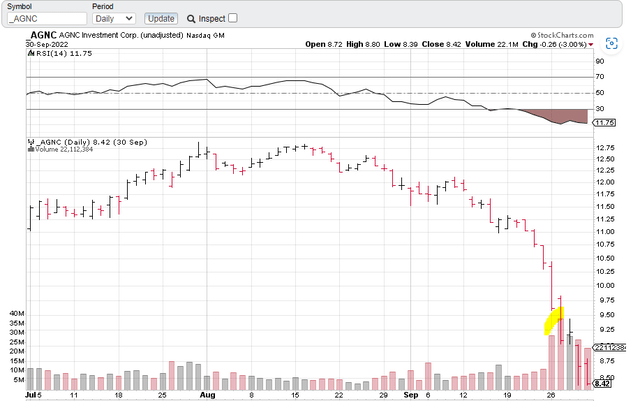

In fact, even in this quarter, the weighted average barely moved. This makes sense when you look at the price at which the shares were issued. AGNC did not come close to that $10.10 price till extremely late in the quarter. It traded at or below that level on just six trading days.

Stock charts

Based on volume and price we think the share offering via ATM, likely came on the highlighted two days. This is the irony of investing in this space. Mortgage REITs will happily issue stock when the shares are trading at a big premium to the tangible book value on that day. This is because it is accretive to book value. From an investor standpoint, the best time to issue equity is at the highest possible price, which would near $16.00, if we are looking at the last 12 months. If you got $6 extra per share, your tangible book value per share would be about 30 cents higher per share (28.6 million shares X $6/556 million shares outstanding).

AGNC still retains a lot of leverage to movements in the price of mortgage-backed securities. So suggesting with 100% clarity where this goes, is not a mortal endeavor. All we can say is that if the current pricing trends on mortgage-backed securities persist, you can look at that 28.6 million stock offering as just an appetizer.

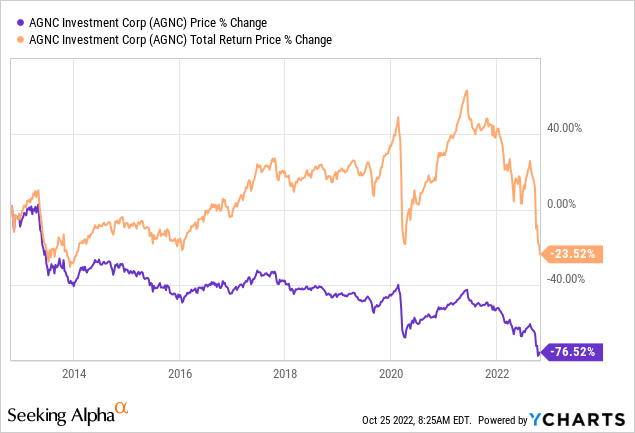

AGNC’s total return profile over the last decade shows all that can go wrong with excessively leveraged assets, even with one of the best management teams.

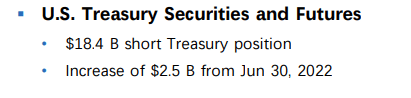

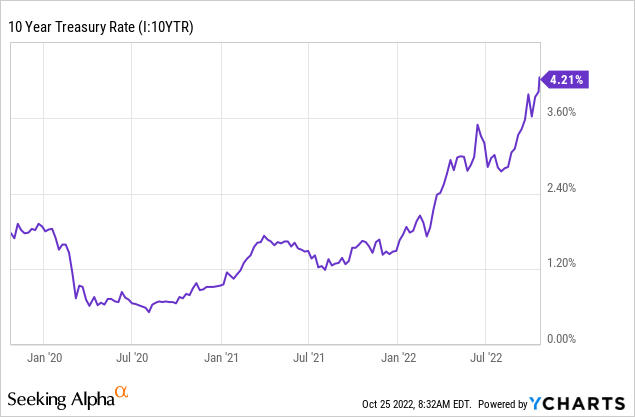

After that epic collapse on the right side of the chart, we would be on the lookout for a rebound rally that resets sentiment. This is all the more likely if the Federal Reserve pauses or abandons its quantitative tightening measures. Longer term, it is very hard to get bullish the common shares. The spread collapse and collapse in tangible equity means that AGNC will have a very different host of issues to deal with in 2023. One of AGNC’s hedges is a short position on the 10-year Treasury.

AGNC Q3 Presentation

These short positions had an interest cost of less than 1% in 2020. Today they cost well in excess of 4%.

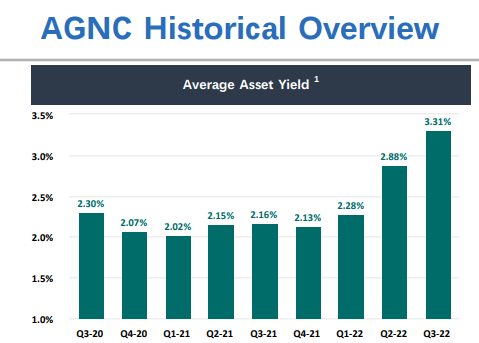

For comparison, here is AGNC’s average asset yield.

AGNC Q3 Presentation

There are a lot of other hedges in place including those protecting shorter term funding costs, and that is the reason that spread income is holding up. But when total costs including hedges are taken into account, we think 2023 will be very difficult.

Preferred Shares

Besides AGNCL mentioned above, AGNC has four more classes of preferred shares.

- AGNC Investment Corp. 6.12 DP SH PFD F (NASDAQ:NASDAQ:AGNCP)

- AGNC Investment Corp. 6.5% DP SH PFD E (NASDAQ:NASDAQ:AGNCO)

- AGNC Investment Corp. 6.875 DEP REP D (NASDAQ:NASDAQ:AGNCM)

- AGNC Investment Corp. CUM 1/1000 7% C (AGNCN).

The good news here is that the $300 million common equity issuance increased the buffer for these. The bad news is that the buffer is still so thin for us, that we would not even care to venture here. Common equity market capitalization is about $4.3 billion and preferred share market capitalization is about $1.69 billion. With $55 billion of assets in play at AGNC, we are happy to choose lower yielding alternatives with a lower risk profile.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment