Jeff Spicer/Getty Images Entertainment

Introduction

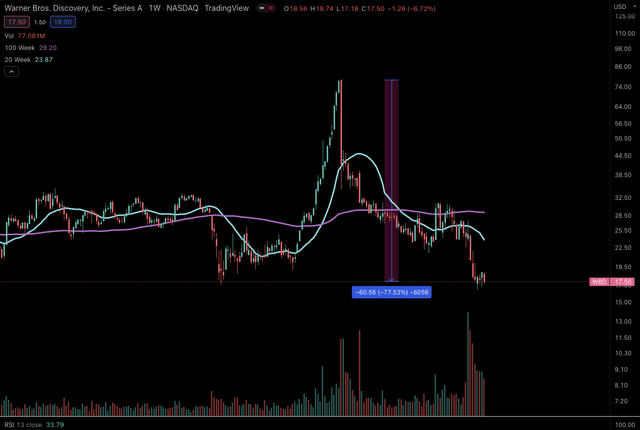

WBD (NASDAQ:WBD) currently trades at $17.50, down 77% off its local highs in March 2021. The stock’s downtrend was first triggered by the collapse of Archegos Capital Management, and recent selling pressure from dividend seeking AT&T (NYSE:T) shareholders has further exacerbated this decline. Additionally, negative spillover sentiment towards streaming stocks in general as a function of Netflix’s (NASDAQ:NFLX) disappointing earnings also contributed to the unjust selloff in WBD. Today, WBD’s market capitalization stands at only $43B. In comparison, its peers have the following market caps:

Clearly, the above-mentioned negative catalysts have nothing to do with the fundamentals of the business. In fact, shareholders will only get more clarity of the new combined company (post merger between Discovery and WB, the latter of which was spun-off by AT&T) in the next ER when the financials of both entities (Discovery & Warner Media) are reported as one. As such, it is my opinion that WBD’s stock price has been oversold and is currently undervalued. In this article, I will be assessing WBD’s:

- Streaming offering relative to peers

- Growth rate relative to peers

- Valuations relative to peers

Business Model

WBD is a mass media conglomerate who is transitioning into the streaming space. As such, it earns revenue from 4 segments:

- Linear TV: WBD earns revenue from traditional cable tv subscriptions and from the advertisements aired in between shows.

- Streaming: WBD earns revenue from the subscriptions users have to HBO Max and Discovery+. Additionally, WBD also earns advertising dollars from advertisements aired on the cheaper ad streaming plans.

- Licensed Content: WBD earns revenue from licensing out its content to other media companies as well as game studios.

- Theatre Releases: WBD earns revenue from box office releases like The Batman.

These diversified revenue channels have pros and cons to them. Although WBD’s Linear TV segment is declining, should the Streaming market get too competitive, WBD can rely on its other segments to boost revenue growth. This is an advantage WBD, Disney and Paramount have over Netflix. Additionally, I believe that not every household is ready to cut the cord despite a substantial decline observed in Linear TV already. However, that does not mean that these exact households are not already embracing streaming. As such, traditionally linear TV companies have the advantage of distributing its content through 2 channels compared to NFLX’s, Amazon’s and Apple’s streaming-only channel. This allows WBD to earn more revenue per content than Netflix for the same number of subscribers in the near future – at least until Linear TV completely phases out. To be clear, linear TV is a dying trade, but at this juncture it still provides the benefit of diversification of revenue.

Streaming

In this section, I will focus solely on WBD’s streaming business given that it is the main growth driver. There are 3 types of streaming:

- SVOD: Streaming Video-On-Demand lets users subscribe to a library full of content that they can watch anytime the user chooses, e.g.: Netflix

- AVOD: Ad supported Video-On-Demand lets the user watch content for free or at reduced price relative to SVOD. For that privilege, the content may be interrupted by ads, e.g.: Discovery+ With Ads

- TVOD: Transaction Video-On-Demand allows the user to rent/purchase content at a one-off fixed price, e.g.: Renting movies online

WBD will engage in all 3 forms of streaming depending on the demographic of its subscribers. The recent news of Netflix losing subscribers has also cast doubt on the streaming TAM. However, Jason Kilar, the former CEO of Warner Media commented:

I don’t think the ceiling is 222 million subscribers. I think the ceiling is far closer to 1 billion. You get there by giving customers the choice. “The choice” refers to ad tier subscription plans. If he is right, there is still a long runway for growth in the streaming market.

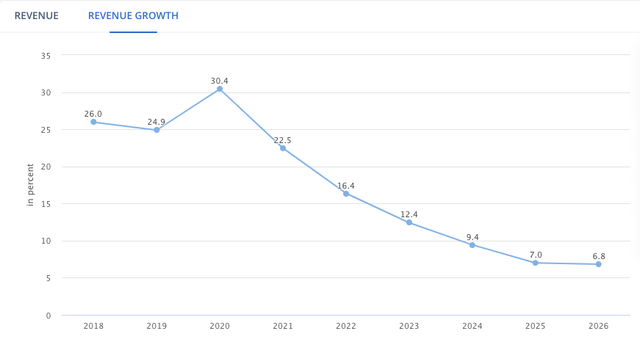

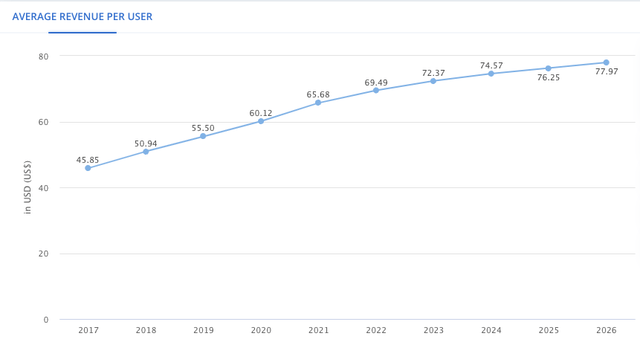

SVOD Growth Rate Projections (Statista) SVOD ARPU Projections (Statista)

Furthermore, the revenue growth rates and ARPU room for expansion for SVOD still has lots to grow as per Statista projections.

- Revenue growth rates for SVOD is set to grow at an average of +10% for the next 5 years.

- ARPU from SVOD is expected to grow to $78 in 2026, up from $65 in 2021. In fact, WBD is already making $11 in ARPUs from each ad tier subscriber/month. This translates to $132 in ARPUs today, ahead of the market average.

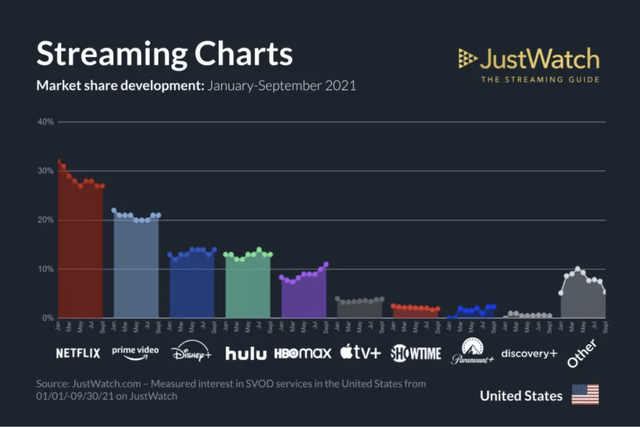

Streaming Market Share (JustWatch.Com)

Currently HBO Max is also the 5th largest player in the streaming market in terms of market share. More interestingly, we can see that HBO Max maintains the fastest market share growth rate relative to its peers, defending its user base as competition within builds up.

Discovery + Warner Media – The Power Combo

To assess a streaming company’s product, we have to consider 3 things:

- Churn rates (‘CR’), acquisition strength, and investments into content.

Discovery+ Has a Lower Churn Rate Than HBO

Discovery+ maintains a lower CR because its shows are more educational in nature and have many parts to it. Gunnar Wiedenfels, WBD CFO, said:

We also think that one of the big opportunities here is going to be churn reduction. There is meaningful churn on HBO Max, much higher than the churn that we have seen.

HBO is Stronger at Customer Acquisition

WarnerMedia is able to attract new subscribers easily with the release of popular hit shows like Game of Thrones or Batman.

John Malone, Discovery’s largest shareholder, said:

Discovery+ is not blockbuster, it’s personality, it’s great entertainment, but it’s not the kind of acquisition type content that Warner can bring to the table. So you have to look at this game both from getting people to reach into their wallet and pull out their credit card point of view, the marketing point of view, but you also have to look at the churn and the satisfaction of the consumer. Discovery does very well on the customer satisfaction, but it doesn’t have the Wonder Woman type of big event content that will get you an acquisition program where you can add hundreds of thousands or millions of consumers in one campaign.

David Zaslav, Discovery’s CEO said:

What we’ve learned is people love our product in ways that even surprises us, over 3 hours they’re spending with us… Churn is extremely low. But we’re also learning that to get people to come in… the ability to drop into this product, the King Kong or Godzilla or a Game of Thrones. That together, we think that this could be much more compelling… . I met one of the biggest streaming players, who said to me recently, ‘If I had you, my churn would be zero.’ And I think just the combination of people now spending over 3 hours with us, and then you add to that Batman, Wonder Woman, King Kong, Sex and the City, Friends. It’s just -it’s an unrivalled combination. And churn matters.

Merging Discovery+ and HBO Max Into One

Given Discovery+ and HBO Max’s complementary strengths which thereby creates more synergies, it is no surprise that WBD management is combining them into one product. Zaslav also added that the combined and enlarged streaming platform would look to reduce subscriber churn, especially for HBO Max, with a broader content offering. Given that the number of services that households are willing to pay for is limited, it certainly seems like the right move to marry Discovery and Warner Media together to offer a more complete and sticky streaming service to customers. This is good because WBD’s product now has low churn with high acquisition strength.

Now, let us compare WBD’s combined streaming service with that of its peers.

WBD-Discovery+ Vs Competition

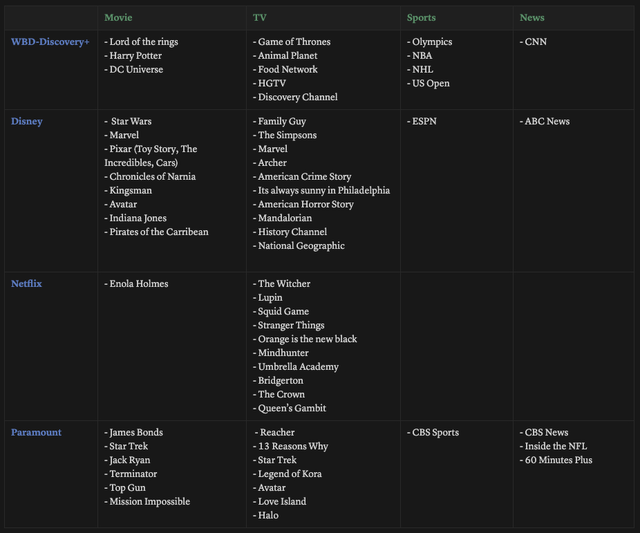

Content Wars (Panther Investment Research)

Comparison of Movie Franchises

In terms of movie franchises, Disney definitely leads the pack and WBD comes in 2nd. Disney has the largest number of popular movies. If WBD could develop its DC universe in the footsteps of Disney’s Marvel, it would truly be a cash cow. Paramount comes next as many of its movies are also very popular. Netflix has largely focused on TV series and so in terms of original movie production, it hasn’t produced many record hits.

Comparison of TV Franchises

In terms of TV franchises, I would argue that NFLX and Disney share the crown. Netflix’s many quality TV shows nest in some portion of our minds. On the other hand, Disney’s move to transform many of its famous movie franchises into TV series has piqued interests. A few examples are The Mandalorian and Moon Knight. I think Paramount and WBD tie for last place.

Although WBD comes in last place, its TV shows operate in a different field from the others. Coming from a linear tv background, WBD’s TV shows span a very large horizon of niche interests, such as cooking, travelling, nature, architecture, etc. On top of this, WBD also now has some big name TV series inherited from Warner Media. This differentiates WBD from the rest and in fact presents itself as a boon to them in terms of managing its churn.

Comparison of Sports Content

In terms of sports coverage, Disney is the best. It owns ESPN which is the most popular sports coverage channel. WBD follows in 2nd place with the Eurosport channel, and Paramount comes in third with its CBS sports channel. In this regard, many of the other streaming competitors are at a disadvantage. Netflix, Amazon Prime, and Apple TV all do not have their foot in the realm of sports. That being said, recent reports have shown that Apple and Amazon are bidding for NFL rights.

Some readers may question the importance of having sports content. However, sports content is imperative in making the content provider more attractive.

Sporting events continue to be the most powerful draw in television, accounting for 95 of the 100 most-watched live broadcasts in 2021. And ESPN once again set the bar this quarter with live games across each of our four major US sports, including the revolutionary Monday Night with Peyton and Eli, Chapek said.

Disney will add alternative programming for UFC, golf, and college football events over the course of the next three years, he added. Providing sports content also reduces churn.

Levy, chairman of data firm Genius Sports said:

With sports, there’s a guaranteed built-in audience, It’s much different than entertainment. With entertainment, every show is hit or miss, and you always have to market content. You never know what will succeed and what won’t. That’s why sports is the best content to invest in, and it will be no matter what the distribution model is.

Moreover, sports content provides a potential arm of revenue generation – sports betting, just like how fuboTV does it (NYSE:FUBO). In fact, Disney already has plans to go into sports betting. Bob Chapek said that the future of sports programming will extend to “sports betting, gaming and the metaverse”. Sports betting has exploded in the US since a 2018 Supreme Court decision ended Nevada’s hold on the market. If Disney has plans to go into sports betting, I am sure WBD will soon follow. Furthermore, given that the sports betting customer acquisition cost (‘CAC’) is typically very high and operators will remain unprofitable in this segment for long, especially when competing against heavyweight single-waller casino operators, the source of capital is important. But for WBD’s case, their main SVOD business should more than be able to finance this arm of the business.

Comparison of News Content

As a result of the merger, WBD now also owns CNN. CNN is one of the largest news networks in the world regardless of your political alignments. CNN Worldwide Chairman and CEO Chris Licht said in a statement:

CNN will be strongest as part of WBD’s streaming strategy which envisions news as an important part of a compelling broader offering along with sports, entertainment, and nonfiction content.

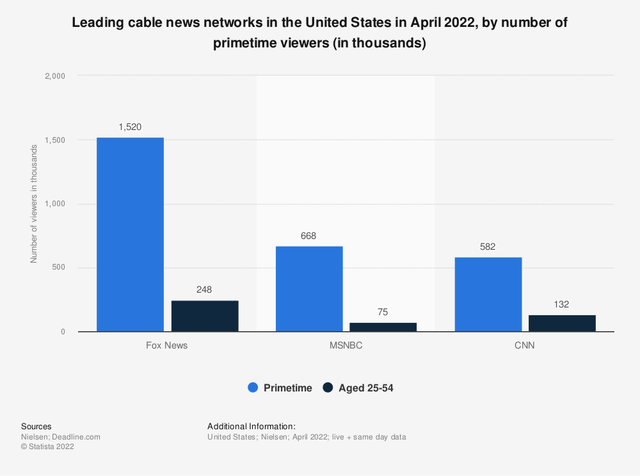

Leading Cable News Network (Statista)

Like sports, news is a highly important offering as well given that content is always evolving. However, it is no surprise that news content has the lowest acquisition strength. Nobody would realistically pay for news as there are many avenues for it, especially with the prevalence of social media. Realistically, CNN’s viewership numbers have also been collapsing substantially. Thus, as a standalone product the odds of its success are highly against it, but together as part of a bundle with stronger acquisition strengths such as movies and TV shows, it would make sense.

Therefore in terms of news content strength, WBD is likely the leader as it owns one of the top 3 news networks in the world. Disney and Paramount don’t lag too far behind as they still have exposure to news, but Netflix, Amazon and Apple tie for last place with zero exposure.

Content Spend

In order of highest to lowest spending (DTC Only):

WBD DTC Relative Content Spend (Panther Investment Research)

Netflix still leads the spending spree, but Disney is close behind with Amazon and WBD following after. Paramount is far behind in terms of content generation, which means that it will face difficulty in attracting more subscribers. Comparing the content of DIS, NFLX, AMZN, WBD, AAPL, and PARA, I would rate the strength of their product in this order:

- 1st (Disney), 2nd (Netflix/WBD, Amazon), 3rd (Apple), 4th (Paramount)

Disney has the highest acquisition strength given it famous franchise and low churn given it breadth of content types and is spending considerably on DTC content. I rank Netflix, WBD and Amazon together because Netflix seeks to reduce churn by spending loosely, WBD by having a diverse amount of content across various categories, and Amazon by bundling its streaming services with others. In terms of acquisition strength, they are all behind Disney. Moreover, WBD and Amazon are spending similarly on DTC content. It’s hard to rank Apple as their DTC budget is unknown. Paramount is last because despite its surprisingly low CR and diverse content range, they hardly spend on producing DTC content. Based on product strength, we should expect to see Netflix and WBD be valued on equal footing.

Creating Synergies

WBD management has targeted $3B in cost synergies. During the last earnings call, CFO Wiedenfels also added that the $3B target might be conservative.

Some measure management have already taken / may take include:

- Shutting Down CNN+: WBD’s management shut down CNN+ a few weeks after it launched, attributable to a low start of just 10,000 viewers a day. The executive who helped design CNN’s streaming strategy, Andrew Morse, also departed. Going forward, Licht said CNN will focus its resources on its core news-gathering operations and building CNN Digital.

- Reducing Marketing Expenses: According to SA contributor Mike Kytka, there are around $6 billion in technology and marketing expenses between the two distinct platforms. A portion of that is definitely unnecessary in the future.

- Measure 3: Selling Assets: Just 3 weeks after announcing the merger with WarnerMedia, Discovery sold its Great American Country Network.

Given the measures management has already taken, I am confident of management’s focus in exceeding their expectations. Again, this is good news, and if executed well, may translate to higher operating leverage and an improvement in margins.

Prudent Spending

On numerous occasions, Zaslav has asserted the importance of a disciplined approach by stating, “We plan on being careful and judicious. Our goal is to compete with the leading streaming services, not to win the spending war.” Management’s goal is clearly not to chase subscriber growth at all costs.

WBD CFO Wiedenfels also added that he wants to see more FCF coming out of Warner Bros. and its hefty content investments.

Right or wrong, management has made a decision to invest a lot of the incoming funds into a number of investment initiatives. As I’m looking under the hood here, again CNN+ is just one example, and I don’t want to go through a list of specific examples, but there’s a lot of chunky investments that are lacking for what I would view as a solid analytical financial foundation and meeting the ROI hurdles that I would like to see for major investments, Wiedenfels argued.

This is positive news for investors, as we can expect WBD to aim for profitability instead of growing market share at the expense of its bottom line.

Revenue Drivers

Growth for WBD can come from:

- An increase streaming subscriber count

- An improvement in advertising quality translates to higher ad dollars

- Joint ventures

Increase In Subscribers

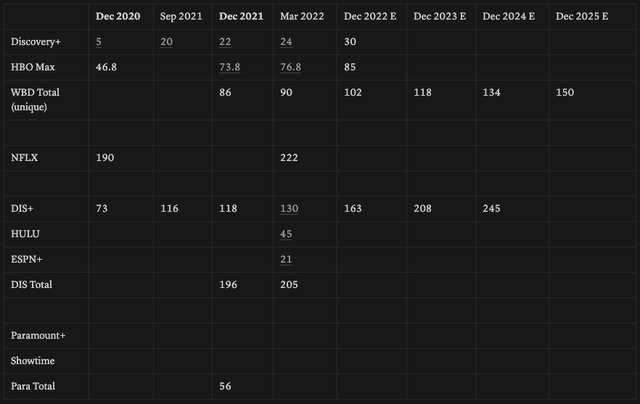

Relative Streaming Subscriber Count (Panther Investment Research)

Currently Discovery+ has 24M subscribers while HBO Max has 76.8M subscribers. Assuming that 10M of subscribers have both HBO Max and Discovery+ subscriptions, this bring WBD’s total unique subscriber count to 90M at the end of March 2022. Given that WBD added 4M subscribers in Q1 2022, I anticipate that WBD will likely continue to add 4M subscribers every quarter, reaching an estimated subscriber based of 150M by 2025.

As for Netflix, their growth has materially stalled. In Q1’22, the streaming giant reported losing 200K subscribers, the first in 10 years. It remains to be seen if their incumbent subscriber base remains capped at 220M, but they should still be able to grow subscriber count when ads are implemented and crackdown on password sharing follows through.

In the case of Disney, the company already has 205M subscribers today. Given the numbers of Disney and Netflix, WBD aiming to have 118M subscribers by 2023 is very achievable. If this realistically enfolds and WBD earns $11 of revenue/user/month, DTC revenues would total $15.6B in 2023, a certainly plausible case.

Increase In Advertising Dollars

By having control of the platform and monitoring the choices users make, WBD can possibly sell more sophisticated targeted ads to customers. Targeted ads commands a premium, allowing WBD to grow revenues further. However, the effects of targeted ads also remains to be seen as neither Discovery+/HBO Max is a search engine like Google. The only player in the space that can possible benefit is Roku Inc (NASDAQ:ROKU).

Joint Ventures

WBD can also grow through joint ventures (JV). WBD announced a JV with U.K. telecom giant BT’s sports televising unit, BT Sports on the 3rd of February 2022. According to the announcement, both companies have agreed to form a “50:50 JV to create a new premium sport offering for the UK & Ireland and to transfer the operating businesses of BT Sport to Warner Bros. Discovery. By bringing together the sports content offering of both BT Sport and Eurosport UK, the JV will have one of the most extensive portfolios of premium sports rights including UEFA Champions League, UEFA Europa League, the Premier League, Premiership Rugby, UFC, the Olympic Games, tennis Grand Slams featuring the Australian Open and Roland-Garros, cycling Grand Tours including the Tour de France and Giro d’Italia and the winter sports World Cup season.” This is smart move for both companies, as they cement their positions in the future streaming era.

Financials

In last quarter, WBD reported worse than expected performance from the Warner Media side of the business.

Q1 operating profit and cash flow for WarnerMedia were clearly below my expectations. And given that Q1 performance and previously unplanned projects in sight, I currently estimate the WarnerMedia part of our profit baseline for 2022 will be around $500 million lower than what I had anticipated, said Gunnar Wiedenfels, WBD CFO.

Based on this statement, it is important that the numbers we use are revised downwards from the street’s estimates given that sell-side analysts are often slow to make adjustments.

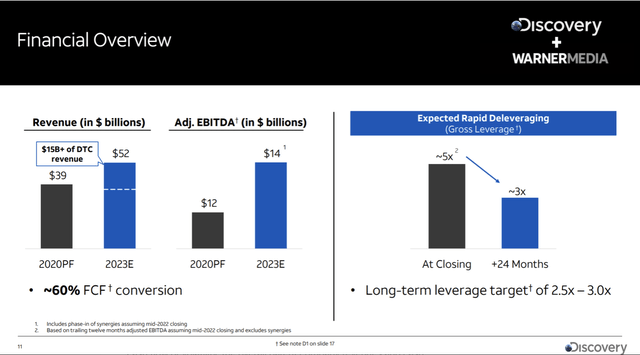

- Revenues for Discovery have grown at 13.5% for the past 5 years. Moreover, analysts expect revenue WBD to grow at 6% for the period 2022-2026.

- EBITDA is expected to grow at a rate of 10.5% from 2022-2026. However, to model in conservatism, I expect EBITDA to grow at a slower rate of 8%.

- FCF is expected to grow at a rate of 23% from 2022-2026. However, to model in conservatism, I expect EBITDA to grow at a slower rate of 18%.

- As for B/S strength (Net Debt to EBITDA), management expects to deleverage quickly and bring down gross leverage from its current 5X to 3X at the end of 2023. As we still don’t have financials for the merged entity, it is difficult to judge if this expectation can be met.

Merger Financials (WB + Discovery Merger)

Valuation

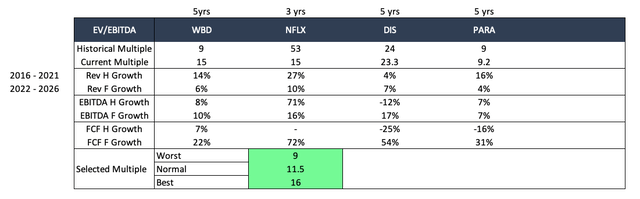

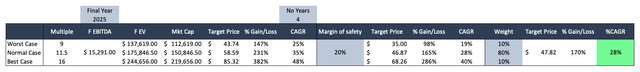

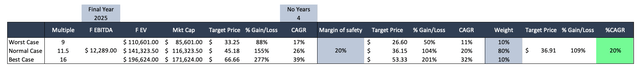

I preface by maintaining that EV/EBITDA relative valuations have been used.

WBD RV (Panther Investment Research)

WBD is currently trading at a multiple of 15X. Its average historical multiple over the past 5 years stood at 9x. For reference, DIS currently trades at 23X, with an average historical multiple of 24X. NFLX currently trades at 15X, with an average historical multiple of 53X.

Comparing between WBD and DIS up until 2026,

- We can see that both are estimated to have revenue growth rates around 6-7%.

- We can see that WBD has a slower EBITDA growth rate of 10% compared to DIS 17%.

- We can see that WBD has less than half the FCF growth rate of 22% compared to DIS 54%. This is likely due to WBD financing its debt from the Warner Media acquisition.

Thus, it’s warranted that WBD trade below the multiple of Disney and 14X seems conservative.

Comparing between WBD and NFLX up until 2026,

- We can see that WBD is to grow revenues slower at 6% compared to 10% for NFLX.

- We can see that WBD is to grow EBITDA slower at 10% compared to 16% for NFLX.

- We can see that WBD has 1/3 the FCF growth of 22% compared to 72% for NFLX.

Thus, it’s warranted that WBD trade below the multiple of NFLX and 7.5X seems conservative.

As WBD is closer in comparison to DIS rather than NFLX, I will give a greater weighting to multiple derived from that comparison (60%) rather than with NFLX (40%). Hence, it seems warranted that WBD trade at a multiple close to 11.5X in the future.

- Normal Case Multiple: 11.5X

- Bear Case Multiple: 9X

- Bull Case Multiple: 16X

For the worst case scenario, I assume that WBD’s growth in streaming equally offsets its decline in traditional linear TV revenues. As such, WBD should be valued similar to its historical multiple of 9X where investors categorized the company as a purely linear TV company.

For the best case scenario, I assume that WBD exceeds future estimates. In this case, I believe that WBD will be second only to DIS in the streaming space and management’s expectations of spending judiciously will materialize, allowing margins to improve. However, I will acknowledge that there is a high possibility that the streaming space is already saturated.

WBD RV (Panther Investment Research)

Using the current stock price of $17.7 and estimated 2025 EBITDA of $15.29B with a scenario analysis, weighting 80% for the normal case and 10% for the other 2 cases, combined with a final 20% margin of safety, I get a TP of $47.8 for 2025, representing a 170% upside from today’s prices (28% CAGR). I used a high margin of safety as I find it difficult to predict how a saturated streaming market will enfold. Regardless, it is evident that WBD still maintains a decent upside.

WBD RV (Panther Investment Research)

Looking at the current macroeconomic environment, it is also possible that analysts overstated 2025’s EBITDA. To be conservative, let us also consider the possibility that 2025’s EBITDA will be 20% lower than analyst estimates. In this case 2025’s EBITDA will be $12.39B. Even with a 20% margin of safety, we have a TP of $36.9 for 2025, representing a 107% upside from today’s prices (20% CAGR). Clearly, such returns despite the conservative expectations are a bullish sign.

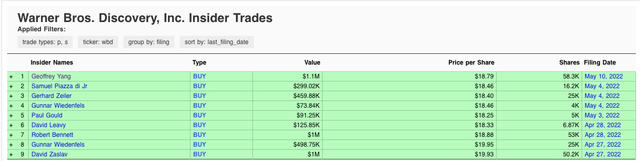

Insider Buying

There has been a flurry of insider buying in the last couple of months. This may indicate that insiders also think the stock if undervalued compared to fundamentals.

Risks

There are certain risks to the investment.

- Not Meeting Current Expectations: The narrative now is that WBD is able to quickly deleverage its 58B debt in a matter of 2Y. If this does not materialize, there is a possibility that WBD’s stock might get punished.

- Leveraged Balance Sheet: WBD’s highly leveraged B/S may impede their ability to invest in new content. Moreover, servicing its debt will affect its bottom line for the time being. That being said, management is aware and based on their comments, are truly focused on addressing incumbent debt.

- Strong Competitors Exploring Growth Initiatives: Disney plans to move into sports betting, gaming, and metaverse. Disney has said that betting presents a huge opportunity for growth and interactivity, particularly as legalisation continues across the US. To remain competitive, WBD will also require the flexibility to explore new areas of growth.

- Password Sharing: Password sharing is indeed a problem. However, it can be solved. Possible solutions include restricting IP addresses and enabling location tracking. If NFLX is able to solve it , we can be confident that other media companies too can crack down on it.

- Current Inflationary Environment: Inflationary pressures are forcing consumers to cut discretionary spend. This means that subscription, advertisement, and transaction revenue will all be impacted. However, I would argue that WBD is in a better position than NFLX to weather this storm. WBD has a diverse revenue stream and a majority of its revenues still come from linear TV. To me, perhaps if consumers were to cut back on subscriptions, NFLX subscribers would cancel their subscriptions first before looking to cancel on WBD. Furthermore, not many elderly households are ready to cut the cable.

Investor Takeaway

From the collapse of Archegos Capital to the selling of WBD shares by dividend seeking AT&T shareholders, combined with the spillover effects from the loss of subscribers by Netflix and the current inflationary environment, there has been a cascade of negative catalysts dragging WBD’s price action downwards. However, none of these have anything to do with the fundamentals of WBD.

HBO Max continues to add subscribers and WBD is making a higher ARPU on SVOD subscribers than linear TV subscribers. Moreover, management is focused on eliminating unprofitable projects and spending judiciously on content with can translate to operational leverage and hence margin expansion. These are all sign of an improving business, not a declining one.

With a potential TP of $37 in 2025 based on entirely conservative numbers, that represents more than a 100% upside from today’s prices. I believe the current markets are irrational and prices unjust. Till next time!

Be the first to comment