damircudic/E+ via Getty Images

Futu Holdings (NASDAQ:FUTU) soared after posting strong quarterly results. This gain is not a victory for investors who seek capital gains by holding and accumulating discounted shares. Readers will correctly call out that last September 2021, FUTU stock failed to break out.

Investors who look at the macroeconomic headwinds will notice that publicly-listed companies in China fared poorly. KraneShares CSI China (KWEB) lost 19.6% in the year-to-date period. Including today’s rally, FUTU stock lost 14.9%, beating the index. How will Futu fare in the weeks ahead after it posted first quarter results?

Futu Posted Strong First Quarter

In the first quarter, Futo posted revenue falling by 25.6% Y/Y to $209.51 million. Its paying client base grew by 67.9% Y/Y to 1.33 million. It now has 2.91 million registered clients, up by almost 49% from last year. Still, trading volume in Q1 fell by 41% Y/Y. Futu managed to increase paying customers amid stock market weakness hurting trading volume. The stock is approaching a bear market. Higher interest rates in every country will weigh on the market. Fortunately, China is the only country cutting interest rates to offset the slowdown caused by the over two-month Shanghai lockdown.

Futu saw a meaningful uptake in securities lending balance and margin financing. To manage risks, clients deleveraged some of their margin positions to avoid further losses from the market turmoil. Strong interest in China tech names, along with leveraged and inverse exchange-traded funds, lifted trading volumes.

Futu grew its market share of derivatives trading. Hong Kong futures and options trading volumes grew by 6% and 12%, respectively. To optimize its operating margins, expect the company to benefit from new trading product offerings. For example, it’s launching VIX futures in Hong Kong and exchange-traded products in Australia. It also will offer two new algorithmic orders for accredited investors in Singapore.

Futu offset the decline in trading volume with blended commission rates that rose by 5.9bps to 7.3bps.

The company limiting operating costs where possible. Sales and marketing expenses increased by 5% Y/Y. But general and administrative expenses increased by 128% Y/Y. It increased its headcount to support its international office openings.

Opportunity

Consolidation of small brokers in Hong Kong will lift Futu’s market share growth. In Singapore, more clients are entrusting Futu by increasing their asset deposits. Investors should expect net asset inflows to continue as clients choose Futu’s platform.

If stock markets continue to weaken, client asset size could shrink. This is akin to ARK Invest (ARKK) benefiting from a net asset inflow while the value of stocks held falls. As long as Futu attracts quality clients in Singapore in growing numbers, its business growth will continue. Furthermore, if stock prices stabilize, Futu will report an accelerated growth in quality clients.

Futu offset lower trading volumes by collecting more commission revenue from derivatives. In Q1, derivative accounts accounted for 30% of the trading commission. Investors needed financial instruments to hedge against the volatility and downside risks. The company only needed to guide clients to derivatives by offering them investor education. Unlike Robinhood (HOOD), Futu values the importance of supplying investment education to empower its clients to manage their risk-reward returns.

Headwinds

Futu experienced higher costs of acquiring customers than planned. Chief Financial Officer Arthur Chen said that it had a budget of HKD2,500 to HKD3,000 in CAC costs. Instead, CAC costs topped around HKD3,500. It spent more on advertising campaigns that continued from the last fourth quarter into the first quarter. Looking ahead, CAC levels should drop within the budgeted range.

The industry consolidation suggests the stock trading market is shrinking. However, Futu has marketing campaigns targeting existing clients. That should increase net asset inflows. Its competitors also are exiting the Hong Kong market, which encourages new customers to do business with Futu.

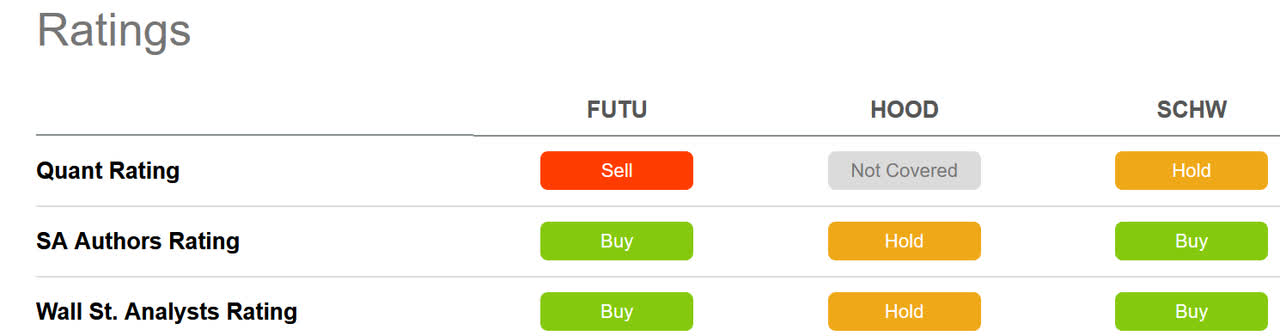

Futu’s Stock Grade Comparison

Futu has a poor quant rating with a “sell.” By comparison, SA’s scoring system rates Schwab (SCHW) a “hold.”

SA Premium

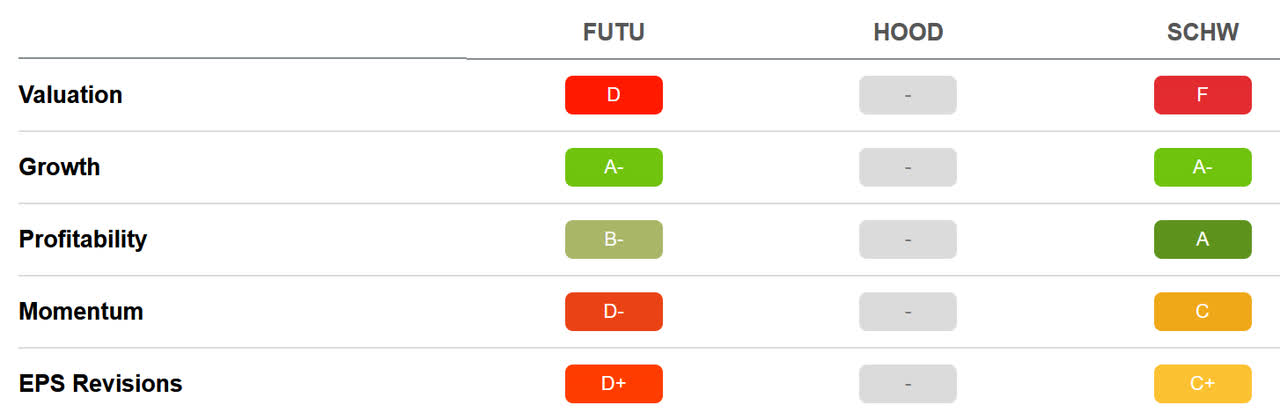

FUTU stock scores well only on growth and fair on profitability. It beat Schwab stock on the value score:

SA Premium FUTU stock score

Chart Analysis

Stock Rover

The moving average convergence divergence, or MACD, crossed over on May 2, 2022. The stock signaled a buy, ahead of the rally on June 6. The buying volume is a level not seen since March. Consider using the 50-day and 200-day moving averages as a guide. The stock could trade in the $40 – $55 range from here.

Your Takeaway

Admittedly, Futu rose after China lifted its probe against DiDi and the U.S. government lifted its tariff on green energy. Investors should consider letting the market take profits on these macroeconomic events. They have very little to do with Futu’s rally after the earnings report.

Short sellers have a big bet against the stock. The post-earnings short squeeze is due to the 17.38% short float position. Again, consider letting the market take profits on Futu shares before re-establishing a position.

Be the first to comment