JHVEPhoto

Intro

Teva Pharmaceutical Industries Limited (NYSE:TEVA) came across our desk as a liquid setup that is currently trading with under-average levels of implied volatility. With implied volatility being mean reverting in nature, opportunity always presents itself when it is trading at extremes (either very high or very low compared to itself over time). Before we get into strategy, let’s see where Teva Pharmaceutical is from profitability, technical and valuation standpoints.

In terms of a standard value play, one would find it hard to get a better setup as we see from the valuation multiples below. Teva continues to trade well below the sector averages with the company’s sales and earnings in particular meaningfully cheaper in earnest.

| Metric | Forward Multiple | 5-Year Average | Sector Averages |

| Price To Earnings (Non-GAAP) | 3.63 | 4.79 | 19.11 |

| Price To Book | 1.03 | 0.86 | 2.61 |

| Price To Sales | 0.68 | 0.77 | 4.19 |

| Price To Cash-Flow | 13.2 | 13 Approx | 16.36 |

EPS Revisions

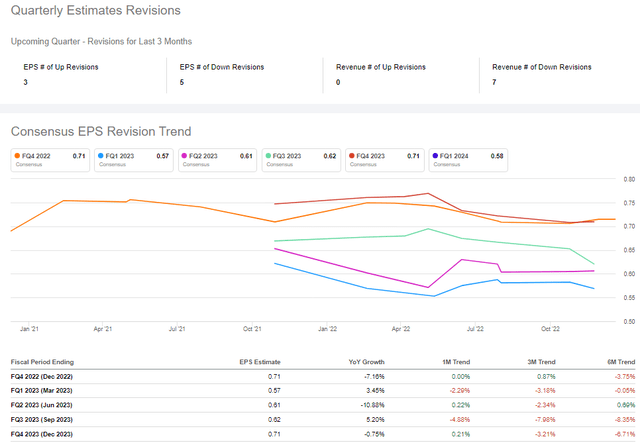

From a profitability standpoint, the company looks strong with Teva’s return on capital over the past 12 months coming in at 5.36% and EBITDA margins remaining firm at 27.62% over the same timeframe. However, as we can see from the consensus estimates below, there have been 5 downward EPS revisions over the past three months as opposed to 3 upward revisions. This is due to negative expected rolling quarter sales growth (To the tune of approximately 5% at present), over the next three quarters.

Teva Quarterly Estimates Revisions (Seeking Alpha)

Technicals

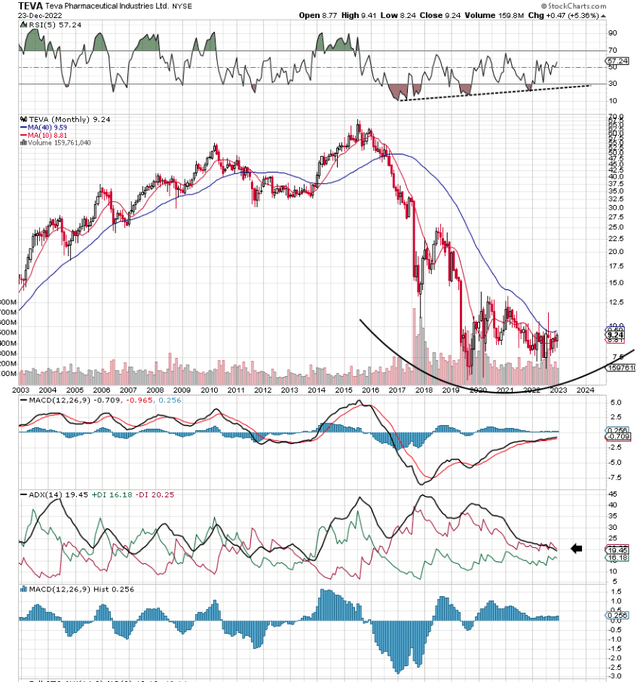

If we go to the long-term technical chart, we see that we have a bullish divergence in the RSI momentum indicator and the ADX trend-following indicator is getting ever closer to giving a long-term buy signal. Furthermore, the recent turning up of the 40-month moving average leads us to believe that we have a bottoming pattern in play here. Suffice it to say, if the 10-month moving average ($8.81) can move convincingly above the 40-month ($9.59), this would send a strong signal that a long-term trending move would be on the cards for Teva.

Teva Long-Term Chart (Stockcharts.com)

Implied Volatility

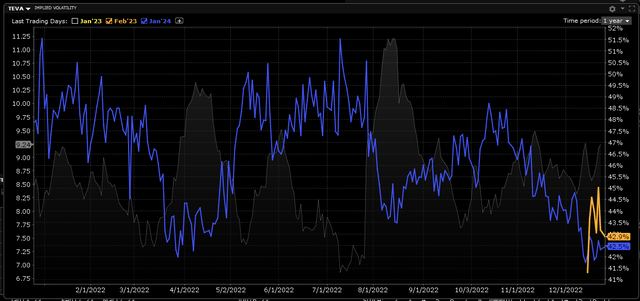

As we can see below, Teva is currently trading with very low levels of implied volatility both in its near-term cycles as well as its long-term cycles (January 2024). When implied volatility is trading well below its average 52-week range, buying options is preferred to selling them as option prices through vega will naturally increase in value all other things remaining equal.

Teva Implied Volatility Chart (Interactive Brokers)

On the other hand, the problem with buying options is that theta is working against the option buyer. Suffice it to say, until that 40-month moving average gets taken out convincingly by its shorter-term counterpart, buying options in Teva may be risky as the suspected bottoming pattern may endure for some time to come.

Strategy

This is why we turn to the poor man’s covered call or long-term diagonal spread which is the purchase of the long-dated deep-in-the-money call option offset by the sale of an out-of-the-money short-term option. The advantage of this setup is numerous over the purchase of buying TEVA stock outright at this juncture.

- First buying deep in the money LEAPS (Long-term Equity Anticipation Securities) with a high delta (90+) is a much cheaper alternative over buying shares outright. This means that LEAP investors can pretty much participate in all of the potential gains TEVA will enjoy on an up move (Option Deltas will increase as the stock goes up) whilst only having maybe 50% of capital at risk.

- Furthermore, since the option will lose delta on a potential down move (as opposed to a long stock position which always has the same delta), the rate of decline of the option’s value compared to a long stock position would be significantly less. In this scenario, the key here would be to roll the LEAP out in time well before expiration to ensure one can stay in the game long enough

- All the time, one can consistently bring in income (which essentially reduces the purchase price of the LEAP) by selling those near-term options. The key is to consistently bring in credit when rolling those shorter-term options whilst always endeavoring to keep those options out of the money. This ensures we always have long deltas in play which is what we want in a low-volatility environment.

Conclusion

To sum up, Teva Pharmaceutical Industries looks to be undergoing a long-term bottoming pattern, although recent earnings revisions have disappointed. Therefore, in the event of more sideways action continuing, the play here for us given the stock’s liquidity and low implied volatility is a long-term diagonal spread. Investors should remember that this strategy is a long-term strategy so patience as always is key. We look forward to continued coverage.

Be the first to comment