ArtistGNDphotography/E+ via Getty Images

It’s been a little over four months since I finally pulled the trigger and bought a few shares of Johnson Outdoors Inc. (NASDAQ:JOUT), and there’s no way to sugarcoat it, dear readers. The stock has cratered since, down about 25% against a loss of about 1.5% for the S&P 500. The company has posted financial results since, so it’s time to review this name yet again. In particular, I want to determine whether or not it makes sense to add to my small stake or take my lumps at this point. I want to comment on the most recent financial history, and compare it to the same periods in 2020 and 2019. In addition, I’m going to look at the stock that appeared so cheap to me a few months ago.

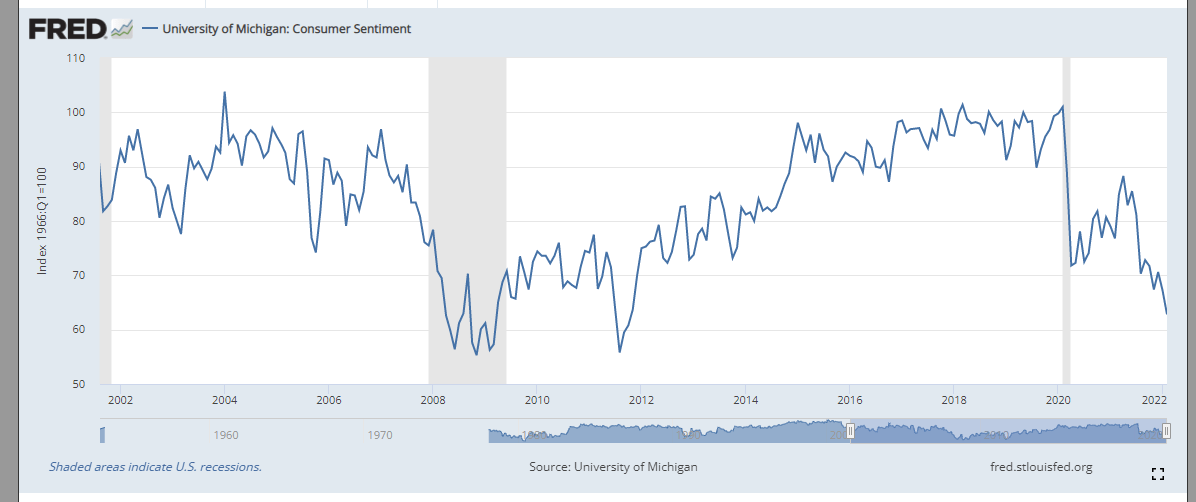

I know that you’re a busy crowd, dear readers, and for that reason I’m going to give you the gist of my argument now so you won’t have to wade through another 1,200 of my words. I think the company has returned to trend, and on that basis, the recent financial results were actually rather good. Although profitability is obviously lower than it was in the recent past, it’s still quite decent by historical standards. The problem is the valuation. While it seems cheap according to some measures, the stock is downright expensive according to others. In order to “break the tie”, I reviewed consumer sentiment data recently published by the St. Louis Fed, and, based on that, I’m choosing to avoid. It seems that consumers are in a very pessimistic mood at the moment, and that can’t be good for a company such as this. For that reason, I’m neither adding to, nor selling my stake here. If you’re in the same boat as me, I would recommend holding. If you’re just joining us, I would recommend that you wait until either shares drop further in price, or until the company posts even greater financial results. There you have it. I’ve just provided you the means to get the “juice” of my argument without most of the “squeeze” of reading text heavily laden with “Doyle mojo.” You’re welcome.

Financial Snapshot

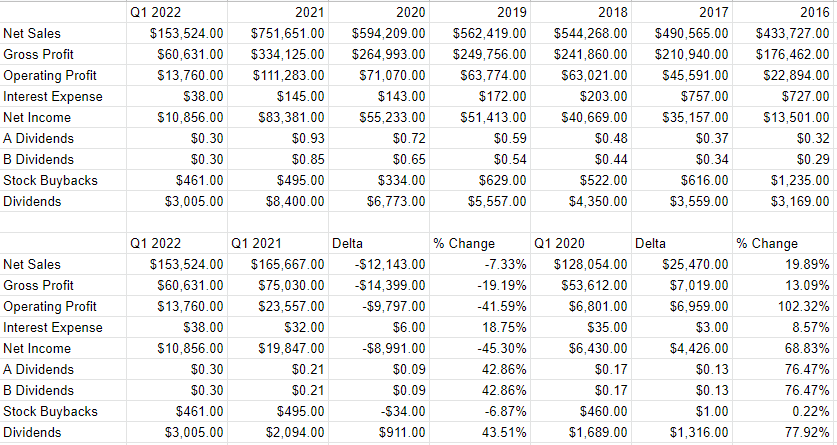

After a quick review of the financial history here, it becomes obvious that 2021 was a banner year for the company, with revenue and net income up by 26.5% and 51% respectively from the prior year. Thus, we should go into our review of the most recent quarter with an understanding that last year will be a tough point of comparison. With that as preamble, the most recent quarter was rather soft compared to the same period in 2021. Revenue was about 7% lower, and net income was fully 45% lower than the same period during 2021. The problem is that there’s no one non-recurring event to blame for this drop in net income. As sales slowed, cost of sales rose by about $2.2 million, for instance. Although marketing and selling expenses declined by about $4.3 million, that wasn’t enough to compensate the ~$15 million reduction in gross profit. Thus, it may be the case that the company is reverting to a previous “normal.”

Things aren’t completely terrible, though. When we cast our gaze back, and draw comparisons between the most recent quarter and the pre-pandemic era, things look rather good. In particular, revenue during the most recent quarter was about 20% greater than the period before the pandemic and net income was up by about 69%.

So, in my view, the most recent quarter wasn’t anomalously bad as much as the prior year was anomalously good. Thus, I would characterise the most recent quarter as fairly decent when compared to the longer run trends here. For that reason, I’d be comfortable averaging down and adding to my stake at the right price.

Johnson Outdoors Financial History (Johnson Outdoors investor relations)

The Stock

Yep. It’s that time again, dear readers. It’s the time when I remind you yet again of what I remind you of daily, and that is that stocks are distinct from the underlying business. A great, very profitable company like Johnson Outdoors can be a terrible investment at the wrong price. I think my history with the stock over the past four months demonstrates that fact. It’s not like the company’s profit making potential cratered by 25%, but the stock price would suggest that that’s exactly what happened. In my view, the price paid for a given investment is probably the single most important variable to determine whether the investment is “good” or “bad.” The more you pay for a stream of future dollars (which is what you can distill a business down to), the lower will be your subsequent returns. Rather than try to demonstrate this point abstractly, I’ll use Johnson Outdoors itself to demonstrate the principle. The company released its latest quarterly report on February 4th. If you bought this stock the next day, you’re down just under 5% since. If you waited exactly one month, you’re up about 2.6%. I hope it doesn’t come as a shock to you that not much changed at the firm over this month to warrant a near 7.6% swing in returns. The investors who bought virtually identical shares more cheaply did relatively better. This is why I try to avoid overpaying for stocks.

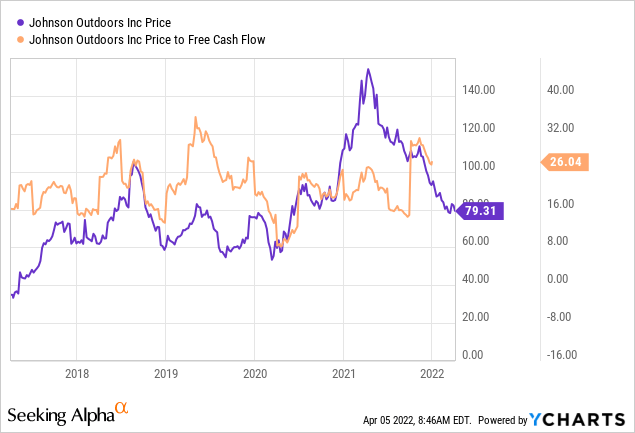

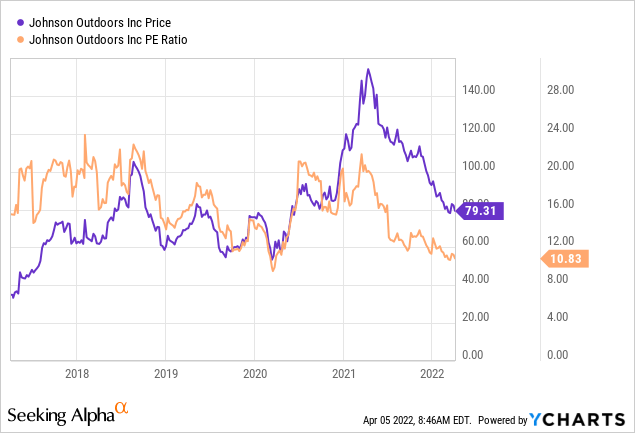

If you read my stuff regularly, you know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my article before last on this company I avoided the shares because they were trading at a price to free cash flow of ~24 times. I then “pulled the trigger” when the price to free cash flow had dropped to 14.9 times. On that basis, things look expensive again, per the following:

I made a few mistakes here. Since I anchored on the first valuation of 24 times, the 14.9 times valuation looked downright cheap. It may not have been objectively cheap, actually. Also, I made the mistake of assuming that we were in a new normal, and, given what I wrote about the financial history above, that’s obviously not the case. That said, the stock’s not unequivocally expensive, per the following:

My regulars know that in addition to simple ratios I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Johnson Outdoors at the moment suggests the market is assuming that this company will grow at only about 0.33% going forward. While the shares look expensive on a price to free cash flow basis, I consider this to be nicely pessimistic. What’s a man to do?

The Tie Breaker

To sum up so far, the company seems to have reverted to trend, which is consistently profitable. The shares are either expensive or relatively cheap, depending upon how you measure it. I feel a strong need to try to cut through this ambiguity, and in order to do that, I’ll turn to a survey of consumer sentiment. In my view, when consumers are in a sour mood, they spend less, especially on non-essentials. So, if consumers are upbeat, I’d be happy to add more shares. If consumers are in the doldrums, I think it would be prudent to hold. We see from the following that consumer sentiment is currently actually very near great financial crisis lows, and that’s troublesome in my estimation. If consumers are in the mood to “batten down the hatches”, I see no reason to aggressively add to my position here.

Consumer Sentiment (St. Louis Fed Database)

Conclusion

I still like the company a great deal, and I’m willing to hang on to the shares, as I have faith that it will remain profitable, and shareholders will eventually be rewarded. The problem is that the shares aren’t definitively cheap at the moment, and consumers seem to be in a rather sour mood. For that reason, I’ll not add to my stake in this company until something changes. If you own shares and have a long time horizon to wait, I see no reason to sell. If you are just coming to this party, I would recommend against buying at current levels, as there’s little compelling reason to do so in my view.

Be the first to comment