Kirkikis

Earnings of Atlantic Union Bankshares (NASDAQ:AUB) will likely surge next year on the back of high-single-digit loan growth. Further, the well-positioned balance sheet will enable margin expansion amid a rising rate environment. Overall, I’m expecting Atlantic Union Bankshares to report earnings of $2.91 per share for 2022 and $3.58 per share for 2023. Compared to my last report on the company, I’ve barely changed my earnings estimates. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Atlantic Union Bankshares.

Robust Pipelines, Regional Economy To Drive Loan Growth

Atlantic Union Bankshares’ loan portfolio continued to grow at a satisfactory rate in the third quarter of 2022. The portfolio grew by 1.9% during the quarter, taking the nine-month growth to 5%, or 7% annualized. The management expects high-single-digit loan growth for both 2022 and 2023, as mentioned in the earnings presentation. This target seems achievable given the employment situation in Atlantic Union Bankshares’ markets.

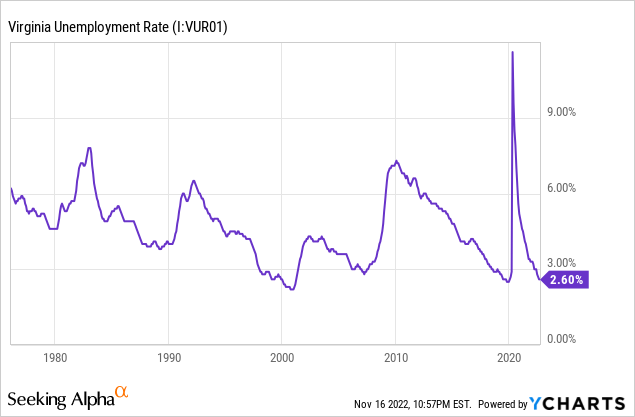

The company mainly operates in Virginia, with some presence in Maryland and North Carolina. Virginia’s unemployment rate is very low from a historical perspective.

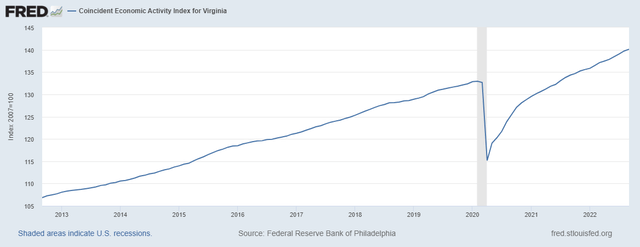

Further, the coincident economic activity index shows that the region’s economy is currently quite robust.

The Federal Reserve Bank of Philadelphia

Credit line utilization improved to 32% by the end of September from 25% a year ago, as mentioned in the conference call. However, the utilization is still well below the pre-pandemic level. Therefore, there is plenty of room for further growth. Moreover, the management appeared optimistic about the on-the-ground situation during the conference call. Further, the management mentioned that lending pipelines continued to remain strong at the time of the conference call.

Considering these factors, I’m expecting the loan portfolio to grow by 2.0% in the last quarter of 2022, leading to full-year loan growth of 7.6%. For 2023, I’m expecting the loan portfolio to grow by 8.2%.

Meanwhile, I’m expecting deposits to grow in line with loans. However, the growth of both securities and the equity book value will trail loan growth. As interest rates rise, the market value of available-for-sale securities will fall, leading to unrealized mark-to-market losses. These losses will skip the income statement and flow into the equity account, as per relevant accounting standards. Due to these unrealized losses, the equity book value has already plunged by 17% in the first nine months of the year.

The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 9,675 | 12,569 | 13,861 | 13,096 | 14,087 | 15,248 |

| Growth of Net Loans | 36.2% | 29.9% | 10.3% | (5.5)% | 7.6% | 8.2% |

| Other Earning Assets | 2,486 | 2,960 | 3,596 | 4,829 | 3,905 | 4,064 |

| Deposits | 9,971 | 13,305 | 15,723 | 16,611 | 16,877 | 18,268 |

| Borrowings and Sub-Debt | 1,756 | 1,514 | 841 | 507 | 676 | 704 |

| Common equity | 1,925 | 2,513 | 2,542 | 2,544 | 2,057 | 2,144 |

| Book Value per Share ($) | 29.2 | 31.3 | 32.2 | 32.9 | 27.5 | 28.7 |

| Tangible BVPS ($) | 17.4 | 19.6 | 19.6 | 20.2 | 14.8 | 15.9 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||

Balance Sheet Positioning To Drive Further Margin Expansion

Atlantic Union Bankshares’ net interest margin expanded by 19 basis points in the third quarter after growing by 20 basis points in the second quarter of the year. Further margin expansion is likely in the coming quarters because of the conducive balance sheet positioning. Around 51% of the loan book is based on variable rates, while the remaining is fixed, as mentioned in the earnings presentation. Therefore, the average earning-asset yield is moderately rate sensitive. In comparison, deposits that reprice frequently, that is NOW, money market, and savings accounts made up 57.3% of total deposits at the end of September 2022, as mentioned in the 10-Q filing.

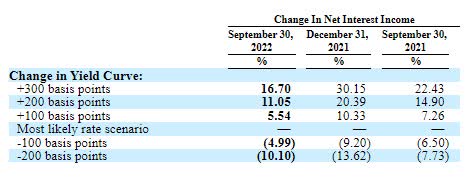

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis point hike in interest rates could boost the net interest income by 11.05% over twelve months.

3Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to grow by 15 basis points in the last quarter of 2022 and a further 15 basis points in 2023.

Expecting Earnings To Grow By 23% Next Year

The loan growth and margin expansion discussed above will likely be the key drivers of earnings next year. Meanwhile, the net provision expense will likely remain near a normal level. I’m expecting the net provision expense to make up 0.16% of total loans in 2023, which is close to the average from 2017 to 2019.

On the other hand, inflation-driven growth in non-interest expenses, especially salary and occupancy expenses, will likely restrain earnings growth. The management is targeting an efficiency ratio (non-interest expenses divided by revenues) of less than or equal to 51%, as mentioned in the presentation. This target is much below the actual efficiency ratio of 56.7% achieved in the third quarter. Considering the high-inflation environment, I believe the management will miss its target for next year.

Overall, I’m expecting Atlantic Union Bankshares to report earnings of $2.91 per share for 2022, down 11% year-over-year. For 2023, I’m expecting earnings to grow by 23% to $3.58 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 427 | 538 | 555 | 551 | 580 | 677 |

| Provision for loan losses | 14 | 21 | 87 | (61) | 19 | 24 |

| Non-interest income | 104 | 133 | 131 | 126 | 120 | 110 |

| Non-interest expense | 338 | 418 | 413 | 419 | 404 | 422 |

| Net income – Common Sh. | 146 | 194 | 153 | 252 | 217 | 267 |

| EPS – Diluted ($) | 2.22 | 2.41 | 1.93 | 3.26 | 2.91 | 3.58 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Atlantic Union Bankshares, I estimated earnings of $2.91 per share for 2022 and $3.57 per share for 2023. Following the third quarter’s results, I’ve tweaked every line item a little bit. My earnings estimates have barely changed, as the tweaks I’ve made cancel each other out.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

High Price Upside Justifies A Buy Rating

Considering the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.32 per share in the third quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 33% for 2023, which is below the five-year average of 42%. Based on my dividend estimate, Atlantic Union is offering a forward dividend yield of 3.6%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Atlantic Union Bankshares. The stock has traded at an average P/TB ratio of 1.79 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 17.4 | 19.6 | 19.6 | 20.2 | ||

| Average Market Price ($) | 38.0 | 35.6 | 26.2 | 37.1 | ||

| Historical P/TB | 2.18x | 1.81x | 1.33x | 1.84x | 1.79x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $15.9 gives a target price of $28.5 for the end of 2023. This price target implies a 17% downside from the November 16 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.59x | 1.69x | 1.79x | 1.89x | 1.99x |

| TBVPS – Dec 2023 ($) | 15.9 | 15.9 | 15.9 | 15.9 | 15.9 |

| Target Price ($) | 25.3 | 26.9 | 28.5 | 30.1 | 31.7 |

| Market Price ($) | 34.3 | 34.3 | 34.3 | 34.3 | 34.3 |

| Upside/(Downside) | (26.3)% | (21.6)% | (17.0)% | (12.4)% | (7.7)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 14.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.22 | 2.41 | 1.93 | 3.26 | ||

| Average Market Price ($) | 38.0 | 35.6 | 26.2 | 37.1 | ||

| Historical P/E | 17.1x | 14.8x | 13.5x | 11.4x | 14.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.58 gives a target price of $50.8 for the end of 2023. This price target implies a 48.0% upside from the November 16 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.2x | 13.2x | 14.2x | 15.2x | 16.2x |

| EPS 2023 ($) | 3.58 | 3.58 | 3.58 | 3.58 | 3.58 |

| Target Price ($) | 43.7 | 47.2 | 50.8 | 54.4 | 58.0 |

| Market Price ($) | 34.3 | 34.3 | 34.3 | 34.3 | 34.3 |

| Upside/(Downside) | 27.2% | 37.6% | 48.0% | 58.4% | 68.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $39.7, which implies a 15.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.1%. Hence, I’m maintaining a buy rating on Atlantic Union Bankshares.

Be the first to comment