bgwalker

Introduction

Duolingo (NASDAQ:DUOL) is the most popular language learning app worldwide with more than 56m monthly active users. Founded in 2011, Duolingo offers a freemium model where people can use the app for free with ads (ad-supported plan) or pay a small monthly/annual fee to avoid ads and gain access to a range of other features, such as being able to use the app in offline mode and practice frequent mistakes (Super Duolingo).

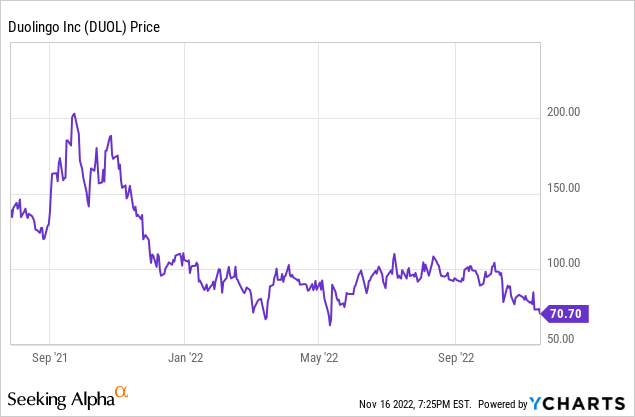

Duolingo’s share price has performed poorly since their IPO in July 2021, despite reporting accelerating user growth, and beating both revenue and adjusted EBITDA guidance each quarter. This share price weakness is likely due to Duolingo’s lack of GAAP profitability, which has become the “topic du jour” for investors in 2022 with tightening monetary policy and a rising cost of capital. However, as I argued in my last article, Duolingo has a clear path to profitability due to their capital-light business model, 73% gross margins, high research and development spend which can be dialed back, and demonstrated track record of positive free cash flow.

In this article, I discuss my seven key takeaways from Duolingo’s latest Q3 2022 results and why I believe the current share price represents an attractive entry point for long-term investors.

1) Another quarter of accelerating user growth

Duolingo’s main user metrics are the number of users that engage with their app on a daily (daily active users; DAUs) and monthly basis (monthly active users; MAUs). In Q3, growth for both metrics was very strong and accelerated for the fifth consecutive quarter to 35% YoY growth (MAUs) and 51% YoY growth (DAUs).

| Quarter | MAUs | MAUs YoY Growth | DAUs | DAUs YoY Growth |

| Q3 2022 | 56.5m | 35% | 14.9m | 51% |

| Q2 2022 | 49.5m | 31% | 13.2m | 44% |

| Q1 2022 | 49.2m | 23% | 12.5m | 31% |

| Q4 2021 | 42.4m | 15% | 10.1m | 20% |

| Q3 2021 | 41.7m | 13% | 9.8m | 16% |

| Q2 2021 | 37.9m | (3%) | 9.1m | 2% |

Duolingo’s conversion rate from MAUs to DAUs has also trended higher over the past six quarters, indicating increased engagement for Duolingo’s core language learning app.

| Quarter | Ratio of DAUs to MAUs |

| Q3 2022 | 26% |

| Q2 2022 | 27% |

| Q1 2022 | 25% |

| Q4 2021 | 24% |

| Q3 2021 | 24% |

| Q2 2021 | 24% |

Duolingo’s CEO noted that their strong user growth was broadly consistent across geographies, with relative strength in Asia.

So the first question is in terms of geography and where are the kind of the new MAUs coming from and kind of the geographic spread. Generally, we’re seeing that we’re growing across all geographies. Of course, some are growing faster than others. Asia continues to be our fastest-growing place. It’s not China. I mean, China has been growing some, but I mean it’s countries like India, Vietnam, et cetera.

– Duolingo CEO Luis von Ahn, Q3 2022 earnings call

Overall, Duolingo’s user growth in recent quarters has been phenomenal. Growing DAUs and MAUs represents the “top of the funnel” for Duolingo as the more users that interact with their app on a daily or monthly basis, the more opportunities they have to convert free users into paid subscribers and the larger the available audience for targeted ads and in-app purchases.

2) Increasing paid subscriber penetration

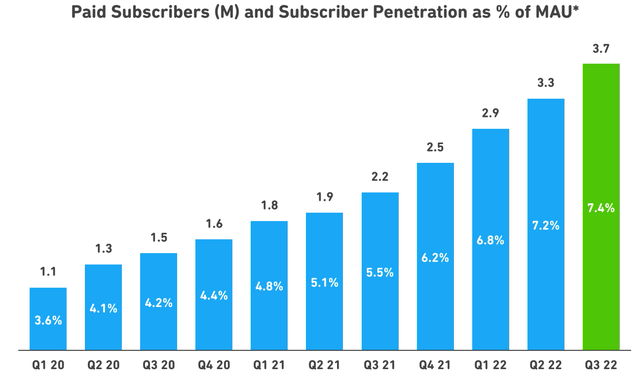

As mentioned in my last article on Duolingo, the core aspect of my investment thesis for Duolingo lies in their ability to: (1) continue to grow both MAUs and DAUs, but also (2) increasingly convert free users into paid subscribers. Pleasingly, Duolingo has increased their paid subscriber penetration each quarter since Q1 2020, reaching a high of 7.4% in Q3.

In Q3, Duolingo reported 3.7m paid subscribers, which increased 68% YoY. I expect Duolingo to increase paid subscriber penetration each quarter through to at least 2025 (with the occasional blip here or there), likely until they plateau at a paid subscriber penetration rate of around 15% based on previous guidance from CEO Luis von Ahn. For some context, Spotify (NYSE:SPOT) (another well-known D2C software app) has a paid subscriber penetration rate of 43% with 456m MAUs.

Duolingo Paid Subscriber Penetration (Q3 2022 Shareholder Letter)

3) Another quarter of 50%+ revenue growth

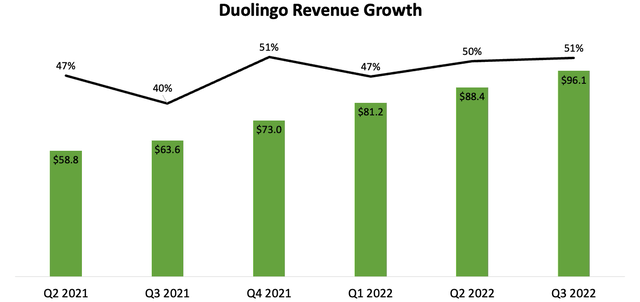

Duolingo’s main source of revenue (75% in Q3) is subscription revenue from Super Duolingo users. As such, subscription revenue growth is the biggest driver of Duolingo’s overall revenue growth.

In Q3, Duolingo reported $72.2m in subscription revenue, which was up an impressive 11% QoQ and 57% YoY. Total revenue was $96.1m (+9% QoQ; +51% YoY) and exceeded their guidance for revenue of $93-96m, continuing Duolingo’s unbroken streak since IPO of beating internal revenue guidance. Owing to these strong results, Duolingo upgraded their FY22 bookings guidance from $404-410m (37-39% YoY growth) to $414-417m (41-42% YoY growth).

Such strong subscription revenue growth helped to offset weaker growth for the Duolingo English Test (+22% YoY) and ad revenue (+18% YoY), which are more volatile and sensitive to macroeconomic conditions.

Duolingo’s revenue growth rate has exceeded 40% each quarter since IPO and hovered around the 50% mark for the past four quarters. While many other public tech companies had revenue growth “pulled forward” due to COVID-19 and are now reporting substantial deceleration in growth rates, Duolingo pleasingly continues to report strong top-line growth rates.

Duolingo Revenue Growth (Author Generated from Company Filings)

Indeed, CEO Luis von Ahn sees no signs of a slowdown in consumer demand for their app, despite a whole host of macroeconomic headwinds (e.g., high inflation, tightening monetary policy, rising unemployment, etc).

So of course, we’re aware of the macro situation. So, we’ve been looking for our subscriptions product, we just haven’t seen anything even if you see geographically, I mean we just haven’t seen any softness in the numbers.

– Duolingo CEO Luis von Ahn, Q3 2022 earnings call

4) Let’s see some GAAP profits!

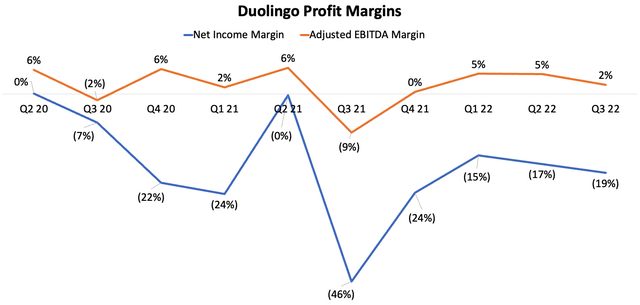

It’s hard to find flaws with Duolingo’s revenue and user growth rates. However, Duolingo has likely suffered in the public markets due to their lack of GAAP profitability and being lumped in with other “unprofitable tech companies”. While they have been profitable for eight of the past ten quarters on an adjusted EBITDA basis, GAAP net income margins have, for the most part, remained sharply negative.

Duolingo Profit Margins (Author Generated from Company Filings)

Why is Duolingo not profitable? Almost all of the difference between Duolingo’s adjusted EBITDA and net income margin is attributable to stock-based compensation (SBC), which is a common concern for US-listed software companies. Indeed, Duolingo issued $21.1m of SBC in Q3, primarily related to founder equity awards from the IPO.

It is quite common for SBC as a percentage of revenue to be elevated in the 12-18 months following an IPO (due to founder equity award packages), but I expect SBC to decrease sharply from 22% of revenue in Q3 to 10-15% over the next four quarters. This reduction in SBC will be a large driver of Duolingo becoming GAAP profitable.

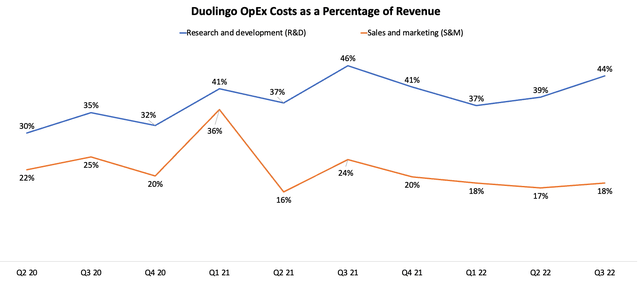

Another reason that Duolingo is unprofitable is because they continue to invest significantly in research and development (R&D) to both improve their core language learning app and develop their newly released maths learning app. While sales and marketing (S&M) costs have largely remained flat over the past three quarters at 17-18% of revenue, R&D costs have moved sharply higher to 44% of revenue in Q3. While high R&D spend helps Duolingo cement their market leadership position, such costs can be dialled back if tough macroeconomic conditions persist as a lever to become profitable on a GAAP basis.

Duolingo OpEx Costs (Author Generated from Company Filings)

5) Duolingo’s balance sheet remains very healthy

Dowling has a very healthy balance sheet and is in no danger of being forced to engage in a dilutive capital raising.

As of Q3, Duolingo had $554m of cash and cash equivalents and no long-term debt. This net cash position represents almost 20% of Duolingo’s current market cap of $2.80b.

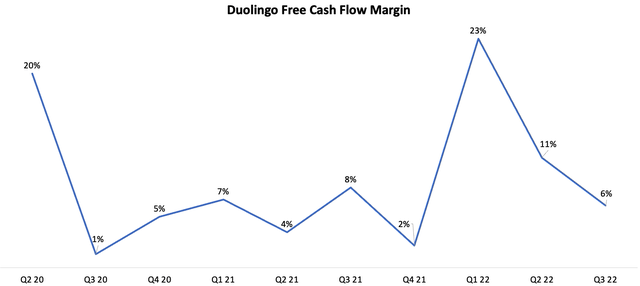

In addition to their strong balance sheet, Duolingo has consistently been free cash flow positive since 2020, albeit with significant volatility in free cash flow margins. Overall, investors can sleep easy at night knowing that Duolingo will not be forced to raise emergency capital in the midst of a prolonged economic downturn.

Duolingo Free Cash Flow Margin (Author Generated from Company Filings)

6) Increasing opportunities to monetise in-app purchases

Investors gained more insight in this latest quarter into Duolingo’s strategy to monetise in-app purchases, which represents a significant future growth area for Duolingo. In Q3, revenue generated from buying “gems” (Duolingo’s virtual currency) to gain access to new games/challenges and additional power-ups only accounted for 5% of Duolingo’s total revenue.

While revenue from in-app purchases is currently quite small at $20m annualised, it grew at a staggering 176% YoY in Q3. Indeed, video games and dating apps have increasingly begun to monetise their user base through in-app purchases and CEO Luis von Ahn believes they could become a much more meaningful contributor to Duolingo’s revenue over the coming years.

Sometimes people ask us how big can that be as a subtraction of our revenue. And the honest answer is I don’t know. But if you look at comparables, something like Tinder has about 30% of the revenue from in-app purchases. So, we think there’s a lot of room to grow from 5%.

– Duolingo CEO Luis von Ahn, Q3 2022 earnings call

As one of Duolingo’s loyal 14.9m DAUs, I’ll be keeping a keen eye out for UX changes as in-app purchases become a more prominent focus for Duolingo. While Duolingo does not break down gross margins for revenue generated from in-app purchases, I estimate it would likely be very high-margin revenue (>90%+), helping to boost consolidate gross margins above 73%.

On the other hand, in-app purchase revenue is a priority for us as we believe it’s a bigger opportunity than ad revenue. Today, IAPs or in-app purchases only make up about 5% of revenues, up from 3% last year. But we believe we have plenty of room to increase this as we experiment with new features that encourage learners to make à la carte in-app purchases.

7) Why did shares fall 13% post-Q3 earnings release?

Despite reporting strong growth in DAUs/MAUs and revenue and adjusted EBITDA that exceeded management’s guidance, Duolingo’s share price fell more than 13% following release of their Q3 earnings. This drop is made all the more significant when considering that the Nasdaq Composite Index was up 1.8% and the ARK Innovation ETF (NYSEARCA:ARKK) was up a whopping 8.3%.

While investors may have been reacting to the weaker-than-expected growth in ad revenue and the Duolingo English Test, I think there are three more plausible reasons for the drop in share price.

Weaker Q4 guidance

One potential reason for Duolingo’s drop relates to their Q4 bookings and revenue guidance (although keep in mind that Duolingo upgraded FY22 guidance for both metrics).

In Q4, Duolingo has guided for 23-27% YoY bookings growth and 34-38% YoY revenue growth. Such growth is still strong in absolute terms, but represents a slowdown from the 41% YoY bookings growth reported (48% in constant currency) and 51% YoY revenue growth reported in Q3. It is also somewhat counter to CEO Luis von Ahn’s remarks that Duolingo is not seeing any “softness in the numbers”.

However, I am not overly concerned about Duolingo’s Q4 guidance because: (1) Duolingo has historically been very conservative with guidance and exceeded their own guidance across all metrics each quarter since IPO and (2) a slight deceleration in growth would likely be accompanied by an equivalent or larger reduction in operating expenses, helping to reduce cash burn and boost margins.

Investors expected more cost cutting measures

In a market where investors are favoring companies enacting aggressive cost cutting measures to boost short-term profitability, investors may have been disappointed by the following remark from CEO Luis von Ahn in the earnings call:

Overall, we continue to maintain our financial discipline and manage our costs prudently. While our headcount continues to grow, we have never gone nuts on hiring and because of that, we don’t have to implement cost controls like layoffs or hiring freezes in order to achieve profitability.

– CEO Luis von Ahn, Q3 2022 earnings call

Concerns about valuation

Notwithstanding the recent 13% fall in share price, it is difficult to argue that Duolingo is valued “cheaply” on an absolute basis. With an enterprise value of $2.24b, investors are valuing Duolingo at:

- 6.1x FY22 revenue multiple.

- 4.9x FY23 revenue multiple (note: based on analyst estimates for 26% revenue growth in FY23).

- 61x LTM free cash flow.

Multiples of profit (either adjusted EBITDA or net income) are not particularly meaningful at this stage for Duolingo, given their low adjusted EBITDA margin and negative net income margin. This inability to value Duolingo on classic earnings multiples (e.g., a P/E ratio) may be keeping some investors on the sidelines.

Conclusion

While valuation remains the biggest risk with an investment in Duolingo, I believe their capital-light business model, dominant market position, 50%+ revenue growth rates, significant runway for future growth in adjacent segments (e.g., ads and in-app purchases), clear path to profitability, and healthy balance sheet makes today’s price an attractive entry point for long-term investors willing to withstand short-term volatility.

The drop in valuation multiple following their Q3 results has only increased my conviction in the business.

Be the first to comment