monsitj

The S&P 500/SPX (SP500) recently surged by 7.5%, possibly forming another tradable short-term bottom in this grizzly bear market. This week will bring even more exciting action despite the big five banks and other bellwether companies reporting in recent sessions. Additionally, the S&P 500 and other major market averages are around critical resistance levels, representing crucial inflection points in the marketplace. With all the trillion-dollar mega caps announcing earnings in the coming days, we’re about to witness the most significant earnings week of the season. I expect most bellwether companies will continue beating their top and bottom line estimates. Moreover, I suspect that most companies’ forward guidance will be better than many analysts expect. Therefore, we should see many stocks break out, and the SPX could rise to around 4,000 – 4,200 before the next near-term top comes.

The Market Is At Another Inflection Point Here

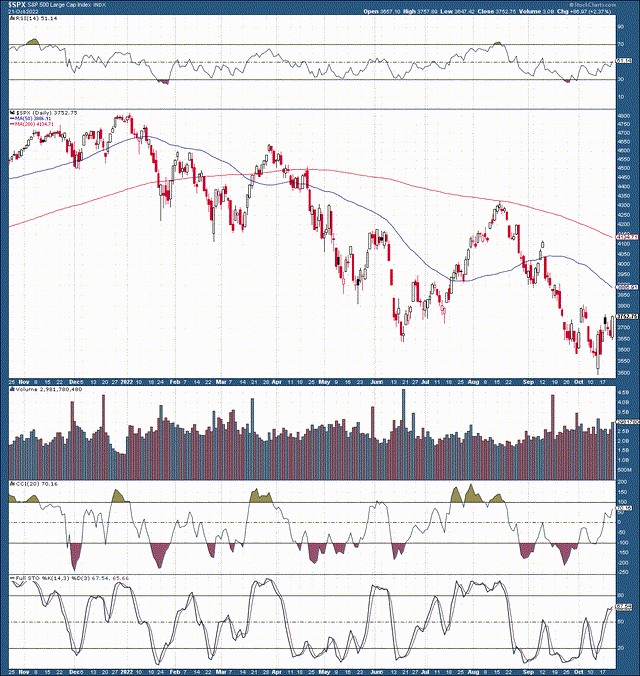

SPX (StockCharts.com)

The SPX made a sharp panic-driven, capitulation-like reversal around the critical support level at 3,500. This price action was the signal to close out hedging/short positions and increase long holdings in risk assets, as we discussed in Group/AWP chat and supporting articles “Recent Hedging Explained” and “Stocks Are Going Higher For Now.”

So, we’ve seen about a 7.5% move from the recent bottom in the S&P 500. The $64,000 question is, can stocks continue heading higher from here despite the upcoming November Fed meeting? I believe, yes, they can! First, we see a bullish head and shoulders pattern developing here. Second, the SPX is bumping against critical resistance at the 3,750-3,800 level. Once the SP can move above this crucial point, we will likely see a continuation of the current rally to about 4,000 and possibly higher. We also see technical indicators like the RSI, CCI, full stochastic, and others improving, illustrating improving movement and adding to the probability for further upside in the near term.

Now, I want to be clear about something. I’m not calling the bottom to the bear market. However, we must recognize that we’re not dealing with the same kind of bear market we saw in 2000 or 2008. The current bear market is not nearly as steep, is much choppier, should produce numerous powerful countertrend rallies, and may take longer to play out than some market participants expect.

We’ve already seen several very powerful countertrend bear market rallies. The most recent one lasted from mid-June to mid-August and increased the SPX by approximately 19% in roughly two months. Therefore, the current rally could run to 4,000 – 4,200. However, that doesn’t mean that the market has seen its ultimate low yet. A continuation of this rally to the 4,000-4,200 level would equate to a gain of approximately 15-19% from the 3,500 SPX low. Therefore, it’s plausible to see this rally persist through earnings and the upcoming Fed meeting, but the market may start heading south once sentiment switches again.

Earnings Snapshot – So Far So Good

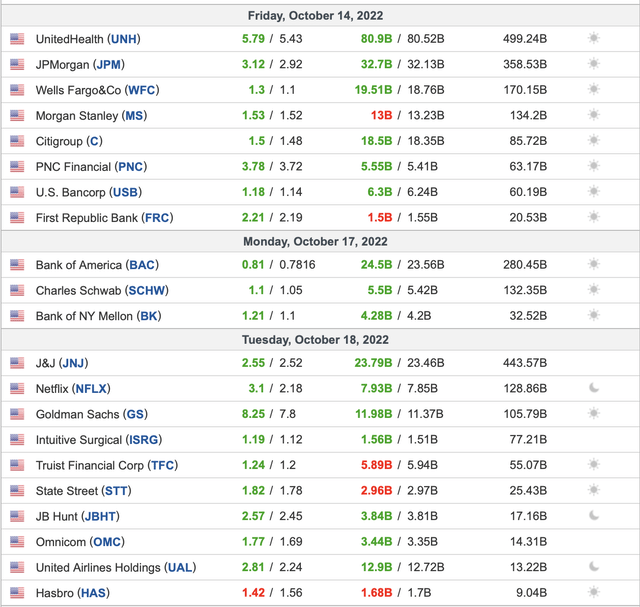

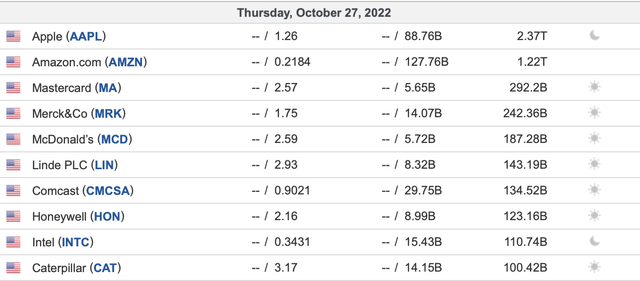

Recent earnings (Investing.com)

The big banks kicked off earnings season with big beats. JPMorgan (JPM), Wells Fargo (WFC), Citigroup (C), Bank of America (BAC), Goldman Sachs (GS), and others provided excellent results beating both the top and bottom lines. America’s big five banks all crushing top and bottom line earnings is an excellent prelude to the broader market’s earnings season.

It’s Not Just Banks

We also saw J&J (JNJ), Netflix (NFLX), UnitedHealth (UNH), IBM (IBM), Danaher (DHR), AT&T (T), Dow (DOW), Verizon (VZ), American Express (AXP), Schlumberger (SLB), and other big names smashed earnings estimates last week. So, we’ve seen excellent results from some bellwether names. However, the real test comes this week as the mega techs get set to report Q3 results.

Tuesday – Google, The First Major-Tech Bellwether Reporting

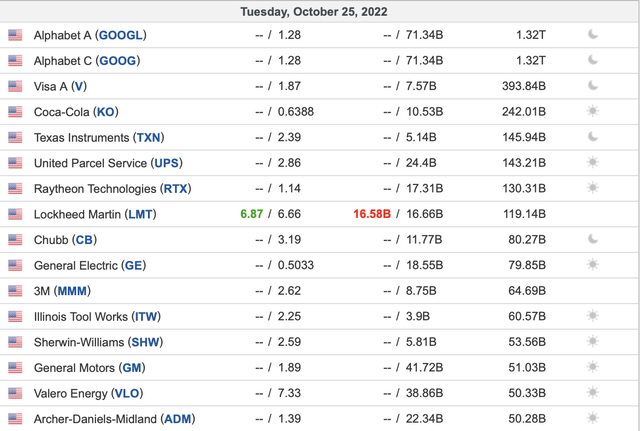

Earnings (Investing.com)

Tuesday, we have Alphabet (GOOG) (GOOGL), Visa (V), Coca-Cola (KO), and others reporting Q3 numbers. I expect inline or better results from Google, Visa, and most other big names reporting Tuesday.

Wednesday – Maga-Tech Earnings Continue with Microsoft And Meta

Earnings (Investing.com )

Microsoft (MSFT), Meta Platforms (META), Bristol-Myers Squibb (BMY), Boeing (BA), and other big bellwether names report on Wednesday. I suspect most will beat their revenue and EPS estimates. Moreover, Meta and others could surprise by significant margins and provide better than anticipated forward guidance for Q4.

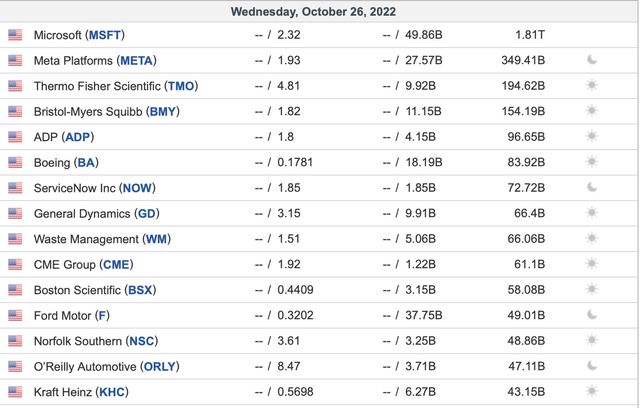

Thursday – The Most Valuable Company In The World Reports

Earnings (Investing.com)

Amazon (AMZN) and Apple (AAPL) report Thursday, and I expect both mega caps to deliver better than expected top and bottom line numbers. Many other big names like Mastercard (MA) and McDonald’s (MCD) report Thursday, and I expect most will beat earnings projections. I’m concerned about Intel (INTC), but I believe the stock may present a buying opportunity if it drops due to another bad quarter.

Friday – Big Oil Bellwethers Set The Tone For Sector

Earnings (Investing.com)

Friday is not too busy, but we have the two biggest oil companies reporting. I own Exxon (XOM), but I like both stocks. Also, I think we will see better-than-expected revenues and EPS coming from oil majors, in general, this earnings season.

The Takeaway

We saw a solid start to this earnings season, and the market reacted well. Big banks typically set the tone for the earnings season in general, and the preliminary results of big banks were solid. This week is the busiest and most crucial period of the earnings season. We have all the trillion-dollar mega tech stocks reporting in the coming days. Provided recent earnings, economic indicators, and other factors, I expect most bellwether companies will continue beating analysts’ estimates in the coming days and weeks. This phenomenon should serve as the primary catalyst to continue fueling this rally to approximately the 4,000 – 4,200 resistance range in the S&P 500, roughly 8%-12% above current levels.

If You’re Concerned About The Fed

The Fed’s FOMC meeting and interest rate decision is coming on Nov. 2, in nine days. If you’re concerned about stocks selling into the meeting, it’s probably too late for that. We saw a 17% decline in the SPX from the mid August high to the recent low in mid October.

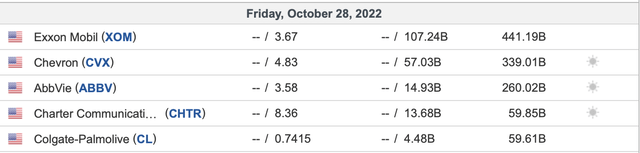

Target Rate Probabilities

Target rate probabilities (CMEGroup.com)

Furthermore, there’s now a 95% probability that the Fed will increase the benchmark rate by another 75 basis points in a few days. Therefore, the upcoming rate increase is currently priced into the stock market. Moreover, we do not see signs of a deteriorating labor market (unemployment rate of 3.5%) or indications that the economy is about to fall off a cliff. Instead, we’re seeing signs of a possible soft landing, and the Fed should slow the pace of raising interest rates in the coming months.

To be clear, I’m not confident that the labor market will remain relatively strong for long, and I’m not optimistic about a soft landing. Moreover, I believe that the Fed will need to “pivot” due to deteriorating market conditions down the line. However, it’s not important what I think will occur several months from now. Instead, what the market perceives will happen in the near term is essential. The market sees that most economic indicators are not deteriorating, the labor market is strong, and most earnings are better than expected.

Moreover, the market may perceive that the economy is relatively healthy, the Fed knows what it’s doing regarding inflation, and rates are not going much higher. There may even be a Fed pivot soon. This dynamic is bullish for stocks in the near term, and that’s why I want to have increased exposure in risk assets until the next top of this bear market arrives.

Portfolio Overview

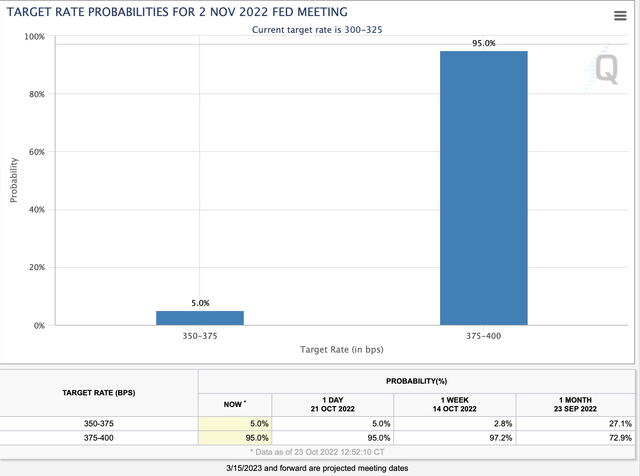

The AWP (The Financial Prophet )

While the AWP is nearly fully invested, parts of the portfolio are still in defensive positions. I own some physical gold, bond instruments, staples, defense, and several healthcare stocks. However, the AWP is positioned more aggressively in the near term. I deployed nearly all of my dry powder (roughly 25% of portfolio holdings) around the recent October lows. I closed the remainder of our collar hedges on the morning the market bottomed (reported in real-time in the AWP chat room).

Note: All portfolio adds were publicly announced in the Financial Prophet’s AWP chat room.

Moving Forward

I expect that the S&P 500 can break out above the 3,800 resistance level and move toward the 4,000-4,200 zone. Therefore, I’m bullish on risk assets in the near term and positioning my portfolio accordingly. However, once the enthusiasm dies down, sentiment may worsen again, and we could see renewed selling pressure develop around the 4,000-4,200 resistance zone. Thus, I will adjust the AWP’s holdings near the next high point in the market, increasing dry powder, reducing risk, and implementing hedges to avoid unnecessary losses in my portfolio. QTD, the All-Weather Portfolio, is up by around 4.4%. Due to portfolio adjustments around significant peaks and troughs and effective hedging strategies, the AWP is up by approximately 11% YTD.

Be the first to comment