adamkaz

Looking for dividend growth income vehicles in the MREIT space? Maybe you should take a look at Arbor Realty (NYSE:ABR).

Company Profile:

ABR is an internally-managed major US real estate lender, classified as a mortgage REIT. However, it has a versatile multifamily-centric operating platform and a unique business model, consisting of three primary business platforms which produce predictable cash flow: Balance sheet loan origination, GSE/Agency loan origination, and Mortgage Servicing.

ABR site

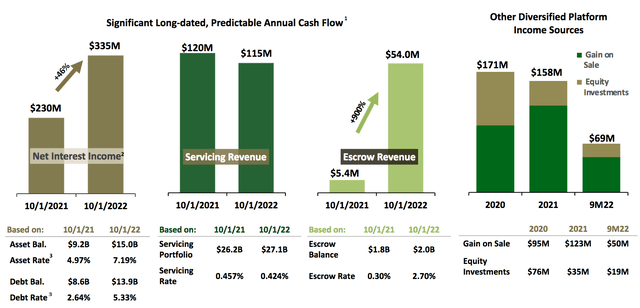

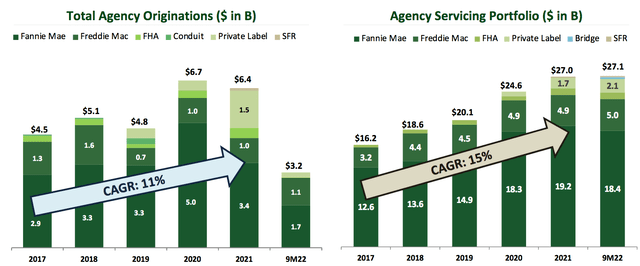

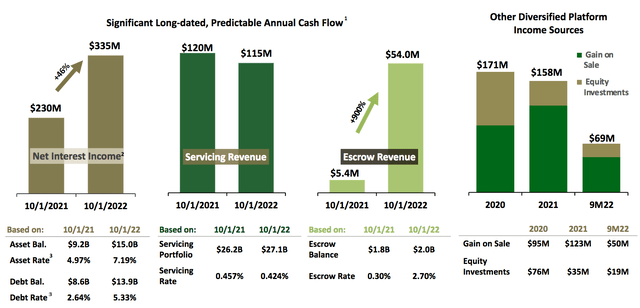

It has a $15B investment portfolio, and a $27B Agency servicing portfolio, with a prepayment protected annual income stream of ~$115M with a nine-year average remaining life. The servicing portfolio has grown 6% in the last year, is mostly prepayment-protected and generates approximately $120M/year in recurring cash flow.

ABR’s Agency originations have a CAGR of 11% since 2017, while its Agency servicing portfolio has a 15% CAGR:

ABR site

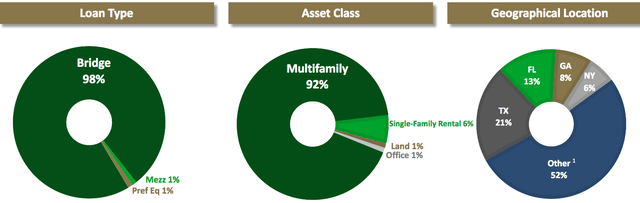

While Multifamily forms 92% of the assets, management also has built a growing single-family rental, SFR, platform with a $1B-plus pipeline, that forms 6% of assets. ABR’s biggest regional exposure is in Texas, at 21% each, followed by Florida, at 13%, Georgia, at 8%, NY, at 6%, with other states comprising 52%. Management ramped up exposure to Texas by 900 basis points in Q2-3 ’22:

ABR site

ABR site

Earnings:

Q3 1011: Arbor reported Q3 ’22 net income of $62.7M, or $0.36/diluted common share, compared to net income of $72.8 million, or $0.51 per diluted common share for Q3 ’21. Distributable earnings for the quarter was $105.1M, or $0.56/ diluted common share, vs. $75.7M, or $0.47/diluted common share for Q3 ’21.

The per share amounts were lower due to a 28% rise in the share count over the past year.

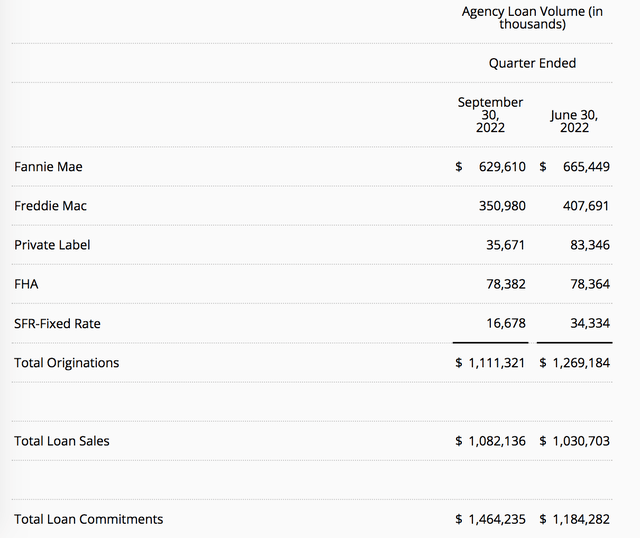

Total loan originations were down -12% in Q3 ’22, while loan sales rose 4%, and total loan Commitments rose 24% in Q3 ’22.

“In the third quarter, we successfully refinanced around 25% of our balance sheet runoff into new agency loans that produce strong gain on sale margins and long-dated servicing income. And again, our strategy is to preserve and build on a strong liquidity position to allow us to remain offensive and garner premium yields on our capital. In our GSE/Agency business, we originated another $1.1B of loans in the third quarter. October’s originations came in the $250 million range.” (Q3 call)

ABR site

ABR’s fee-based servicing portfolio totaled $27.07 billion at 9/30/22 and excludes $127.1 million of private label loans originated that were not yet sold or securitized. Servicing revenue net was $22.7M in Q3 ’22, and consisted of servicing revenue of $37.5M, net of amortization of mortgage servicing rights totaling $14.8 million.

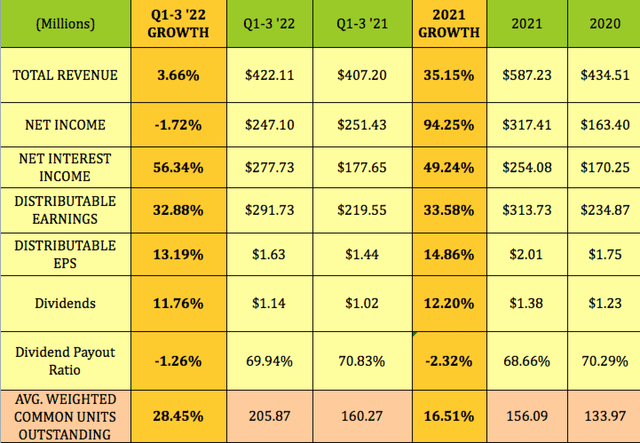

While 2022 has seen growth in most categories, the pace of that growth has slowed in some categories compared to 2021, which was a big bounce from 2020. Total revenue is up 3.7%, and Net Income is flattish, but, Net Interest Income is up over 56%, and Distributable Earnings are up ~33% again so far in 2022, as it was in 2021.

Management has continued to grow the dividends – they’re up by ~12%, similar to 2021’s growth rate. The Dividend Payout ratio has held steady, at ~70% in 2022, in spite of a big jump in the share count, and the 12% dividend growth.

Hidden Dividend Stocks Plus

Dividends:

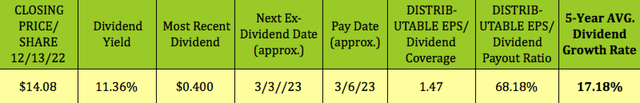

ABR has a strong five-year dividend growth rate of ~17%, with 10 straight years of dividend growth and 10 consecutive quarters of dividend hikes, a 33% increase, with the lowest payout ratio in the industry, and an annualized current dividend of $1.60.

ABR generated distributable earnings of $0.56/share in Q3 ’22, which is $0.16 in excess of its current $.40 dividend, representing a payout ratio of 71%.

At its 12/13/22 closing price of $14.08, ABR yields 11.36%.

Hidden Dividend Stocks Plus

Profitability and Leverage:

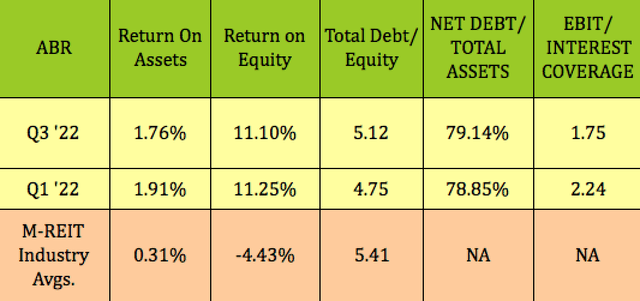

Q3 ’22 ROA and ROE were roughly in line with Q1 ’22 figures, and were both much higher than industry averages. Debt/Equity moved higher in Q3 ’22, as management continues to build up the portfolio.

Hidden Dividend Stocks Plus

With the growth in ABR’s portfolio, Interest Income has nearly doubled in Q1-3 ’22, to $628M, vs $321M in 2021. Q3 ’22 had $260M in interest income, more than 2X the Q3 ’21 total. With the big rise in interest income has come higher Interest expense, hence the lower EBIT/Interest coverage.

Debt and Liquidity:

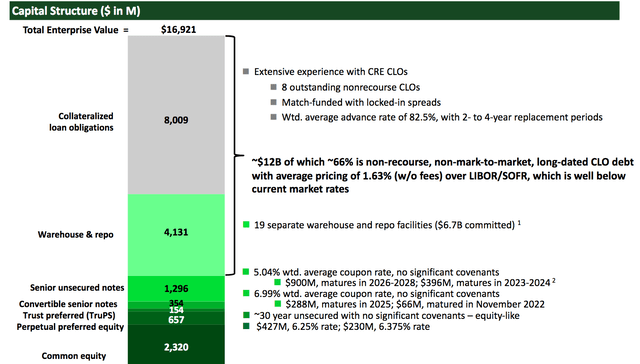

As of 10/31/22, ABR had ~$500M in cash available, and an additional ~$375M of deployable cash in its CLO vehicles.

ABR site

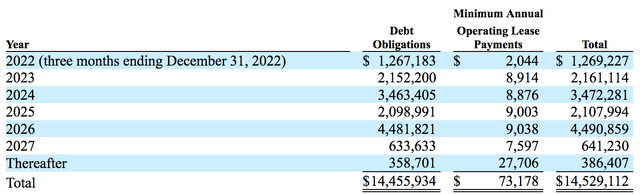

15% of ABR’s total debt is due in 2024, with 24% due in 2024.

However, ABR has good access to the capital markets, and management has continued to strengthen its funding sources in Q1-3 ’22: They closed three securitizations totaling $3.6B, increased its warehouse revolver capacity by $1.7B, and raised ~$400M through equity/debt offerings.

ABR site

Performance:

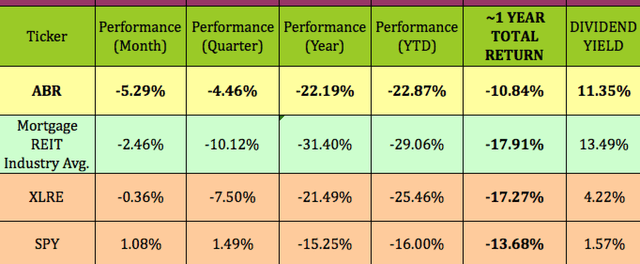

ABR has outperformed the M-REIT industry over the past quarter, year, and year to date, but has trailed the S&P over the past month, quarter, year, and year to date. However, it has outperformed the M-REIT industry, the broad Real Estate sector, and the S&P on a total return basis over the past year.

Hidden Dividend Stocks Plus

Analysts’ Targets:

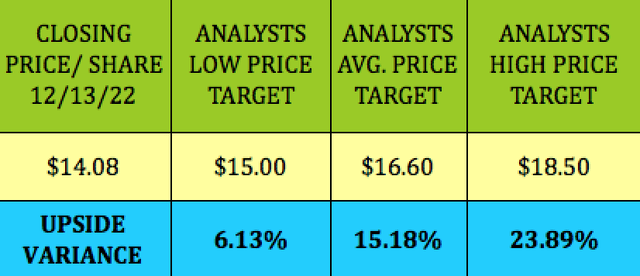

At $14.08, ABR is 6% below the street’s lowest price target of $15.00, and 15% the average $16.00 price target.

Hidden Dividend Stocks Plus

Valuations:

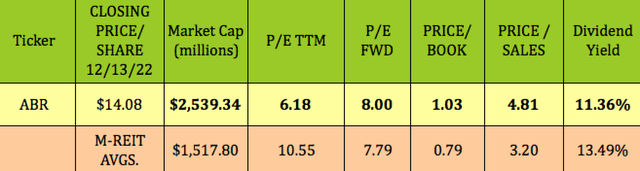

ABR’s trailing P/E is much lower than M-REIT averages, whereas its forward P/E is in line and its P/Book is a bit higher than average. As an industry leader, ABR often tends to get premium valuations vs. its peers.

Hidden Dividend Stocks Plus

Parting Thoughts:

ABR’s “overall spot net interest spreads were up to 1.86% at September 30th vs. 1.82% at June 30th, mostly due to positive effects of rising rates on our floating rate loan book.”

“97% of our balance sheet loan book is floating rate, while 88% of our debt contains variable rates, further enhancing the positive effect that interest income spreads as rates increase. In fact, all things remaining equal, a 1% increase in rates would produce approximately $0.10 a share and additional annual earnings.” (Q3 earnings call)

ABR has a long, positive history, having outperformed the NAREIT and M-REIT’s index since 2016. Additionally, insider ownership was 12% as of 9/30/22 – it’s good to see management with skin in the game.

We rate ABR a BUY.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment