maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) has an upper hand over its chief rival JD.com (JD) despite the regulatory headwinds which the company had to face. Over the past few quarters, Alibaba has been reporting better growth and margins compared to JD. Alibaba’s economic moat is also much stronger because of the different services offered by the company under a single platform. Tencent (OTCPK:TCEHY) has recently announced that it would be divesting its 17% stake in JD and distributing it to shareholders. After the divestment, Tencent’s stake in JD will fall to only 2.3%.

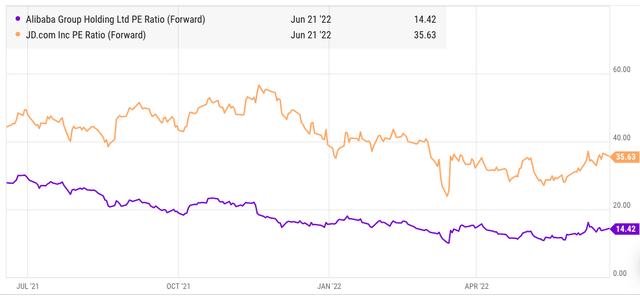

Without Tencent’s support, JD would need to invest more to gain customers and increase their loyalty. Alibaba is trading at 15 times the forward PE ratio compared to 36 for JD. Another major advantage for Alibaba is the rapid international expansion undertaken by the management. Even if Alibaba faces some regulatory issues in the home market, it could still show strong growth in cloud and international markets. This should allow Alibaba to weather any regulatory storm and gives it a better moat than JD making Alibaba stock a good long-term bet.

Alibaba at an advantage due to regulatory issues

For most of the last year, Alibaba saw its stock decline due to regulatory pressures. However, there are also some advantages to the new regulatory regime in China. Tencent is an arch-rival of Alibaba and has invested in JD, Pinduoduo (PDD), Meituan (OTCPK:MPNGF) (OTCPK:MPNGY), and other competitors of Alibaba. However, this could lead to antitrust issues against Tencent. In order to prevent this, Tencent has decided to divest its massive stake in JD and distribute it to the shareholders.

Tencent has over a billion users on its platform who use various services. JD had a close relationship with Tencent which helped it to gain access to this massive customer base. It is likely that the arrangement between Tencent and JD will change once the divestment is completed. This would be very important for Tencent if it wants to prevent big regulatory trouble in the near term.

Alibaba is going to gain from this because JD will not have the same partnership with Tencent as it had prior to the divestment. JD would now need to build a more comprehensive platform to compete with Alibaba which would require a lot of time and investment.

Fundamental performance of Alibaba

Despite the regulatory issues and the pandemic, Alibaba continues to deliver strong numbers in several categories. It has reported close to 30% growth in the delivery business. The cloud computing business is also performing very well. Alibaba’s annualized revenue rate in the cloud business is over $12 billion which is quite high considering the fact that it still receives most of the revenue from China.

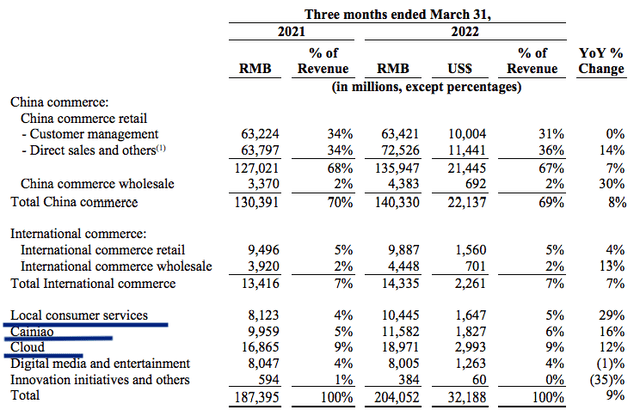

Figure 1: Alibaba’s performance in several categories has been quite strong. Source: Company Filings

We can see from the above image that Alibaba reported good YoY growth in delivery business, Cainiao, Direct sales and cloud business. This growth was despite the strong Covid lockdowns in several major cities in China. Although the overall revenue growth was in single digits, there are a number of growth drivers which can generate good business in the next few quarters.

International growth

The differentiating factor in the rivalry between Alibaba and JD will be the ability of these companies to expand internationally. International expansion not only provides an additional growth runway but also helps in diversifying the revenue base away from China. In this race, Alibaba is clearly in the lead. Alibaba’s Lazada is already one of the key players in Southeast Asia. In this region, Alibaba is looking to build an e-commerce business with GMV of $100 billion. Along with this, Alibaba is expanding in other services like gaming, cloud, payments, delivery, and others in this region.

Alibaba is also quite ahead in Europe where it is building logistics to directly supply goods from China. It has a majority stake in Trendyol which is the leading e-commerce player in Turkey and is valued at $16 billion. It is unlikely that JD will be able to replicate Alibaba in terms of international presence. If the regulators continue to create issues in China, Alibaba will be in a better position to show Wall Street that it is still growing in other international markets.

Alibaba is very cheap

While Alibaba has better fundamental growth and international presence, the stock is trading at a massive discount to JD compared to their forward PE ratio. Alibaba’s forward PE ratio is 15 while JD’s forward PE ratio is 33.

Figure 2: Comparison of forward PE ratio of Alibaba and JD. Source: YCharts

If regulatory headwinds subside, Alibaba would be in a better position due to its economic moat, cloud services, and international presence. The withdrawal of Tencent’s investment in JD and lack of a strong ecosystem like Alibaba would make it difficult for JD to deliver similar growth and margins in the near term.

It is likely that Alibaba will see lower competitive pressure from JD in the core commerce segment over the next few quarters due to Tencent’s withdrawal. This should improve the margins for Alibaba and also improve the growth runway of the company in several categories. Alibaba stock is trading at a very low multiple which does not reflect the change in competitive environment within China. The new regulations have hurt Alibaba but they have also been a big challenge for Alibaba’s rivals like JD, PDD and Tencent.

Alibaba can rely on businesses other than core e-commerce to deliver growth. These include cloud, delivery, international expansion, subscription, physical retail, and others. We could see a strong improvement in key metrics from the company over the next few quarters which should help in improving the sentiment towards the stock.

Investor takeaway

Alibaba is in a better position against JD despite the regulatory issues. There has also been some advantage of the new regulations as it could be one of the main factors behind Tencent’s divestment of its JD stake. It is likely that Tencent will end up reducing the close operational relationship with JD in order to prevent any antitrust issues. Alibaba is expanding rapidly in Southeast Asia and Europe. This international expansion will shield the company against some of the regulatory headwinds in the future.

Despite these advantages, Alibaba stock is at a massive discount compared to JD. As the regulatory issues reduce over the next few quarters, we could see strong progress in Alibaba stock making it a good long-term bet.

Be the first to comment