Alexyz3d/iStock via Getty Images

Shares of Aerojet Rocketdyne (NYSE:AJRD) have lost significantly after the company released its Q2 2022 results, which produced misses on the top and bottom lines. In this investor report, I will analyze the earnings and management comment to see where the sharp earnings miss is coming from.

Aerojet Rocketdyne: Standard Missile Program Pressures Revenues

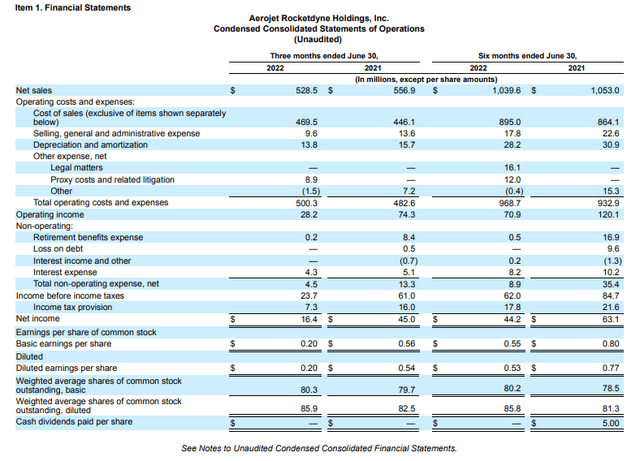

Aerojet Rocketdyne results (Aerojet Rocketdyne )

Second quarter revenues came in at $528.5 million, marking a 5% decline compared to last year and missing the consensus by $41.5 million. The miss was partially caused by a reversal of Standard Missile revenues in the amount of $16 million as was required by the decision of Aerojet Rocketdyne to increase its Standard Missile production capacity. This brought the existing contract to a loss position and triggered accounting mechanisms that require reversal of revenues and profits. So, around 40% of the miss can be attributed to the Standard Missile program. Additionally, there were continued supply chain issues on the Standard Missile program. For the RS-25 rocket engine for which Aerojet Rocketdyne is restarting production and going through the audit, delays related to first article qualification testing reduced sales as revenues are recognized as work progresses. So, less progress equals less recognized sales. What also should be kept in mind is that in the same quarter last year, there were favorable adjustments in the amount of $25.7 million.

Operating income declined by 62% or $46.1 million and $37.3 million on the EBIT level, driven by a negative $53.5 million swing in adjustments, bringing a $0.26 headwind to earnings per share while last year there was a $0.22 tailwind. That’s where the numbers become interesting as Aerojet Rocketdyne produced a $0.27 miss on EPS. You could say that most of the miss was produced by the unfavorable adjustments on the Standard Missile program. Excluding these items EBITDAP margins would have actually increased from 12% to 13%. So I would say that the underlying performance actually was good, also given that the offset from the Standard Missile program did not only account for supply chain issues but also prepared for higher production to meet demand and actually finish the existing contract 6 months before the initial completion date.

Aerojet Rocketdyne Positions For The Future

Aerojet Rocketdyne is actually positioning for the future. The company has had some challenges after the acquisition by Lockheed Martin was called off and it’s now facing the realities of supply chain issues faced across the aerospace industry, but it’s also forward looking as it invested in the Standard Missile program for future returns in 2024 and 2025 when quantity increases are expected. The company is currently looking to hire 400 employees to support defense growth and we’re also seeing involvement on some important defense platforms such as two hypersonic programs, the Next Generation Interceptor, Stinger missiles, Javelin missiles, the Patriot missiles and in Space with the Artemis program and I would say that with the current state of affairs regarding defense and space Aerojet Rocketdyne is positioned rather well.

Going forward the watch item will be cost escalation on fixed cost contracts which cover 55% of Aerojet’s contracts and force the company to absorb cost hikes into the next round of annual and multi-year buys, but for the current round of fixed price buys and cost-plus-fee contracts covering the remaining 45% there is not much risk. That’s something that will provide some modest pressure in the upcoming years.

Conclusion: Sell Off of Aerojet Rocketdyne Stock Was Overdone

It’s indeed true that Aerojet Rocketdyne saw some delays that triggered costs and produced a wide miss on the earnings level. However, embedded in that miss is the investment for the future almost completely covering the miss. Additionally, there could be some favorable adjustments in the back half of the year as adjustments tend to be favorable by around $10 million to $40 million per quarter and there has been around $32 million in unfavorable adjustments in the first six months ended June. So, there’s some prospect on favorable adjustments in the second half of the year. That combined with the exposure to hypersonics, Patriot and Space programs where the world is trying to arm against Russian aggression and remove Russian dependency positions Aerojet Rocketdyne in an almost superior space.

Be the first to comment