Wolterk

By The Valuentum Team

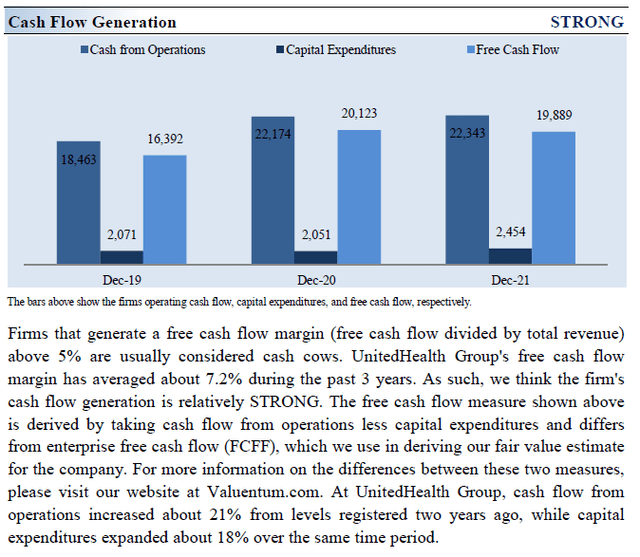

There is a whole lot to like about UnitedHealth Group (NYSE:UNH) as the largest insurance provider in the US with two primary business platforms: ‘UnitedHealthcare’ (provides health benefits) and ‘Optum’ (for health services). The company’s Optum businesses have been a source of strength in recent years, and we expect strong expansion to continue. From 2018 to 2020, UnitedHealth’s annual free cash flows averaged ~$16.7 billion while its annual run-rate dividend obligations stood at ~$4.6 billion in 2020. UnitedHealth’s Dividend Cushion ratio is impressive, and we expect the firm will push through aggressive annual dividend increases over the coming years. Shares of UnitedHealth yield ~1.1% at the time of this writing, and the company has a Dividend Cushion ratio of 3.4.

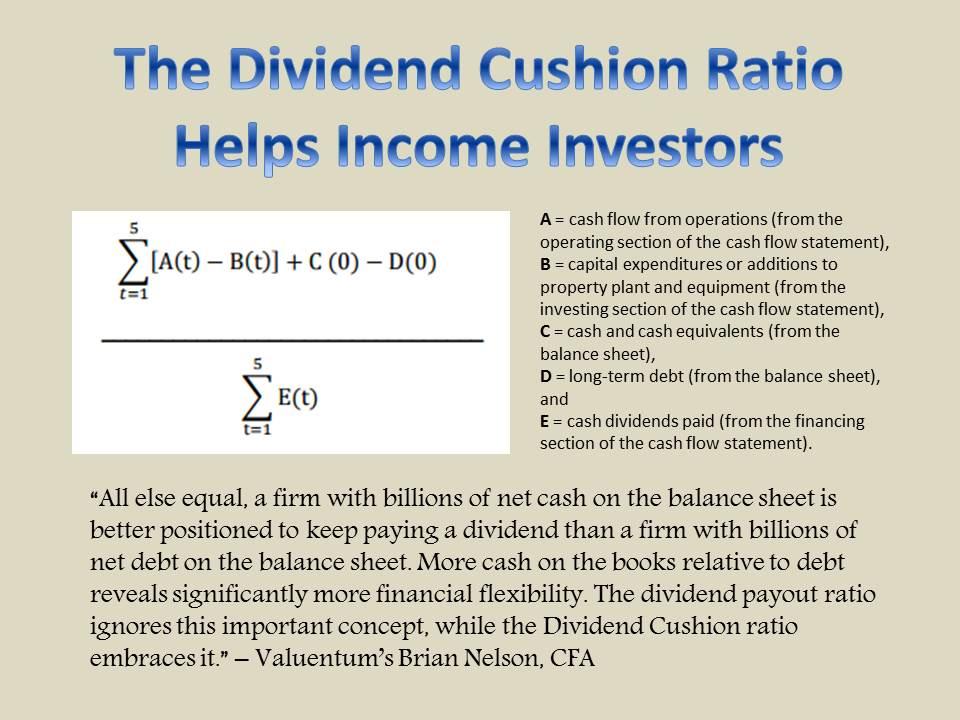

Image Source: Valuentum. The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free cash flow based and forward-looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at ~90%.

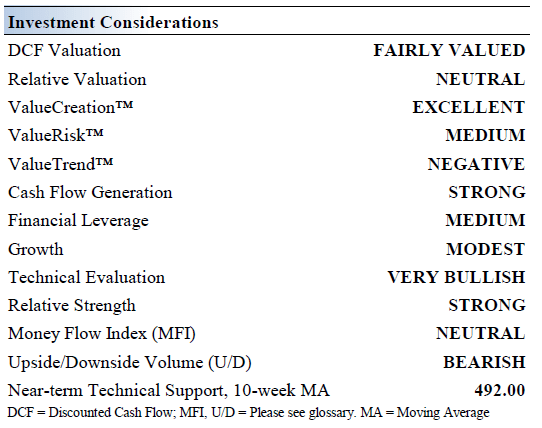

UnitedHealth Group’s Key Investment Considerations

Image Source: Valuentum

UnitedHealth Group is a diversified healthcare and well-being company, and the firm provides health care benefits to a wide range of customers in an array of markets. Its two business platforms operate through four segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. The company was founded in 1974 and is headquartered in Minnesota.

The firm’s UnitedHealthcare segment can be broken down into four operating divisions: Employer & Individual, Medicare & Retirement, Community & State, and Global. UnitedHealth is the largest health insurance provider in the US.

Though UnitedHealth Group is a behemoth, it is not without its fair share of competition, which in its case comes from a variety of sources. Managed health care companies, insurance companies, HMOs, TPAs, PBMs, and business services outsourcing companies all provide similar services to any one of its businesses. The firm’s significant scale is an advantage.

UnitedHealth Group adeptly navigated the headwinds created by the COVID-19 pandemic while maintaining its free cash flow cow status. The company is quite shareholder friendly, and its capital allocation priorities include utilizing a combination of dividend increases and share buybacks to return cash to shareholders.

The company’s Optum businesses, which focus on improving the healthcare system itself, have been performing extremely well of late. The firm was sued by the US DoJ over alleged Medicare overcharges, but most of those charges were dropped in 2018.

UnitedHealth’s Latest Quarterly Earnings Analysis

On July 15, UnitedHealth Group reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. The health care giant also boosted its non-GAAP adjusted EPS guidance to $21.40-$21.90 for 2022, up from $21.20-$21.70 previously, in conjunction with its second quarter earnings update. Please note that this is the second time UnitedHealth Group has increased its earnings guidance for 2022 (it also boosted its full-year forecasts back in April 2022), and we appreciate management’s confidence in UnitedHealth Group’s near-term outlook.

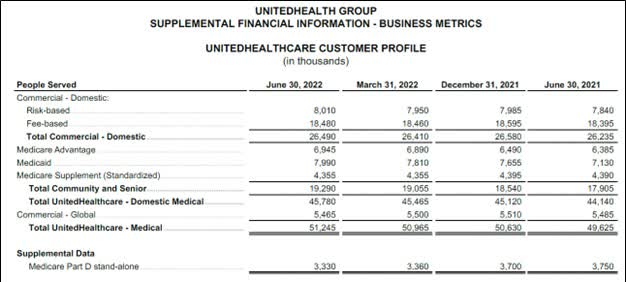

As of the second quarter of 2022, UnitedHealth Group’s enormous health care insurance business (run by its UnitedHealthcare division) catered to 51+ million customers along with an additional 3+ million customers via the standalone Medicare Part D plans. On a year-over-year basis, UnitedHealthcare’s customer base (excluding its standalone Medicare Part D plans) grew ~1.6 million in the second quarter, though the customer base of its standalone Medicare Part D plans declined moderately during this period.

The company’s health insurance operations are backed up by its longstanding relationships with all types of entities across the health care landscape, including its own health care service provider operations, its sheer scale in the industry, and its financial firepower. In our view, it would be incredibly difficult for any company to replicate this kind of reach, highlighting why we view UnitedHealth Group as having moaty business characteristics, one with ample pricing power.

Image Shown: UnitedHealth Group’s health care insurance business, run by its UnitedHealthcare division, continues to grow its core customer base. (Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release)

UnitedHealth Group’s health care service provider business is run by its Optum division which includes its ‘Optum Health,’ ‘Optum Insight,’ and ‘OptumRx’ segments. This part of its business offers a wide variety of offerings through its urgent care centers, pharmacy benefits managers (‘PBMs’), specialty pharmacy operations, ambulatory care systems, virtual health care delivery systems, and much more. Additionally, Optum provides analytical, research, and consulting services along with related technology offerings to entities operating within the health care sector that aim to improve patient outcomes, support administrative activities, and for various other purposes.

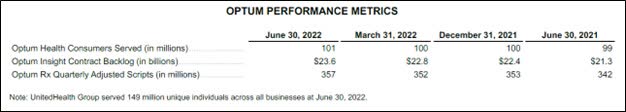

In the second quarter of 2022, Optum Health served 101 million customers (up 2 million year-over-year), Optum Insight’s contract backlog stood at $23.6 billion (up $2.3 billion year-over-year), and OptumRx filled 357 million scripts on an adjusted basis (up 15 million year-over-year). We appreciate that UnitedHealth Group has been doing great of late, and demand for its offerings remains robust.

Image Shown: UnitedHealth Group’s Optum division is steadily meeting the health care needs of a greater number of consumers. (Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release)

By integrating its health care insurance operations with its health care service provider operations, UnitedHealth Group aims to generate substantial synergies across its portfolio. These synergies seek to reduce costs, integrate health care activities across multiple entities, and improve patient outcomes. Here, we will stress once again that these operations would be incredibly difficult for a competitor to replicate.

UnitedHealth Group is continuously searching for more effective ways of providing health care-related services. During the second quarter of 2022, UnitedHealth’s medical care ratio – health care costs divided by health care premiums – stood at 81.5%, down from 82.8% in the same period last year (a lower medical care ratio is a positive for UnitedHealth Group).

Putting it all together, UnitedHealth Group’s GAAP revenues grew 13% year-over-year to reach $80.3 billion in the second quarter of 2022 due to solid growth at both its UnitedHealth and Optum divisions. Its GAAP operating income climbed higher 19% year-over-year to reach $7.1 billion as UnitedHealth Group benefited from revenue growth, economics of scale, and meaningful improvements in profitability at its UnitedHealthcare division.

Its non-GAAP adjusted diluted EPS came in at $5.57 in the second quarter, up from $4.70 in the same period in 2021, as UnitedHealth Group benefited from strong net income growth and a reduction in its diluted outstanding weighted-average share count on a year-over-year basis.

The company generated $11.0 billion in free cash flow during the first half of 2022 while spending $2.9 billion covering its dividend obligations and another $5.0 billion buying back its stock. We are enormous fans of UnitedHealth Group’s stable cash flow profile. Additionally, UnitedHealth Group is very shareholder friendly.

UnitedHealth Group’s Economic Profit Analysis

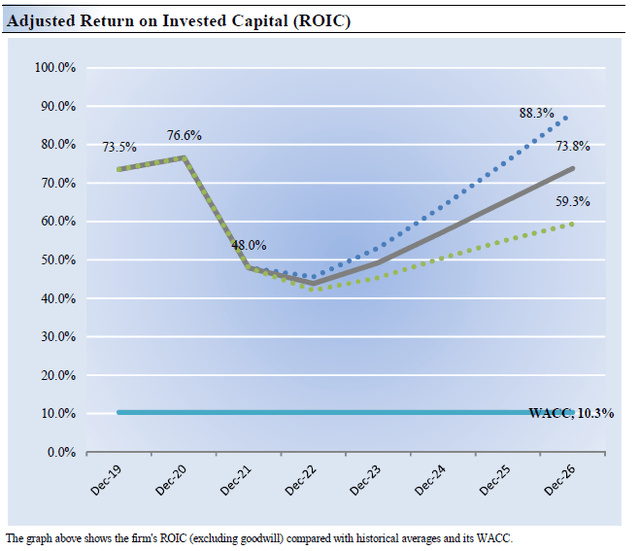

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. UnitedHealth’s 3-year historical return on invested capital (without goodwill) is 66%, which is above the estimate of its cost of capital of 10.3%.

As such, we assign UnitedHealth a ValueCreation rating of excellent. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. UnitedHealth is a fantastic economic-profit generator.

UnitedHealth Group’s Cash Flow Valuation Analysis

At the end of June 2022, UnitedHealth Group had $70.4 billion in cash, cash equivalents, and long-term investments on hand versus $51.4 billion in total debt (inclusive of short-term debt) on the books. Its fortress-like balance sheet, stellar free cash flow generating abilities, and dividend growth track record (its quarterly dividend more than tripled from June 2015 to June 2022 on a per share basis after management increased the firm’s payout 14% on a sequential basis in June 2022) underpin our expectations that UnitedHealth Group will push through substantial payout increases going forward.

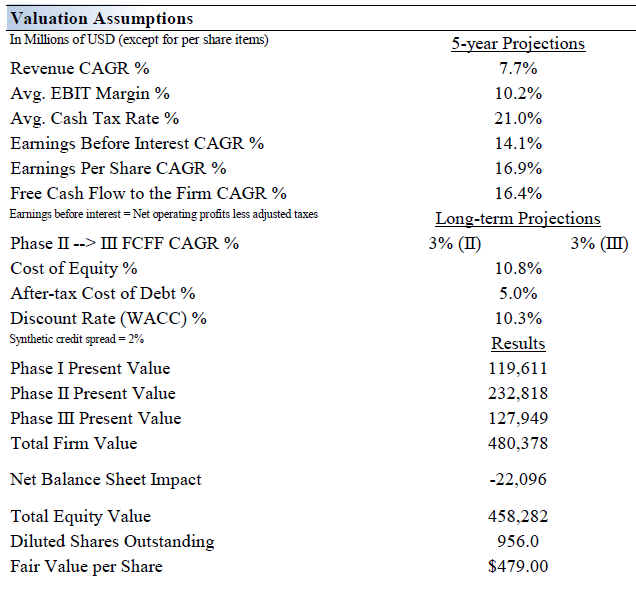

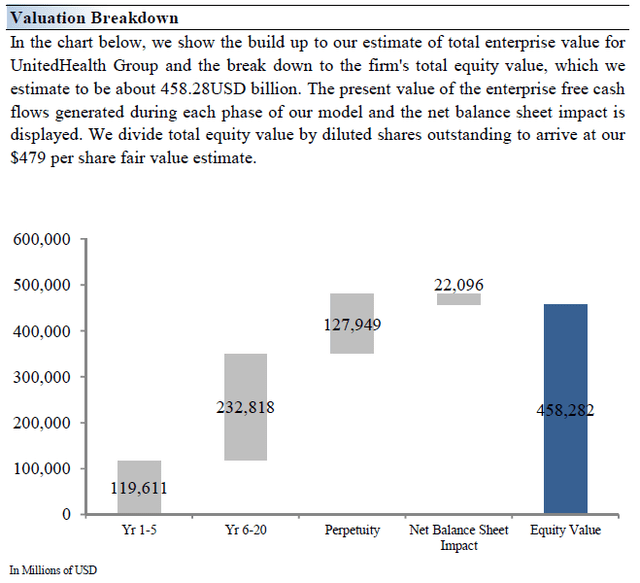

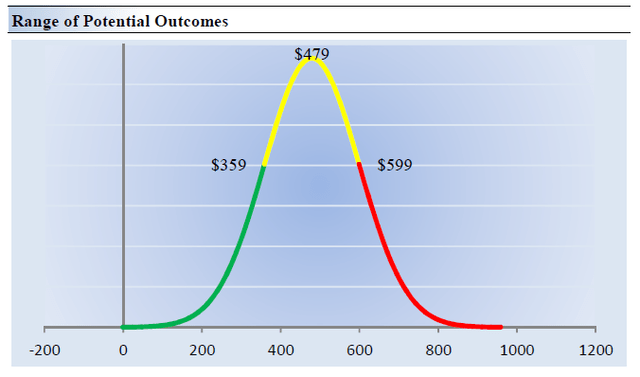

We think the company is worth $479 per share with a fair value range of $359.00 – $599.00. The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance.

Our valuation model reflects a compound annual revenue growth rate of 7.7% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 8.3%. Our model reflects a 5-year projected average operating margin of 10.2%, which is above UnitedHealth Group’s trailing 3-year average.

Beyond year 5, we assume free cash flow will grow at an annual rate of 3% for the next 15 years and 3% in perpetuity. For UnitedHealth Group, we use a 10.3% weighted average cost of capital to discount future free cash flows, which is a bit elevated relative to other companies in our coverage, but reasonable, in our view.

Image Source: Valuentum Image Source: Valuentum

UnitedHealth Group’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate UnitedHealth’s fair value at about $479 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct. This is a key part of our book Value Trap: Theory of Universal Valuation.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for UnitedHealth Group. We think the firm is attractive below $359 per share (the green line), but quite expensive above $599 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

UnitedHealth is in the process of acquiring Change Healthcare Inc. (CHNG) through a ~$13 billion deal that has faced sizable regulatory headwinds (the merger agreement was extended to the end of this year). This deal aims to bolster UnitedHealth Group’s billing and payment solutions operations, though the acquisition may ultimately not end up going through.

Additionally, UnitedHealth Group is working on acquiring LHC Group, Inc. (LHCG) through a ~$5.4 billion deal that would improve its ability to provide in-home health care services. Through its Optum UK unit, UnitedHealth Group is also working on acquiring UK-listed EMIS Group Plc for approximately GBP£1.2 billion (~USD$1.5 billion), which provides software, services, and technology used in the health care sector.

These deals, if completed, will not significantly weaken UnitedHealth Group’s financial health given its large net cash position on hand at the end of June 2022. UnitedHealth Group is a highly acquisitive entity, though it possesses the ability to quickly rebuild its balance sheet if needed given its strong free cash flows.

As UnitedHealth’s impressive Dividend Cushion ratio suggests, finding cracks in its dividend profile is not easy. Acquisitions will remain an important part of the company’s growth strategy, as it continues to scoop up assets (selection and overpayment risk are high). However, we are pleased with UnitedHealth’s deal-making in light of portfolio benefits and strong incremental free cash flow generation. UnitedHealth’s shares are hard not to like, and we could see shares surge to the high end of our fair value estimate range ($599 per share).

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment