solarseven/iStock via Getty Images

Overview

D-Wave Quantum Inc. (NYSE:QBTS) is a quantum computing company. Focused primarily on building quantum computers in of themselves, it also offers software services and cloud infrastructure that leverages its hardware offering.

D-Wave was an early entrant to the quantum computing space that was founded in 1999. The firm constructs both types of quantum machine that exist today: gate-model and annealing quantum computers. Gate-model quantum machines are more prevalent and have been built in-house at multiple high-profile technology enterprises such as IBM. Annealing quantum computers are significantly more rare. While both ultimately leverage the same quantum principles, the way that they render logic is distinct. Notably, D-Wave brands itself as the only company producing both types of quantum computers at present.

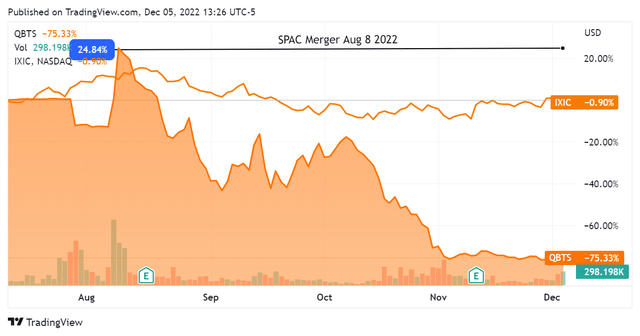

D-Wave entered the public markets this past summer, in Q2 2022, via SPAC. Merging with DPCM Capital before rebranding and henceforth trading under its current name, D-Wave has exhibited a very high beta this year and has significantly underperformed the NASDAQ Composite to date:

SeekingAlpha.com QBITS 12.5.22

While trading as high as $12.44 on the day of its SPAC merger, D-Wave has since depreciated to $2.44 as of this article. The company is seeing significant activity in today’s trading day, with a gain of 14.5%. This article will evaluate what may be driving this short-term activity as well as the company’s fundamental position to determine if it is worth investing in.

Financials

D-Wave is undoubtedly an early-stage growth stock, and its revenue picture immediately drives home this point: the company is producing less than $2M revenue quarterly. It also appears to have hit $1.7M in Q1 2022 before dipping down to $1.4 in the subsequent quarter, then returning to its Q1 2022 level of performance in Q3 2022.

Since this company is clearly very early in its growth cycle, we aren’t able to establish a reliable trendline and won’t read too far into these revenue figures. The astute investor should nevertheless be aware of just how small this firm’s financial footprint is at this time.

SeekingAlpha.com QBITS 12.5.22

Looking further into the firm’s operating picture, we see an ongoing and increasing operating loss. Interestingly, the company appears to be putting its foot on the gas in terms of Selling/G&A Expenses. This could indicate that it is now more actively trying to saturate its market and scale its revenues. Overall, D-Wave’s operating cycle lost it 9 dollars for every 1 dollar of revenue that it brought in last quarter.

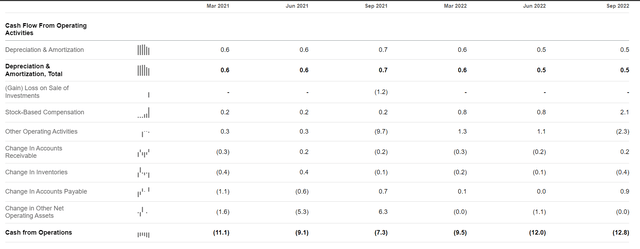

SeekingAlpha.com QBITS 12.5.22

The company’s operating picture from a cash perspective is not materially different, although the core operating loss is somewhat smaller due to the ongoing increases in its non-operating expenses.

Something that stands out from this would be the company’s relatively small issuance of stock-based compensation. Oftentimes technology entities at this point in their lifespan are issuing shares at a much brisker clip – and giving investors a haircut in the process. D-Wave appears to be displaying discipline in this regard, although notably the stock-based comp also ticked up to a record high this past quarter. This metric will be worth watching as it evolves.

Additionally, the company has drawn down inventories for every quarter but one for the last six quarters – it is moving (quantum) product out the door. This adds an element of momentum to its otherwise miniscule revenue base.

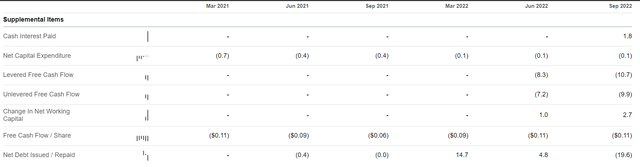

SeekingAlpha.com QBITS 12.5.22

The overall cash picture is interesting and reflective of this company’s early-stage nature. The firm has not paid any cash towards interest service until this recent quarter – where it paid $100K more than its revenues in cash interest. The free cash flow per share metrics are unsurprisingly negative, but not altogether terrible either.

SeekingAlpha.com QBITS 12.5.22

The picture that is forming here is of a company that has not yet achieved revenue traction, profitability, or anything close to cash flow positive operations. This is overall to be expected with a company of this nature; the question before us now is whether it has the balance sheet to see itself through this portion of the growth curve.

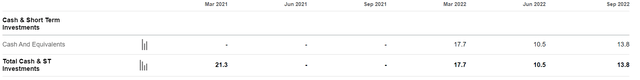

D-Wave had $13.8M cash & cash equivalents on hand as of Q3 2022.

SeekingAlpha.com QBITS 12.5.22

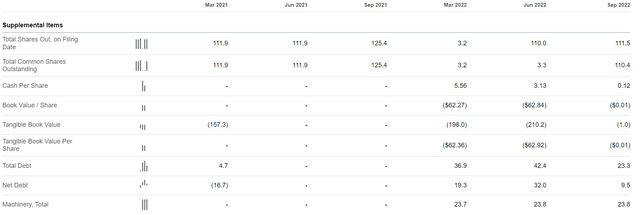

Its debt structure is not particularly indexed towards the short term, and it appears to be managing down its current liabilities well – note the significant decrease in this metric over the last 3 quarters.

SeekingAlpha.com QBITS 12.5.22

Broadening our scope to include both short and long-term liabilities, I am pleasantly surprised to see that the company has actually reduced its total debt and its net debt significantly.

The other metric that stands out here is tangible book value. This is of course a concern for value investors. While often a difficult metric to analyze in the context of technology companies, D-Wave’s statements are amenable to this as it is a company building and selling hardware. The firm has brought itself to a significantly better position as to tangible book value, going from roughly negative $200M over the first half of 2022 to only -$1M this past quarter. At this rate the firm may have a positive tangible book value as of next quarter – providing investors with a quantifiable margin of safety no matter the prospects of the business at hand. This is indeed also reflected in the tangible book value per share, which is also showing a significant increase in hard value.

SeekingAlpha.com QBITS 12.5.22

Proceeding to core share metrics, we see the firm’s significant uptick in tangible book value represented in the rapidly increasing value of its common equity. Assets minus liabilities equals equity, and this company just got itself a lot closer to zero – and fast. I like what I am seeing here.

SeekingAlpha.com QBITS 12.5.22

Conclusion

D-Wave Quantum Inc. is at a very interesting inflection point. It is still posting very small revenues, but is expending capital for sales and marketing at an increasing rate. This is occurring in conjunction with a greatly increased tangible book value that is nevertheless coming in at zero. What I see here is a high technology hardware company that is beginning to saturate its market while having tangible assets on hand to provide investors with a floor to its valuation. Additionally, it doesn’t appear to be overdoing it with share-based compensation.

If D-Wave can begin to scale revenues while increasing its inventories, its valuation from a value perspective is going to start looking a lot better quite soon. This stock appears high-profile enough to then subsequently experience appreciation in the market. I am inclined to be optimistic as to its ability to scale revenues due to the marquee customers that it has signed to-date, including Volkswagen, Lockheed Martin, and Accenture. I am calling D-Wave Quantum Inc. a buy.

Be the first to comment