Althom/iStock Editorial via Getty Images

Ever since adding Ford Motor Company (NYSE:F) stock to the model value portfolio at Leads From Gurus last year, I have never had to look back despite substantial volatility in its stock price. Ford has continued to make progress with its electrification strategy despite a few setbacks, which is encouraging. Until the dawn of 2022, Europe, China, and other markets dominated the EV industry, which I attribute to the lack of EV truck availability in the United States (Americans love trucks which is evident by how trucks and SUVs have dominated the top-selling list of vehicles in the U.S. for over four decades). Ford’s September sales print may not be as encouraging as investors hoped for, which calls for a reassessment of company prospects to determine whether Ford is still an attractive bet for investors looking to make the most of opportunities available in the EV space.

How Were Ford’s Truck Sales in September?

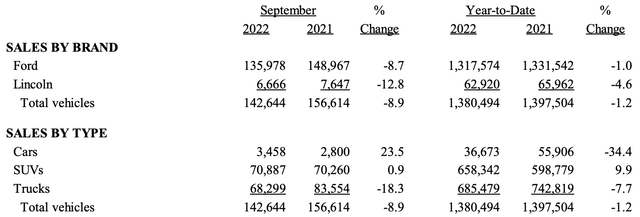

Ford Motor Company recently announced that its third-quarter sales increased by about 16% year-over-year, with strong demand for new vehicles in the United States in September. However, due to supply shortages, sales were down 4% sequentially and the company sold 142,644 vehicles in the U.S. last month, an 8.9% decrease from the previous year. Parts shortages impacted approximately 40,000 to 45,000 vehicles, primarily high-margin trucks and SUVs, which were unable to reach dealers. Sales of all Ford vehicles in the U.S., including its luxury Lincoln brand, totaled close to 1.38 million units in the first nine months of the year, a 1.2% YoY decrease. For the sixth month in a row, pre-orders accounted for more than half of Ford’s retail sales. ‘23MY vehicle demand is up 244%, with retail orders rapidly increasing to 197,000.

Exhibit 1: Ford vehicle sales by brand and type

September sales release

Source: September sales release

Sales of F-Series pickups were down 27% YoY in September, contributing to a 13% drop through the third quarter. However, with 467,307 vehicles sold, the F-Series remains America’s best-selling truck. Bronco SUV sales increased by 221% driven by previously placed orders. Ford electric vehicle sales, on the other hand, continue to outpace all other vehicle categories, with sales up 197.3% to more than 41,200 units through September. The Mustang Mach-E crossovers account for the majority of those sales, which have increased 49% YoY to more than 28,000 units and are turning in just 10 days on dealer lots. Furthermore, the company sold 8,760 units of its all-electric F-150 Lightning from June to September this year, including 1,918 vehicles last month. The F-150 Lightning is one of Ford’s fastest-selling vehicles on dealer lots, with an average turn time of eight days. Through September, Ford hybrid vehicle sales totaled 74,046 units, a 22.6% increase over the previous year.

What is Ford’s Business Outlook?

The market is concerned that rising interest rates and supply chain issues will cause automakers to lose steam in the coming quarters. In the third quarter, Ford reported an additional $1 billion in unexpected supplier costs, which weighed on its profitability. On October 26, the company reported a loss of $827 million for the third quarter, and the automaker narrowly topped analyst expectations for revenue, reporting $37.2 billion in revenue against expectations for revenue of $36.25 billion. The company had already warned about slower growth in the third quarter due to supply shortages, which have resulted in a higher-than-expected number of vehicles waiting for critical components at Ford’s manufacturing plants. The company anticipates that the production of these vehicles will be completed and sold to dealers in the fourth quarter. The September quarter was difficult for the entire automobile industry. Nonetheless, Ford has maintained its previous guidance of adjusted EBIT between $11.5 and $12.5 billion in 2022.

Ford’s F-series trucks have been the most popular truck in the United States for 45 years in a row, and the company has already introduced an EV version of this truck, which is selling well. Ford is trying to catch up with Tesla Inc. (TSLA), the leader in the electric vehicle industry, with record EV sales in September aided by sales of the F-150 Lightning. Tesla, on the other hand, sold fewer vehicles than expected in the third quarter due to logistical issues.

Ford plans to reach 600,000 EV unit capacity by the end of next year, increasing to two million by 2026, and is securing deals for critical battery minerals with suppliers such as CATL to ensure the company meets its targets. The company recently announced new dealer agreements to promote sales of its electric vehicles by focusing on cost reduction as well. Dealerships must also install chargers under the new policies. Because 96% of the U.S. population lives within 20 miles of a Ford dealer, and 85% of Americans live within ten miles, installing fast chargers at dealerships appears to be an effective strategy to lure EV buyers into Ford brands. Model e (Ford’s battery electric vehicle) dealerships’ future is built on five pillars and charging stations, transparency, and non-negotiable pricing is critical to the success of this new model. Ford dealers who want to sell Ford-branded EVs must be certified in one of two ways: Model e Certified or Model e Certified Elite. The new standards would necessitate a significant dealer investment, and dealers have until October 31 to decide whether to invest in one of two “certified” EV tiers to participate in Ford’s Model e business. Only dealers who invest will be able to sell EVs beginning January 1, 2024.

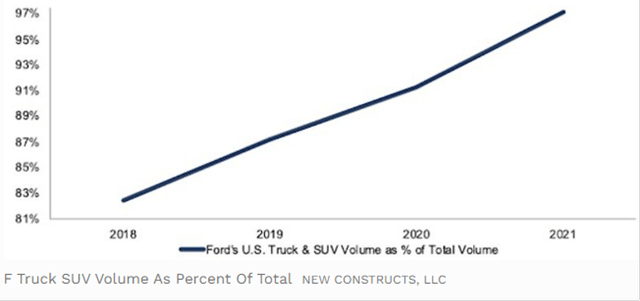

Ford’s U.S. business is now almost entirely comprised of truck and SUV sales. According to the IEA, SUV sales continue to rise in several countries, including the United States, India, and Europe. The growing consumer preference for SUVs resulted in a 10% increase in global SUV sales between 2020 and 2021 and the global fleet of SUVs has increased from less than 50 million in 2010 to around 320 million in 2021. According to Forbes, the percentage of wholesale trucks and SUVs sold in the United States increased from 82% in 2018 to 97% in 2021.

Exhibit 2: Ford’s U.S. Truck & SUV Volume as Percent of Total Wholesale Volume: 2018 – 2021

Forbes

Source: Forbes

However, according to the IEA, more than 98% of SUVs on the roads today still use internal combustion engines. This means that electric SUVs will be in high demand and have a large market opportunity to penetrate in the future as policymakers focus on achieving ambitious climate change goals. SUVs accounted for approximately 55% of all electric vehicle models in the market in 2021, up from 45% two years ago. Given the enormous market opportunity, Ford launched an all-electric SUV in the Mustang Mach-E family three years ago. The model is still in high demand with 2,324 vehicles sold in September, a 47% increase YoY, bringing the total units sold in 2022 to 28,089.

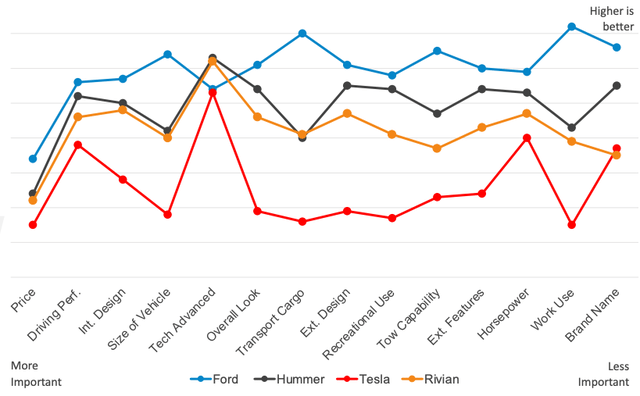

Ford’s market share in the U.S. truck market increased from 21% in 2018 to 25% in 2021. According to a Cox Automotive survey, nearly two out of every five consumers looking for a pickup truck in the next two years are considering an electric pickup truck. The study also reveals that 75% of electric truck customers prefer Ford F-150 Lightning.

Exhibit 3: Ford leads the way in many performance attributes

Cox Automotive

Source: Cox Automotive

Although Ford is facing many headwinds today, the company seems to be moving in the right direction with its electrification strategy. Consumers, as highlighted in this segment, seem to approve of the performance, design, and price of newly launched Ford EVs, which is an encouraging sign as the company’s future is strongly tied to the success of its electric vehicle segment.

Is Ford Stock a Buy, Sell, or Hold?

Ford stock is down 40% this year amid supply shortages, rising interest rates, and broad market negativity. The company, however, has a strong balance sheet and has raised its full-year adjusted free cash flow forecast to between $9.5 billion and $10 billion, up from $5.5 billion to $6.5 billion. To save costs, Ford is shutting down Argo AI, an autonomous vehicle startup, to focus on the internal development of L2+/L3 advanced driver-assist systems. Argo AI focused on the development of Level 4 ADAS technology, and the company claims that “fully autonomous vehicles at scale are a long way off” and that the company does not need to develop this technology in-house.

Ford has also pivoted from low-margin vehicle sales to high-margin vehicles in recent years and has aggressively invested in building a highly successful EV portfolio, recording triple-digit sales and becoming America’s No. 2 EV brand. The company is expanding its production capacity and plans to invest $5.6 billion in the Blue Oval City facility in Tennessee, which will manufacture F-Series EVs and batteries. The company is well-positioned to enjoy significant competitive advantages due to its large manufacturing and distribution networks.

To address the chip shortage, Ford is collaborating with GlobalFoundries (GFS) to design extra chips for Ford’s current vehicle lineup. Ford hopes to become less reliant on Taiwan Semiconductor Manufacturing Company (TSM) through this collaboration. On November 18, 2021, Ford announced a partnership with GlobalFoundries to meet the growing demand for semiconductors in the automotive industry. Both companies intend to work on designing custom-made chips that will power electric vehicles, autonomous driving systems, and other future technologies in the future.

Ford is moving in the right direction to create long-term wealth for shareholders, but in the short run, investors will have to stomach increased volatility in stock prices resulting from lackluster earnings growth in the coming quarters. Ford, at a forward earnings multiple below 7x, is still valued like a traditional automaker – not as a company with a high chance of dominating the U.S. EV industry in the long run. This makes Ford stock an attractive bet for growth investors.

Be the first to comment