Mongkol Onnuan

Thesis

Leading single-tenant Industrial REIT STAG Industrial, Inc. (NYSE:STAG) saw its stock stage a post-earning surge last week as it reported its Q3 earnings release.

STAG Industrial’s earnings report corroborated our view that the REIT has continued to see strong underlying operating performance as same-store cash NOI grew 5.6% YoY, despite tough comps amid worsening macroeconomic conditions.

As such, it proved the stability of STAG’s high-quality tenant base as renewal activities remained robust in Q3. Notwithstanding, STAG lowered its acquisition volume for FY22, given the volatility caused by the Fed’s aggressive rate hikes. As a result, investors should expect near-term headwinds on its revenue growth from FY23, which will likely affect its AFFO growth cadence.

Despite that, the company believes it is well-positioned to overcome these headwinds, as its liquidity position remains strongly configured to capitalize on these investment opportunities when the volatility in the market subsequently stabilizes. Hence, we deduce that there could be upside surprises to the consensus estimates from the current levels, depending on the forward outlook from the upcoming November FOMC this week.

Hence, we expect near-term volatility to continue for STAG as investors focus on the Fed’s guidance moving ahead. Despite that, we believe the reward/risk seems favorable from these levels, even though STAG is not undervalued.

As such, we reiterate our Buy rating on STAG but urge investors to layer in as the market could decide to digest last week’s post-earnings surge before consolidating.

The Fed’s Aggressive Hikes Impacted Its Acquisition Cadence

Management markedly lowered its FY22 acquisitions outlook in its Q3 call, as it expected the “price discovery” phase between the buyers and sellers to continue. In addition, the Fed’s unprecedented rate hikes have certainly impeded the appetite for deals in the near term as 10Y yields surged to 4.34% at their October highs (current: 4.03%).

Management also highlighted the challenges with the Fed’s rate hikes, as CEO Crooker accentuated:

So typically, there’s a 6- to 9-month lag with a material increase in rates to where it starts to impact cap rates. Part of the lag is you’ve got 1031 buyers that are in the market that hold the pricing up for a period of time. It’s a little different from now because a lot of the 1031 buyers are gone. They’re already through their capital. And I think sellers are understanding where the market has changed. So what I think is going to open up the market is the Fed saying where they’re going to stop raising rates, and then that will help the banks lend a little bit more, and then that should up the market. (STAG Industrial FQ3’22 earnings call)

We assess that the company prudently lowered its acquisition volume guidance for FY22 to reflect these near-term uncertainties. Notably, STAG Industrial posted a YTD acquisition volume of $459M in FQ3.

The updated guidance saw the company reined in its guidance to $492.5M (midpoint), with the low end of the range indicating effectively zero acquisitions for Q4. It also lowered its acquisition cap rates guidance to 5.3% (midpoint), in line with Q3’s cash cap rates.

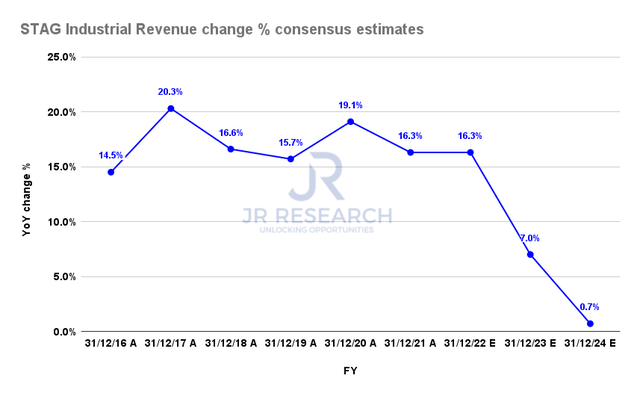

STAG Industrial Revenue change % consensus estimates (S&P Cap IQ)

Therefore, the consensus estimates (bullish) have also been revised markedly through FY24. As seen above, Street analysts projected a 7% growth in revenue in FY23 and just 0.7% growth in FY24. It was down markedly from the previous projections in September.

As such, we believe that Wall Street has lowered their expectations sufficiently for STAG Industrial to potentially surprise to the upside if the FOMC doesn’t move to break the current market expectations of a peak in Fed Fund rates (FFR) of 5% by Q1/early Q2’23.

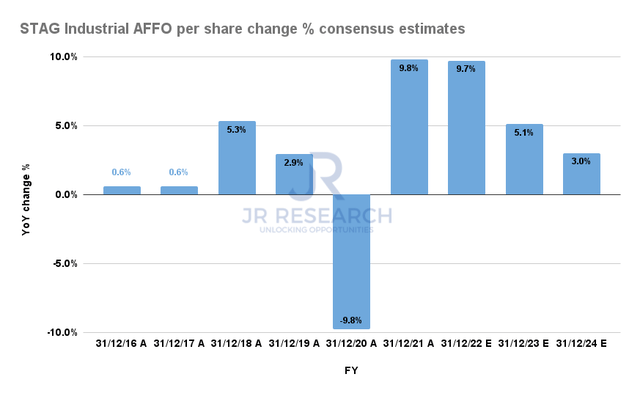

STAG Industrial AFFO per share change % consensus estimates (S&P Cap IQ)

Accordingly, STAG Industrial’s AFFO per share estimates have also been lowered markedly, with FY23’s increase penciled in at the 5% mark. Hence, investors should watch the Fed’s commentary this week, as we believe the market has likely priced in peak Fed’s hawkishness unless Powell and team decide otherwise.

Is STAG Stock A Buy, Sell, Or Hold?

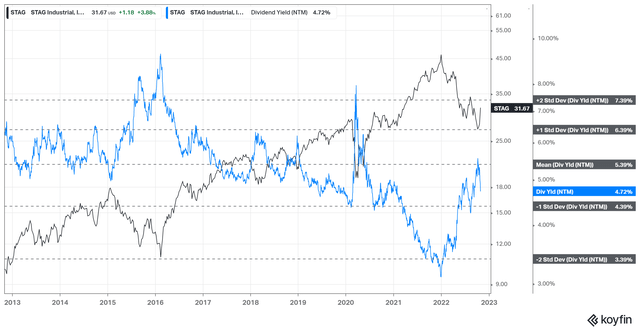

STAG NTM Dividend yields % valuation trend (koyfin)

With an NTM dividend yield of 4.72%, it’s still below its 10Y mean of 5.4%. Therefore, we assess that STAG is not undervalued relative to its historical averages.

STAG’s NTM AFFO per share multiple of 15.8x trades at a slight discount against its 10Y mean of 16.1x. So, again, nothing overly exciting here. Furthermore, it’s also in line with its peers’ average of 15.7x. Therefore, we didn’t discern any significant undervaluation advantage that we need to point out specifically.

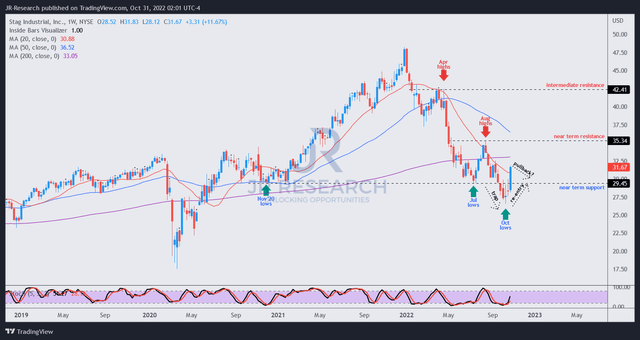

STAG price chart (weekly) (TradingView)

We observed constructive price action on STAG’s recent moves. The market forced a bear trap to form its October lows, as seen above.

That move was significant as it was predicated against its near-term support, undergirded by the lows of November 2020 and July 2022. It was also that most significant swing-low before a steeper fall through “no man’s land” further down. Hence, the buyers needed to hold this support level decisively.

As such, the re-entry move to retake its near-term support is highly constructive, suggesting the robustness of the buying momentum. However, we postulate a pullback is imminent, as the recovery surge from last week’s post-earnings spike needs to be digested first for the price action to consolidate sustainably.

We suggest investors cut back on adding more positions if the price action surges back up toward its August high. We expect a robust resistance zone at that level, as the market would not be likely to re-rate STAG markedly higher in the current macro conditions.

Accordingly, we reiterate our Buy rating on STAG.

Be the first to comment