Nikola Stojadinovic/E+ via Getty Images

Investors are recommended to sharpen their pencils on ZimVie Inc. (NASDAQ:ZIMV) and look for opportunities to accumulate shares in the coming months, as Zimmer Biomet Holdings Inc. (ZBH) will be looking to offload their shares. ZimVie screens attractive at just 7.3x adjusted P/E.

Who is ZimVie?

ZimVie Inc. was spun out of Zimmer Biomet Holdings Inc. in March. It comprises the non-core Dental and Spine business of Zimmer Biomet. According to Zimmer management, the main rationale for the spin-out was to enhance management focus and alignment, reduce operating complexity, and re-ignite growth for the Dental and Spine businesses. More importantly, ZBH wanted to spin out the lower growth dental and spine businesses and refocus its own management on the higher growth core orthopaedic business.

ZimVie At A Glance

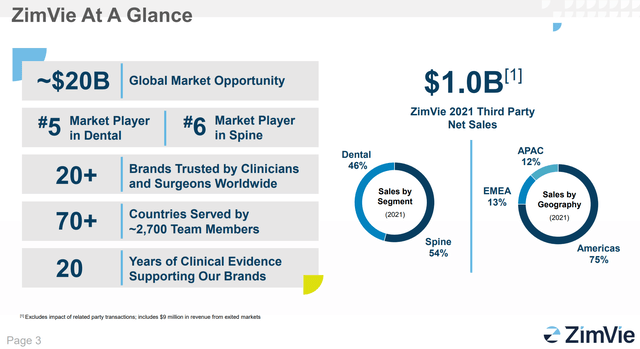

The spin-out ZimVie is a leading player in the dental implants and spine markets (combined $20 billion TAM), with #5 and #6 market share, respectively (Figure 1). Approximately half the business is in dental implants and half in spine products.

Figure 1 – Zimvie At A Glance (Zimvie investor presentation)

Dental & Spine Markets Overview

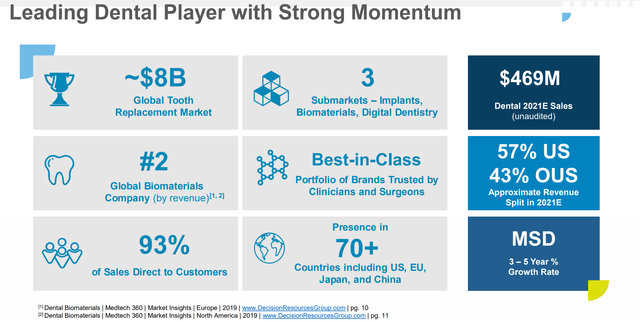

The dental business is a $8 billion market with moderate growth rates, with dental implants and biomaterials generating MSD growth and digital solutions (oral scanners, CAD/CAM equipment, treatment planning software, etc.) generating high-single-digit HSD growth (Figure 2). ZimVie is the #2 player in the biomaterials subcategory and the proposed strategy is to leverage its leading position in biomaterials to drive dental implant conversions.

Figure 2 – Zimvie dental business overview (Zimvie investor presentation)

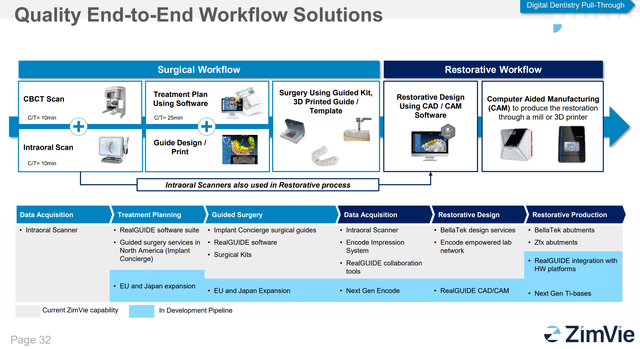

ZimVie also wants to expand adoption of its comprehensive digital workflow solutions to drive pull-through for its dental implants (Figure 3).

Figure 3 – Overview of ZIMV digital dentistry solutions (Zimvie investor presentation)

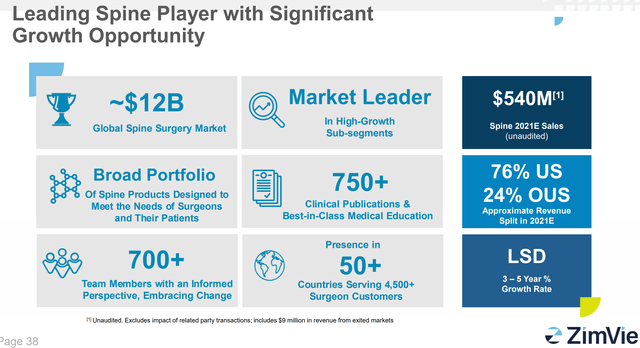

The spine business is an approximately $12 billion market with LSD growth rates (Figure 4). The sub-categories are core and complex solutions with LSD growth, bone healing with LSD growth, minimally invasive surgery with MSD growth, and motion preservation devices with HSD growth rates.

Figure 4 – Zimvie spine business overview (Zimvie investor presentation)

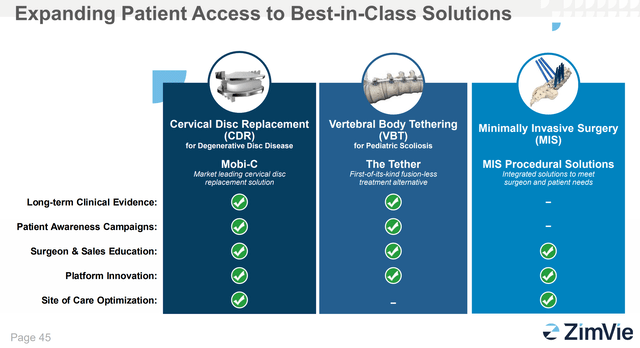

Unlike the dental business, ZimVie is not a market leader in any sub-category. However, it does have some interesting innovations that could spur some market share gains. For example, ZimVie’s Tether system, introduced in 2019, treats scoliosis in children without impacting mobility (Figure 5). Also, its Mobi-C device to treat degenerative disc disease has better clinical outcomes (less recovery time, higher range of motion) versus the common practice of fusing discs together.

Figure 5 – Zimvie’s best in class spine solutions (Zimvie investor presentation)

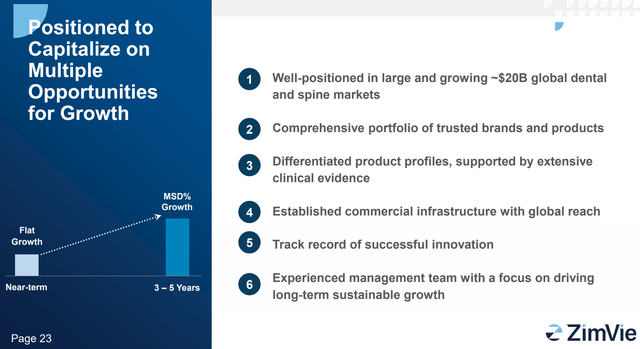

Overall, the goal of ZimVie management is to stabilize its businesses and re-ignite growth to MSD rates overall in 3-5 years’ time (Figure 6).

Figure 6 – Overall goal is to reignite growth (Zimvie investor presentation)

Financial Overview

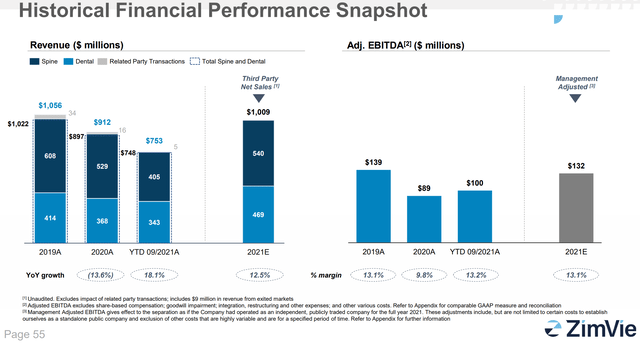

ZimVie’s historical financials are a little messy, as all the numbers are carved out of historical Zimmer Biomet financials and are adjusted as if ZimVie was a separate entity (Figure 7).

Figure 7 – summary historical financials (Zimvie investor presentation)

From the figures presented, 2020 was a challenging year as revenues fell 13.6% YoY and EBITDA margins fell to 9.8% due to COVID-19 disruptions to elective surgeries. However, 2021 recovered nicely, with top line recovering back to $1 billion and EBITDA margins rebounding to historical norms.

Spin-out Set Up Stock To Fall

From day one, ZIMV stock has been in a free-fall. From its opening trade at $31.55, the stock has fallen almost 50% to $16.01 as of June 30th (Figure 8). What happened?

Figure 8 – Zimvie stock price in free fall. (author created with data from stockcharts.com)

In my opinion, ZimVie was set up to fall by Zimmer Biomet. First, Zimmer Biomet framed the spin-off as:

“an important step toward shifting our portfolio mix to higher-growth markets where we have a clear path to leadership and right to win.”

– Quote from Bryan Hanson, ZBH CEO, press release February 5, 2021 announcing the spin-off

The implication is that the spun-out entities were non-core and did not have a clear path to leadership positions in their respective markets. As 80% of ZimVie shares were distributed to existing Zimmer Biomet shareholders who presumably invested in ZBH for its ‘core’ orthopaedic business, it is no surprise they disposed of the ‘non-core’ ZIMV shares as soon as they could.

Moreover, there was an interesting reason that Zimmer Biomet retained just under 20% of ZimVie shares (rather than distribute all the shares) that I have not seen any other analyst pick up on. I have pasted the entire paragraph from ZimVie’s Form 10 and highlighted the relevant sentences:

In considering the appropriate structure for the separation, Zimmer Biomet determined that, immediately after the distribution becomes effective, Zimmer Biomet will own no more than 20 percent of the outstanding shares of ZimVie common stock. The retention of ZimVie common stock strengthens Zimmer Biomet’s balance sheet by providing Zimmer Biomet a security that can be exchanged to accelerate debt reduction, thereby facilitating an appropriate capital structure consistent with maintaining Zimmer Biomet’s investment grade rating, which is critical to Zimmer Biomet having the financial flexibility necessary to execute its growth strategy and fund capital expenditures. Zimmer Biomet currently intends to dispose of all of the ZimVie common stock that it retains after the distribution by exchanging such ZimVie common stock for Zimmer Biomet debt held by one or more investment banks. To the extent Zimmer Biomet holds any ZimVie common stock thereafter, Zimmer Biomet will dispose of such stock as soon as disposition is warranted (but in no event later than five years after the distribution), consistent with its business purpose of creating independent companies with separate capital structures and maintaining its investment grade credit rating. Following such debt-for-equity exchange, it is anticipated that the investment banks will sell such shares to public investors in a pre-marketed equity offering. We anticipate that ZimVie would benefit from increased equity research coverage in connection with such an offering.

– Excerpt from ZimVie Form 10 to SEC

Zimmer Biomet retained just under 20% of ZimVie’s stock (19.7% which is just below the definition of ‘control’) so that they could swap the ZIMV shares for existing ZBH debt held by investment banks and the investment banks will sell the shares to the public in a secondary offering. With such a well-telegraphed large block of shares waiting to be sold, is it any wonder existing ZBH/ZIMV shareholders rushed for the exits as soon as they got their share distribution?

Incidentally, as of the writing of this article, Zimmer Biomet is still registered as a 10% holder of ZimVie stock and has not disposed them yet. I believe the reason is Zimmer Biomet is restricted from selling its ZIMV shares as the shares are ‘unregistered’ and Zimmer Biomet must wait 6 months before selling them, according to SEC Rule 144. This puts a potential catalyst around September as when Zimmer Biomet may offload their ZimVie shares.

Valuations Screen Attractive

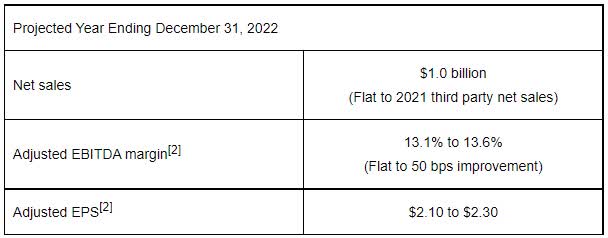

Despite the steep fall in stock price, ZimVie operations appear to be humming along nicely. On May 5th, the ZimVie reported its inaugural quarterly earnings as an independent company, posting revenues of $236 million and non-GAAP EPS of $0.50 a share. Both the top and adjusted bottom line beat consensus expectations. The company also reiterated full year guidance of $1 billion in revenues and $2.10 to $2.30 in adjusted earnings. Figure 9 summarizes company guidance for 2022.

Figure 9 – Zimvie 2022 guidance (Zimvie Q1/2022 earnings press release)

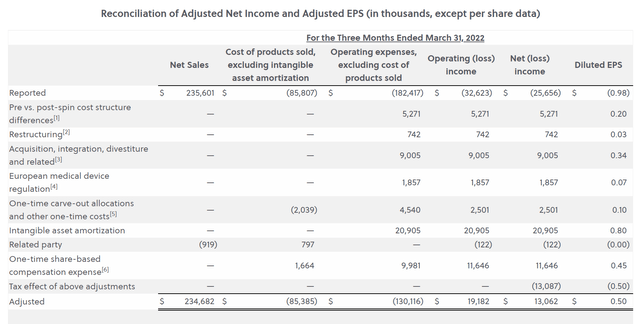

Note however, the above figures are adjusted earnings. GAAP earnings for Q1/2022 was -$0.98 a share. Figure 10 shows a reconciliation between the reported GAAP EPS and management’s adjusted EPS. As we can see, the biggest difference is $0.80 in intangible amortization, $0.40 in one-time share-based compensation expense, and $0.34 in divestiture expense. While these adjustments should be one-time or non-cash, it will be important to monitor the coming quarterly earnings. Persistent differences between GAAP and ‘adjusted’ earnings is a red flag.

Figure 10 – Adjusted to GAAP EPS reconciliation (Zimvie earnings press release)

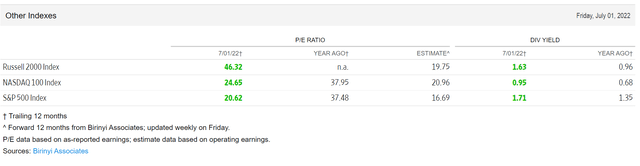

Trading at a recent $16, ZimVie has a Price-to-forward adjusted earnings multiple of just 7.3x. This is far below the market’s multiple of 16.7x (Figure 11) and screens as very attractive, particularly if the company can restart topline growth in 3-5 years’ time.

Figure 11 – Summary market P/E multiple (wall street journal)

Key Risks To ZimVie

Heavy Debt Burden On Day 1

There are several key risks to the ZimVie story. First, as part of the spin-off, ZimVie borrowed $595 million in term loans and paid $540 million to Zimmer Biomet as a special dividend. With Q1/2022 cash balance of $104 million, this translates to net debt of $452 million, giving ZimVie a net debt-to-forward EBITDA ratio of 3.4x, which is quite high.

A high debt burden limits a company’s financial flexibility, particularly as the economy appears to be slowing down quite rapidly in recent months.

Business Execution Is Key

A second risk factor to the ZimVie story is management’s history of execution, or lack-thereof. ZimVie is CEO Vafa Jamali’s first stint as the chief executive of a public company. Although he has a history of executive appointments at Medtronic (MDT), it remains to be seen whether he can deliver on his strategy and vision for ZimVie.

Similarly, ZimVie is CFO Rich Heppenstall’s first stint as a public company CFO. He was formerly CFO of private knee brace maker, Breg Inc. Will the transition to public company CFO be a smooth one?

On the positive side, there is continuity at the business segment level, where Zimmer Biomet dental and spine business managers have joined ZimVie.

The key, as we have highlighted in the market overview section, is whether ZimVie is able to increase dental implant adoption by leveraging its strength in dental biomaterials and comprehensive digital dental workflows. In spine, ZimVie will need to rationalize the product suite while simultaneously re-ignite growth.

Conclusion

As a recent spin-out, ZimVie’s stock has faced enormous selling pressure from day one as a result of Zimmer Biomet’s positioning of the transaction and intended use of ZIMV stock to satisfy some debt obligations. This has driven ZIMV stock to an attractive valuation of just 7.3x adjusted P/E. I would recommend long-term investors get ready to accumulate shares, with an eye towards Zimmer Biomet’s block of shares that should come onto the market around September when their Rule 144 hold expires.

Be the first to comment