matejmo

For those who are only interested in a CEFs high market yield, this was the genesis of my article from Aug. 22:

Equity CEFs: Got High Yield? Swap GGT For CLM And Get A Lot More

Essentially the article stressed that the more an investor looked for a high market yield, the more important it would be to also keep track of the fund’s NAV yield and NAV performance. That’s because uber high-yielding equity CEFs often trade at premiums so if a fund is showing subpar NAV performance and has too high of an NAV yield, it’s only a matter of time before it collapses.

And since that article, the fund’s highlighted have declared and gone ex-dividend on their fourth quarter distributions. And that’s where I would like to pick up the story now because it may appear that the one fund that didn’t cut its distribution is the one to own while the two funds that did cut should be sold, but that’s entirely the opposite of what you should be doing.

The biggest reason is simply NAV performance and NAV yields. If a fund can’t reasonably be expected to cover its NAV yield, then the fund will continue to lose NAV. And if a fund continues to lose NAV, then eventually its market price will follow. I actually try to stay away from funds that have 12% or higher NAV yields since that seems to be the upper limit of what a fund can reasonably be expected to cover each year.

But in this article, we’re looking at the few funds that have incredibly high NAV yields, 21% and higher, currently. Generally, that would be a recipe for disaster, particularly in this market, but there are reasons why some funds actually set that high of an NAV yield.

The Cornerstone funds, i.e. the Cornerstone Strategic Value Fund (NYSE:CLM), $7.66 current market price, $6.55 NAV, +16.9% market price premium, 19.2% current market yield, and the Cornerstone Total Return Fund (NYSE:CRF), $7.41 current market price, $6.30 current NAV, +17.6% market price premium, 19.0% current market yield, have made a living by establishing uber high 21% NAV distribution policies, by far the highest of all CEFs.

In fact, distributing 21% of a fund’s NAV each year usually guarantees that a fund’s NAV will erode, even in a positive market environment. Though last year, for the first time in many years, the Cornerstone funds actually raised their distributions as their NAVs grew even after those huge distributions.

But at least Cornerstone understands that in most years, the funds will lose NAV and that’s why each year, Cornerstone tries to supplement each fund’s NAV by undertaking Rights Offerings at a premium to NAV, ideally when the fund’s market prices are also at a high premium.

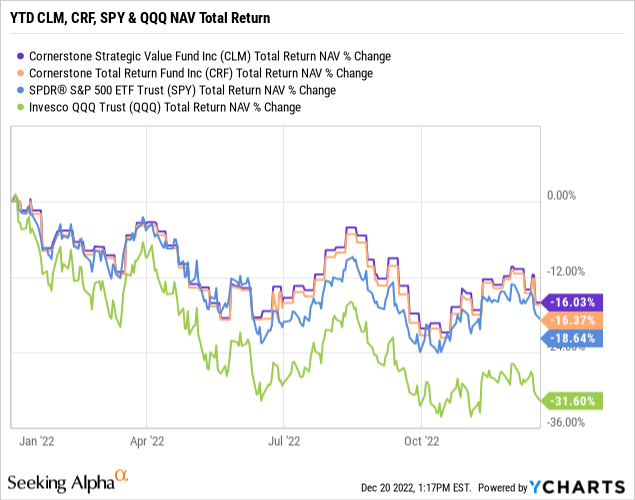

As a result, this year’s total return NAV performance for CLM and CRF are holding up quite well considering the bear market we are in with the S&P 500 (SPY), $380.02 current market price, down -19.0% YTD while the NASDAQ-100 (QQQ), $269.75 current market price, is down a stunning -31.8% YTD, the worst since the 2008 financial crisis.

As you can see below, CLM and CRF’s total return NAV performances are actually holding up far better than the S&P 500 and way better than the NASDAQ-100 despite both funds having a large exposure to the large cap technology names like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOGL), their top four holdings.

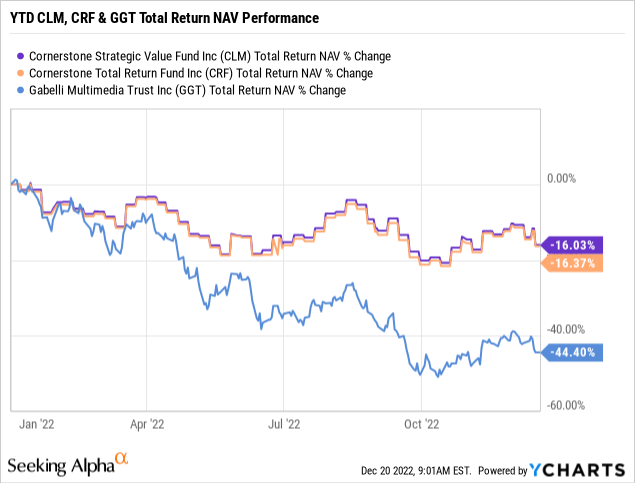

So when you see another technology and growth fund like the Gabelli Multimedia fund (NYSE:GGT), $5.86 current market price, $3.75 NAV, +56.3% market price premium, 15% current market yield, which has seen its NAV collapse this year, down -44.4% and even worse than the Nasdaq-100, and now has an even higher NAV yield than the Cornerstone funds at 23.5% vs 22.5% for the Cornerstone funds, who in their right mind wouldn’t rather own CLM or CRF compared to GGT?

Y charts

Now I understand that any CEF that cuts their distribution may be considered a sell and I think that’s a big reason why we’re seeing the Cornerstone funds sell-off here at year-end, but you have to look at the bigger picture with the Cornerstone funds.

Based on Cornerstone’s uber high 21% NAV distribution policy (the highest of any CEFs), the reset distributions beginning in January of 2023 (calculated from the NAV value of each fund at the end of October) went from $0.1808/share to $0.1228/share for CLM while CRF’s distribution went from $0.1734/share to $0.1173/share.

Those are big cuts and are reflective of the bear market we are in. But that’s why CEFs have an NAV distribution policy, to re-adjust based on current market conditions. And at least Cornerstone is abiding by its distribution policy, something that Gabelli did NOT do, which essentially kicks the can down the road into 2023, making it even more likely that GGT’s NAV erodes even more.

Compared to Cornerstone, GGT has a much lower 10% NAV distribution policy, but that 10% was actually used up by the third quarter so it was a shock to see Gabelli (GAMCO) come out with no change to GGT’s $0.22/share distribution in the 4th quarter when declared on November 11th.

This is from GAMCO’s 4th Quarter Distribution Declaration for GGT:

The average net asset value of the Fund is based on the average net asset values as of the last day of the four preceding calendar quarters during the year. We note that 10% of the average net asset value of the Fund would be $0.54 based on the ending net asset values per share as of December 31, 2021, March 31, 2022, June 30, 2022, and September 30, 2022 of $8.25, $7.17, $4.94, and $3.62, respectively. In declaring a distribution of $0.22 per share, the Board of Directors has chosen to distribute $0.28 greater than that called for by the distribution policy. The net asset value per share fluctuates daily.

In other words, GGT shareholders should have had no distribution for the fourth quarter, and in fact, should have given back -$0.28/share! Let that sink in when you realize that GGT’s current market price of $5.86 is at a 56.3% premium over its $3.75 NAV, which now makes it much harder to sustain heading into 2023.

By not cutting GGT’s distribution, Gabelli has essentially turned GGT into an annuity that may please shareholders who don’t care about the NAV going to zero at this pace, but I have a feeling a lot of shareholders would rather have taken less than $0.22/share or $0.88/share a year out of the fund’s current $3.75 NAV instead of ignoring the elephant in the room.

Now maybe 2023 ends up being a good year for growth and technology stocks, and GGT, with its highly leveraged all-stock portfolio, performs better than expected at NAV. But if that does happen, the Cornerstone funds, CLM and CRF, will perform comparatively well too with their high weighting in growth and technology stocks too and since Cornerstone has already bitten the bullet with distribution cuts for CLM and CRF and now trade at much better valuations, I’m not sure how you don’t look more positively on the Cornerstone funds now compared to a fund like GGT.

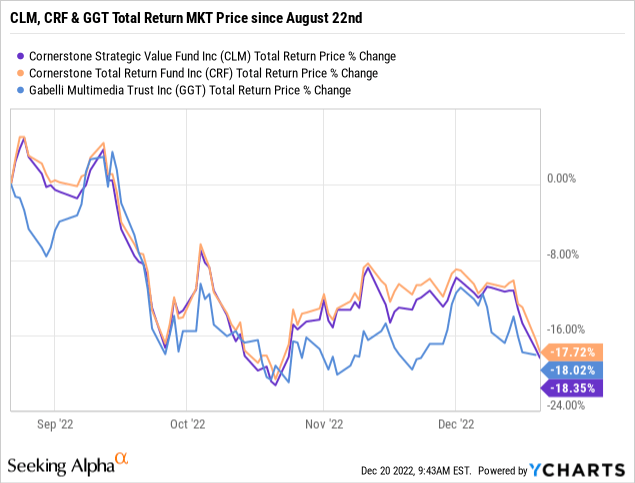

Now you may think that since my Aug. 22 article this year (link also above), that GGT must be outperforming CLM and CRF, since GGT now trades at a higher premium while the Cornerstone funds trade at a lower one. And yet despite the heavy selling we are seeing in the Cornerstone funds recently, probably due to tax-loss selling, that’s not really the case.

Since I wrote that article on Aug. 22, the total return market price performances have been pretty much the same even with the heavy selling in the Cornerstone funds.

Y charts

The fact that the three funds are performing about the same at market price despite the widening valuations between the funds, should tell you all you need to know about which funds to own going forward since the Cornerstone funds are crushing GGT at NAV performance this year (see above). But that market price performance doesn’t even take into account the primary reason why you want to own the Cornerstone funds.

If you go back to the Aug. 22 article, there’s one more reason to own the Cornerstone funds and that has to do with reinvestment of the distributions. Because despite setting unrealistic 21% NAV yields each year, Cornerstone allows shareholders to reinvest those huge distributions at the fund’s NAV no matter what the market price premium is.

No other fund family offers such a bonus for shareholders and the higher CLM and CRF trade at a premium, the more of a bonus that is.

And given that feature, one has to ask how much of CLM and CRF’s current premium (currently 17% though has gotten as high at 70% in years past) should be discounted when shareholders know they can reinvest over 20% of their total shares each year at a discount to the market price?

On the other hand, GGT has no such reinvestment policy and for those shareholders who mistakenly are enrolled in it, they reinvest those large distributions at 95% of GGT’s market price!

Now I’m not saying you should rush out and buy CLM or CRF since the tax-loss selling has dramatically accelerated and could continue through year end, but on a comparative valuation basis, the Cornerstone funds continue to be significantly more attractive than say, a fund like GGT, and that will be proven in 2023 no matter how the markets perform next year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment