ewg3D

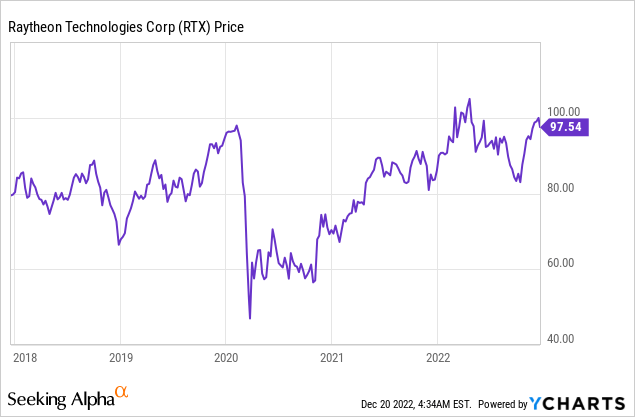

Raytheon Technologies (NYSE:RTX) is a leading aerospace and defense conglomerate that was formed from a merger between “Raytheon” and “United Technologies” in 2020. The company has recently reported many contract wins and is poised to benefit from the war in Ukraine. Raytheon is one of the two key suppliers of cutting-edge weapons in Ukraine and with U.S stockpiles dwindling, more orders are poised to commence in my view. In this post I’m going to break down Raytheon’s weapon systems and tailwinds in detail, before diving into the financials and valuations, let’s go to battle.

Raytheon’s Business and Ukraine Tailwinds

Raytheon has a diverse business model that owns four business subsidiaries, which I will discuss in turn.

Raytheon Missiles & Defense [RMD]

Its RMD segment supplies the “Javelin” anti-tank weapon which has proven to be immensely effective and popular during the war in Ukraine. The Javelin uses cutting-edge infrared technology to detect and track the tank target. Fired from a range of up to 2.3 miles, the missile uses a “double warhead” strategy to first break the outer layer of tank steel, before a second warhead blows up the inside. The missile can penetrate steel of up to 2.6 feet thick.

Javelin Anti-Tank Missile (Raytheon)

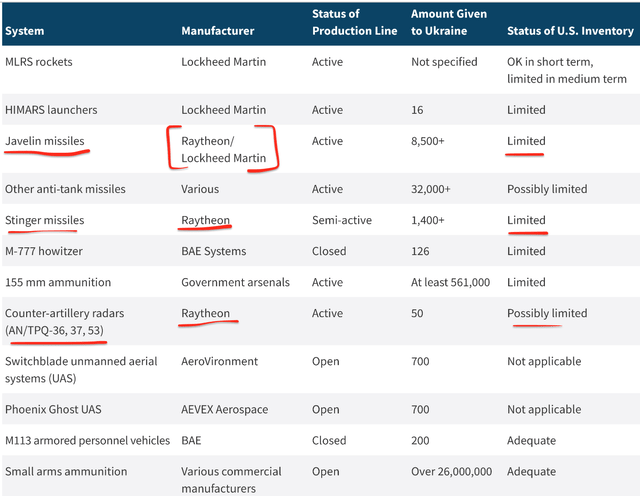

Like any product, if it solves the problem and is popular with customers, so I think you can reason more orders are on the way. In this case, U.S data indicates that the first 112 Javelins sent to Ukraine, had a 98% accuracy rate hitting 100 of their targets. The United States has sent ~7,000 of these Javelins or one-third of its entire Javelin supply to Ukraine and thus will likely need to replenish its weapons. In May, both Raytheon and Lockheed Martin (LMT) in a joint venture were awarded a $309 million contract for 1,300 Javelins for the U.S. Army. Then in September, the U.S. ordered another 1,800 Javelins valued at ~$311 million, from Raytheon and Lockheed Martin to replenish its supply. The table below also shows Raytheon has supplied over 1,400 “Stinger Missiles”, to Ukraine. These “Stingers” are hyper-accurate surface-to-air missiles designed to take out attacking aircraft.

US weapons Supplied to Ukraine (CSIS)

The U.S. (and Raytheon) is also reportedly “close” to supplying Ukraine with the iconic “Patriot” Air missile defense system. Ukraine President Zelensky has previously called on Israel to help it with missile Air defense systems, of which the country has resisted. Now it looks as though the U.S. is stepping up to the plate. Russia has used missiles and drones to take out Ukraine’s infrastructure. These attacks lessened during the summer of 2022, as Russian supplies dwindled. However, in October Iran supplied Russia with more drones and the attacks continued. The Patriot is expected to stop these attacks as it is a battle-tested system, which has been used during the Yemen Missile crisis and many more conflicts. The “Patriot” defense system is also not cheap and costs approximately $1.1 billion, which can be broken down into $400 million for the ground system and $690 million for the missiles. Therefore, Raytheon is poised to benefit from an order.

Patriot missile defense system (Zuma/Raytheon)

Raytheon Intelligence & Space (RIS)

This business segment sells advanced sensors, radars, and software to the US Department of Defense. The prior table shows that Raytheon has supplied ~50 Counter-Artillery radars to Ukraine, via the U.S Army. This means the U.S has “possibly limited” inventory, thus a repeat order would be effective. This segment also includes “Space Solutions” such as ballistic missile warning systems via satellites and “Space” cybersecurity. The Biden Administration is also reportedly drafting rules to simplify space regulation which would likely result in an increased velocity of investments.

Pratt & Whitney [P&W]

Pratt & Whitney is a leading supplier of aircraft engines. This business supplies the iconic F-35 fighter jet (manufactured by Lockheed Martin) with its jet engine (F-135). The Russia-Ukraine war has caused many countries to bolster their air defenses through the order of more F-35 jets. For example, Germany ordered 35, F-35 Jets in early 2020. The Czech Republic has also started negotiations to buy 24, F-35 jets, and Greece appears to be moving close to an order. I would reason logically that more F-35 jets, would require more engines (obviously), and thus Raytheon would benefit. Raytheon has also recently (December 16th) been awarded a huge $619 million contract modification related to F-35 propulsion systems, contracted by the U.S Navy.

F-35 Jet (Lockheed Martin, Engine by Raytheon)

Collins Aerospace Systems [CAS]

Raytheon also owns Collins Aerospace Systems [CAS] which is one of the largest suppliers of aerospace equipment in the world. This business segment manufactures landing gears, control dashboards, and much more. Its largest customers include aerospace giants such as Boeing and Airbus, which contribute to 18% of the revenue. Collins has also recently been awarded a contract to supply Nasa with the next generation of space suits.

Financial Recap

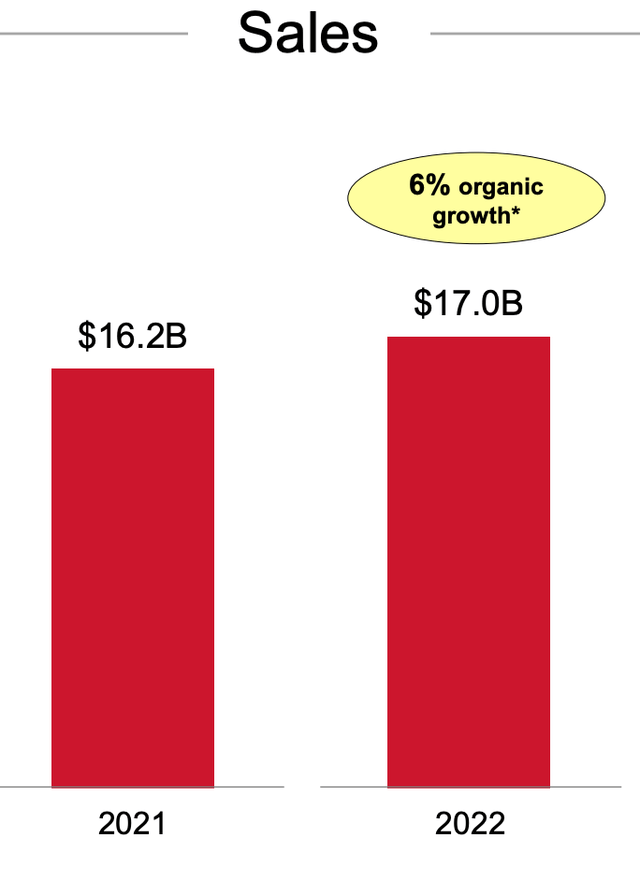

Raytheon reported solid financial results for the third quarter of 2022. Revenue was $17 billion, which increased by 6% year over year. Its backlog ballooned to a staggering $168 billion, up $6 in the quarter.

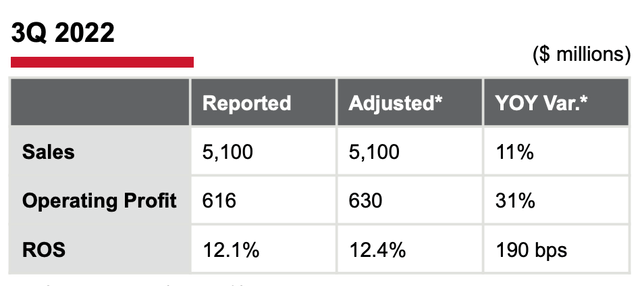

Collins Aerospace was a strong performer in the third quarter as its sales increased 11% (adjusted) and its operating profit jumped by a fantastic 31%. This result was driven by a $583 million contract for a Mounted Assured Positioning, Navigation, and Timing System [MAPS], which is used in military ground vehicles.

Collins Aerospace segment (Q3,22 report)

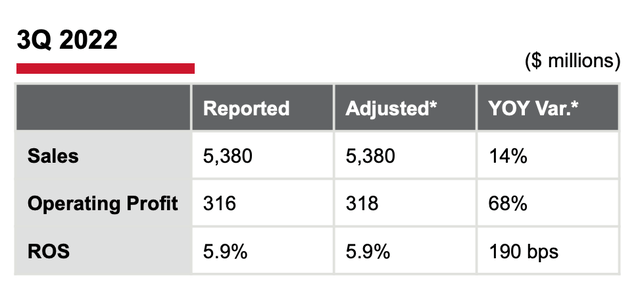

Its Pratt and Whitney business segment also increased sales by 14% year over year and operating profit by a staggering 68%. This was driven by strong commercial original equipment and aftermarket sales. The company delivered its 1,000th F135 engine and has been awarded over $800 million worth of contract orders in Q3,22. I think the battle-tested and proven nature of the F135 engine gives it a competitive advantage over new entrants. As even more advanced systems will require rigorous testing and, in a war, any fault can be deadly.

Pratt and Whitney (Q3,22 report)

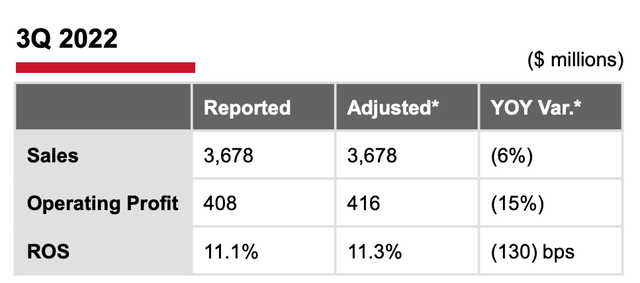

Surprisingly, Raytheon’s Missiles & defense segment reported a 6% decline in sales to $3.678 billion, in addition to a 15% decline in operating profit to $416 million on an adjusted basis. This looks to have been driven primarily by the timing of orders and supply chain constraints. As I mentioned in the first section of this post, this segment has huge tailwinds from the Russia-Ukraine War. As of the third quarter, the company reported a huge backlog of $32 billion. Notable contract wins included a $1 billion order for a Hypersonic Attack Cruise Missile (HACM) and $972 million for an AMRAAM.

Raytheon Missile defense (Q3,22 report)

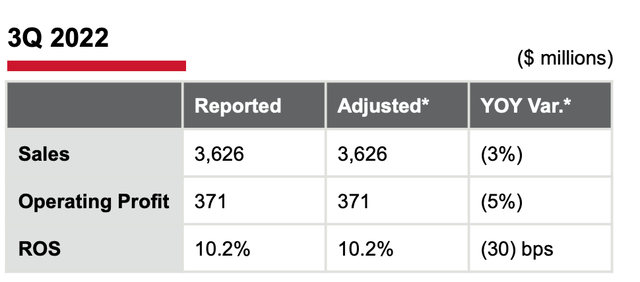

Raytheon’s Space segment reported a 3% decline in sales to $3.626 billion and a 5% dip in operating profit to $371 million. This was driven by lower tactical systems volume, but the segment backlog was valued at a huge $17 billion at the end of the third quarter.

Bringing everything together, Raytheon reported adjusted EPS of $1.21, which beat analyst estimates by $0.07. The company also has a strong balance sheet with $5.38 billion in cash and short-term investments. Raytheon does have fairly high total debt of $34.986 billion but just $193 million of this is current debt and thus manageable.

Advanced Valuation

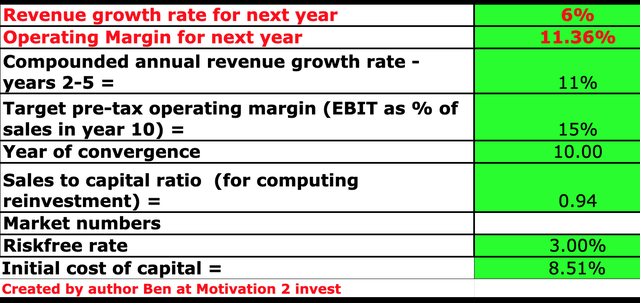

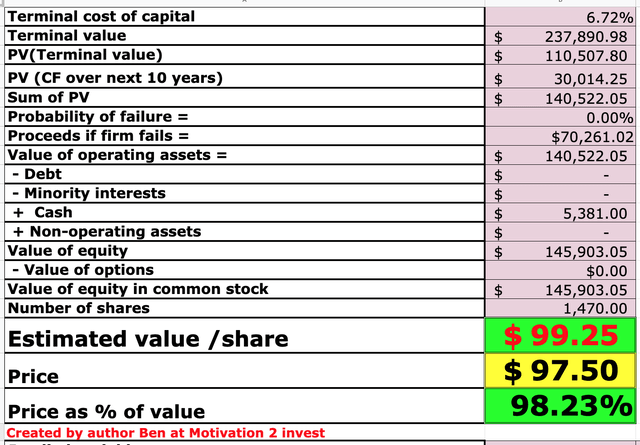

In order to value Raytheon, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 6% revenue growth from next year, which is aligned with the current year’s figures. In addition, I have forecasted 11% growth per year in years 2 to 5, as the company benefits from Russia-Ukraine tailwinds and a booking of backlog as revenue.

Raytheon stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have also capitalized R&D expenses which have lifted net income. In addition, I have forecasted a pre-tax operating margin of 15% in year 10, as the company improves its profitability with order scale.

Raytheon stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $99.25 per share, the stock is trading at $97.50 per share at the time of writing and thus is “fairly valued”.

Risks

Valuation and Opportunity Cost

Given the current market environment, there are many “cheap stocks” and undervalued investments (see my other posts). Therefore, with Raytheon just been “fairly valued”, there may be an opportunity cost if you are thinking of investing significant sums.

Final Thoughts

Raytheon is a tremendous company and a true powerhouse when it comes to technology. The company has reported solid financials, a strong backlog of orders and has many Ukraine War time contract tailwinds. Raytheon also has many competitive advantages from its cutting-edge technology to brand trust. The stock is fairly valued at the time of writing and thus could be a great long-term investment.

Be the first to comment