wundervisuals/E+ via Getty Images

Grindrod Shipping (NASDAQ:GRIN) jumped yesterday on news of a non-binding bid worth $26 per share by Taylor Maritime (OTCPK:TMILF). The bid consists of $21 in cash and $5 based on a special dividend from Grindrod shipping. To put it in poker terms; to me this looks like Taylor Maritime taking a cheap stab at the pot. A non-binding offer isn’t particularly expensive and they may pick up a big pot if there happens to be no resistance.

Notwithstanding, the stock has jumped up to $24.20 post-market. That’s a pretty big jump for a few reasons 1) the bid is non-binding, 2) the $5 dividend could be taxable to some investors (I’m not sure how it will work exactly), 3) The bidder is a private Hong Kong-based company of modest size.

There are three good reasons for the stock to jump quite a bit: 1) This is a tender offer, and these tend to close fast 2) the bidder already owns ~1/4th of Grindrod’s equity suggesting it could bid a little bit more and knows the target very well 3) Grindrod has great fundamentals 4) Grindrod has pretty good medium-term prospects 5) Grindrod has way too much cash and this event highlights that fact. The special dividend should be a “go” whether the bidder gets serious or not.

The fundamental backdrop of Grindrod specifically and the dry-bulk industry has me thinking there’s a good chance of this deal getting sweetened. On the other hand, the structure with the $5 cigar already seems pretty desperate.

Let me first dive into some of the company’s fundamentals. Grindrod shipping trades at a forward P/E of 2.7x, a TTM P/E of 2.23x, an EV/EBITDA of 2.27x and at around 1x book value. That’s after incorporating most of the premium represented by this non-binding offer. The company has $8.71 in cash per share on the balance sheet. There’s also a lot of debt (which is common in this asset heavy industry). On a net debt basis there’s about ~$90 million.

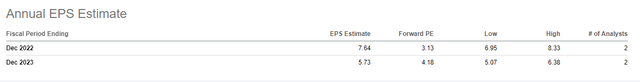

Analysts tracked by Seeking Alpha estimate earnings of $7.5 and $5.5 for 2022 and 2023. For 2022 way over half of that number is already in the bag and rates aren’t all that bad. The 2022 target seems highly achievable.

analyst estimates for Grindrod shipping (seeking alpha)

The prospects for the industry are fairly favorable as well. I’ve discussed this at greater length in recent public shipping articles like Star Bulk Carriers Stock: Looks Too Cheap At 4x Forward Earnings and Navios Maritime: Market Overly Pessimistic, Trading At Discount.

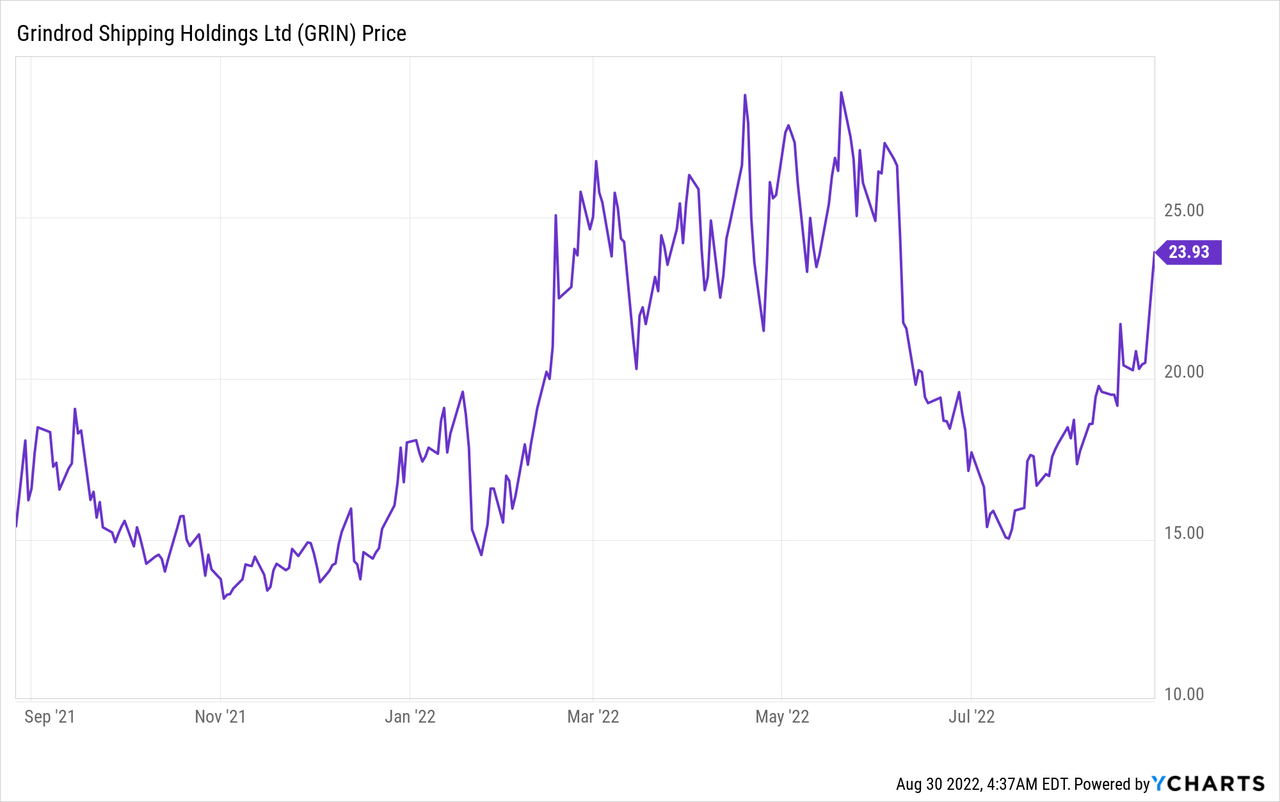

Grindrod is trading below trailing-twelve-month lows:

Boards tend to be reluctant to sell-out below twelve month lows. If prospects aren’t great, that’s a different story. Therefore its relevant to see what management thinks about the future of the industry as there will be a lot of common ground with the board (not to mention management may have something to say about the bid).

Here are some key quotes from the most recent earnings call (emphasis mine):

On Slide 9, we provide our bank loans and other borrowings repayment profile at June 30, 2022. We continue to have limited debt maturities until 2025 which combined with a conservative amortization profile provides us with balance sheet flexibility going forward. Overall, we maintain low leverage and this is even lower when you take into consideration the market value of our fleet which is comprised mainly of modern Japanese-built eco vessels.

Management is touting its low leverage profile. That’s even more notable given the huge amount of cash per share on the balance sheet. If the acquirer can get the deal done doling out the companies own cash, there’s room to give out a few more dollars. The company also touted its modern fleet suggesting it is undervalued on the balance sheet (note the company trades at roughly 1x official book value). Management commented on conditions and the outlook as follows (emphasis mine):

War in Ukraine has negatively impacted flows of certain drybulk commodities, particularly in the grain and fertilizer sectors, while weaker economic conditions in China have reduced steel demand, a key driver to global drybulk trade flows. The demand hit is being partially offset by longer required voyages as replacement cargoes continue to be sourced from further afield. This is demonstrated by the ton-mile demand expectations that are still expected to increase by 1.2% in 2022 whilst actual tons transported are projected to be flat year-over-year. The primary examples of this trade route substitution are in the grain and coal markets, where buyers are sourcing alternatives to Ukrainian grains and European buyers are seeking alternatives to Russian coal, whilst Russia finds new export markets for its commodities.

The war in Ukraine is hurting drybulk in volume but ton-mile demand (due to rerouting) is making up a lot of that.

…Turning to Slide 16. The drybulk order book continues to shrink to multi-decade lows and is estimated at only 7.1% of fleet. This potential growth or lack of it is quite favorable, especially considering approximately 23% of the drybulk fleet is 15 years or older and approximately 12% of the drybulk fleet 20 years or older, measured by deadweight tons.

The order books are lean which is a common theme in shipping. Not to mention shipyards having disappeared during bad years for the industry.

The smallest newbuilding order book in decades continues to support market strength in medium term, due to constriction in vessel supply growth as uncertainty over engine technology and emissions hampers newbuilding orders, particularly in the smaller vessel segments. Newbuilding orders in other sectors such as LNG and container shipping has limited the shipyard spare capacity, meaning that most new orders could not hit the water until mid-2024 at the earliest.

To the extent that ton-mile demand continues to grow, the lack of available supply growth, combined with EEXI environmental regulations in 2023, is expected to lead to an attractive potential multiyear window for the drybulk market.

The overall picture is a highly constructive management that expects the good years to continue for dry bulk shipping.

Conclusion

It makes sense to me that the market is pricing in a large percentage of the Taylor Maritime bid. The fundamentals of the company can easily support the bid. The bid is a vote of confidence in the future of the industry. The bidder isn’t the strongest brand, the bid’s structure suggests Maritime may have challenges financing a deal at a much higher price, and we’re talking a non-binding bid here. However, Grindrod has so much cash on the balance sheet, there seems to be quite some room to increase the cash dividend. With the company trading below its trailing-twelve-month share price, I don’t think the bid is likely to succeed as is. Perhaps if it is upped to $30+ in value and shareholders continue to receive dividends as long as the deal isn’t closed. The bottom line is I don’t think the deal is likely to come to fruition at this price. Either a deal not coming together or a bump in price seem more likely options to me. I already owned Grindrod shares before the bid and I’m happy to continue my ownership if the board rebuffs the acquirer at this price.

Be the first to comment