masterzphotois/iStock via Getty Images

A week ago, Mohamed El-Erian opined in a Bloomberg op-ed that July’s outstanding stock market performance illustrates how “the market is not the economy.” The highly respected economist asserted that what he viewed as a bear-market bounce was not driven by fundamentals but technical factors and relative valuations. Meanwhile, the economic fundamentals that dictate market prices continue to deteriorate. Most Wall Street market strategists are taking his cue, forecasting a continuation of the decline in the S&P 500 that began in January. I have taken the other side of this trade, convinced that the consensus is interpreting the incoming data as though this were a typical business cycle. It is not. The combination of the pandemic, unprecedented monetary and fiscal stimulus, and the war in Ukraine over the past two-plus years has resulted in extremes in supply and demand that require us to step outside the box of conventional thinking. The economy and market fundamentals are stronger than most think.

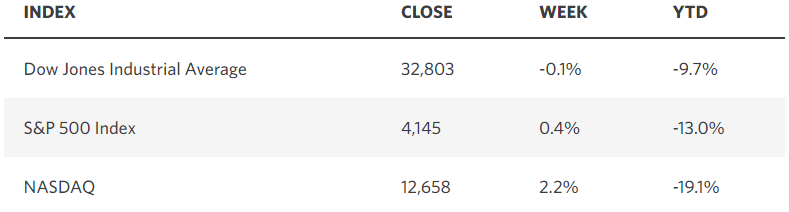

Edward Jones

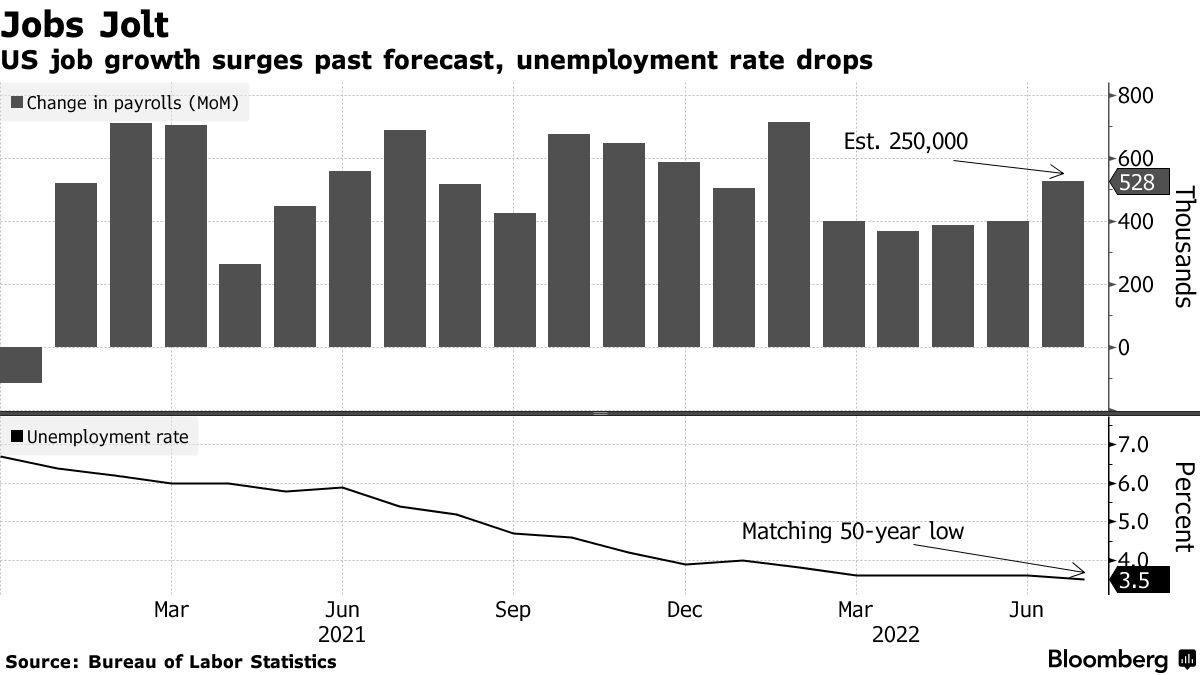

The proof is in July’s jobs report, which revealed that we added double the expected number of jobs at 528,000, while the unemployment rate matched its 50-year low of 3.5%. The gains were led by service industries, while wage growth remaining elevated at 5.2%. This report ended the debate about a recession, so the bears are changing the narrative. Bank of America’s Michael Hartnett reacted to the news by calling for a 13% decline in the S&P 500 to a new low, as the hot jobs report will increase inflation, forcing the Fed to tighten monetary policy more aggressively, which will drive stock prices lower.

Bloomberg

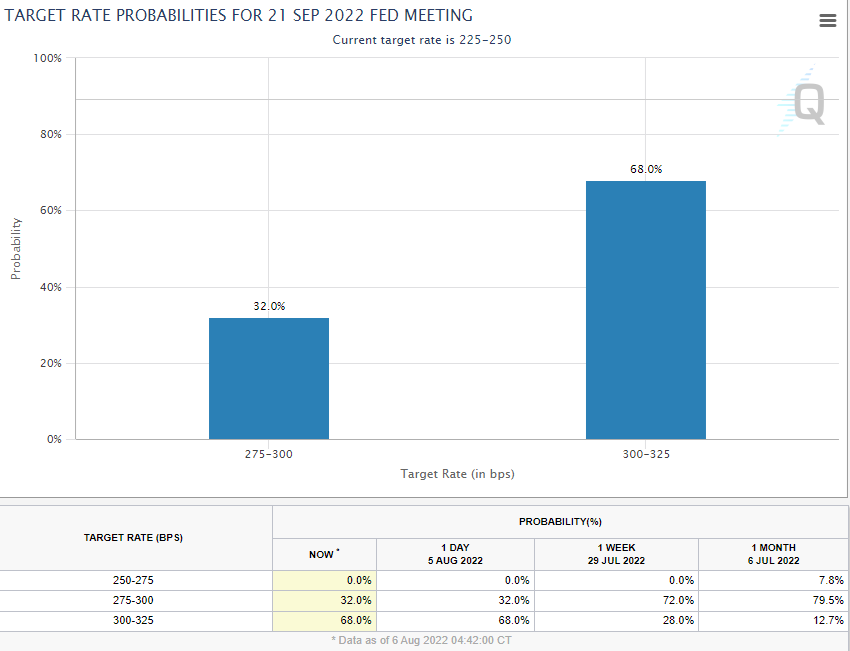

Fed funds futures did react to the news by increasing the probability of a third 75-basis-point rate increase at the Fed’s September meeting from 28% to 68%. Still, we have two inflation reports and another jobs report before that meeting, and I am convinced the Fed will only raise by 50 basis points. We should see meaningful declines in the nominal rate of inflation and some softening in the labor market by then. Regardless, I do not see this jobs report as stoking even higher prices.

CME Group

Instead, it marks the recovery of all the jobs lost since the pandemic. The 5.2% wage growth, which is closer to 7% for lower-income workers, has helped consumers absorb the sharp rise in prices over the past 16 months. Excess savings bridged the shortfall between wage growth and inflation over the past year. In my opinion, the primary cause for the surge in inflation has not been job or wage growth, but a combination of pandemic-related supply chain issues and disruptions caused by the war in Ukraine. In addition, corporate America did a poor job of anticipating trends in consumer spending, which resulted in shortfalls in inventories, further exacerbating price increases. The tremendous build in excess savings from the government’s pandemic-relief programs clearly fueled inflation, but its impact is waning, and it has more recently helped inflation-adjusted consumption stay afloat.

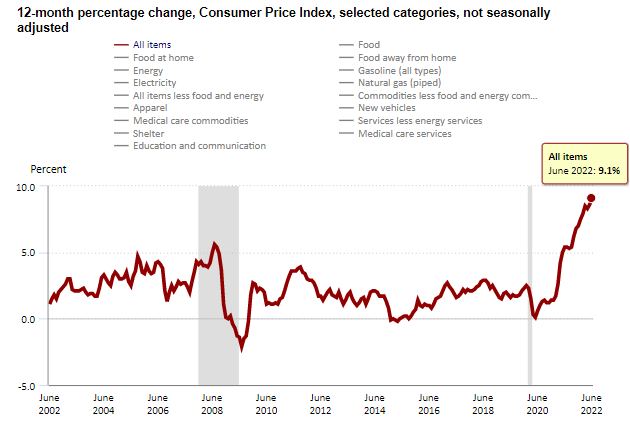

BLS

For these reasons, the stock market did not plunge on Friday, following the blowout jobs report. I think the consensus of investors are starting to realize that supply chain bottlenecks are easing, hard and soft commodity prices are falling, home price appreciation has stalled, and bloated inventories for goods will result in more favorable price adjustments. At the same time, corporate profits are much better than expected, which suggests that market fundamentals are not deteriorating as bears contend.

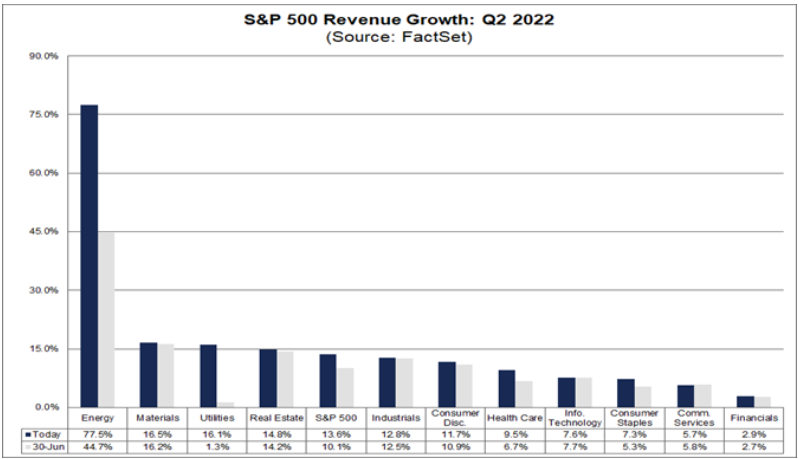

According to FactSet, the earnings growth rate for the S&P 500 in the second quarter is now 6.7%, which is up from 5.8% one week ago and 4.0% at the end of the quarter. This is with 87% of the index members having now reported. The revenue growth rate is 13.6%, which is up from 12.5% one week ago and 10.1% at the end of the quarter. All 11 sectors are showing revenue growth during what was one of the most difficult macroeconomic environments on record. I would not call this a deteriorating fundamental backdrop, especially with positive rate of change now occurring for many of the headwinds faced during the second quarter.

FactSet

I think conventional thinking about the recovery and ongoing new expansion will lead to a misguided market outlook. The distortions brought on by the self-induced recession in 2020 and turbocharged recovery that followed into 2021 were unprecedented. They were compounded by the war in Ukraine and zero-Covid policy in China. We are now in the process of normalizing monetary and fiscal policy to the extent that the economy can stand on its own two feet again. Today’s stock market is leading improvements in the real economy, as it used to do prior to the era of monetary manipulation that began following the Great Recession. Therefore, I am going to continue listening to markets and focusing on the incoming economic data for confirmation that my current outlook remains sound.

Economic Data

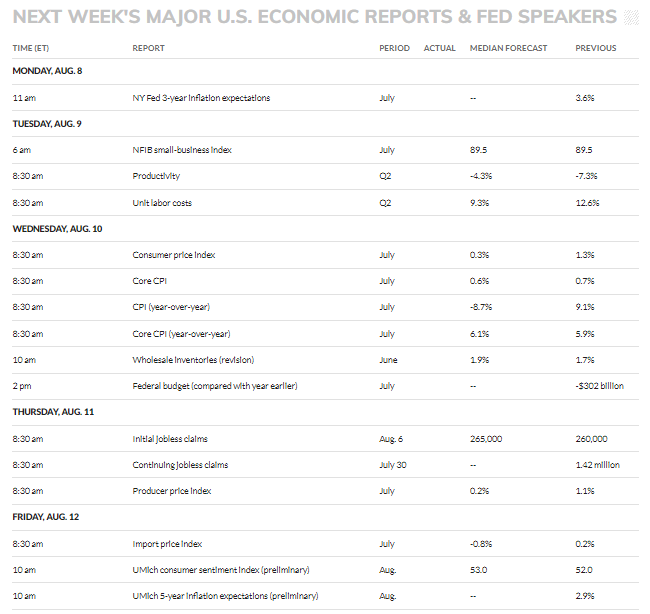

The second-quarter earnings season is winding down, so focus will shift to the incoming economic data and whether it comes in too hot, too cold, or just right. We have the Consumer Price Index for July on Wednesday, and the consensus is expecting a decline from June’s rate of 9.1%. That will be followed by the Producer Price Index on Thursday, which should also show a decline. I expect both to be reported lower than the consensus now expects.

MarketWatch

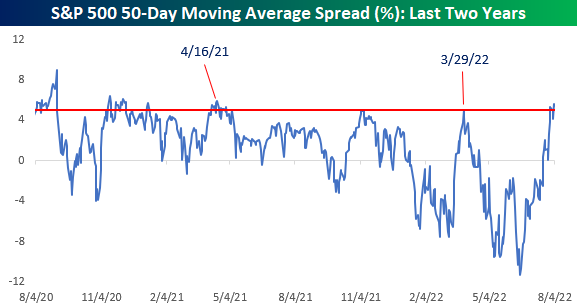

Technical Picture

The S&P 500 looks overbought on a short-term basis, which suggests we need it to correct either through a pullback in price or time. I think we will see a test of the 50-day moving average at the 3,950-4,000 level. The index is 4% above its 50-day moving average, which is the top of the trading range it has held for the past two years. You can see in the chart below how oversold we were in June when I was looking for a sharp rebound to start the second half of the year.

Bespoke

Be the first to comment