Joe Raedle

Thesis

Nike, Inc. (NYSE:NKE) stock held its July 2022 lows firmly, despite worsening macro headwinds in the US and a still weak consumer discretionary spending climate in China. Therefore, we believe the multitude of headwinds that engulfed NKE since its November 2021 highs could ease as the market looks ahead.

Recent earnings commentary by the leading China commerce player Alibaba (BABA) also suggested that the worst macro headwinds in China could be over (which we discussed in an update). Furthermore, global freight rates have also been trending down since Nike’s FQ4’22 earnings in June, which could also help improve its profitability growth. In addition, our analysis of the dollar index indicates that its rapid surge has reached unsustainable zones and, therefore, could top out soon.

Therefore, the gamut of near-term challenges which buffeted Nike over the past seven to eight months could reverse soon. We also believe that the market has likely priced in these headwinds. Unless they continue to worsen dramatically, we are confident that NKE has already staged its long-term bottom in June/July 2022.

Coupled with an attractive valuation and constructive price action, we are confident that its Nike Direct execution should continue to drive the recovery of its revenue and profitability growth in the medium term.

Accordingly, we rate NKE as a Buy.

Near-Term Headwinds Have Eased Further

Global container freight rates have eased a further 6.7% (as of August 5), given improving port congestion conditions and supply chain visibility. In addition, the aggressive rate hikes by the Fed amid record inflation have undoubtedly impacted consumer end demand, which likely contributed to the easing seen in the goods supply chain. Citi (C) articulated (edited):

Pressures in the global goods sectors, which have been a central driver of inflation, may finally be easing. The bad news is that this looks to be occurring on the back of a slowing in the global consumer’s demand for goods, especially discretionary goods, and thus may also signal rising recession risks. – Bloomberg

Therefore, the countervailing forces of demand destruction have also impacted the easing of the costs buildup for Nike, which muddles the analysis for investors. Notwithstanding, given the massive 37% collapse from NKE’s November 2021 highs, we are confident that the market has already factored in the worst of the consumer spending headwinds.

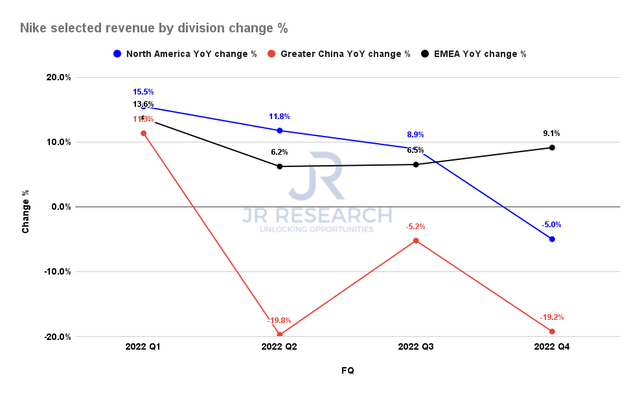

Nike revenue by division change % (Company filings)

Moreover, Nike could also see the pendulum swinging back in its favor as China emerged from the worst of its COVID lockdowns and concomitant supply chain disruptions. Greater China was a significant drag in Nike’s FQ4’22 performance, as revenue fell markedly by 19.2% YoY, underperforming the other key regions.

However, we gleaned positive earnings commentary from Alibaba in early August, suggesting it’s confident of a revenue growth acceleration through 2023. Coupled with Nike’s confidence in its long-term game plan and structural advantages in China, Nike is well-primed to benefit from the recovering China growth story. CEO John Donahoe highlighted (edited):

Nike extended its leadership position as Chinese consumers’ #1 cool and #1 favorite brand. Nike also created a clear separation on 6/18 as the undisputed #1 store and #1 brand on the Tmall sports channel, outperforming the market. Nike has been in China for 40 years. We’ve always taken a long-term view. And to be clear, we believe that China remains a growth market with significant potential to unlock. And coming out of this lockdown, we’re seeing increased energy from the Chinese consumer. (Nike FQ4’22 earnings call)

Things Should Get Better For Nike From Here

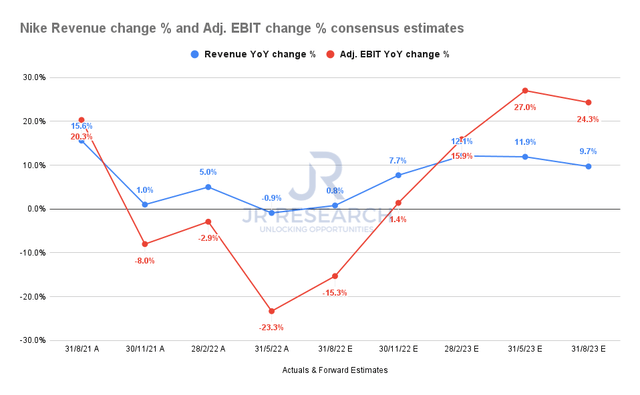

Nike revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Nike highlighted that it has continued to invest in entrenching its market leadership further as its competitors pull back. We believe management’s strategy is sound, as it could help drive market share gains for Nike once these near-term headwinds subside.

The consensus estimates (bullish) suggest the Street is also confident that Nike should turn the corner on its profitability growth trend after reaching its nadir in FQ4. Its revenue growth is also expected to improve, driving further operating leverage gains as Nike laps challenging 2021 comps.

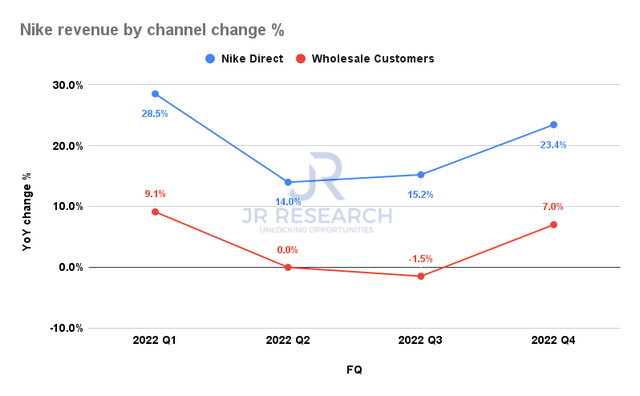

Nike revenue by channel share % (Company filings)

Management is also confident in its DTC roadmap, which has continued to drive performance through these headwinds. CFO Matthew Friend accentuated (edited):

Our consumer-led digital transformation is driving long-term growth and value. Today, our own digital business, representing over $10 billion in revenue, is more than double in size versus pre-pandemic levels. Nike Digital now represents 24% of total brand revenue. More importantly, we are accelerating the pace and scale of Nike’s direct consumer connections. With growing digital traffic and Nike App downloads, our apps now represent almost 50% of total digital demand. (Nike earnings)

Is NKE Stock A Buy, Sell, Or Hold?

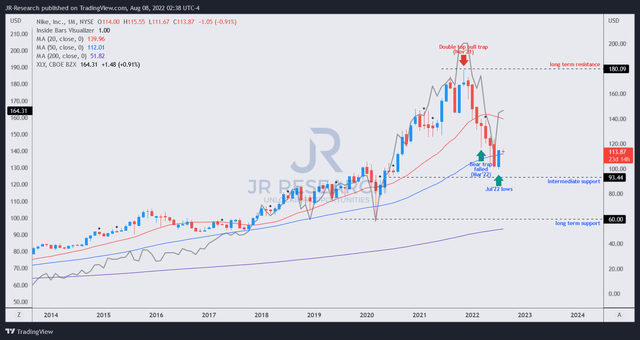

NKE price chart (monthly) (TradingView)

We observed that NKE has retraced to its 50-month moving average (blue line) on its long-term chart in June/July. Investors should note that the 50-month moving average has consistently supported NKE’s long-term uptrend and has likely attracted long-term dip buyers.

Our price action analysis also indicates that the buying upside has been robust in July, indicating that NKE should have bottomed out. Coupled with the long-term bottom in the Consumer Discretionary ETF (XLY), we believe the sector re-rating should benefit NKE and support its long-term bottoming process.

Our internal valuation models also indicate that NKE’s valuation is attractive, as it last traded at an FY25 free cash flow (FCF) yield of 4.32% (Vs. all-time average of 3.4%).

While NKE’s performance has lagged behind the recent recovery in the XLY (gray line overlay), more constructive sentiments emerging from China could help NKE narrow the gap moving ahead.

Therefore, we rate NKE as a Buy.

Be the first to comment