Sundry Photography

Cloudflare (NYSE:NET) reported another very strong quarter with revenue growing 54% yoy and coming in nicely above expectations. In addition, the company continued to improve on their profitability metrics, with non-GAAP operating income and FCF both coming very close to breakeven. As I discuss later on, investors may start to poke more at the company’s profitability metrics, especially as we potentially enter into a recession.

In addition, management provided Q3 guidance that was above expectations and raised the full-year guidance metrics, despite acknowledging the macro environment becoming more challenged. Investors quickly applauded the stock, sending shares up almost 30% since they reported earnings.

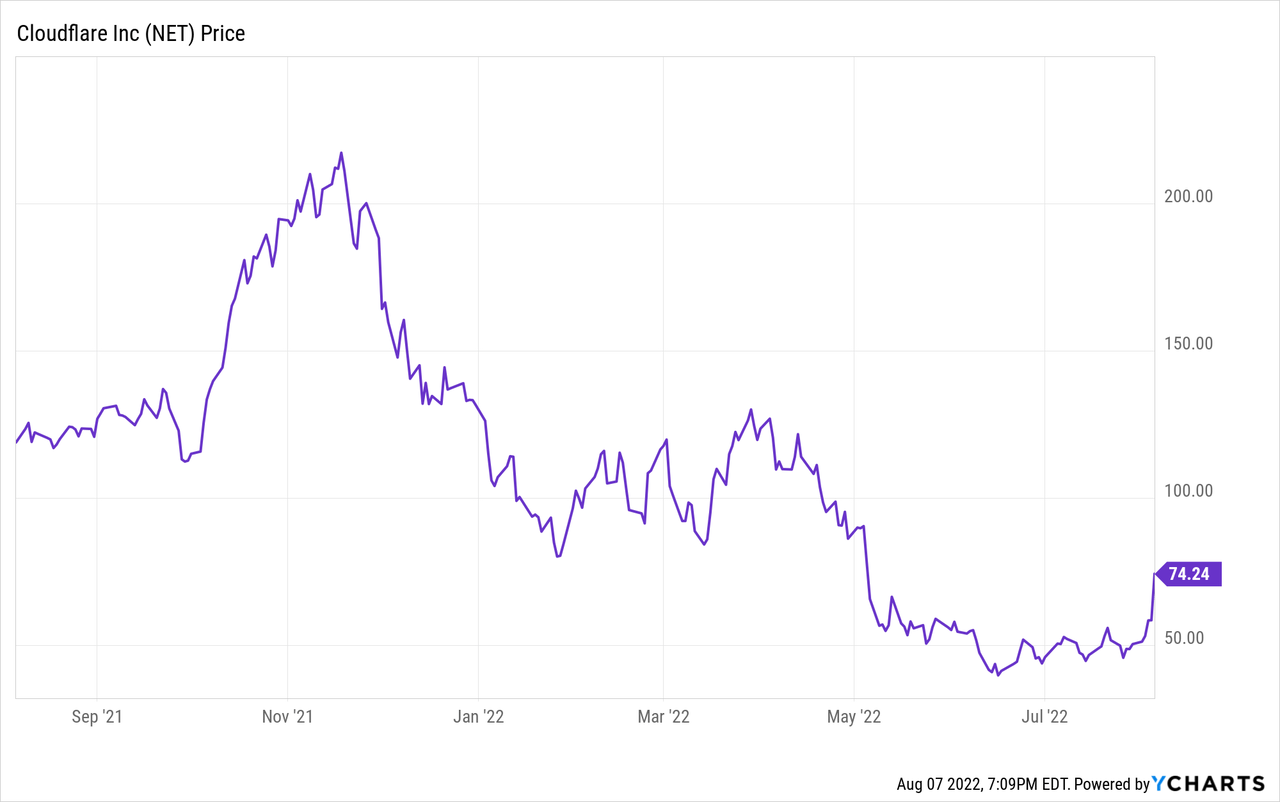

Even after this post-earnings pop, the stock remains down almost 50% year to date, as investors have largely rotated out of high-valuation technology stocks that fail to produce profitability. As fears around a potential recession continue to rise, as well as higher interest rates, high-valuation stocks are not currently in favor. While this may take a few quarters to reverse, I believe long-term investors will be rewarded.

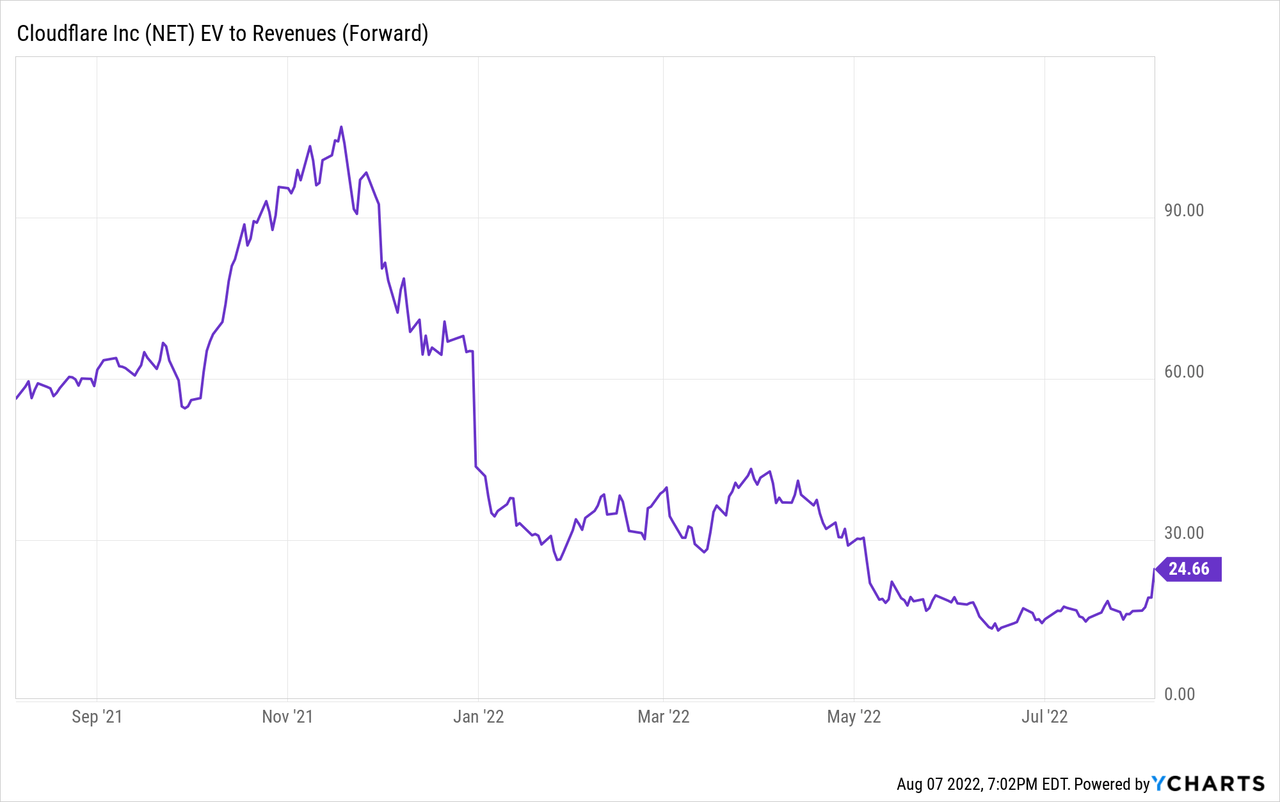

Yes, the stock’s valuation currently stands at 25x forward revenue and while this is certainly not cheap, Cloudflare has leading revenue growth metrics (growing 50%+) and has experienced ongoing success with larger clients, who tend to be stickier and more recurring.

For now, I continue to remain bullish around the long-term opportunities.

Financial Review and Guidance

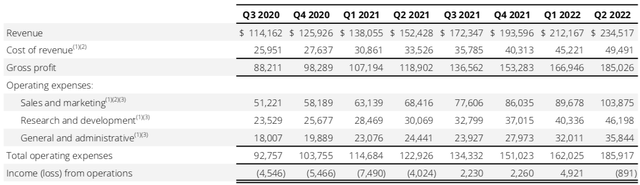

Cloudflare continues to report beat and raise quarters and Q2 was no different. During the quarter, revenue grew 54% yoy to $234.5 million and handily beat expectations for $227 million. Given the company’s software subscription revenue model, it’s no surprise to see non-GAAP gross margins come in at 78.9% during the quarter, expanding from the 78.0% margin in the year-ago period.

In my opinion, Cloudflare continues to have a long runway left of top line growth and with ongoing gross margin strength, operating margins will naturally expand over time. While Q2 non-GAAP operating loss was $0.9 million, the company continues to invest heavily in their Sales & Marketing and Research & Development expenses.

Despite the rather large revenue beat during the quarter, the ongoing margin pressure causes non-GAAP EPS to be breakeven during the quarter, which was $0.01 above consensus expectations.

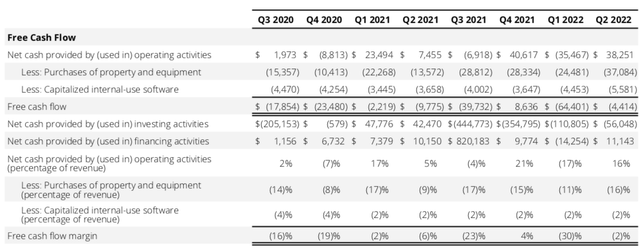

Also during the quarter, the company improved their free cash flow margins and while they still remain at a -2% FCF loss margin, this is an improvement from the year ago period. Typically, the company has experienced a free cash flow loss during Q2, but the ongoing improvement, which was 400bps during the most recent quarter, continues to bode well over time.

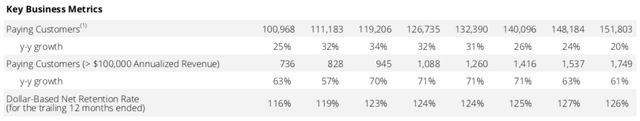

One of the biggest metrics that gives me ongoing confidence in Cloudflare is around their customer base. For starters, Cloudflare continues to grow their paying customer base by 20%+ yoy, which is an impressive feat given how big the company has already scaled, including over 150k paying customers.

In addition and more impressively, the company’s paying customers with >$100k of annualized revenue grew 61% yoy to 1,749. This only represents 1.1% of their total customer base and while this is up from 0.8% of total customers in the year-ago period, the company has a long runway left of growing within their existing customer base.

This is further demonstrated by the company’s 126% dollar-based net retention rate, which has actually been on a steady trend higher over the past few years. This also implies that customers are willing to spend more money on Cloudflare’s services each year, which I believe demonstrates the broader strength seen in the IT security landscape.

Finally, larger customers tend to be stickier and more recurring. Thus, as Cloudflare continues to up-sell their existing paying customer base as well as land new deals, the 126% dollar-based net retention rate bodes well for long-term revenue growth potential.

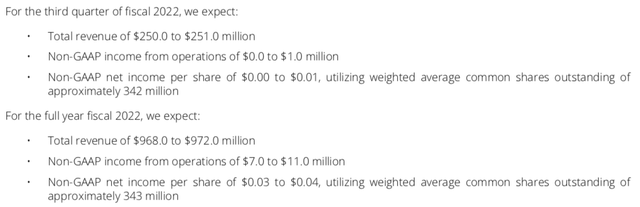

Guidance for Q3 includes revenue of $250-251 million, which was above consensus expectations for $247 million. Non-GAAP operating income is also expected to be positive $0.0-1.0 million, a demonstration of ongoing margin improvement.

For the full-year, revenue guidance was raised to $968-972 million, which was above consensus expectations for $959 million and above the prior guidance range of $955-959 million. In addition, non-GAAP operating income is expected to be $7.0-11.0 million.

On the earnings call, management talked about the broader macro environment and seeing slightly longer sales cycles.

Similar to the early days of COVID, we performed a rigorous analysis to understand both the risks and opportunities in the current environment. However, while COVID particularly affected a narrow set of industries, the current challenges impact a broader set of verticals, which is why we believe it’s important for us to be more prudent in this quarter’s guidance. Headwinds from foreign exchange have also accelerated, and with our product portfolio priced in US dollars, our products are becoming more expensive internationally. And while we haven’t seen a material change in our customer’s behavior to date, we are seeing elongated sales cycles at the high end of our business. We are cognizant of the increasingly cautious environment that factored this into our outlook.

These comments have been heard throughout the tech industry, with some larger purchasing decisions taking a little longer to close. And while this is not a Cloudflare specific issue, it is something worth monitoring through the remainder of the year.

Valuation

Valuation has always been the most challenging aspect of investing in Cloudflare. Operationally, the company is very sound, has a path for strong long-term revenue growth, and plenty of operating margin expansion left. However, the stock has consistently traded at a premium valuation, which can be somewhat difficult to always justify, especially with fears around a slowing macro environment.

While the stock remains down nearly 50% so far this year, investors did see a small relief rally with shares trading almost 30% higher since the company reported earnings. I think much of this positive upswing was due to the company raising guidance for the year, despite the macro environment remaining challenged. In fact, the company raised their full-year guidance more than their Q2 beat, which implicitly means the company is quite comfortable with the second half of the year.

Currently, the stock trades at almost 25x forward revenue, and while this remains near the low-part of the company’s historical trading range, it remains quite a high premium to pay in today’s market.

Yes, revenue growth has been 50%+ for the past 8 quarters, however, with the company now at a $1 billion run-rate, the law of large numbers will certainly kick in. Also, investors are likely to put more emphasis on profitability and free cash flow in the event of a potential recession.

Cloudflare has done a good job showing improvement over the past several quarters, however with margins still being right around breakeven, there remains a lot of progress.

Even after the 30%+ post-earnings pop, I remained bullish around the company’s long-term prospects and believe long-term investors should hold confident. The stock could remain volatile over the coming weeks as more companies report earnings. If the broader industry comments on the macro environment deteriorating since Cloudflare reported earnings, the stock could come under some pressure.

Be the first to comment