Douglas Rissing

Ahead of the Federal Reserve’s 50 basis point rate hike announcement, stocks edged higher. At 2 p.m., the S&P 500 (SPY) and Nasdaq (QQQ) fell sharply. Conversely, the bond market, notably the 30-year Treasury Bond (TLT) and 7-10 year Bond (IEF), retained their uptrend.

What are the key takeaways for investors?

1. Interest Rates at Highest Level in 15 Years

Since before the last Fed meeting, mainstream media pitched stocks as a buy based on a Fed Pivot. In the last meeting, the Fed not only raised rates by 74 bps, but Fed Chair Jerome Powell also issued a warning. He said that investors should not even consider a pivot, or a rate pause and then a rate cut.

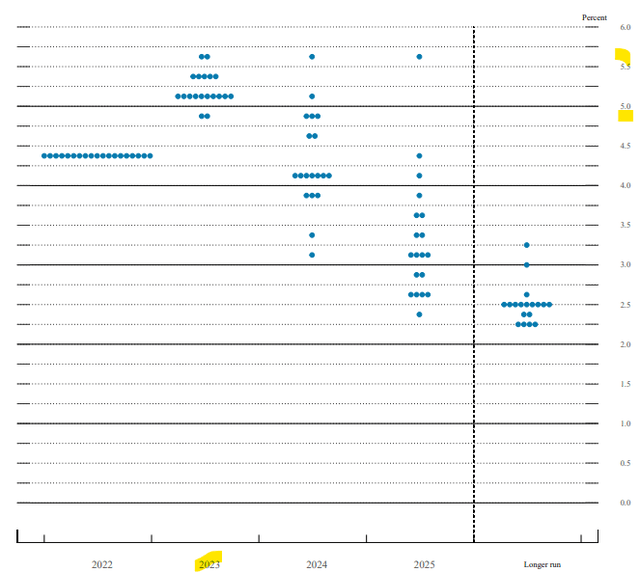

The Federal Open Market Committee voted to raise overnight borrowing rates by half a percentage point. The benchmark interest rate is at the highest level in 15 years. Long-term investors need to zoom out beyond the pandemic stock bubble of 2020 and the financial crisis in 2008. Since rates are below that of inflation, investors should model a range of 4.9% to 5.6% in 2023.

According to its summary of economic projections, investors should expect sustained interest rates in 2023. The “pivot” will not start until 2024 when the lowest projected rate is still above 3.0%.

FOMC Dec 2022

2. FOMC Statement

The FOMC reaffirmed its attentiveness to inflation risks. It cited elevated inflation reflects the imbalance between supply and demand. Conversely, the economy is adding jobs. Unemployment rates remain low. Most importantly, it reaffirmed the bank’s objective of maximum employment and inflation at 2% in the long run.

Officials are expecting unemployment to rise to 4.6% next year. It intends to slow the economy, hitting jobs through 2024.

The strong job market allows the Fed to continue its aggressive attack against inflation. However, the committee will consider financial and international developments in its policy. Until then, investors should expect ongoing rate increases in future meetings.

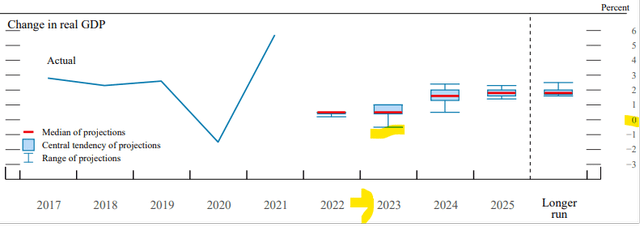

The FOMC cut its GDP growth targets for 2023. It expects the GDP will grow by only 0.5%, as shown below. The negligible growth forecast is as good as predicting a mild recession next year, followed by a rebound from 2024 to 2025.

FOMC Dec 2022

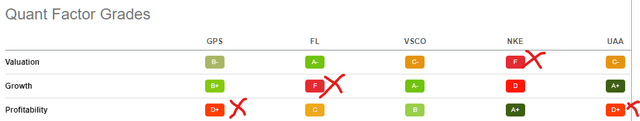

Since stock markets are a forward-pricing machine, it should anticipate a slowdown in multiple sectors. For example, apparel retail is a type of good that consumers could do without. For example, The Gap (GPS) needs to improve profitability amid weaker demand. GPS stock scores a D+ on profitability. Foot Locker (FL) relies on strong footwear demand to grow. It scores an “F” on growth.

Seeking Alpha premium

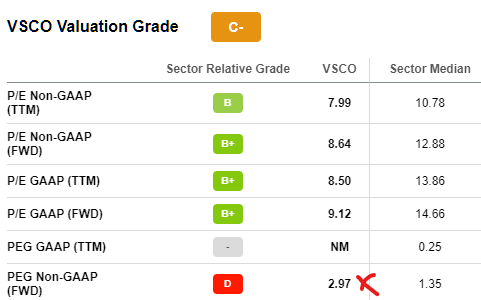

Consumers may consider Victoria’s Secret (VSCO) as nice to have apparel. The stock is trading at a price-to-earnings forward growth multiple above the sector median. Shares risk falling to the $40 support line:

Seeking Alpha quant

3. Negative Market Reaction

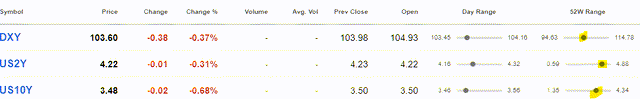

Investors might justify the stock market “priced in” the Fed’s rate hikes. The skeptical investor should watch the US2Y and US10Y closely in the coming months. More recently, the yield backed off from the 52-week high recently.

Seeking Alpha

In addition, the U.S. Dollar (DXY) backed off. Markets already “priced in” a slower pace of interest rate hikes. The weaker U.S. dollar might concern the government. It remains the reserve currency. However, China sold U.S. Treasuries in the last few years. China President Xi Jinping called for oil trade in yuan.

A weaker U.S. currency would lift gold stocks. Investors could buy the SPDR Gold Trust ETF (GLD) or Gold Miners ETF (GDX) as a hedge.

While the slower rate hikes hurt the currency, it benefits companies that thrive under high interest rate conditions. Investors could build a position in diversified banks that reported strong net interest income.

Citigroup (C) and Bank of America (BAC) traded lower ahead of the Fed meeting. Shares of Morgan Stanley (MS) and JPMorgan (JPM) remained in an uptrend. If they navigate the mild recession in 2023, they should all reward investors through 2024.

Consider insurance companies like Chubb (CB), Prudential (PRU) and MetLife (MET). These companies benefit from the wider interest rate spread. Currently, the quant score is neutral on all three stocks:

Seeking Alpha scores

Wait for a “buy” from the quant rating before considering them.

Be the first to comment