LilliDay/E+ via Getty Images

Investment thesis

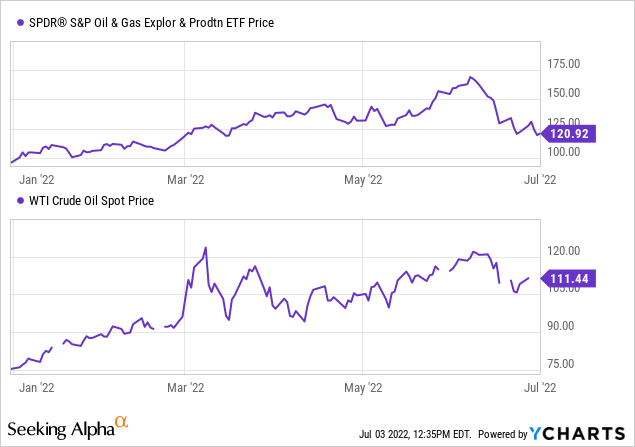

Oil equities have pulled back sharply over the last couple of weeks despite a rather modest drop in the physical oil price which still exceeds $100. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) is undergoing a 30% drawdown:

Oil equities (GUSH) are now firmly below their 2018 levels when WTI crude oil (CL1:COM) was about $65-$70 only.

The conventional wisdom appears to be that, as the Fed continues to hike, the market has now priced in a recession, which, through reduced demand, will crash oil prices in the coming months:

Seeking Alpha

It is a compelling narrative, but most facts suggest the upcoming recession won’t change significantly the oil supply-demand balance:

- The COVID recession and the GFC back in 2008 indeed hit demand hard, but neither was an usual recession;

- Most future demand growth won’t be from the United States but from emerging markets which historically have grown demand even in global downturns;

- The 2008 events transpired when the oil markets weren’t supply constrained;

- That U.S. oil products consumption trails below its 2019 levels suggests that some of the demand impact may have already materialized, so it is unclear how much further demand can fall from here.

It is understandable that recent events dominate the narratives, but I think it is unlikely the coming recession will have COVID or even GFC-level effects on oil demand. The 30% drop in oil equities (XLE) is perhaps sentiment or liquidity driven, but it is hard to rationalize from a fundamental perspective.

Oil and recessions

Despite the falling energy intensity of the U.S. economy, oil (OIL) remains a significant percentage of GDP and oil price shocks have broad repercussions for consumption, industrial production, inflation and pretty much everything else:

CFA Institute: Geo-Economics: The Interplay between Geopolitics, Economics, and Investments.

In the aftermath of the GFC, academic economist James Hamilton observed that an oil price shock had preceded 10 of the 11 recessions since World War II. It is no surprise that the impending recession again coincides with an oil price shock.

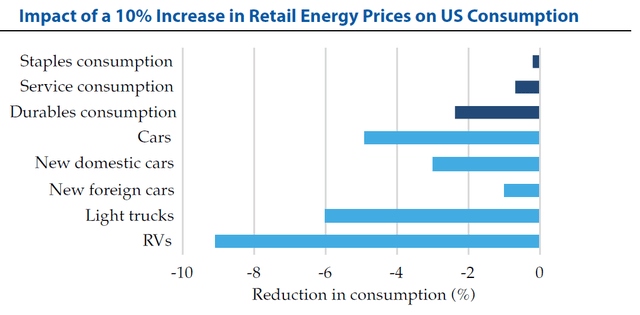

Because of inelastic demand, oil shocks perhaps reduce more so consumption in other sectors of the economy, but the consumption of oil products itself falls too during recessions:

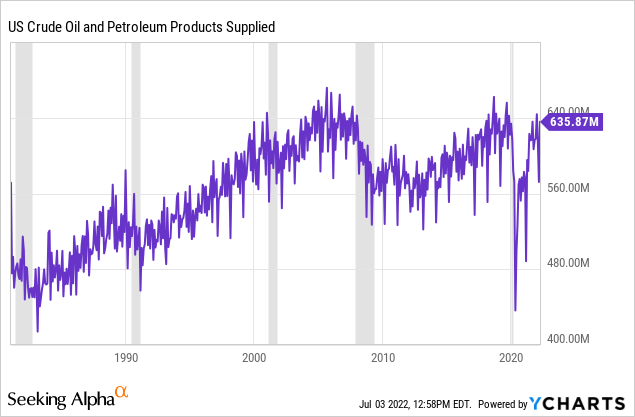

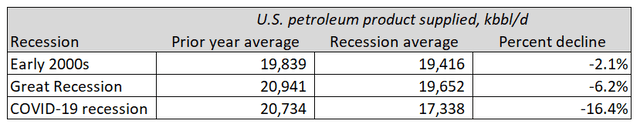

So by how much does demand typically fall? The short answer is by a sizable amount but not even close to the COVID recession:

Author’s calculations using EIA data

The dotcom recession saw the loss of about 0.5 mmbbl/d consumption in the U.S. or about 2%. The GFC reduced U.S. demand by 6%. These are material declines but pale compared to the COVID recession, which leads to my first point: a “normal” recession driven by economic factors can’t come even close to the 2020 pandemic recession.

If COVID resurfaces because of new variants, we could certainly see a repeat of 2020, but for now there isn’t evidence that is happening. Instead, we seem to have more traditional recession fears associated with the general decline in economic activity. If this becomes a systemic financial crisis comparable to the GFC, we are perhaps then looking at a 1.2-1.3 mmbbl/d demand loss in the U.S. if we have a “garden variety” recession, maybe this figure could be closer to 0.5 mmbbl/d.

Supply constraints

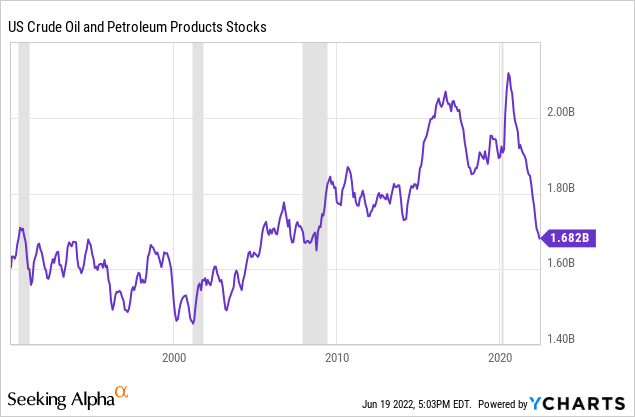

The second point worth considering is that the last few recessions didn’t occur in today’s supply constrained environment:

Compared to 2022, inventories, as a proxy of the short-term supply-demand balance, were a lot more stable in 2000 and 2007-2008. Even during the 1991 Gulf War, Saudi Arabia and OPEC were able to partially offset Kuwait’s lost production.

The 1991 situation is also an interesting parallel to today because the NBER recession coincided with an inventory drawdown. Back then the supply shock was geopolitical, which is also to say exogenous to the U.S. economy, and the inventory trend did not reverse until the war reestablished Kuwait. In contrast, 2000-2001 and 2008-2009 saw a buildup in inventories during the recession, which suggests the constraint was rather on the demand side.

Contrary to what it may seem, the 2022 supply shock is not really geopolitical despite the sanctions on Russia. By most accounts, Russian oil exports are continuing, but just to different buyers. Rather, the current supply shock is the culmination of several years of underinvestment in oil because of ESG constraints imposed by government policies and large institutional investors, and much has been written about this topic on Seeking Alpha.

Therefore, a 2022 recession may look more like 1991 for oil inventories. Unlike the 1991 supply shortage, which was resolved through a quick war though, the current situation would likely need several years of investment, which will require the U.S. and other Western governments reversing themselves on key policy issues.

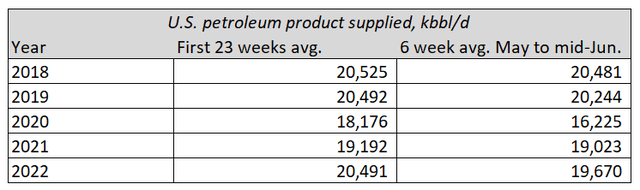

Finally, we should note the NBER declares recessions sometimes long after they have ended. Even if we accept the demand destruction narrative, it remains unclear if this demand destruction has already happened or we think it is still about to happen. Since we can’t observe the demand curve, this isn’t a simple question to answer, but comparing 2022 year-to-date vs. the pre-COVID years suggests some demand response may already be in place:

Author’s calculations using EIA data

Year-to-date, 2022 is comparable to 2019 and 2018. However, if we focus only on the last 6 weeks for which data is available, we probably stand at 0.5 to 0.7 mmbbl/d below the trend. This gap would compare in magnitude to the demand loss during the dotcom recession, so it isn’t unlikely that the physical markets have already taken the recession hit.

International demand

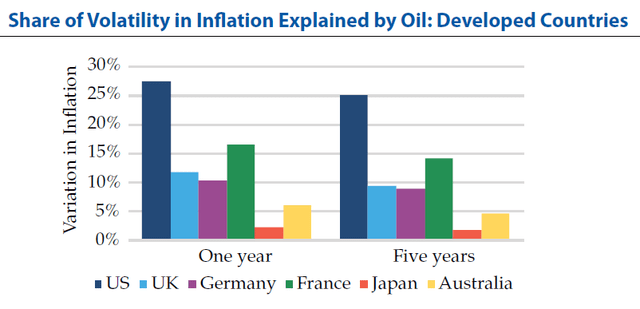

U.S. demand is easier to measure because of the high transparency and quality of the oil market data, but the U.S. is probably not representative of how recessions impact oil consumption. As a rule of thumb, the U.S. economy is more sensitive to oil prices compared to other developed economies:

CFA Institute: Geo-Economics: The Interplay between Geopolitics, Economics, and Investments.

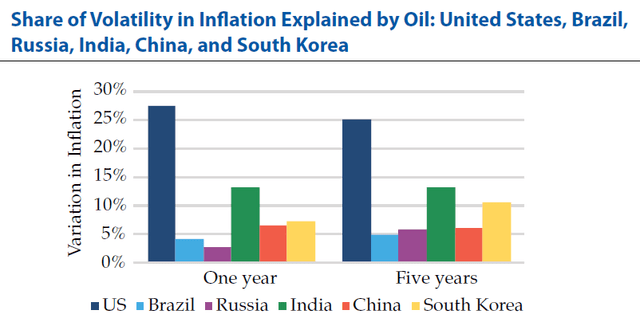

The comparison also holds vis-à-vis emerging economies:

CFA Institute: Geo-Economics: The Interplay between Geopolitics, Economics, and Investments.

Perhaps one reason is that, from infrastructure perspective, the U.S. is a large country with longer commuting distances on average. Most of the commercial goods flow also depends on automotive transportation. An oil shock’s secondary effects are therefore more impactful and the demand response should be stronger.

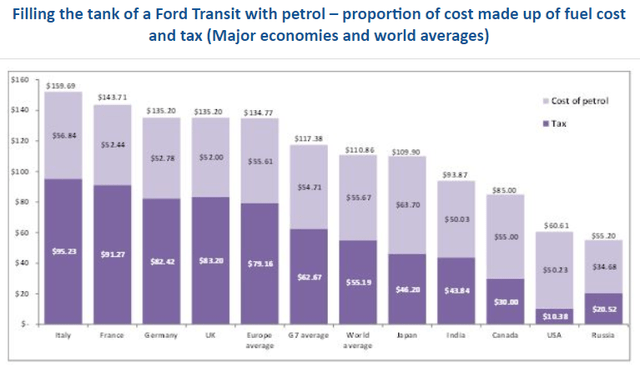

Another reason could be higher fuel taxes outside the United States:

Americans pay less for gas (UGA) than Europeans, but because Europeans pay a lot already, even when oil prices are low, the price shock in the latter case is relatively smaller. Another angle to look at this is that as European governments have proactively suppressed oil demand for so long, for example, through non-linear taxation on car engine displacement, the residual demand left today is probably extremely inelastic.

Many emerging countries maintain fuel subsidies that also limit the demand response to price shocks. For India (INDA) as a net importer, for example, the annual subsidies are estimated at 0.7% of GDP. Reducing these subsidies has proven quite costly from a political perspective in many places.

Last, the growth from emerging economies may slow during cyclical downturns, but it won’t fully stop. The primary reason GDP in emerging countries grows so fast is that they integrate populations which were previously part of a traditional or agricultural economy into the modern industrial economy. These are transformational processes that won’t stop even if the developed world is in a recession.

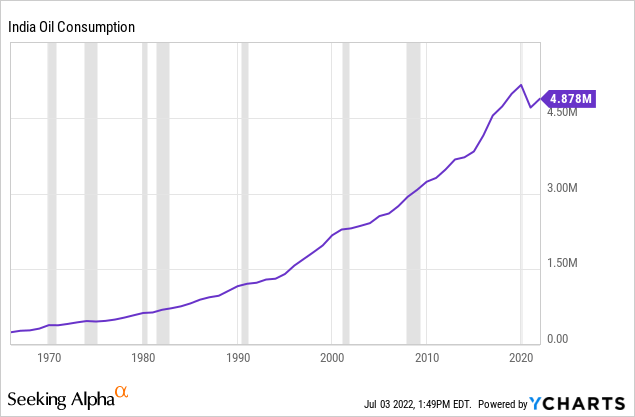

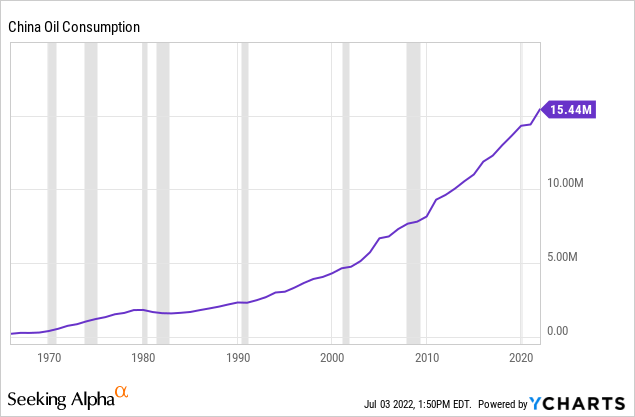

For example, India’s oil consumption kept increasing through all past U.S. recessions except for the COVID one:

Similarly, China’s (MCHI) oil consumption growth never really reversed, though it had some inflection points:

China’s recent slowdown has been because of COVID lockdowns, but it is reasonable to assume the lost demand will come back once the restrictions are lifted.

In summary, even if U.S. oil demand slows considerably, it is not likely that global demand will follow to the same extent. For structural reasons, both other developed nations and emerging countries should have more inelastic oil demand.

Pent-up demand

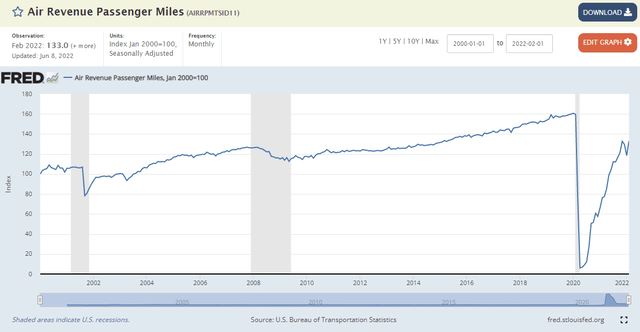

Pent-up demand was one of the major stories of 2021, but in many sectors and geographies, it is still there and will probably counter-balance the cyclical, recessionary effect. One sector where we are yet to see the return to “normal” is civil aviation (JETS).

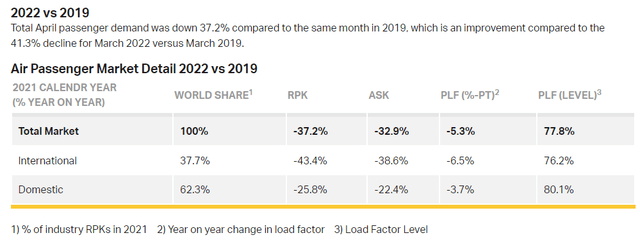

According to a recent release from IATA, the 2022 flight demand to date is still lagging far behind 2019:

Combined domestic and international demand is still close to 40% down from pre-COVID levels. This shows huge potential for more pent-up activity over the next quarters.

But what about the cyclical headwinds? The latest recessions indeed saw a decline in travel demand based on U.S. data:

My first observation here is that the GFC reduced travel demand by about 10%. The dotcom recession had a bigger impact, but most of it is attributable to the general perception of flying security in the aftermath of 9/11. However, both the dotcom and GFC recessions are minor blips compared to the COVID recession, which reinforces the point that the pent-up factor should dominate the cyclical one. The IATA’s release also comments that domestic traffic in China this year is down 80% from 2021; no cyclical recession can achieve this.

So if we take IATA’s global numbers, the potential pent-up demand from here is about 40% of the 2019 levels. If we assume 10% of the 2019 activity will remain suppressed because of the cyclical downturn, we still have the potential for a 30% pent-up recovery. What does this imply for oil?

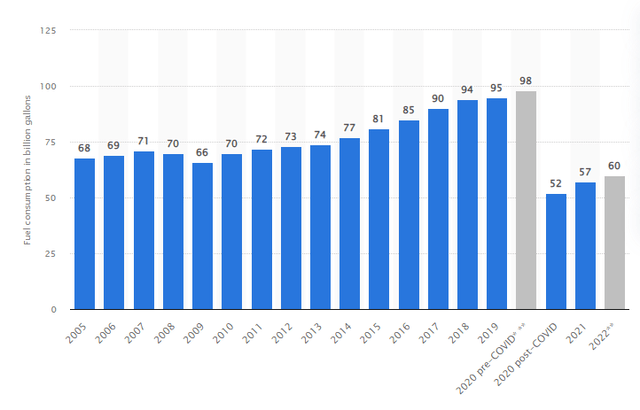

In 2019, almost 10% of OECD oil demand was jet fuel; the pre-COVID trend in 2020 was pointing towards the consumption of 98 billion gallons of jet fuel annually, which translates into about 6.4 mmbbl/d:

The further 30% pent-up amount is therefore about an extra 2 mmbbl/d of oil demand that may come back in the next couple years despite the recession.

Conclusion

Recessions reduce oil demand, but no recession has reduced it as much as the COVID one, and I think it is unlikely the current recession coming our way would do so either. If we take the dotcom recession and GFC as benchmarks, we could expect the U.S. economy to lose perhaps up to 1 mmbbl/d of demand. Arguably, a large part of that loss may have already materialized in the physical markets if we track the latest 2022 consumption data against 2018-2019.

Further, over time, oil demand shifts towards the emerging markets which historically have grown their consumption even during recessionary periods. On the demand side, we also still have a significant pent-up factor mostly related to air travel. Lastly, none of the prior recessions going back to 1991 occurred in an environment with supply constraints as high as what we have today, as evidenced by the continued inventory drawdowns.

On balance, I wouldn’t be surprised if demand remains stable or even grows slightly despite the recession. This should cause steady or even lower inventories, so in the worst case for energy investors the oil prices should hold steady too. For these reasons, I now evaluate my oil equity holdings assuming a $95-$100 WTI long-term price.

Be the first to comment